Digital Policy Document Generation

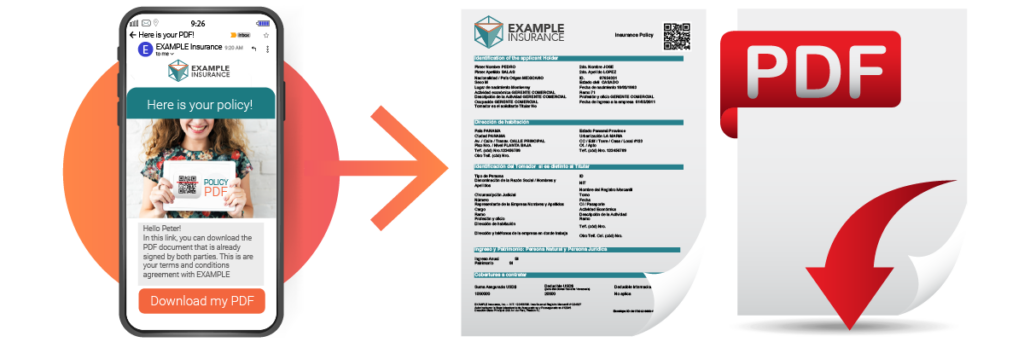

The Digital Policy Document Generation creates the document dynamically with the customer’s data and adds a digitally signed certificate before sending it to the new client. As a result, the document clearly identifies the insurer as the author. In addition, a valid digital signature implies that the document was not digitally altered after it was created.

Want to see a demo of this solution?

Objectives:

- Complete the policy sale or renewal process entirely online.

- Provide the insured with the policy document through a digital channel as quickly and effectively as possible.

- Lower creation and distribution costs.

- Lower delivery times.

- Improve the customer experience by offering more convenience, high availability, and immediacy.

- Relate the corporate brand with innovation and cutting-edge technology.

Solution:

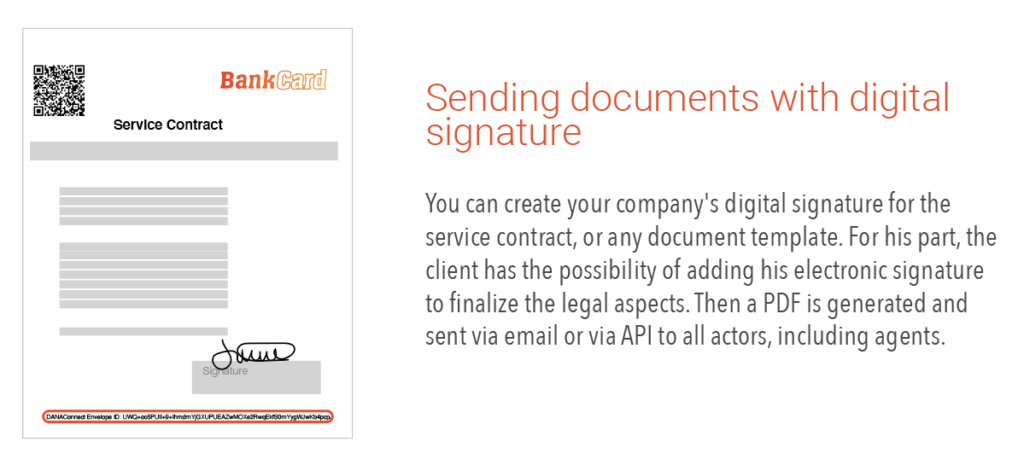

Completing the policy purchase process online through web forms or integrating data from structured sources that generate a signed digital document with technical and legal security standards. DANAconnect also offers a portal for verifying the validity of the digital signature.

Customization options:

- Certificate digitally signed by the insurer

- Corporate image, colors, logo, and image of the insurer in the document and communications

- Dynamically generated and personalized information of the insured on the policy

- The digital channel for delivery can be tailored to specific needs

- Integration with internal systems, tickets, and/or insurance core

- The advisors/brokers can be incorporated into the flows so that they also receive the information

Implementation timeframe:

- 2 to 4 weeks

Pre-requirements:

- DANAconnect Advanced

- Have the data of the contacts already segmented -> You can request the segmentation service from DANAconnect: Customer Centric Data model for insurance

Cross Channel Strategy:

- Emails

- SMS as alternative channel

- Webforms

- CRM Tickets optionally

Want to see a demo of this solution?

¿How Digital Policy Document Generation can benefit insurers?

Digital Policy Document Generation can greatly benefit insurers in several ways. Here are some key advantages:

- Efficiency and Time Savings: Manual policy document creation can be time-consuming and error-prone. Digital policy document generation automates the process, enabling insurers to generate accurate and customized policy documents quickly. This saves time for both insurers and customers, allowing policies to be issued faster and reducing administrative burdens.

- Consistency and Compliance: Insurers need to adhere to regulatory requirements and maintain consistency across policy documents. Digital policy document generation ensures that the documents are generated consistently and comply with the necessary regulations. It helps to standardize the language, formatting, and clauses, reducing the risk of errors or omissions that could lead to legal or compliance issues.

- Personalization and Customer Experience: Insurers can use digital policy document generation to personalize policy documents based on individual customer needs. By leveraging customer data and automation, insurers can tailor policy documents to reflect specific coverage options, endorsements, deductibles, and more. This level of personalization enhances the customer experience and improves satisfaction.

- Flexibility and Adaptability: Insurance policies often require updates or modifications due to changing circumstances or evolving regulations. Digital policy document generation allows insurers to make changes quickly and efficiently. Insurers can easily incorporate new clauses, endorsements, or revisions into the policy documents without the need for manual rework. This agility enables insurers to respond promptly to market demands and regulatory changes.

- Integration with Digital Platforms: In today’s digital era, insurers often operate through various digital channels, such as websites, mobile apps, or partner platforms. Digital policy document generation can seamlessly integrate with these platforms, enabling insurers to generate and distribute policy documents across multiple channels automatically. This integration streamlines the customer journey, reduces manual intervention, and enhances the overall digital experience.

- Document Management and Tracking: Digital policy document generation provides insurers with better document management capabilities. Policies can be stored electronically, making them easily accessible and searchable when needed. Insurers can also track policy document versions, revisions, and updates efficiently. This helps in maintaining an audit trail and facilitates efficient record-keeping.

Overall, digital policy document generation empowers insurers to streamline operations, improve efficiency, enhance customer experience, ensure compliance, and adapt to changing market dynamics. By leveraging automation and digital tools, insurers can optimize their policy document generation processes, ultimately benefiting both the company and its customers.

Frequently Asked Questions (FAQs) about digital policy document generation:

- What is digital policy document generation? Digital policy document generation is the process of automating the creation, customization, and distribution of policy documents using digital tools and technologies. It involves leveraging data, templates, and automation to generate accurate and personalized policy documents efficiently.

- How does digital policy document generation work? Digital policy document generation typically involves integrating data sources (such as customer information and policy details) with document generation software or platforms. The software uses predefined templates and rules to automatically populate the policy documents with the relevant data, formatting, and language. The generated documents can then be reviewed, edited if necessary, and distributed electronically.

- What are the benefits of using digital policy document generation? The benefits of using digital policy document generation include improved efficiency, time savings, increased consistency and compliance, enhanced personalization and customer experience, flexibility and adaptability, seamless integration with digital platforms, and efficient document management and tracking.

- Can digital policy document generation handle complex policy structures? Yes, digital policy document generation can handle complex policy structures. The software or platform can be customized to accommodate various policy types, endorsements, coverage options, and clauses. It can automate the generation of complex documents while ensuring accuracy and compliance.

- Is it possible to customize policy documents using digital policy document generation? Yes, digital policy document generation allows for customization of policy documents. Insurers can define templates that include placeholders for variables and dynamically populate them with customer-specific data, such as names, addresses, policy details, and endorsements. This enables insurers to personalize policy documents for individual customers.

- Can digital policy document generation integrate with other systems or platforms? Yes, digital policy document generation can integrate with other systems or platforms. It can connect with customer relationship management (CRM) systems, policy administration systems, underwriting systems, and other relevant databases to retrieve data for document generation. It can also integrate with digital platforms like websites, mobile apps, or partner portals for seamless distribution of policy documents.

- How does digital policy document generation ensure compliance with regulations? Digital policy document generation can incorporate compliance rules and templates that align with regulatory requirements. By automating the document generation process, insurers can ensure that the policy documents consistently adhere to the necessary regulations, reducing the risk of compliance issues.

- What types of insurance policies can benefit from digital policy document generation? Digital policy document generation can benefit various types of insurance policies, including but not limited to life insurance, health insurance, property insurance, casualty insurance, auto insurance, and commercial insurance. The technology can be adapted to suit the specific needs and complexities of each policy type.

- Is digital policy document generation secure? Yes, digital policy document generation can be designed with robust security measures. It can utilize encryption, access controls, authentication mechanisms, and secure data storage to protect sensitive customer information and policy documents from unauthorized access or data breaches.

- How can insurers get started with digital policy document generation? To get started with digital policy document generation, insurers can explore document generation software or platforms that offer the desired features and integrations . They can evaluate vendors, assess their requirements, and select a solution that fits their needs. Implementation typically involves integrating the software with existing systems, configuring templates, and training staff on its usage.

It’s important to note that specific details and capabilities of digital policy document generation may vary depending on the chosen software or platform and the insurer’s unique requirements.