Discovering the momentum for cross selling insurance policy

What is the momentum for cross selling insurance policy ?

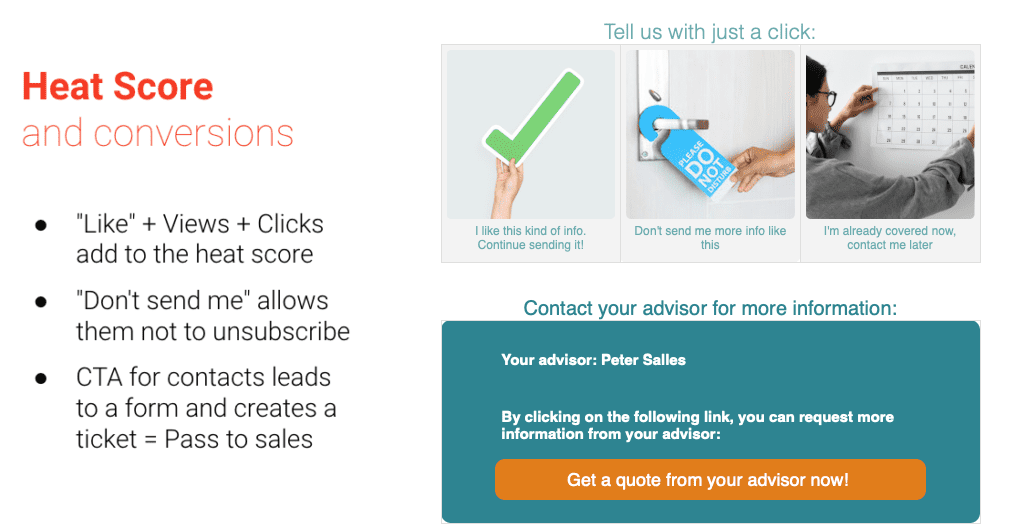

With the Momentum for Cross Selling Insurance Policy you can predict when a prospect may need a policy before the end of their current insurance contract with another insurer by tracking their interest before renovation. For monitoring the leads’ interest, educational content is distributed for 4 to 12 months, and a score is generated based on their interaction with the content. During the opportunity window, the lead may be handed over to sales automatically by sending an SMS message, creating a CRM ticket, or sending an email.

Objectives:

- Have a tool to capture the information on policy renewal dates that clients keep with other insurers.

- Nurture the customer with policy product information that they do not already have.

- Make the transition from marketing prospect to sales through a structured and accountable system.

- Keep the product top of mind during the customer journey.

Solution:

Automated sending of educational content over a period of four months to a year, to a segment of your customer portfolio, so that prospects can self-nurture, minimize friction, and move to the sale stage.

.

Customization possibilities:

- Customized written and graphic content of all emails to be sent during the campaign.

- Configurable corporate image, colors, logo and product image.

- Dynamic and personalized prospect information.

- Fields of the forms and information to collect from the lead.

Implementation timeframe:

- 2 to 8 weeks

Pre-requirements:

- Have a DANAconnect account

- Have the segmented data by products that each client already has with your company

Data source:

- The data to be used as the source of the contacts comes from a segmentation of your current customer base -> See our solution for a customer centric data model in insurance