In this article, we explain how automation can help manage debt recovery and discuss the major factors that contribute to customer payment delays and how to handle them through the lens of collection automation.

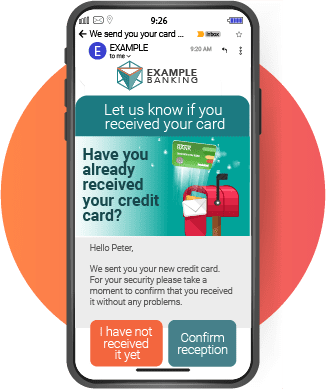

1 – The customer is not aware of the payment day

When customers receive the invoice, they set it aside because they believe that “there is still plenty of time before it expires”. In fact, most customers do not set a reminder to make the payment and expect to be notified when the due date approaches. In some cases, bills or statements simply get lost in customers’ hectic lifestyles.

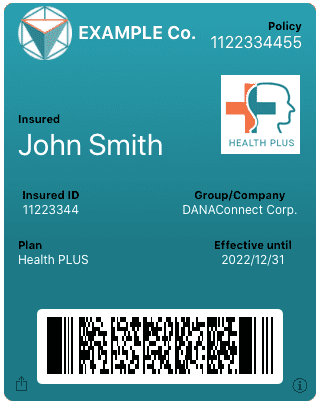

In any case, the payment will not be made until the customer has been reminded it is pending and knows exactly what information is on the invoice or account statement.

How to deal with this:

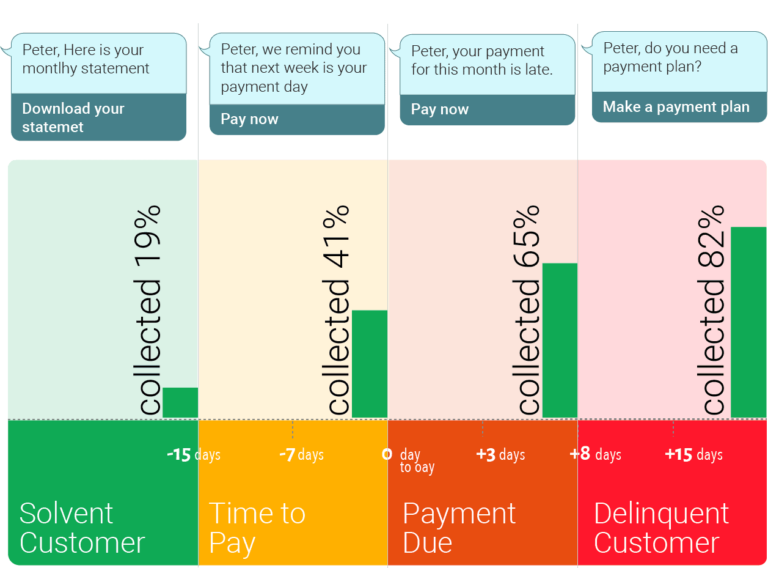

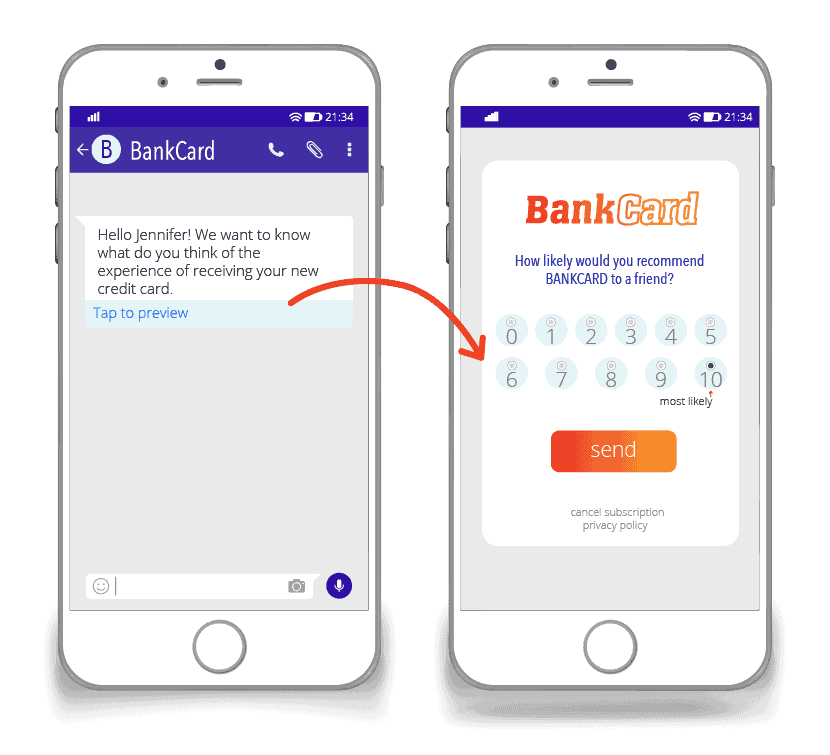

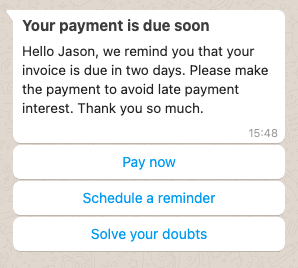

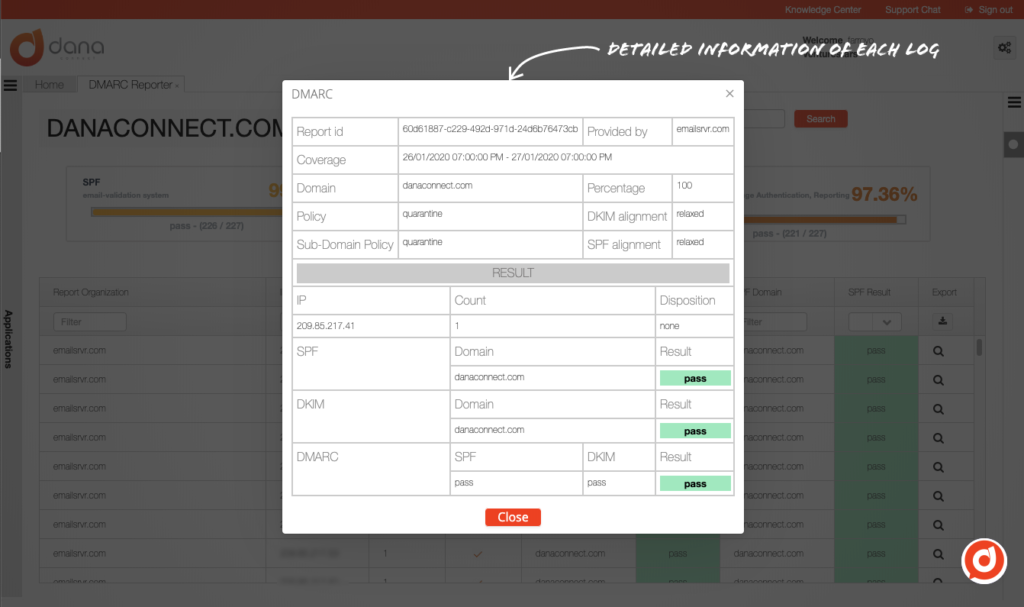

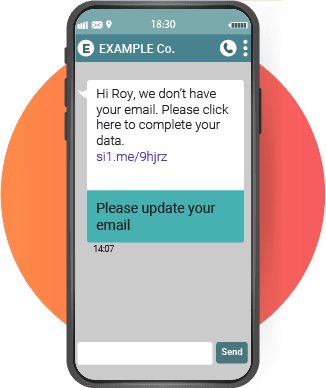

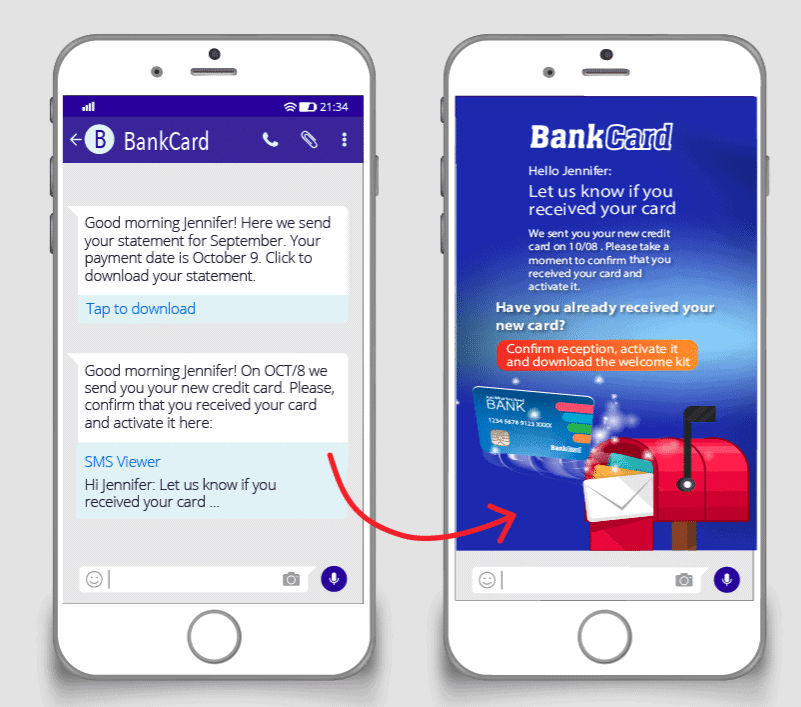

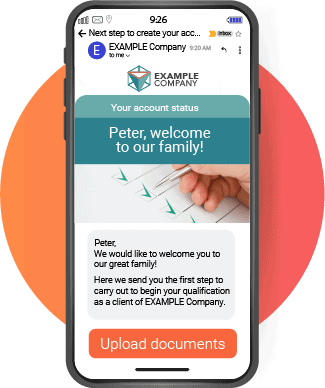

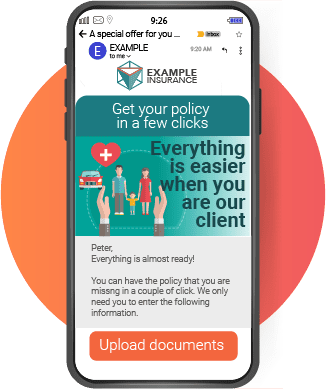

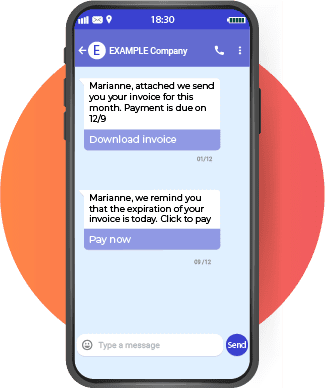

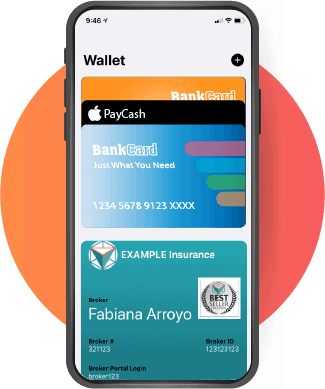

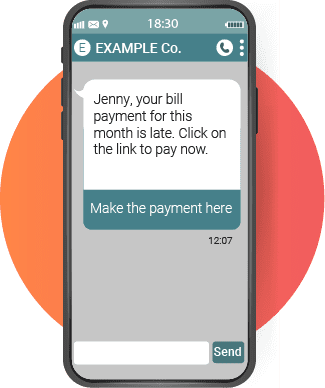

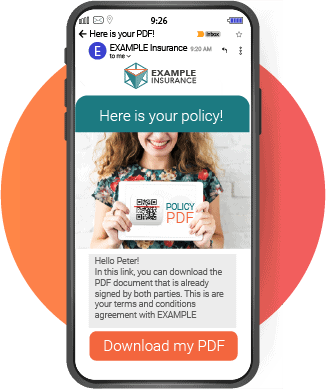

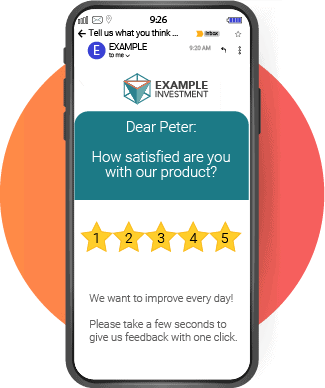

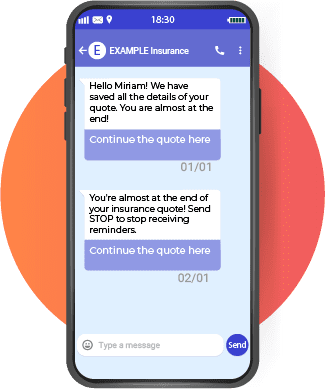

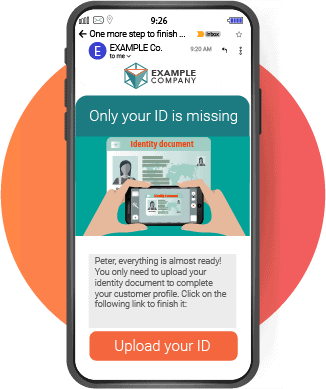

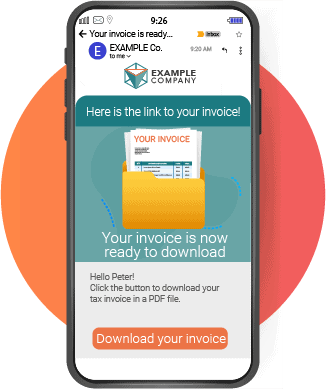

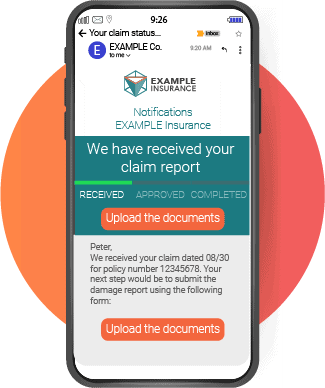

Getting a handle on collections should begin even before the payment is due. Therefore, you should send a reminder before the payment due date. An essential aspect of this reminder is to present it as help given to the client to remember the amount, due date, and equally important is to include the payment channels in the communication. It is also crucial that the customer knows self-service means to download their invoices at any time and from any channel.

See the case of use with sending Account Statements: Sending Credit Card Account Statement with Payment Tracking

See the case of use with sending Invoices: Digital Invoice Sending with Automated Payment Tracking

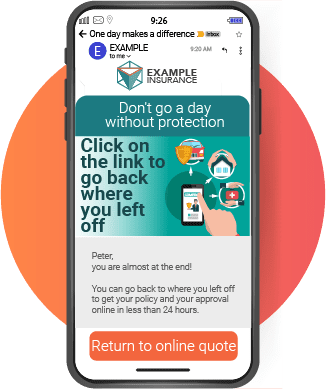

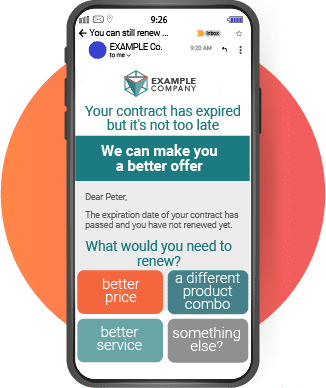

2- The client tries to delay the payment by any possible means

The most common cause of debt recovery delays is this issue. Inevitably, customers always try to maintain their financial comfort.

Even with acknowledgment of receipt, the main excuse is usually that the bill or statement was not received. Another excuse is that the payment has already been made and there must be a problem with the bank.

How to deal with this:

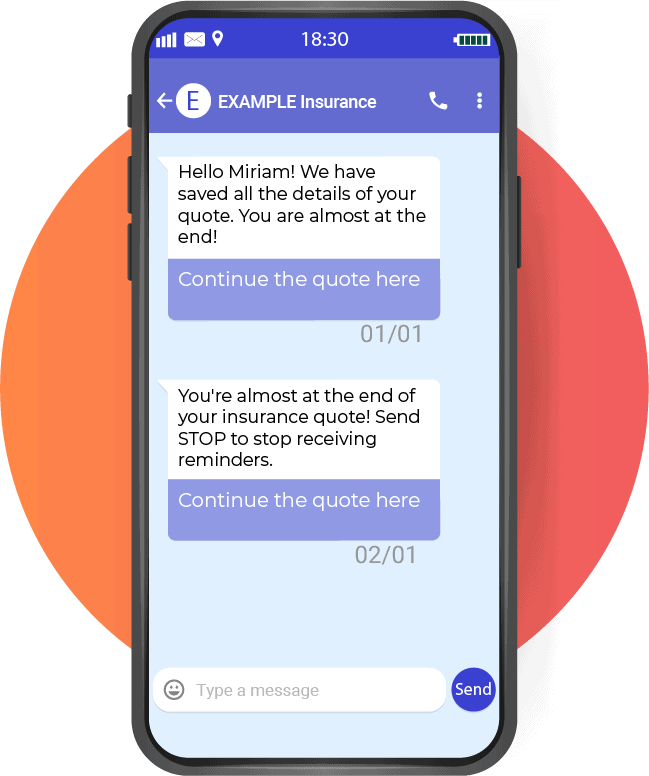

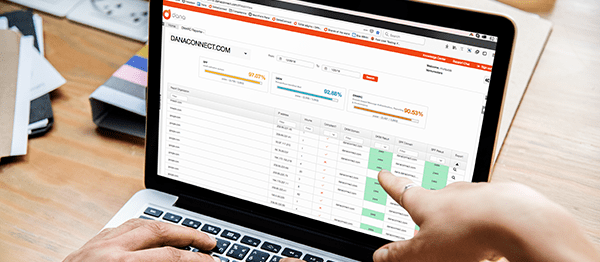

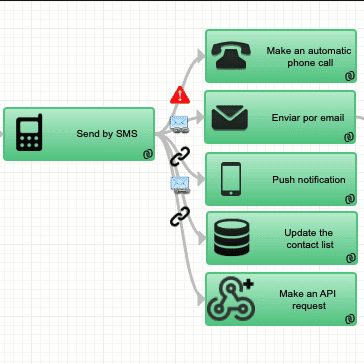

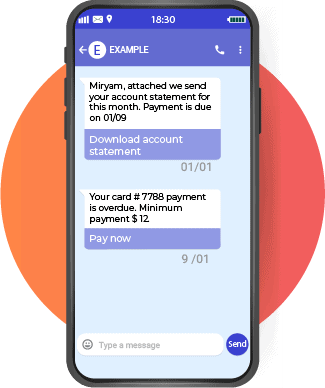

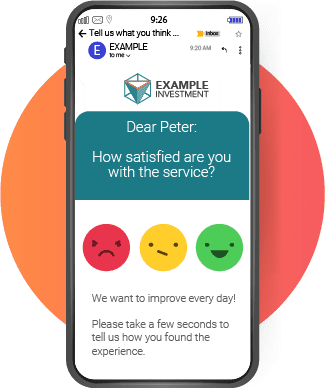

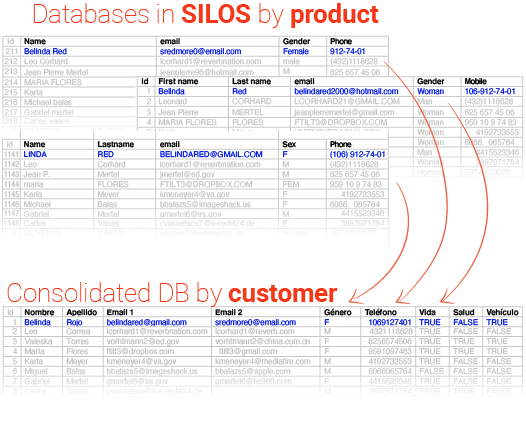

It is essential to verify if the payment has been made on the due date and, if not, claim the payment on the same day. Making this verification for all clients manually the same day is practically impossible, so automation is definitely the best option. Billing and collection data need to be well integrated into automation flows to accomplish this. The reminder schedule must be in sync with the payment cycle and is sent whenever the customer hasn’t paid. To know the best times and the type of messages we recommend that you also read the article “When and how to request late payments: 5 templates for collections”

3 – Customer wants to dispute the charges

When a customer receives an invoice and believes it to be incorrect, they typically file a dispute and wait for a response from the biller. In the absence of a resolution to the dispute, the customer will not pay.

If there is no expeditious and clear way to make this challenge, the payment will simply not be received.

How to deal with this:

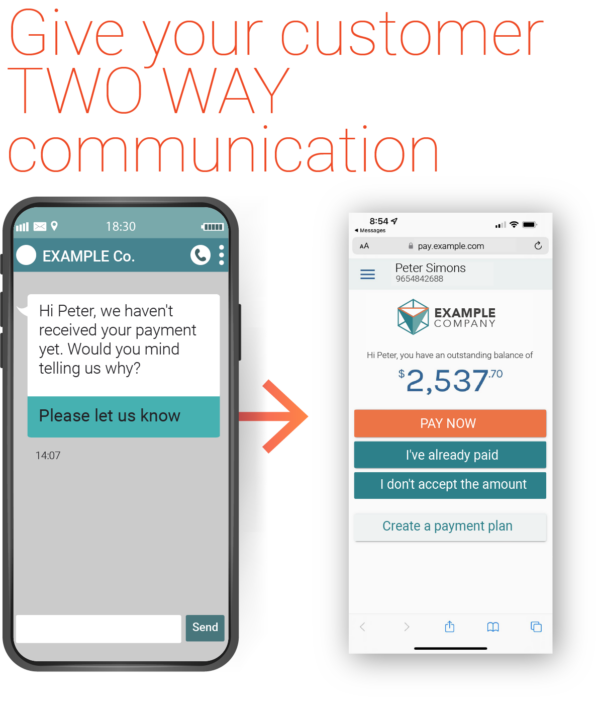

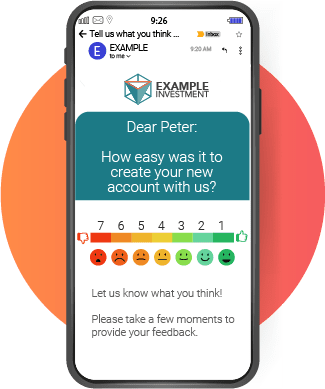

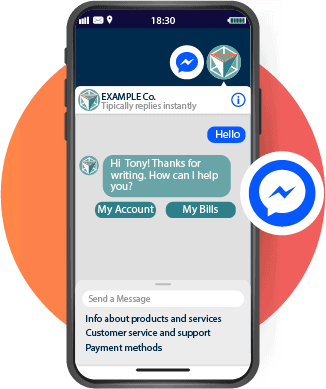

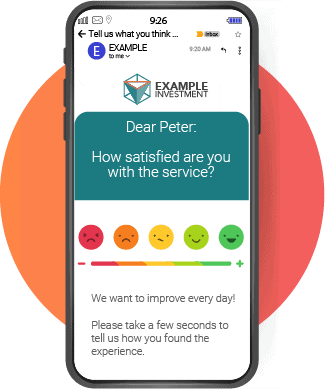

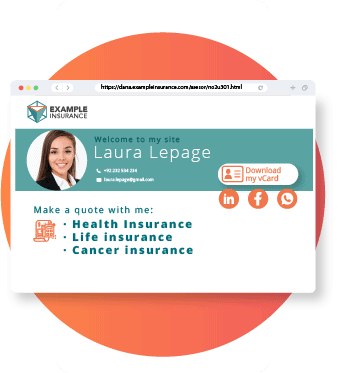

You should handle disputes promptly and even anticipate them by giving the customer a visible and accessible way to let the creditor know “There’s a problem with the bill.” For example, you can add buttons or links that lead to feedback forms that allow customers to identify the reasons for their disputes. In this way, it is possible to easily classify the case and send the information to a collection agent in an organized and timely manner. Even using artificial intelligence in automations makes it possible to continue communication flows with the client without involving a human agent.

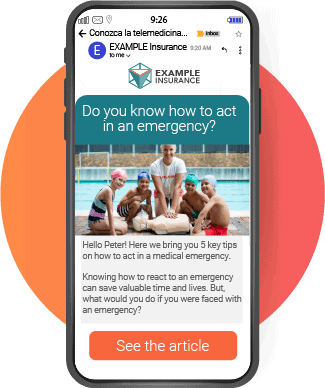

4 – The customer did not receive the invoice/statement, or it was received late

Sometimes it is really true that the customer did not receive the invoice or did not receive it before the due date.

How to deal with this:

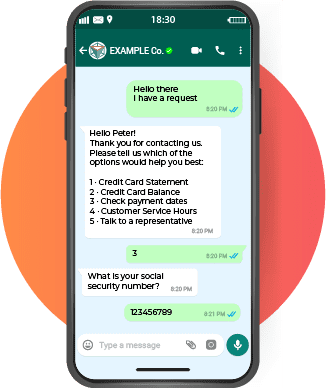

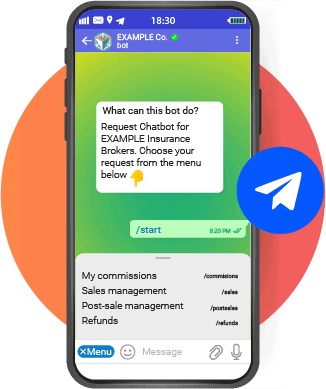

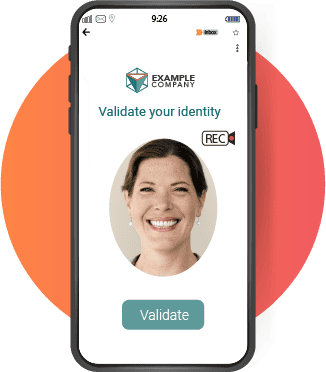

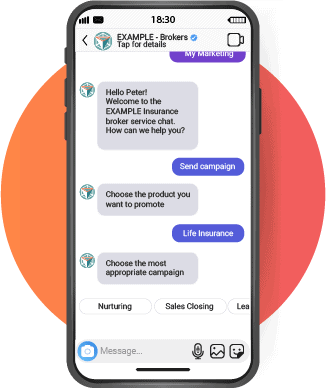

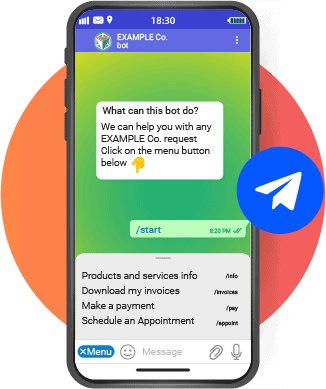

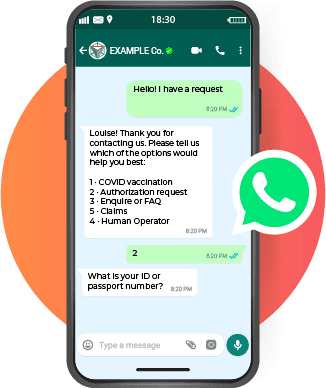

Whenever there is a problem like this, it is important to find ways to get the customer to provide feedback about what is happening in a simple and obvious way. Alternative communication and self-service channels, such as chatbots and feedback buttons, can reduce the volume of service requests to call centers, and improve recovery rates. For example, with a self-service chatbot, the customer can request and download their invoice at any time. Similarly, the chatbot can report the available payment methods.

5 – The customer does not have the financial means to pay

Even if your product is essential or highly valued to your client, it does not matter how hard we try to make the client pay if they do not have the financial means.

How to deal with it:

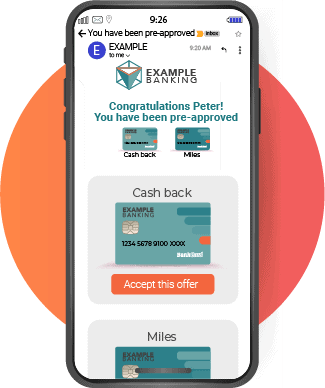

Many times, “bad debt accounts” aren’t really that bad. Most clients are willing to pay if they are given options for organizing their finances.

When it is really late in the recovery effort process, it is necessary to force the customer with a final notice to answer if the delinquency is because they lack the economic resources. This is the time to provide them with a self-service application to help them agree to a new payment terms, including the option of choosing various alternatives, calendars, and means of payment.