Credit Card Pre Approval Cross Selling

What is Credit Card Pre Approval Cross Selling?

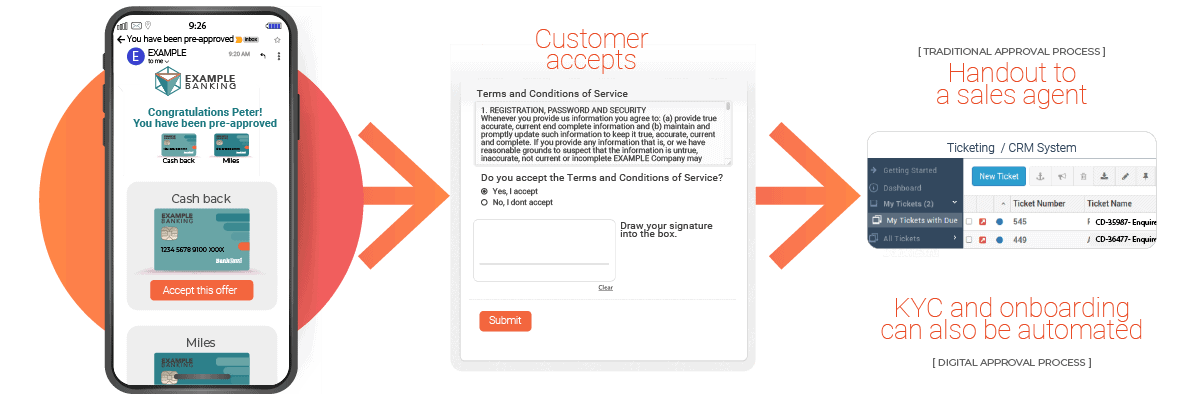

Credit Card Pre Approval Cross Selling is a promotion to a segment of the current customer base that has pre-qualified to offer them a credit card. The acceptance of the promotion is facilitated with a link included in the message. Once the card has been accepted, an executive receives a ticket containing the prospect’s information. Additionally, it can be integrated with automations for enabling the customer to auto-create their dossier like Checklist for digital customer onboarding and other automations like Digitally Issued Service Contract, as well as a sequence of receiving and activating the credit card.

Want to see a demo of this solution?

Objectives:

- Promote credit card cross selling to current client portfolio.

- Include a direct link to accept the account opening.

- Create an internal ticket for sales agents or executives.

- Optionally make an automated digital onboarding and Sequence of reception and activation of credit card.

Solution:

An email or SMS is sent to a specific segment of the customer portfolio offering the opportunity for a credit card pre-approval. The email includes a button for the customer to accept the offer and open the new account.

Customization options:

- Written and graphic content of all communications.

- Customer information that is dynamic and personalized.

- Ticketing and CRM integration.

Implementation timeframe:

- 4 to 8 weeks

Pre requirements:

- Have a DANAconnect Advanced account.

- Have the data of the contacts already segmented -> You can request the segmentation service from DANAconnect: Data model for banks

Cross Channel Strategy:

- Web forms for uploading data and accepting terms.

- SMS as an alternative channel