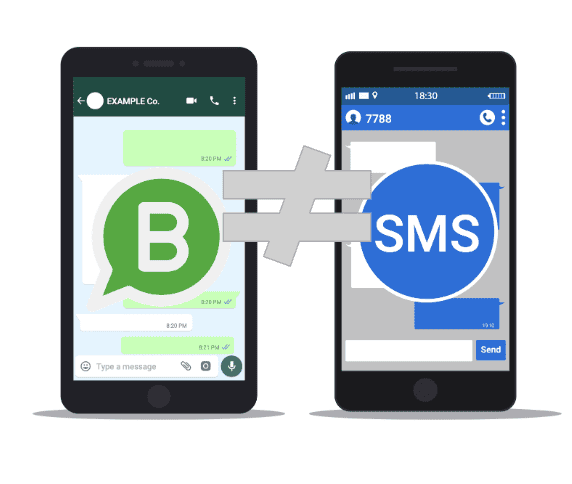

In a world where digitalization is redefining customer-business interaction, WhatsApp has emerged as a key tool in the financial sector. Its role in communicating financial transactions is particularly notable, offering a unique blend of accessibility and efficiency. This analysis examines how financial institutions use WhatsApp for transactional notifications, highlighting both its advantages and potential drawbacks, with a special focus on integration with customer service queuing systems.

WhatsApp: More than Messaging, a Business Channel

Originally a personal messaging app, WhatsApp has evolved to become a vital business communication channel. Its adoption in the financial sector is a reflection of the demand for more direct and personalized communication methods, adapting to the needs of the modern client.

Advantages of Using WhatsApp in Financial Transactions

1. Ease of Use and High Penetration

- Familiar Interface: The global popularity of WhatsApp offers a familiar and easy-to-use platform for banking communication, facilitating its adoption by both customers and financial institutions.

- Immediate Access to Financial Information: The ability to receive real-time transaction notifications through WhatsApp significantly improves the accessibility of financial information for users.

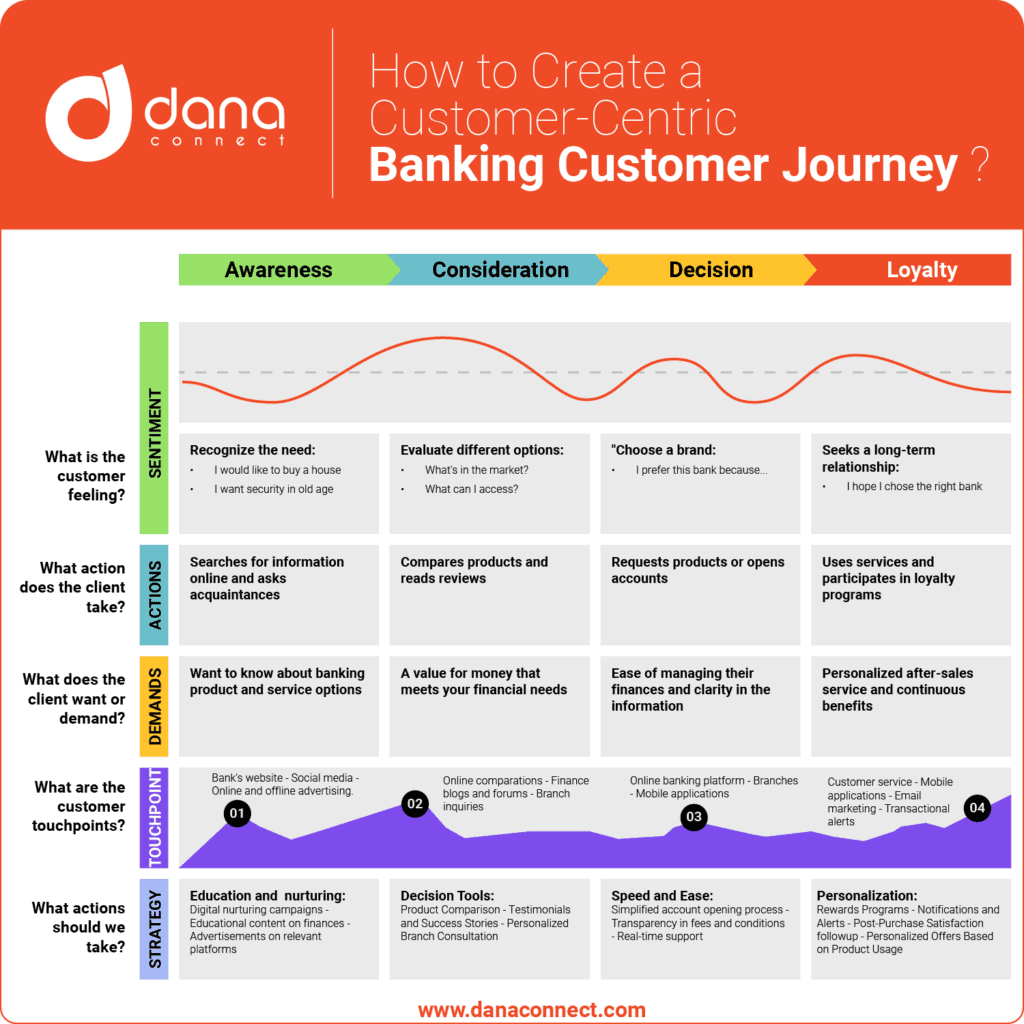

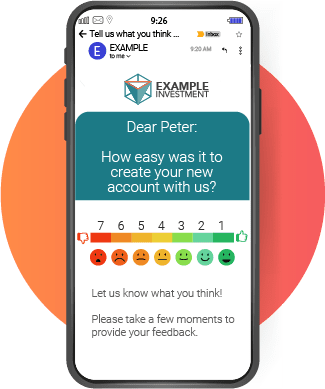

2. Enrichment of the Customer Experience

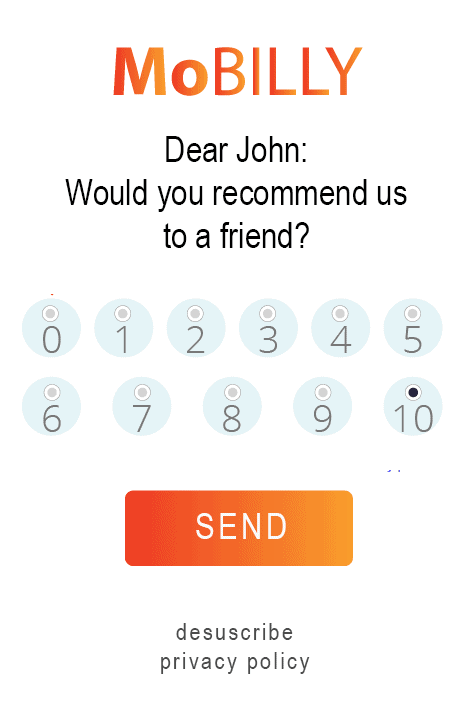

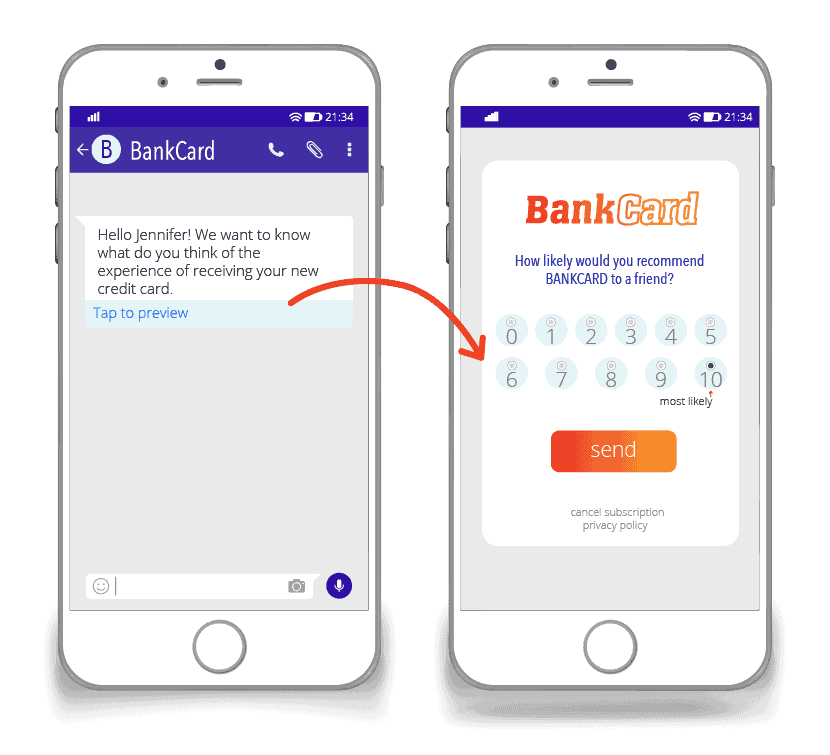

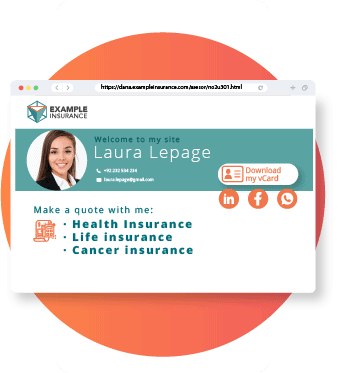

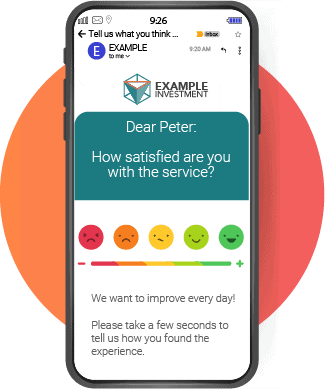

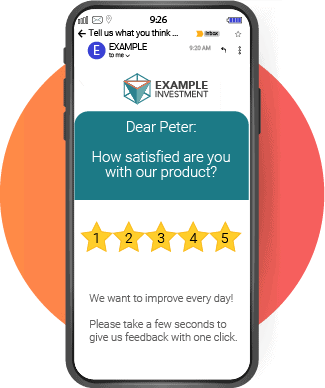

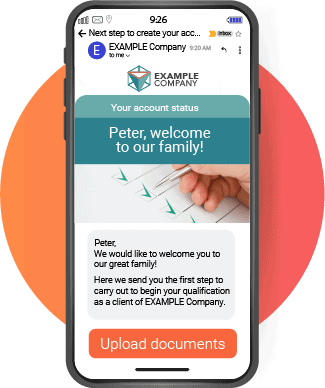

- Personalized Communication: WhatsApp allows financial institutions to send personalized and direct notifications, which can increase customer satisfaction and loyalty.

- Agile Responses and Timely Assistance: Instant messaging facilitates a more dynamic and effective interaction, allowing customers to obtain quick responses and timely solutions to their financial concerns.

3. Innovation in the Provision of Financial Services

- Integration with Digital Banking: The inclusion of WhatsApp as part of digital banking systems opens new possibilities for interaction with financial services, from inquiries to transaction authorizations.

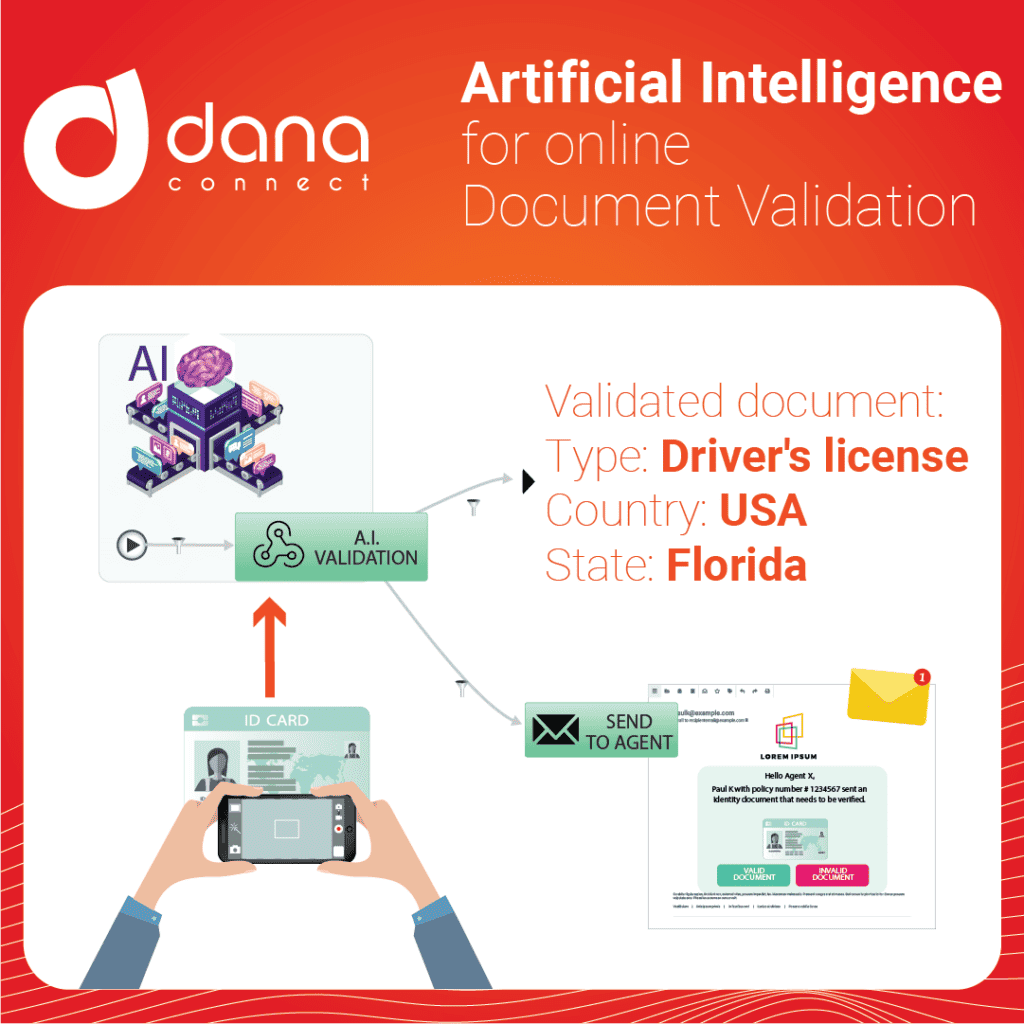

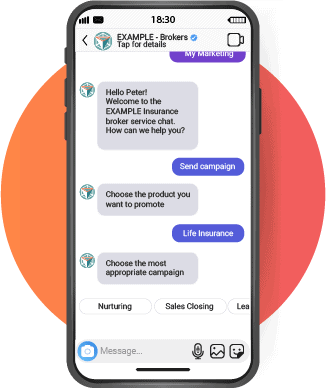

- Chatbots and AI for Better Interaction: The integration of advanced technologies such as chatbots and AI in WhatsApp can provide automated and personalized assistance, improving efficiency in managing queries and transactions.

4. Integration with Queuing Systems for Customer Service

- Efficient Query Management: The integration of WhatsApp with queuing systems allows for more organized and efficient management of customer queries, reducing waiting times and improving the distribution of resources in customer service.

- Case Tracking and Prioritization: These systems allow banks to more effectively track inquiries and prioritize cases based on urgency or complexity, resulting in more personalized and effective customer service.

Challenges in Implementing WhatsApp for Financial Communications

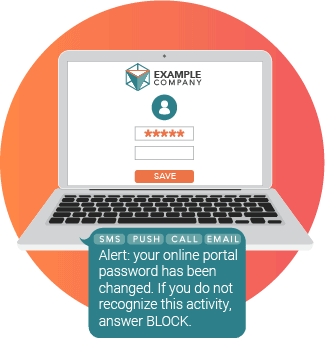

Despite its benefits, integrating WhatsApp into financial communication comes with significant challenges. These include customer concerns about data security and privacy, regulatory compliance, and fraud risk. Effective management of these risks is crucial to taking full advantage of the benefits that WhatsApp can offer in the financial sector.

Challenges and Key Considerations in WhatsApp Implementation

Despite the advantages, the adoption of WhatsApp in financial communication is not without challenges that require careful attention and specific strategies for its management.

1. Data Security and Privacy

- Security Risks: Although WhatsApp offers end-to-end encryption, there are data security concerns when handling sensitive financial transactions and personal customer data.

- Regulatory Compliance: Financial institutions must ensure that their use of WhatsApp complies with data protection and privacy regulations, which can vary significantly between regions and countries.

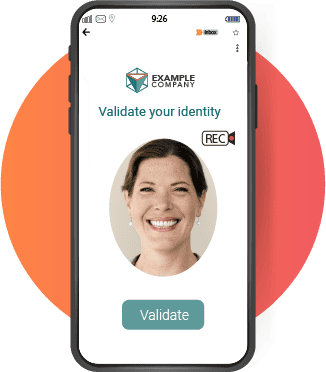

2. Concerns of Fraud and Identity Theft

- Vulnerability to Fraud: WhatsApp’s popularity also makes it a target for fraud and scams, where criminals may attempt to impersonate the financial institution to obtain sensitive information.

- Customer Education: It is vital to educate customers on how to identify legitimate communications and protect against fraud attempts through WhatsApp.

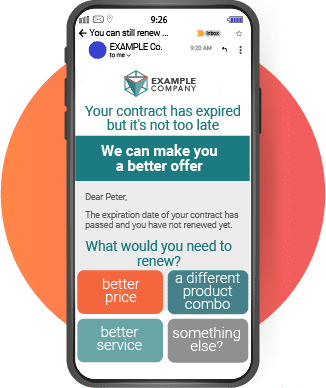

3. Customer Expectation Management

- Immediate Response Expectations: The instant nature of WhatsApp can lead to expectations of quick responses, which can be a challenge during periods of high query volume or outside of business hours.

- Service Quality and Consistency: Maintaining high quality and consistency in communication through WhatsApp is crucial to ensuring a positive customer experience.

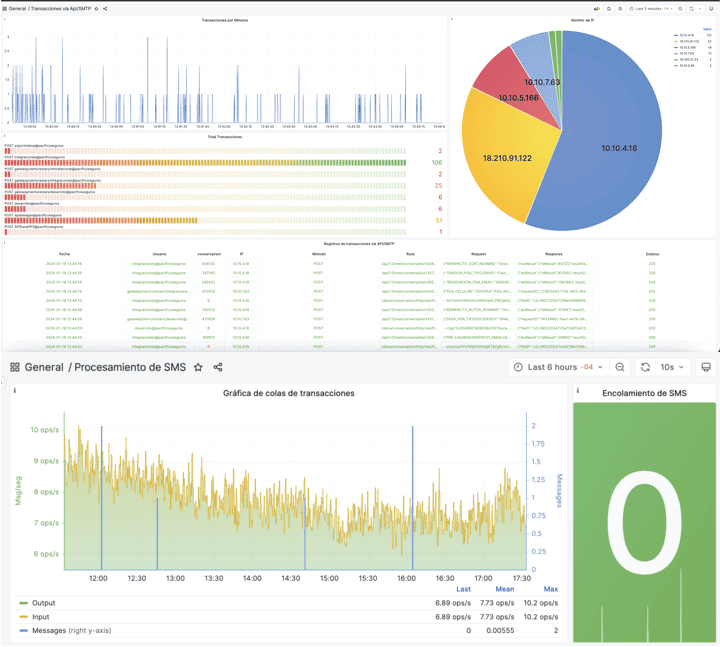

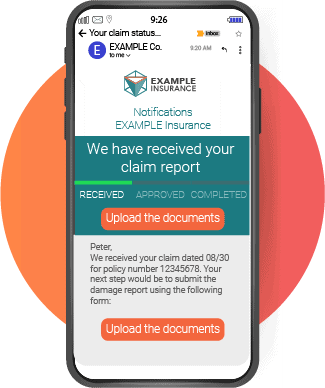

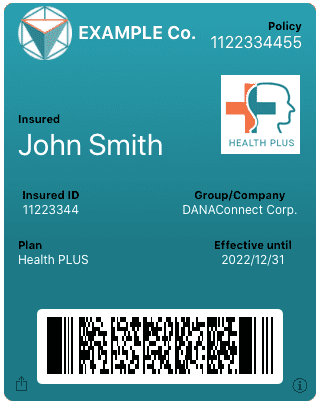

Notifications via WhatsApp

The use of WhatsApp to send transactional notifications in the financial sector covers a wide range of operations. These notifications not only improve transparency and tracking, but also provide an additional layer of security and convenience for users.

1. Monetary Transactions

- Deposits and Withdrawals: Instant notifications when customers deposit or withdraw money, either at branches or ATMs.

- Bank Transfers: Alerts about incoming and outgoing transfers, including interbank or international transfers.

- Payments and Billings: Information about payments made or received, including payment for services, credit cards and other financial commitments.

2. Investment Transactions

- Investment Account Activities: Alerts about purchases or sales of stocks, bonds or other financial instruments.

- Dividends and Yields: Notifications regarding the credit of dividends or interest generated by investments.

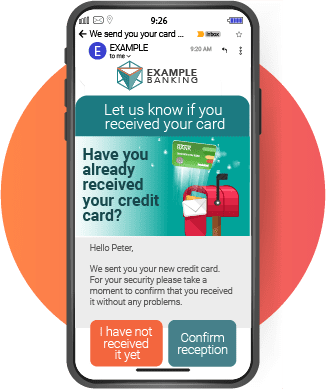

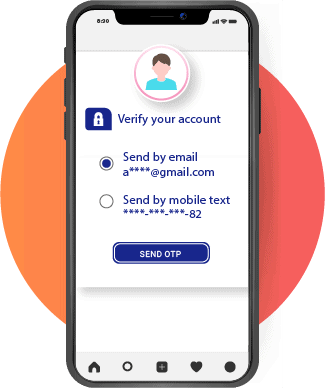

3. Security Alerts and Fraud Prevention

- Unusual or Suspicious Transactions: Quick alerts about activities that appear unusual or suspicious, helping to prevent fraud.

- Account Access Attempts: Notifications of login attempts or changes to bank account security settings.

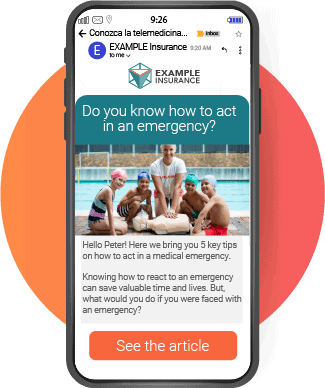

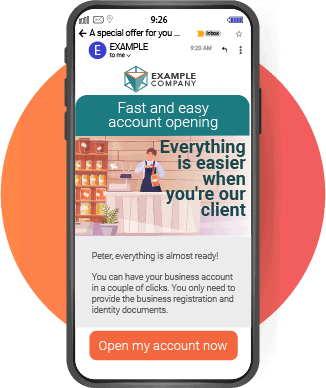

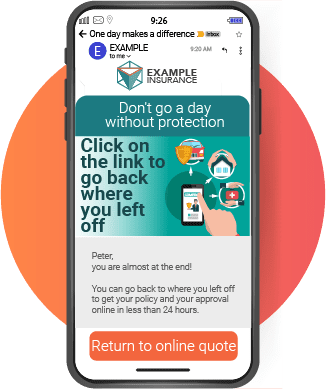

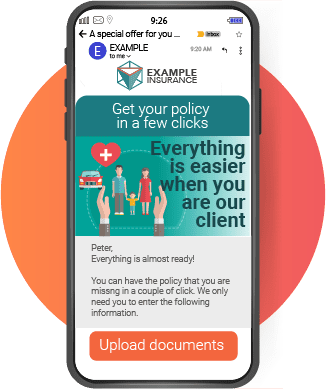

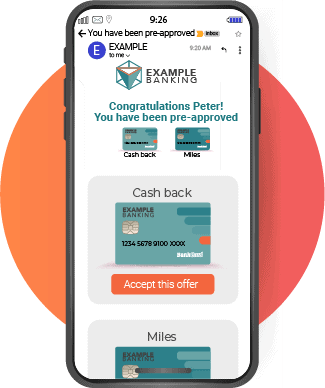

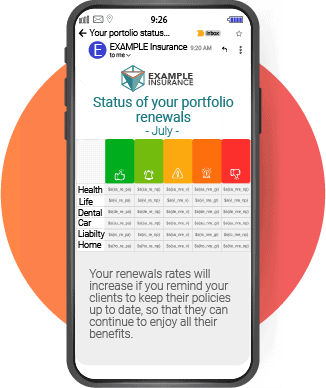

4. Personalized Services and Offers

- Product and Service Updates: Information about new financial products, changes in interest rates or service conditions.

- Personalized Offers: Notifications about personalized offers based on the customer’s history and profile.

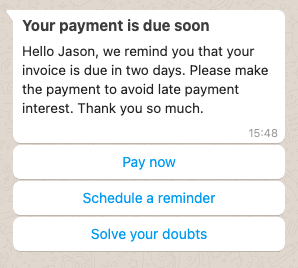

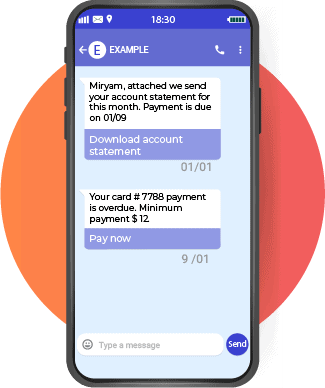

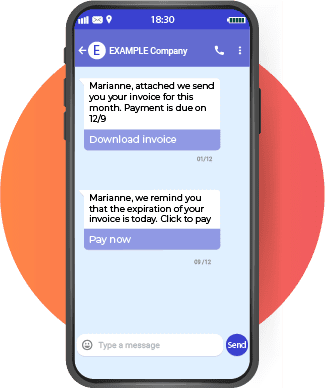

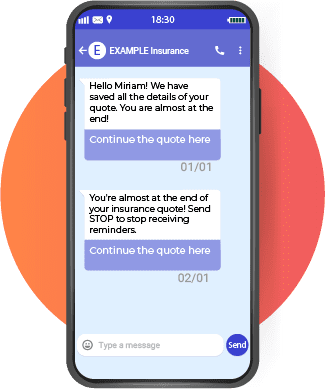

5. Administrative Communication and Reminders

- Payment Reminders: Alerts about payment due dates or reminders to avoid late fees.

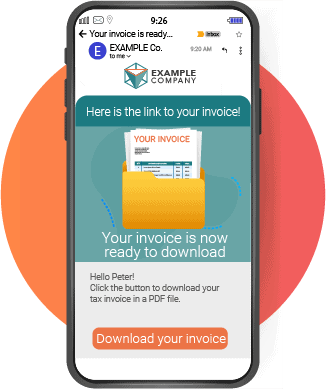

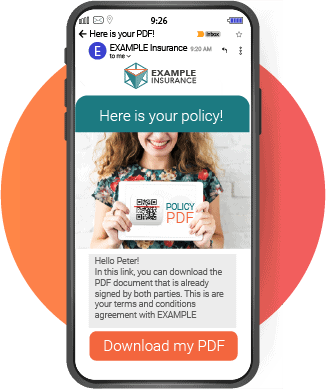

- Delivery of receipts, statements and invoices: Automatic notifications for digital delivery of receipts, statements and invoices directly through WhatsApp, providing customers with quick and convenient access to their important financial documents.

- Documentation and Confirmations: Confirmations of transactions and sending of documents related to the account, such as account statements or annual summaries.

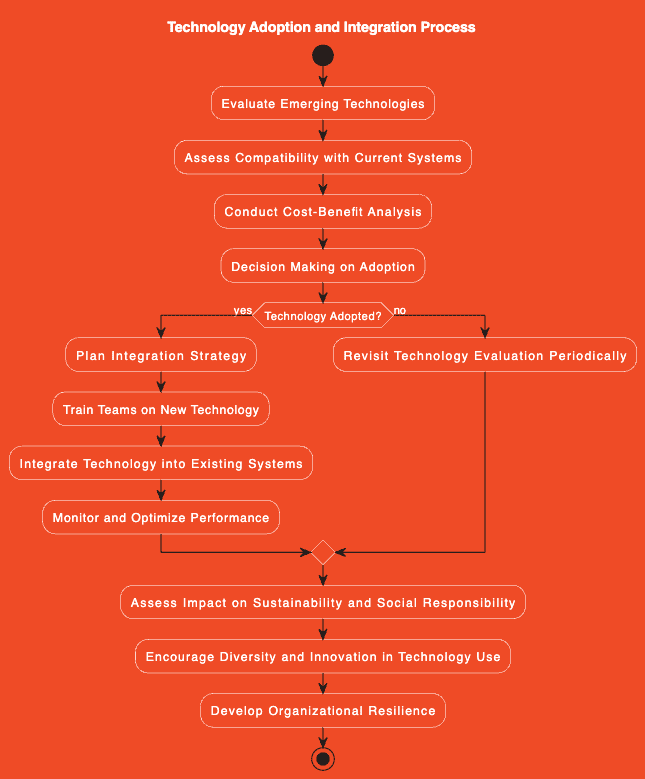

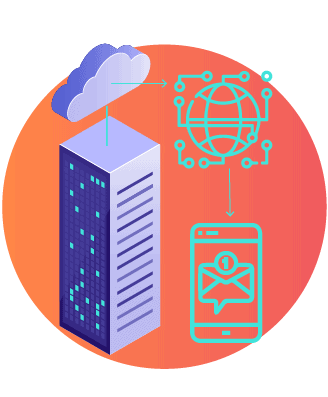

Integrating WhatsApp with Queuing Systems to Improve Customer Service

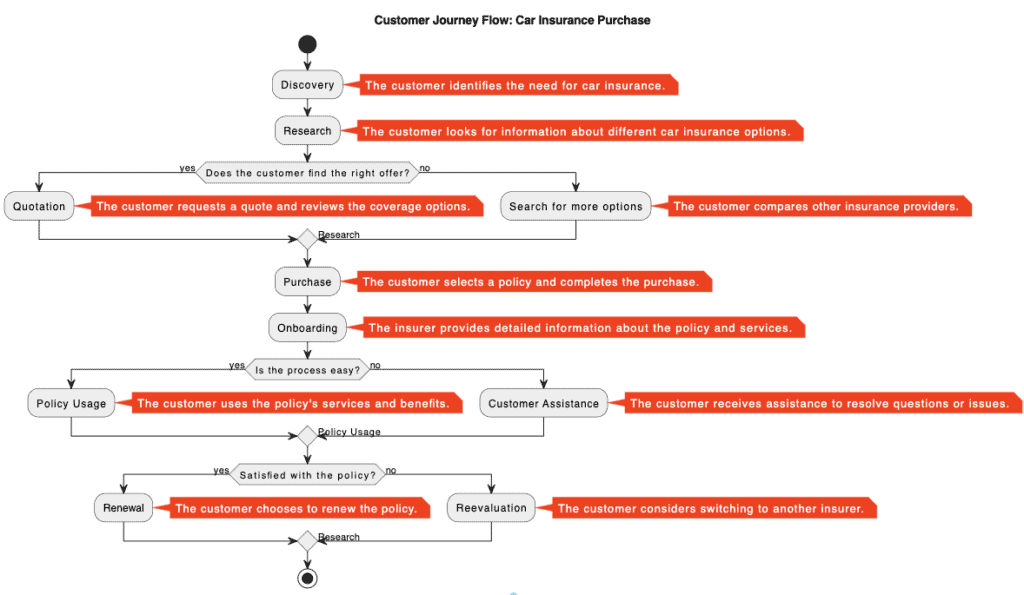

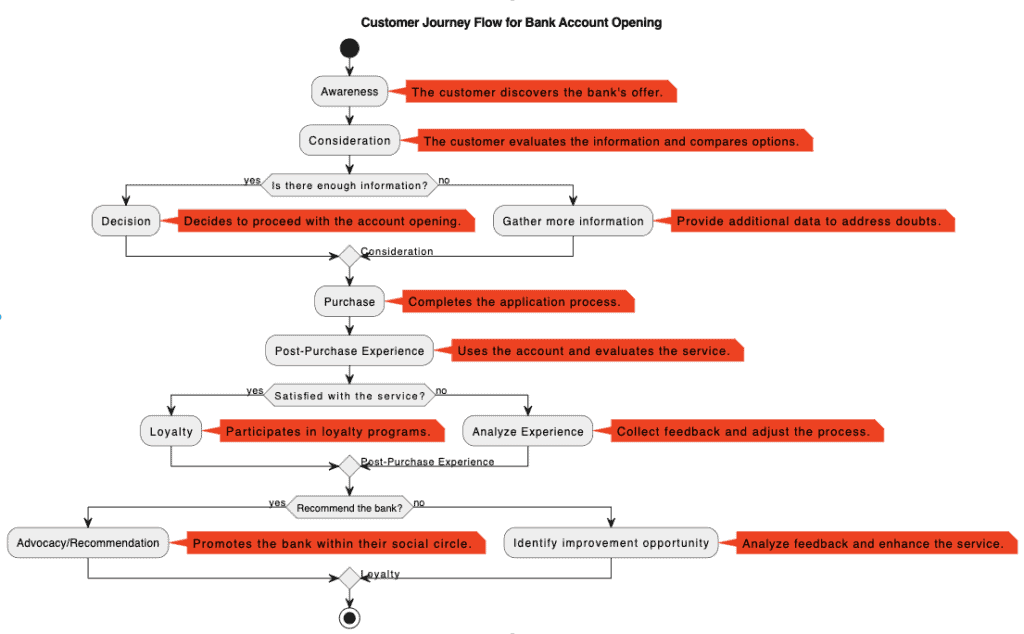

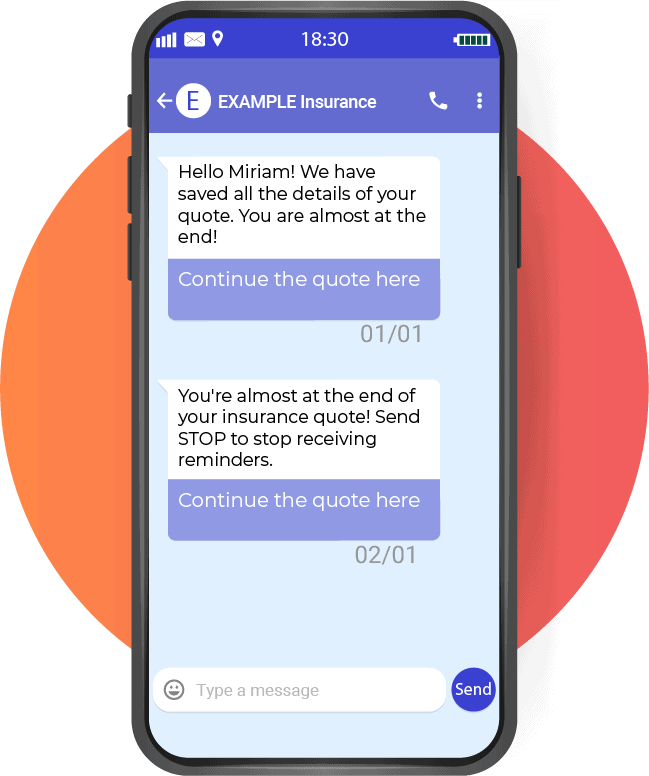

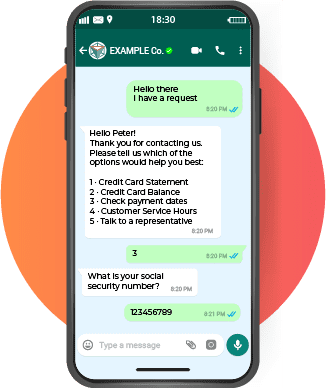

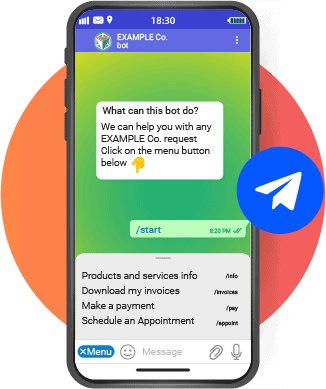

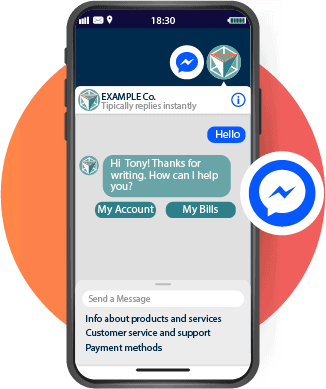

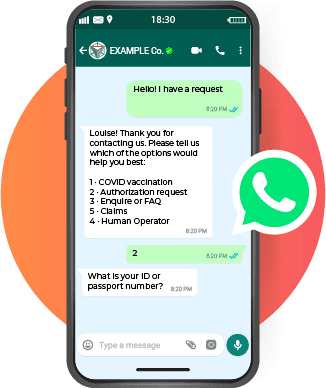

After customers receive transaction notifications, you can also offer automated tracking to provide more information as the customer requires. The integration of WhatsApp with chatbot systems and customer service queuing systems offers innovative solutions to communication challenges in the financial sector, particularly in managing queries and improving operational efficiency.

1. Flexible and Efficient Communication Flows

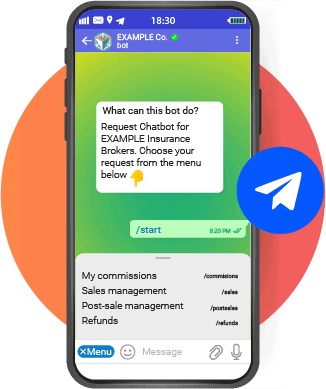

- Beginning Communication with Chatbots: Interaction can begin with intelligent chatbots on WhatsApp, providing automatic responses and immediate assistance for general queries or routine transactions. This improves efficiency by reducing the burden on human agents and providing quick answers to frequently asked questions.

- Smooth Transition to Human Agents: In cases that require more detailed or personalized attention, the system can escalate the conversation from a chatbot to a human agent without interruptions. This transition ensures that clients receive the appropriate care for their specific needs.

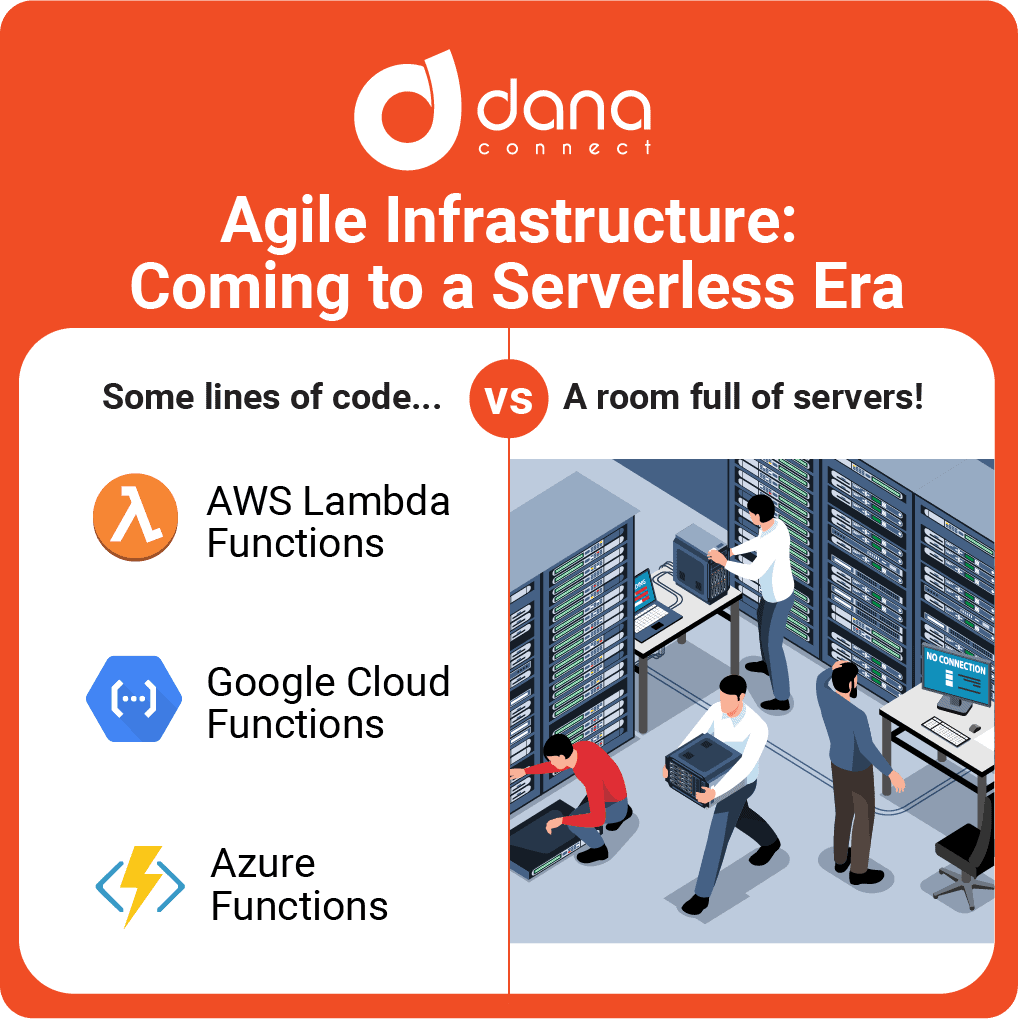

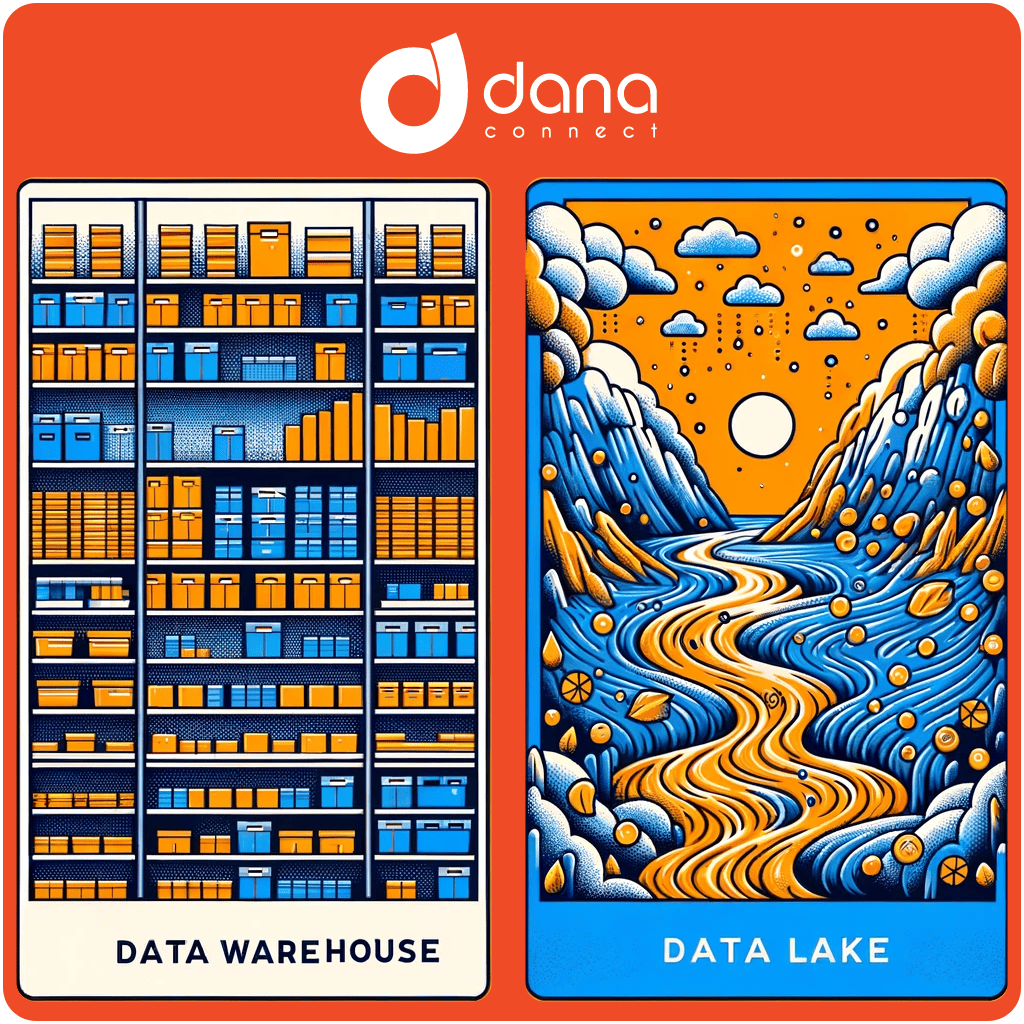

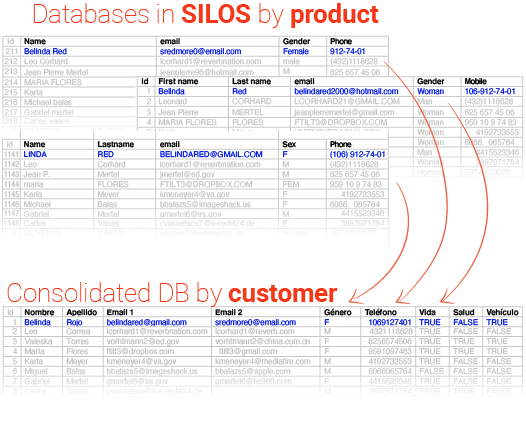

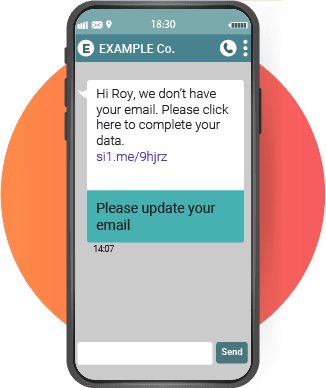

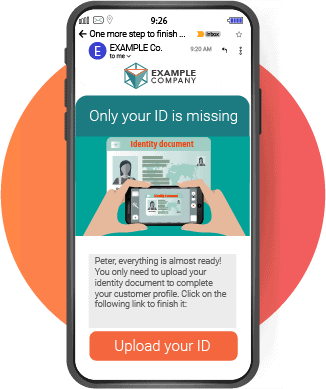

2. Integration with Information Systems and Datawarehouse

- On-Demand Download of Documents: Customers can request and receive important documents, such as account statements or transaction confirmations, directly through WhatsApp. This function is facilitated by secure integration with the bank’s information systems, allowing quick and secure access to the necessary documents.

- Real-Time Information Consultation: By integrating WhatsApp with the bank’s data warehouse, customers can consult relevant information about their accounts and transactions in real time. This integration provides a source of valuable and up-to-date information, improving user experience and decision-making efficiency.

3. Improvement in Organization and Response to Queries

- Efficient Query Management: The integration of WhatsApp with queuing systems optimizes the distribution of queries to agents, improving time and resource management.

- Effective Tracking and Prioritization: These systems allow for effective tracking of inquiries and help prioritize them based on urgency, ensuring that critical customer needs are addressed in a timely and efficient manner.

To go…

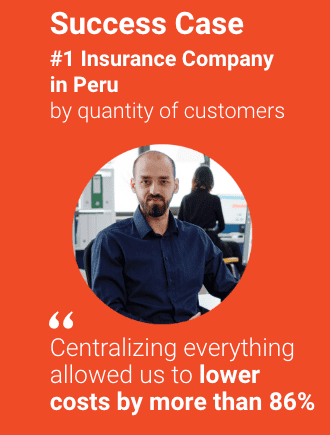

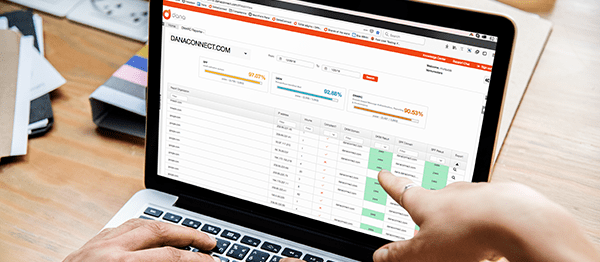

In conclusion, the integration of WhatsApp in the communication of financial transactions is more than a trend; It is a transformation that is redefining the interaction between financial institutions and their clients. From improving transaction reporting efficiency to strengthening security and personalizing the customer experience, WhatsApp has established itself as a valuable tool in the world of digital finance. As we adapt to this changing landscape, solutions like DANAconnect emerge as key enablers, offering a robust and versatile platform capable of integrating these innovations.

Is your institution ready to take communication to the next level?

Discover how DANAconnect can help you transform your customer communication strategy, integrating solutions such as WhatsApp for a more secure, efficient and personalized experience. Contact us for a WhatsApp channel demo.