Your company can choose an outsourced solution to help you manage collections or create your own debt processes in-house. Either way, debt recovery automation can make a difference in how you handle accounts receivable.

Discover more about accounts receivable automation and debt recovery below.

[dflip id=”18330″ ][/dflip]

What Is Accounts Receivable Automation?

There are many reasons why an accounts receivable payment may be late. A customer may not receive a paper bill or they could have forgotten the due date.

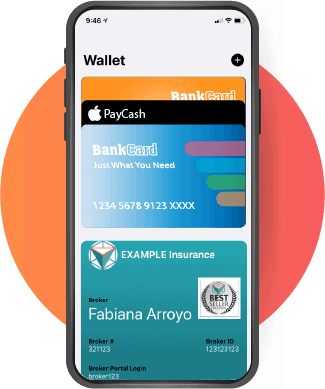

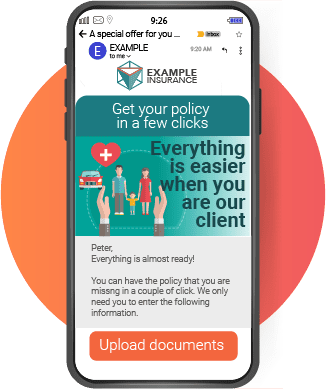

Solve these problems with accounts receivable automation. Automated solutions can streamline your accounts receivable. Automated debt recovery processes ensure nothing is ever missed. You can use artificial intelligence (AI) to:

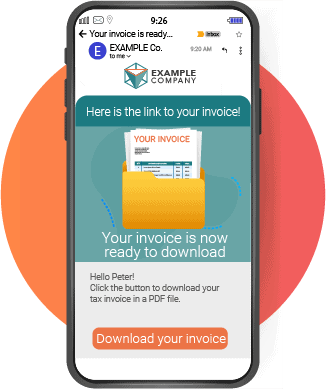

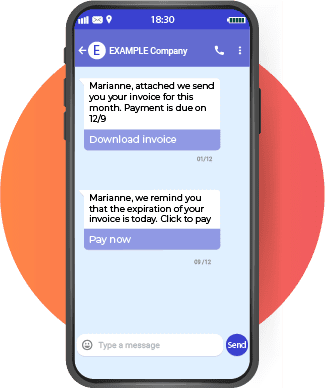

- Automate invoicing

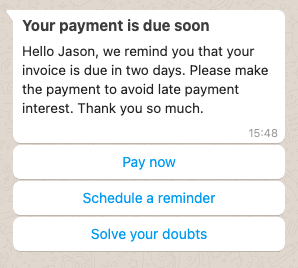

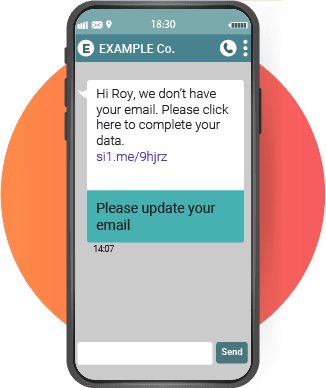

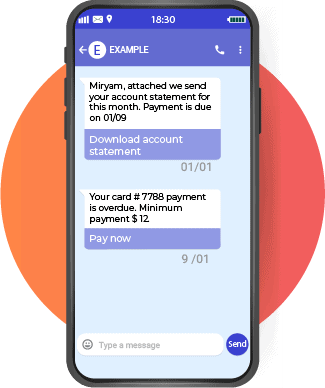

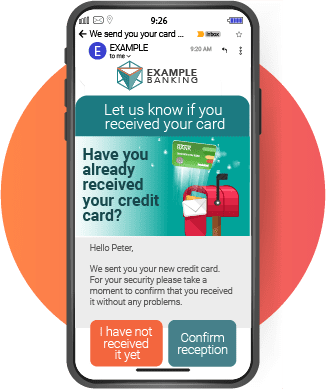

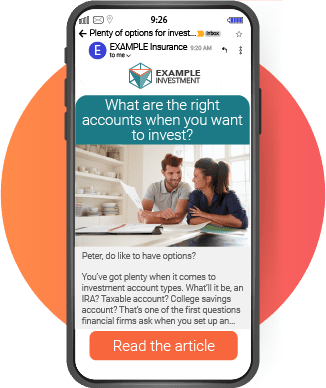

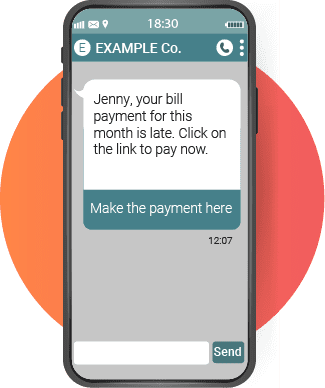

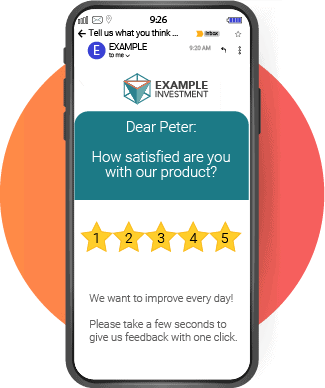

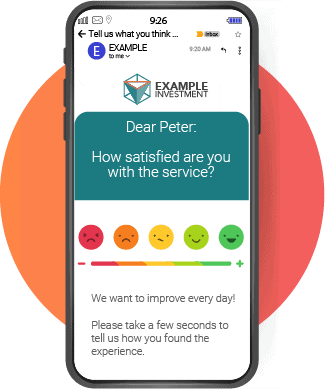

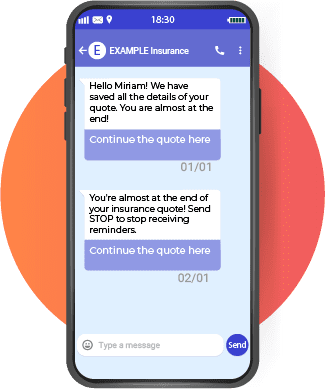

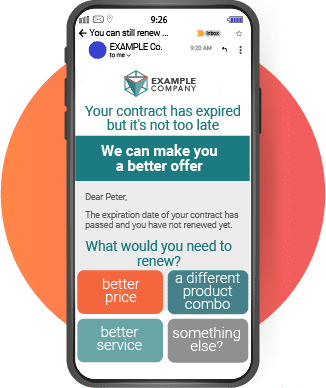

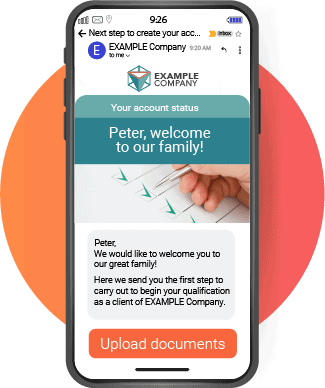

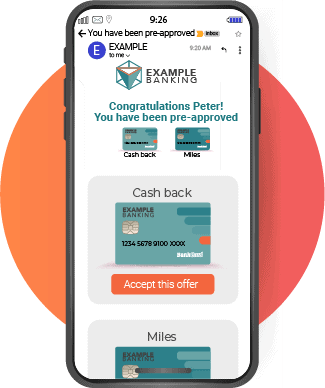

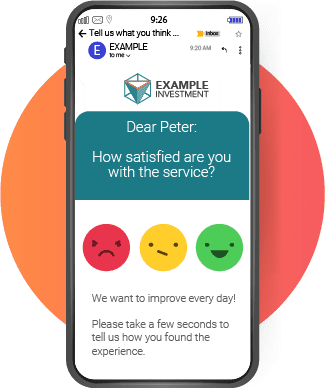

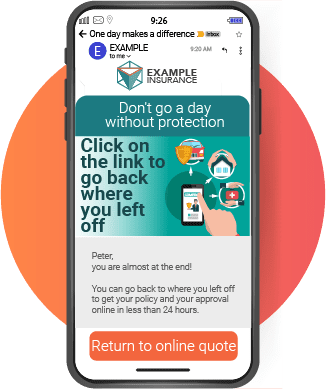

- Text reminders via text message and email

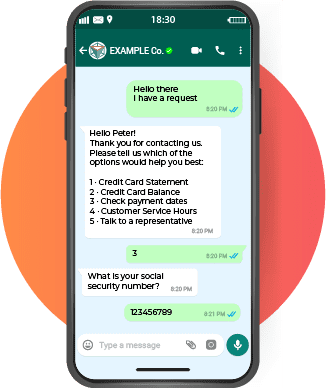

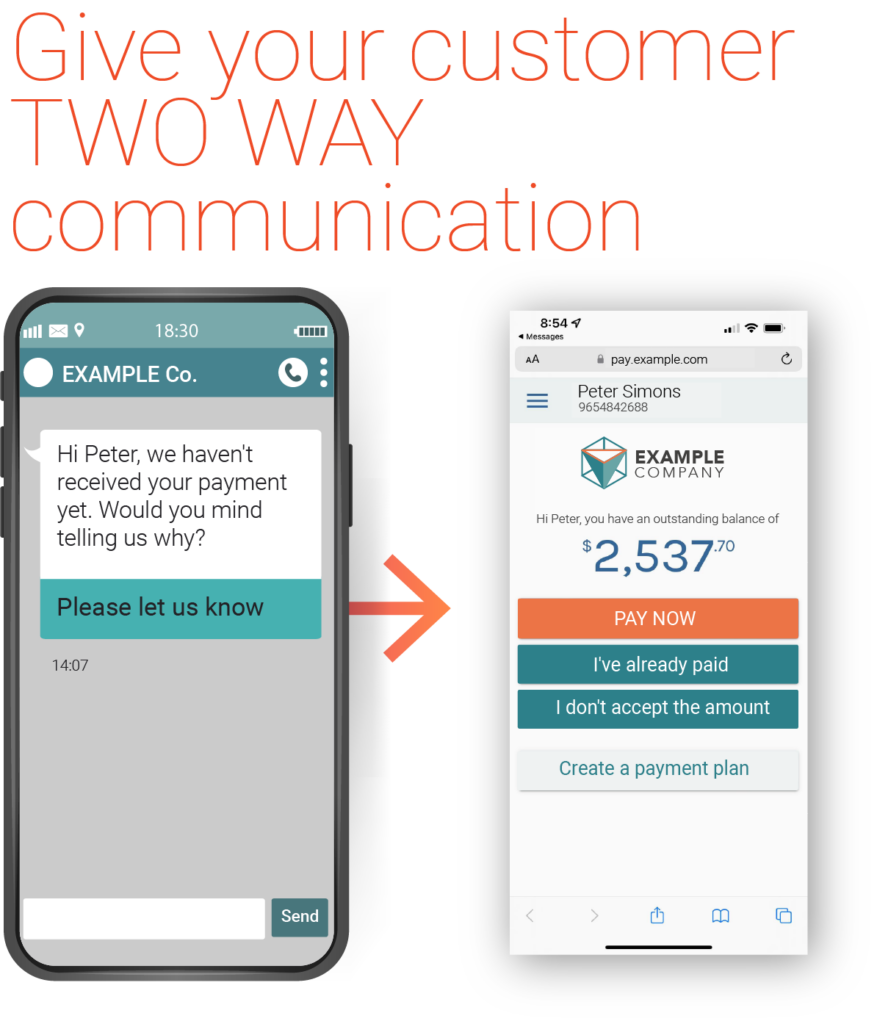

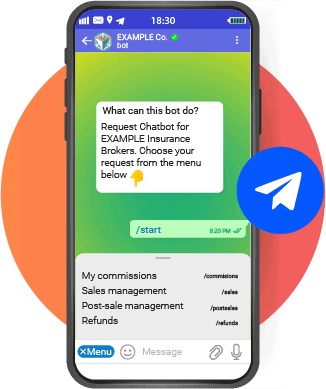

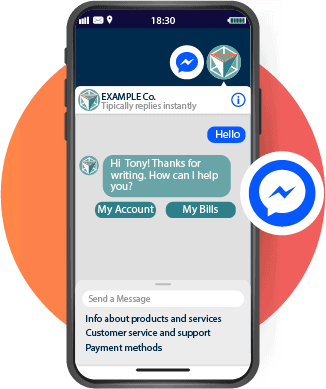

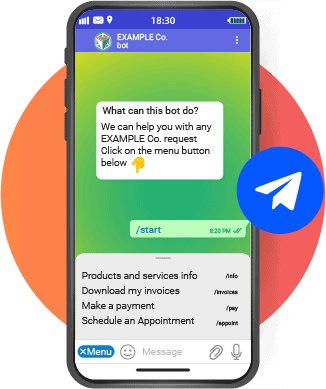

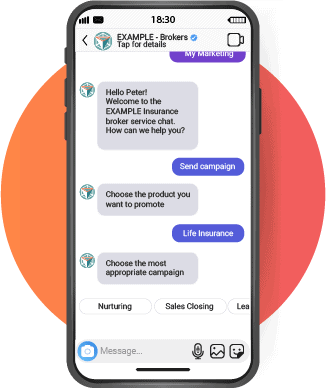

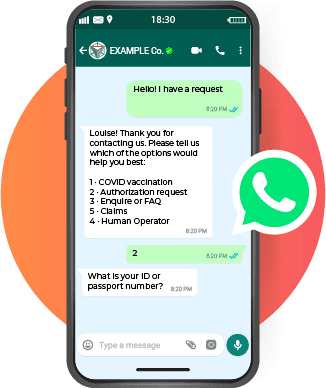

- Chatbots for self-service

- Automated calls combined with IVR Voice response systems

- Virtual assistant services

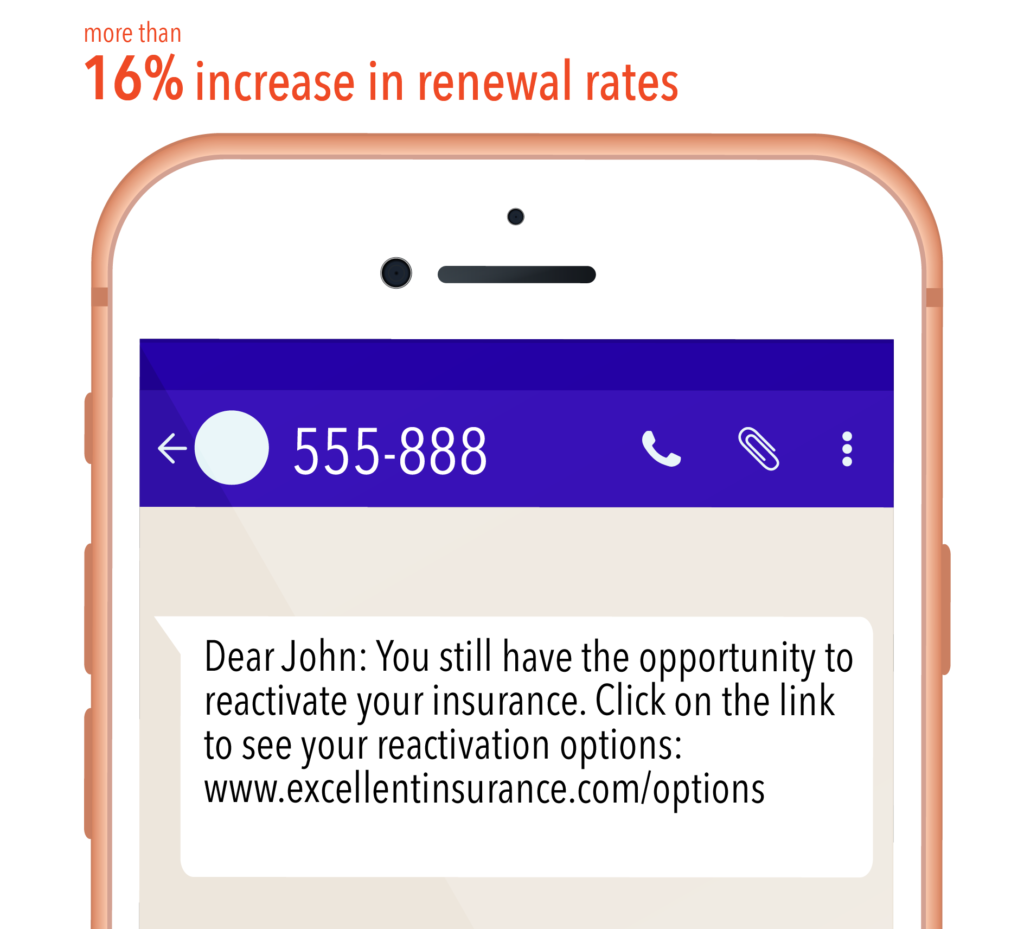

- Automated cross channel follow-ups

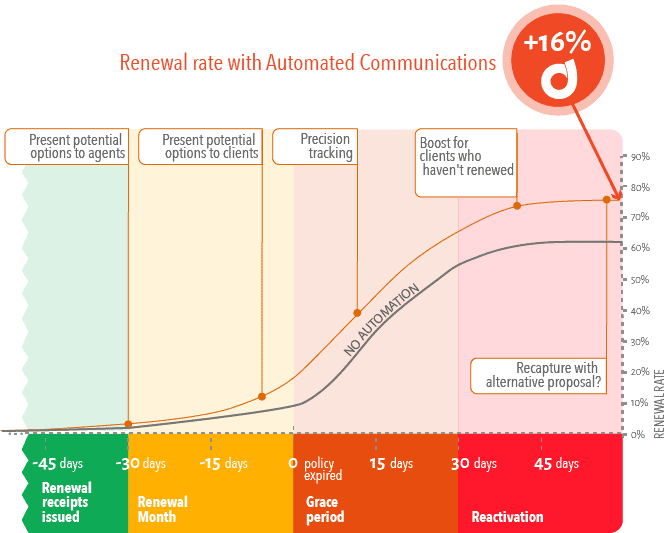

A comprehensive debt recovery automation solution can ensure payments are received on time. But it also leads to many more benefits. Transitioning from manual to automated processes allow you to still manage your debt recovery without relying on an outside agency.

There are many debt recovery automation pros for companies. Not only will you have streamlined operations, but your team members will see many benefits to using automation.

Those include:

- Increased productivity

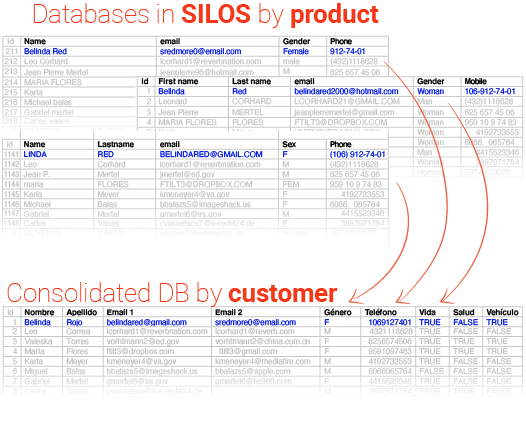

- Updated borrower information

- Cost savings

- A more controlled collections process

- Improved efficiency

- Better performance tracking

- Elimination of manual tasks and processes

Learn more about each of these benefits and how each can lead to operational improvements for your company.

Increased Productivity

Automation can boost employee productivity. Your debt collecting team have a lot to do when collecting past due accounts. With automation, many of these processes and tasks can be done while collectors focus on other duties.

You can also automate invoicing and payment reminders. This saves lots of time for those managing accounts receivable. And with automation, you make sure nothing gets missed or forgotten.

The mundane, administrative tasks won’t eat up hours of time with automation in place.

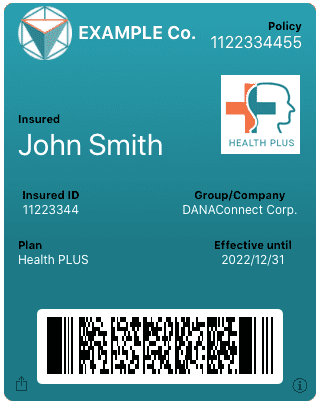

Updated Borrower Information

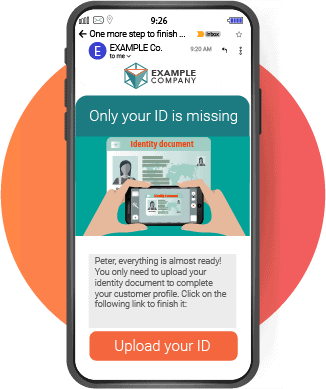

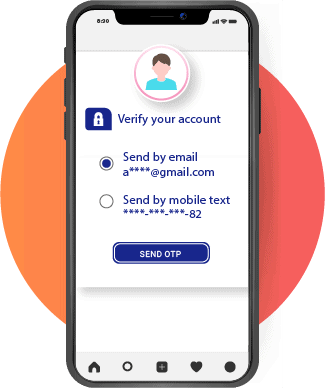

Automation software is a great way to manage customer information. Identity theft is a very common occurrence in today’s world. Having that information readily available is beneficial for companies.

And it greatly improves recovery rates by having the correct and up to date information.

Cost Savings

Automation increases the consistency of payments, thus improving cash flow. Improved cash flow leads to more liquidity and flexibility for business owners.

You can collect more previously uncollectible payments. Automated reminders, communications, and late payment notifications are all done within a system. You’ll save hours of time, and costs, with an automated solution.

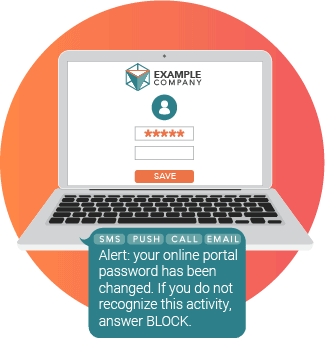

A More Controlled Collections Process

Past due accounts can use a lot of resources when you’re trying to get your money. With an automated process, you don’t have to hire more employees to manage the workload.

And with an automated system, you can input controls and processes to ensure consistency with every account. An AI-powered solution also improves accuracy and reduces the risk of human error.

Removing the need for an external agency to help with collections puts more power into your business.

Improved Efficiency

Improved efficiency is inevitable with automation. Everything is streamlined and most of the functions are completed within the system, so the entire department becomes more efficient.

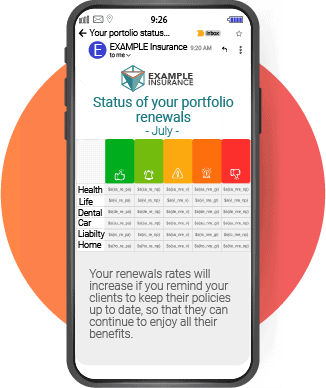

Better Performance Tracking

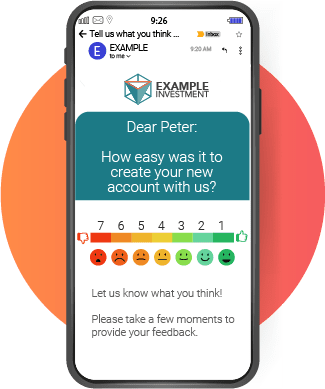

Measuring key performance indicators of your team members will be easier than ever with automation. Performance is usually measured by days outstanding, profits, and promise to pay rates. The system documents and tracks all relevant information with an automated solution.

Eliminate Manual Tasks and Processes

Automation eliminates tedious, manual tasks and processes that take time away from more important operations. Waiting for documents or reports can delay many operations.

But with automation, there isn’t waiting. Reports and metrics are readily available. Follow-up reminders or letters can be automatically sent on a schedule. Employees can be focused on more valuable tasks with automated debt recovery solutions.

Fewer Complex Decisions to Make

In the past, your team members made decisions about each account. With automation, you have data and insights readily available so decisions aren’t up to individuals.

Data-driven decision-making leads to more consistent and focused practices. There won’t be any grey area because the metrics are there for leaders. The data will also help determine which collectors should manage which accounts.

Should You Outsource Debt Recovery Services?

Working with an outsourced agency to develop your debt recovery automated process can save your company a lot of time and effort. When you have an external agency guiding you on how to set up the most efficient and effective processes, your company has more time to focus on revenue-generating operations.

An agency that specializes in debt recovery automation will be able to quickly get it established for you and your customers. This means you could be improving your debt recovery efforts in no time!

Ultimately, it depends on what your business needs are whether or not you should outsource the service. Automation leads to improved debt recovery rates, so it’s really a matter of how you do it and not if you should.

How to Pick an Outsourced Company

You should conduct comprehensive research and test any software you want to implement in your company. When choosing an outsourcing collections solution, you should carefully weigh what options they provide and what your business needs are.

Get Started Today

Are you ready to level up and increase your debt recovery and collections efforts through automation? Do you want to receive more of your accounts receivable payments?

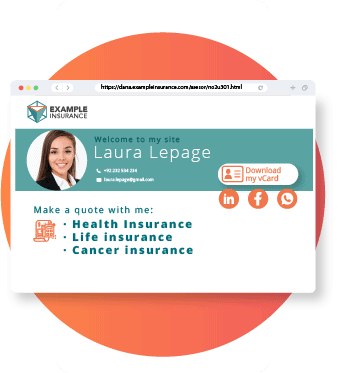

If your business is ready to start with debt recovery solutions, DANAconnect is here to assist! We have a variety of offers to not only streamline collections automation but improve processes across your organization.

At DANAconnect, we have many solutions available to help you manage accounts and collections. Contact us today for more information and to schedule a free demo.