Customer Centric Data Model for Banking

What is a Customer Centric Data Model for Banking?

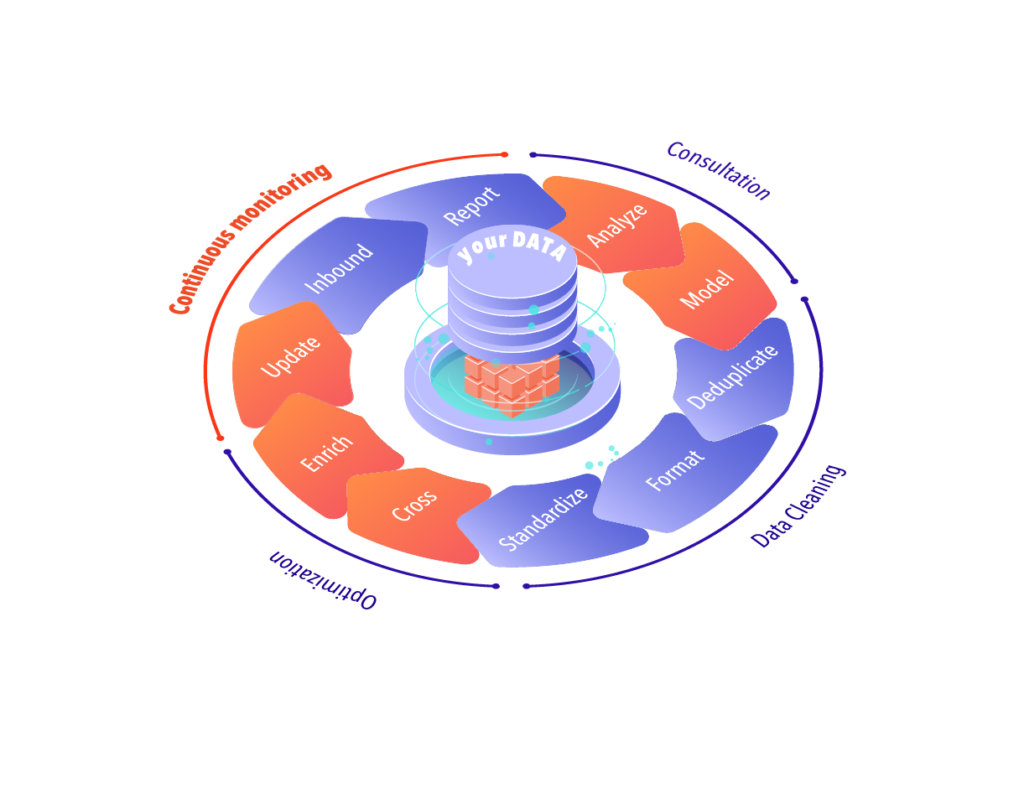

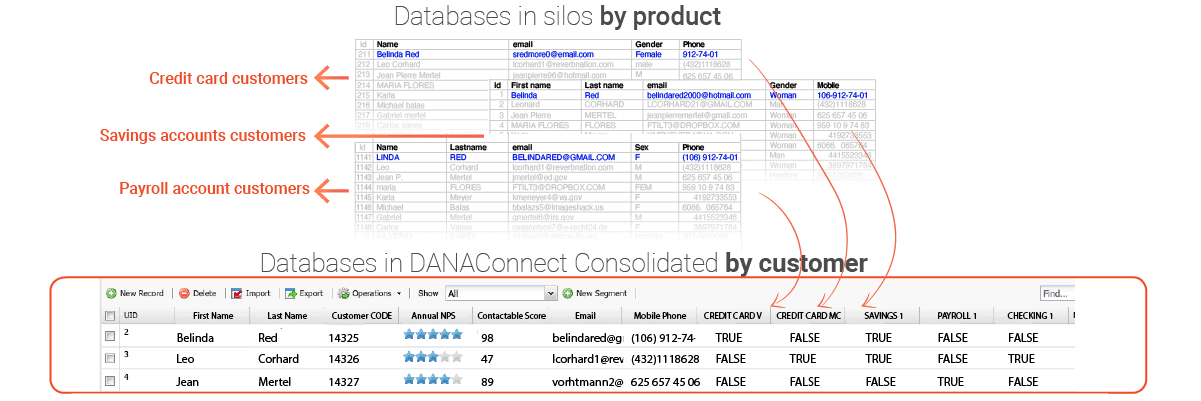

A customer centric data model provides the basis for storing data in a way that makes it possible to track the evolution of customers and automate processes in order to offer the most personalized experience possible, as well as enable the mainstreaming of the information within the organization, keeping the customer’s contact master data updated and centralized in a single repository.

Would you like a personalized presentation of this service?

Objectives:

- Consolidate customer contact information into a single database so they can be accessed and used by all departments and kept up-to-date.

- Improve the bank’s capacity to reach their clients by improving the quality and reliability of contactability data.

- Ensure the management and governance of communication with clients.

- Enhance the customer experience by allowing the flow of data between different digital channels and different departments.

- Have the basis for indexing a digital document repository associated with the client’s dossier or file (identity documents, passports, records, etc.)

Solution:

Unification of customer data that currently is, separated, diparated and multiplied by each bank product, in a single centralized database to facilitate the access, consultation and updatin of said data to improve processes.

Customization possibilities:

- Data model customization to support all your types of customers, products, and customer-agent relationships.

- Segment creation.

- Formatting and normalization of the texts in the fields.

- Email validation and removal of spamtraps

Implementation timeframe:

- 2 to 4 weeks

Pre requirements:

- DANAconnect account

- Provide the data from the different databases to unify