Automated Insurance Claim Follow up

What is Automated Insurance Claim Follow up?

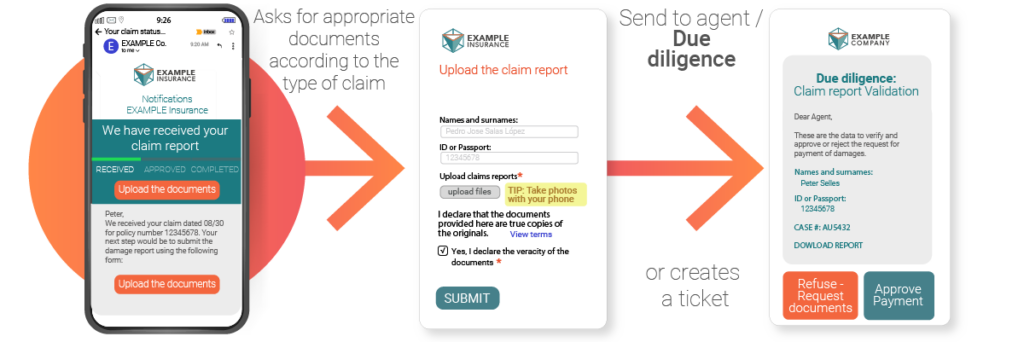

The Automated Insurance Claim Follow up is a sequence of communications sent to the insured where the status of their claim is reported as the case progresses. Likewise, when necessary, links are included for uploading documents. Optionally, it can be integrated, so that customer experience measurement automation is triggered after a loss.

Want to see a demo of this solution?

Objectives:

- Keep the client informed of changes in the status of their claim case.

- Automatically submit, if necessary, links to forms to upload missing documents.

- Keep the insurance agent informed of the status of the claim.

- Reduce the number of calls to the call center and the volume of attention cases related to the status of the claim.

Solution:

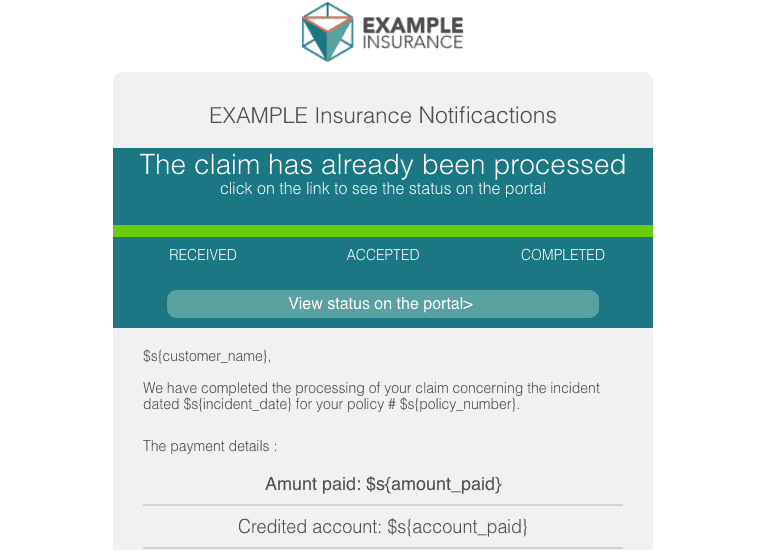

An email sequence is activated and sent every time the claim case status is changed. The messages communicate the reception of the request, if a claim has been accepted or rejected and, when the case has already been completed, if the payment of the damage was accepted or rejected. In addition, the insured has tools and web forms throughout the process so that he can upload the necessary documents. In the same way, insurance brokers and agents can be added to the flows so that they also receive the information.

Customization Options:

- Status types adapted to the internal processes of your company.

- Corporate image, colors, logo of the institution in communications and forms.

- Form fields for loading documents are 100% configurable.

- The digital channel for delivery can be tailored to specific needs.

- Integration with internal systems, tickets and / or core systems as needed.

- Integration with customer satisfaction measurement automation after a claim.

Implementation timeframe:

- 2 to 4 weeks

Pre-requirements:

- DANAconnect Advanced

Cross Channel Strategy:

- Rich SMS as an alternative channel

- Webforms for uploading documents and entering data