Cross Selling for Investment Accounts

What is Cross Selling for Investment Accounts?

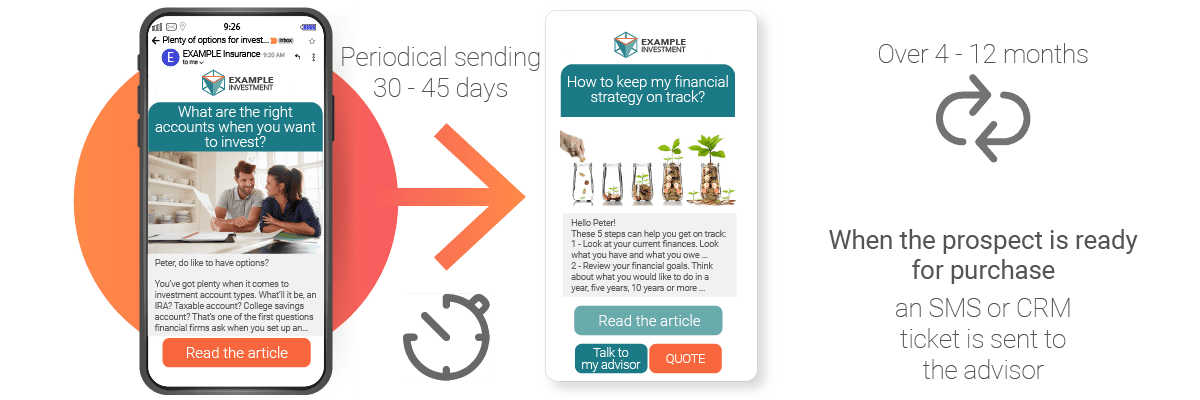

With the Cross Selling for Investment Accounts automation, a segment of customers who already have another product with you will receive educational content over four to twelve months. Analyzing customer interaction with the content determines when to send precision sales content when the lead is nurtured and ready. In addition, prospects can contact a sales consultant immediately for further information once they buy. Contact with the advisor can be automated by sending an SMS, creating a CRM ticket, or sending an email.

Objectives:

- Enlarge the scale of investment prospects to make it more profitable by individual, thus also enlarging the ideal segments to nurture.

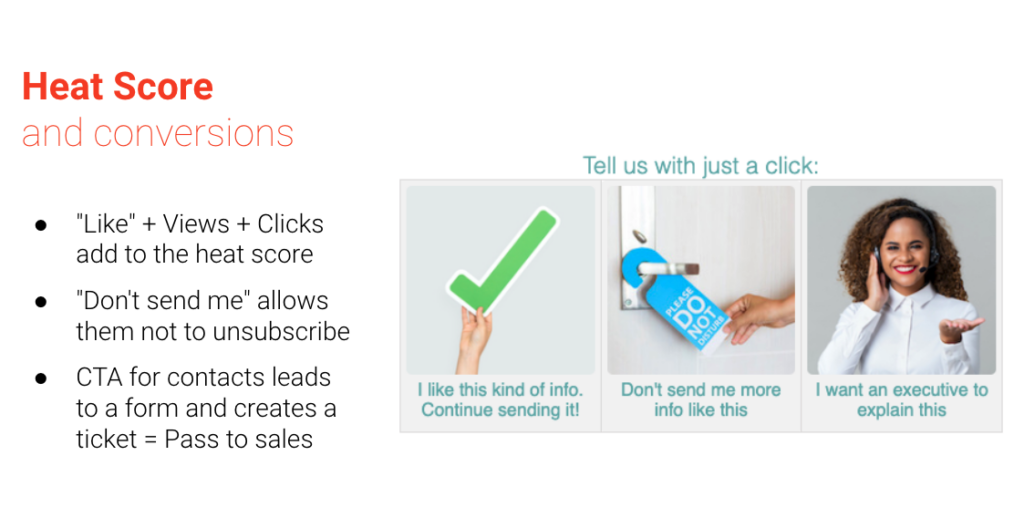

- Keep a “heat score” to determine when the prospect is ready for conversion.

- Make the transition from marketing prospect to sales through a structured and accountable system.

- Keep the product top of mind during the customer journey.

Solution:

Sending periodical educational communications on investing basics for an entire year so prospects can nurture themselves, minimize friction, and move on to the sales stage. It also assesses the level of readiness for the lead conversion and then facilitates contact with the sales department by integrating with the company’s helpdesk or CRM.

.

Customization possibilities:

- Customized written and graphic content of all emails to be sent during the campaign.

- Configurable corporate image, colors, logo and product image.

- Dynamic and personalized prospect information.

- Fields of the forms and information to collect from the lead.

Implementation timeframe:

- 2 to 8 weeks

Pre-requirements:

- You need a DANAconnect account.

- Data should be segmented by products that each client already has with your company.

Data source:

- The data to be used as the source of the contacts comes from a segmentation of your current customer base