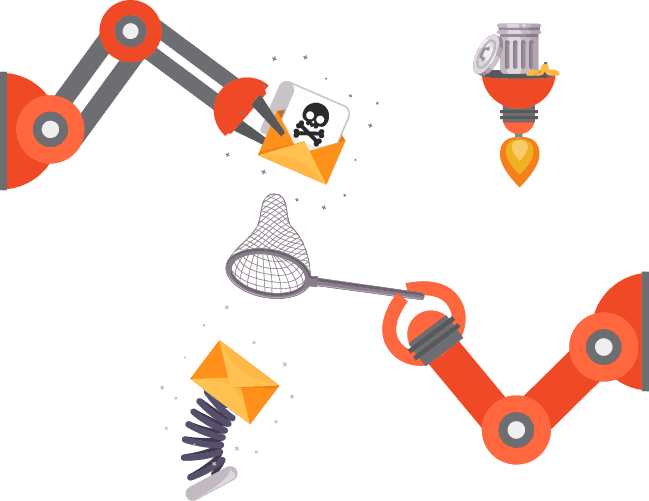

What are spamtraps?

Spamtrap is a buzzword and it sounds like something bad, but really, what are spamtraps? Different email providers and blacklist providers use spamtraps as a method of identifying senders who add email addresses to their contact lists without the permission of their owners.

This technique works by creating email addresses secretly, which are classified as “traps”. Since these email addresses are not shared or published anywhere, there is no reason to receive communications from them. Therefore, campaigns that reach these addresses are considered SPAM.

Using spamtraps isn’t the only method employed by email providers and blacklist creators. There is also another way in which these addresses are created from inactive accounts or accounts that no longer belong to their original owners. Those addresses become the property of the email providers, and as in the previous case, all communications that arrive at these email addresses that have not been used for so long are considered spamtraps, since being owned by email providers gives no authorization to receive communications.

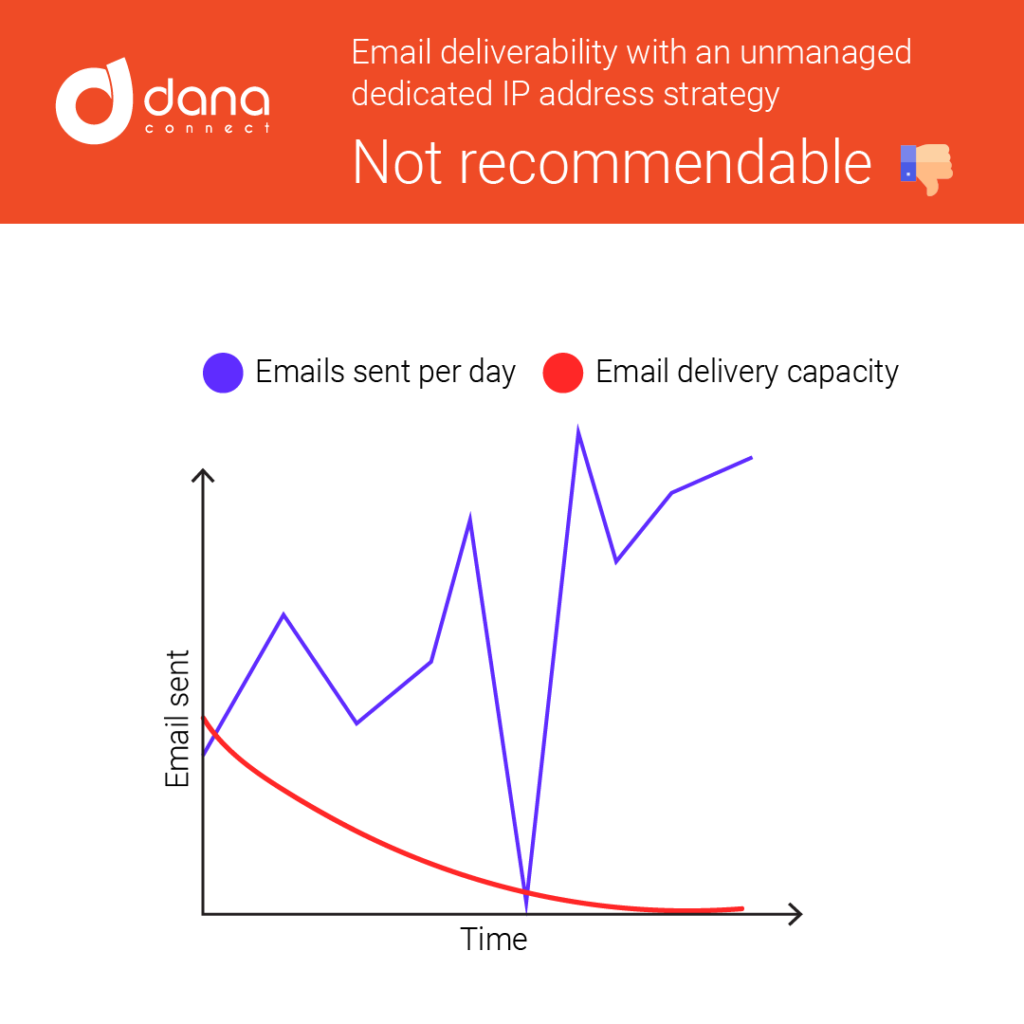

How can spamtraps affect email delivery?

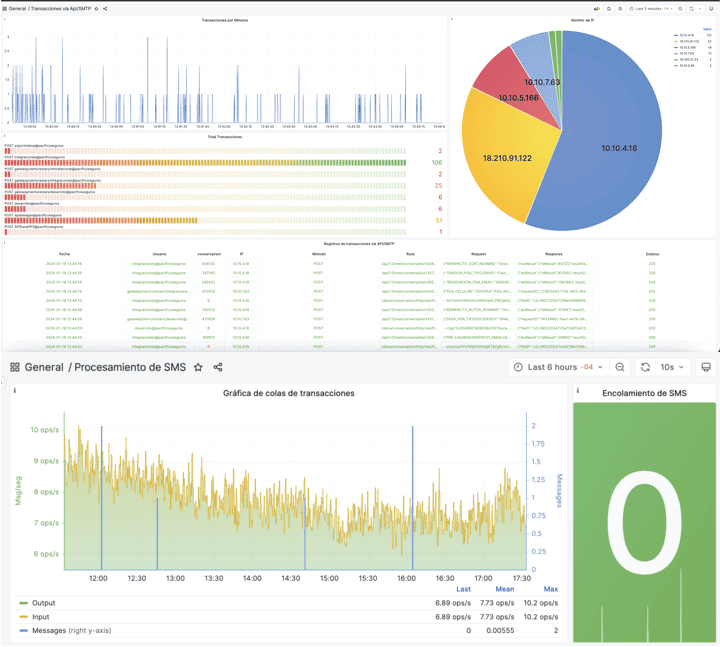

- The IP addresses that output your communications can be blocked.

- This block can be initially for a few days as an alert, but if it is recurrent it can be carried out permanently.

- Not only the IP address through which your communications go out is affected, but in the long term also your domain (yourcompany.com) from which your emails come out could be marked as spam and fall on blacklists.

Top 7 Recommendations to avoid spamtraps and its consequences:

- While you gather information from contact lists, make sure it is the client himself who writes the email address (avoid that a third party participation).

- Use the double opt-in technique which consists of verifying the email address through a confirmation email sent after the customer enters his email address.

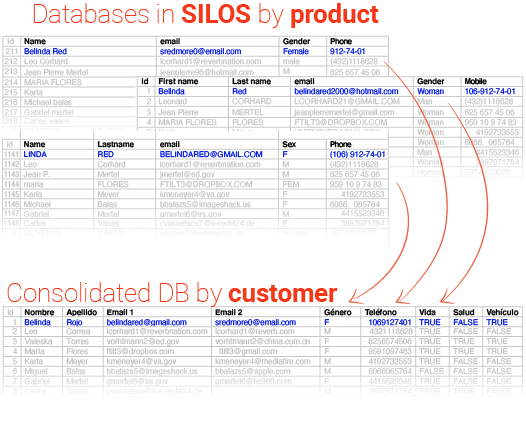

- Debug your contact lists.

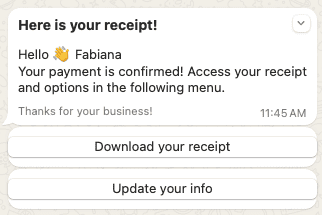

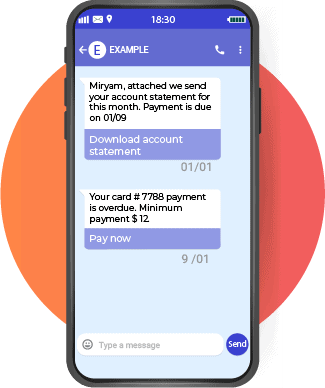

- Keep your contact lists up to date. For this, you can use other communication channels such as SMS, integrating web forms in the communication to speed up the process.

- Periodically notify your contacts that emails will be sent to their email addresses (1 or 2 times a year).

- Provide the opportunity for your contacts to unsubscribe from your communications.

- Never use contact lists that have been bought, rented or that are the property of another company even if they are within the same corporation.