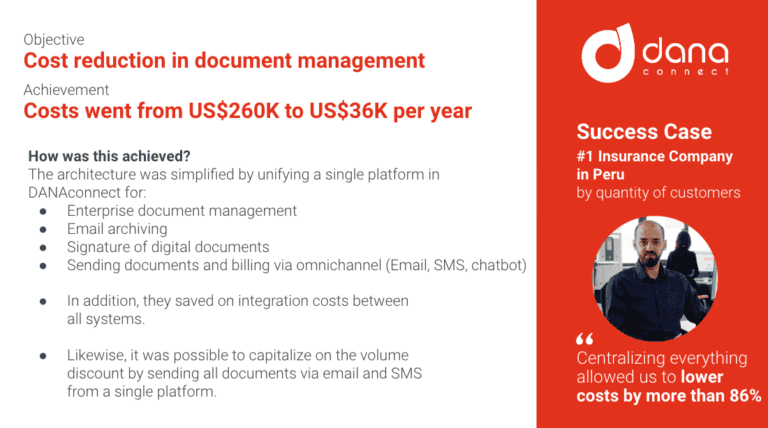

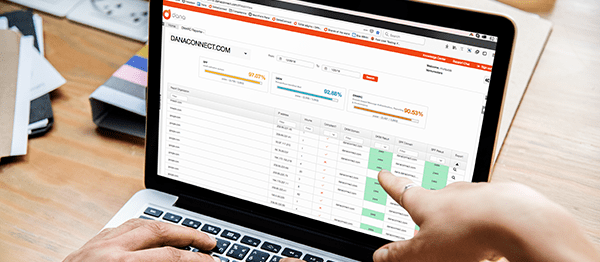

The number one insurance company in Peru by customer count faced a significant challenge in document management and client communication handling. To reduce operating costs, an integrated Digital Document Management solution was implemented with DANAconnect. As a result, annual document handling costs drastically decreased from US$ 260K to US$ 36K, representing an 86% reduction.

Context and Challenge:

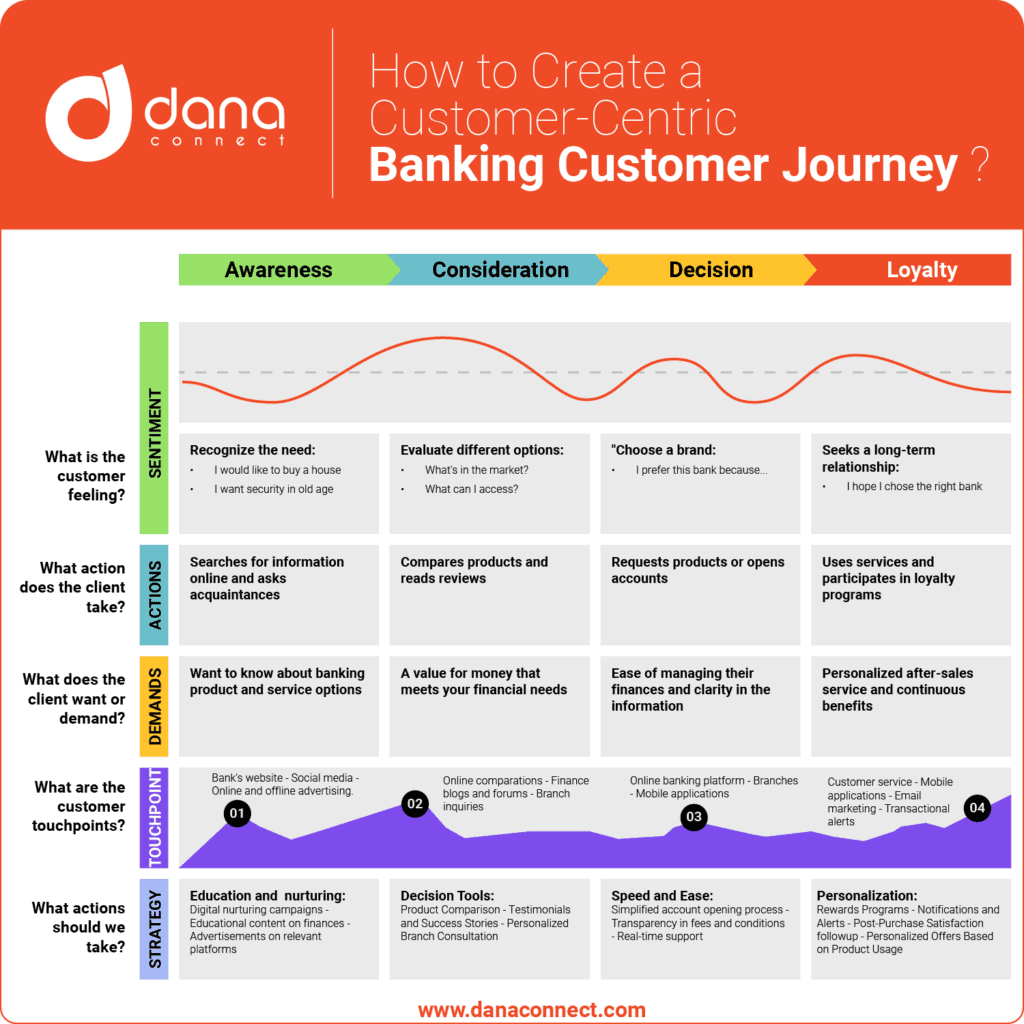

In a highly regulated sector like insurance, efficient document management and secure client communication are crucial. The insurer needed a platform that not only automated and centralized these processes but also ensured regulatory compliance and efficient auditing of client communications.

Provided Solution:

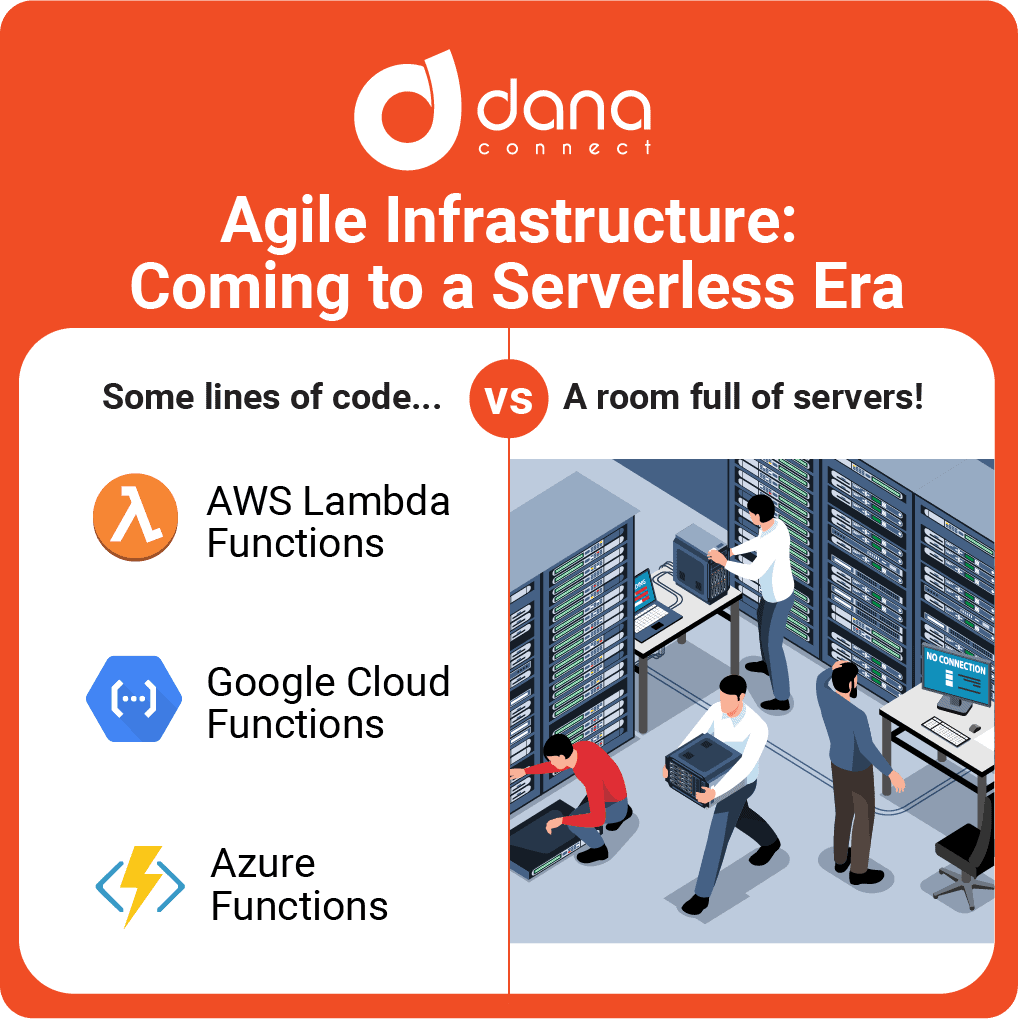

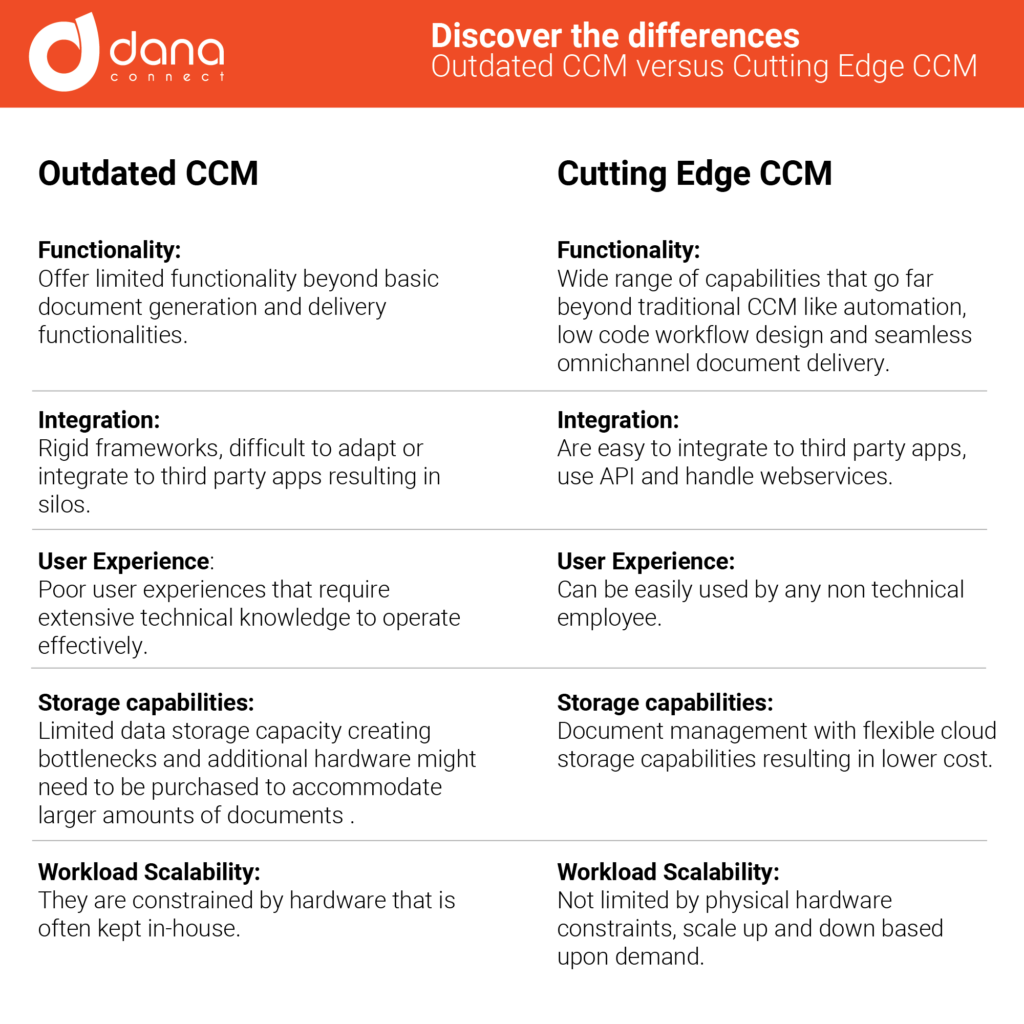

DANAconnect was implemented as a unified platform that integrates:

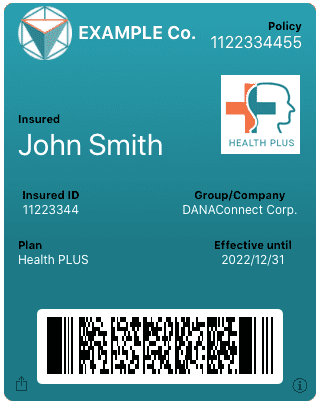

- Enterprise Document Management: Enabled centralized management of client documents.

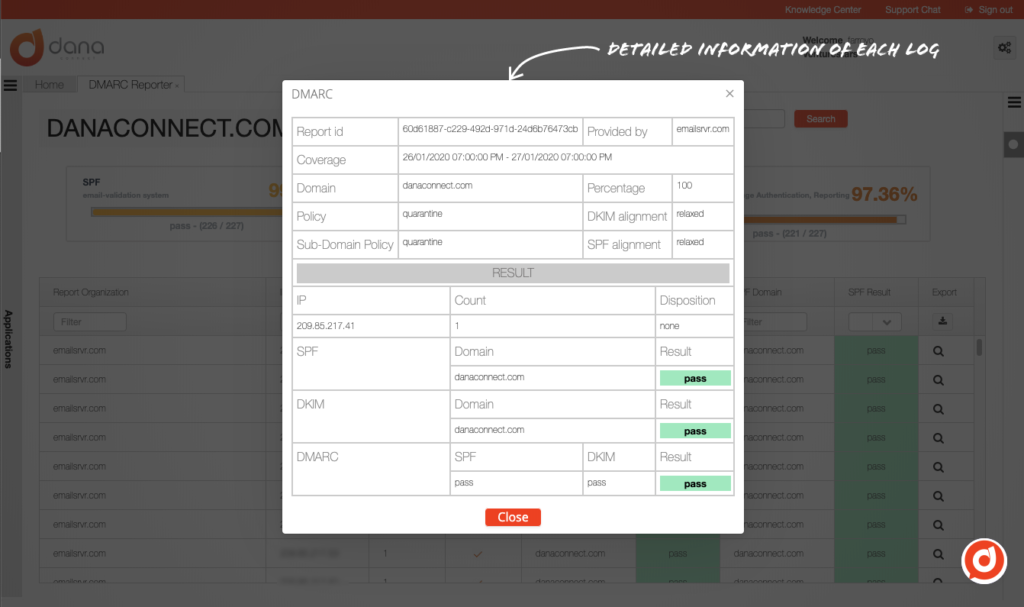

- Email and SMS Archiving for Audit and Regulatory Compliance: Ensured all communications comply with local regulations and provided efficient tools for auditing and e-discovery.

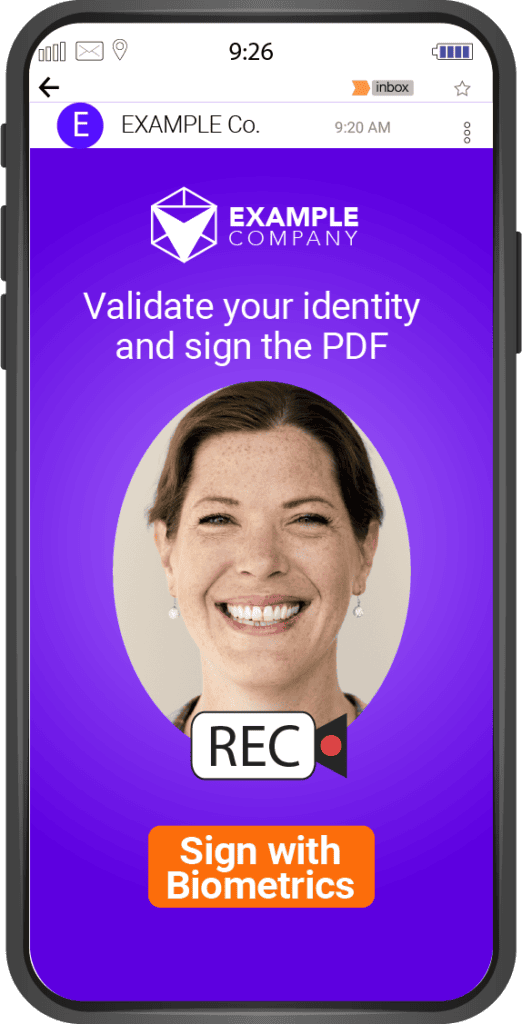

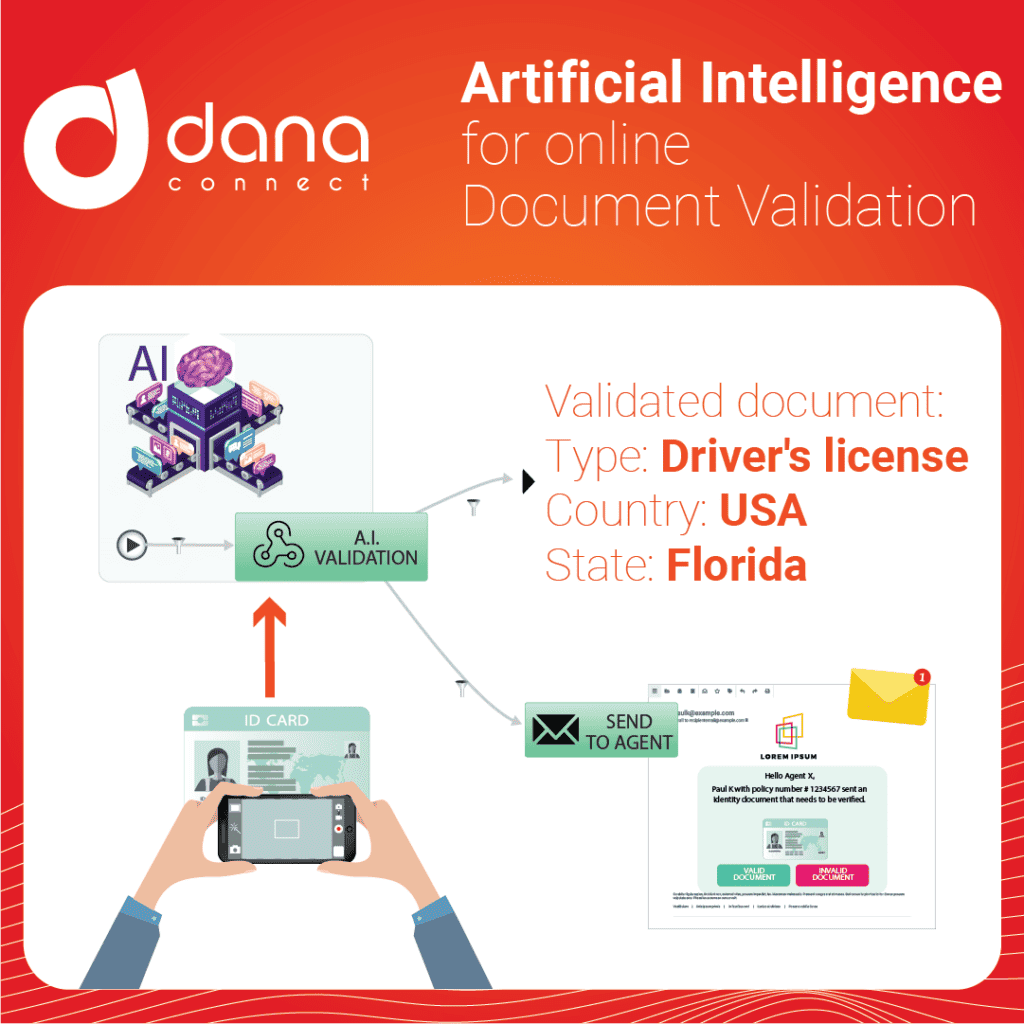

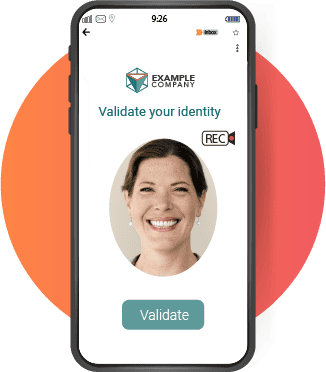

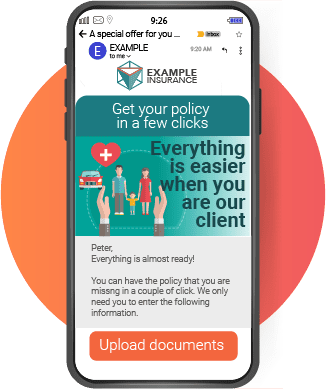

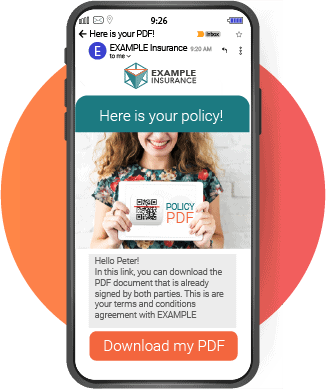

- Digital Signature and Dynamic Document Generation: Facilitated digital authentication and approval of documents.

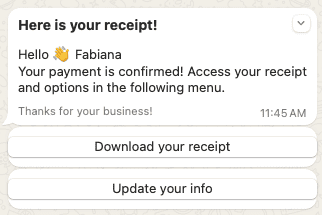

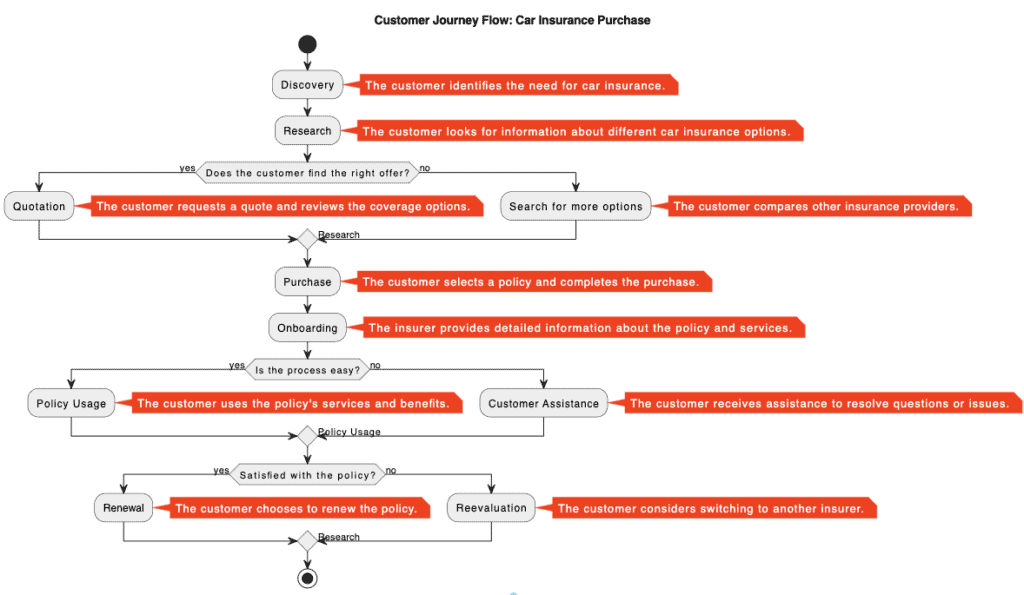

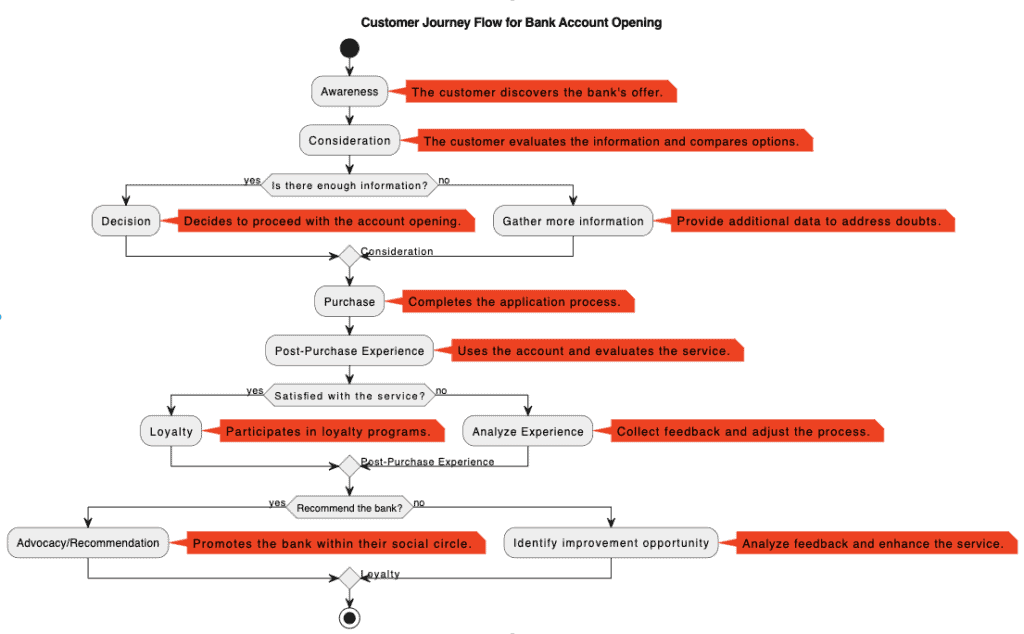

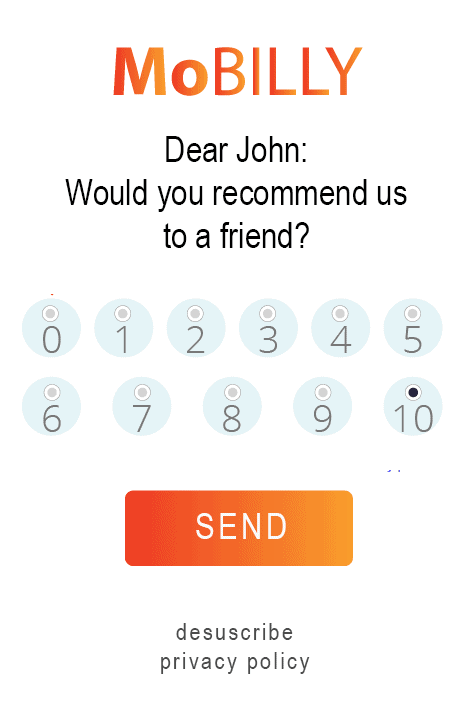

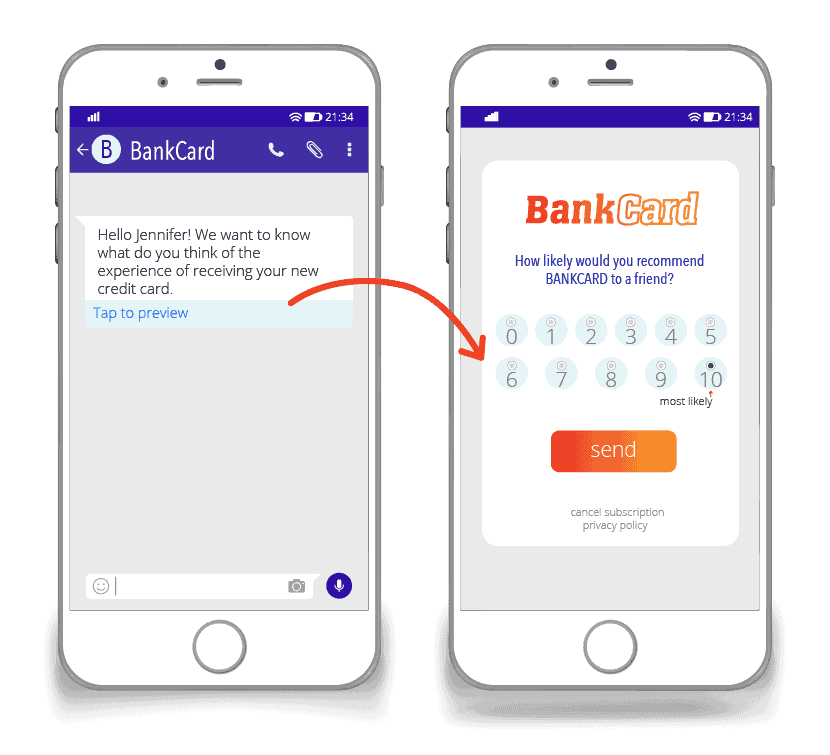

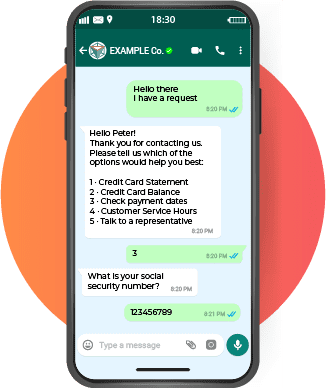

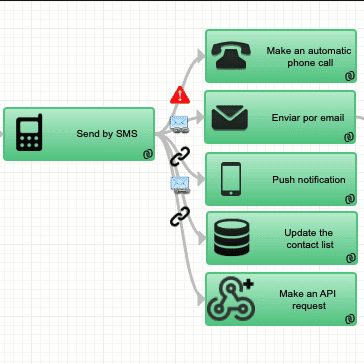

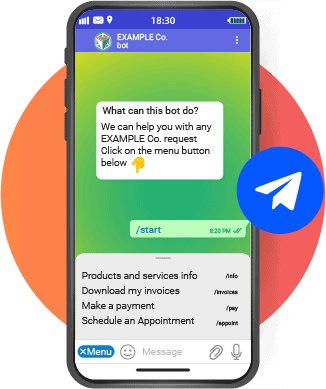

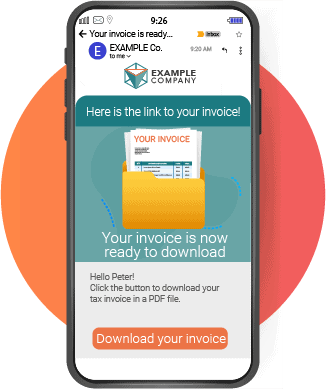

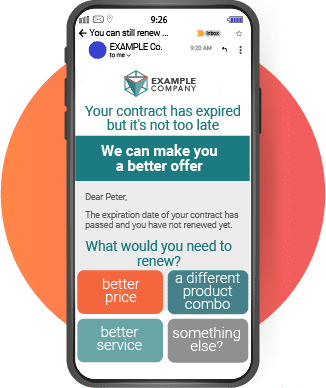

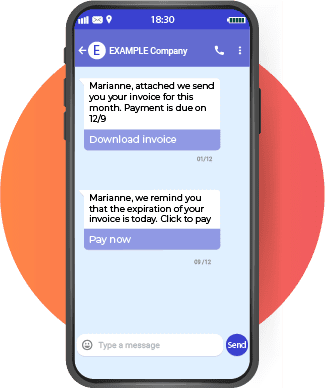

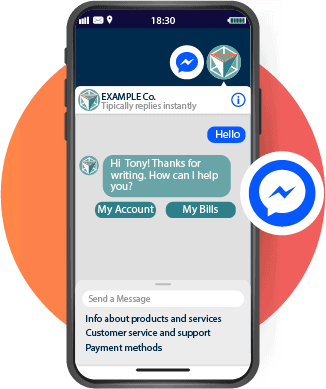

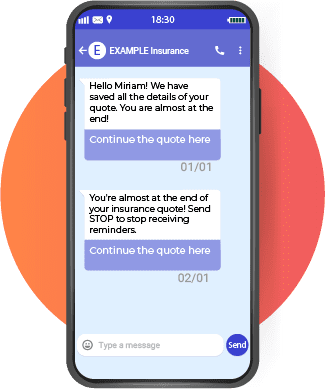

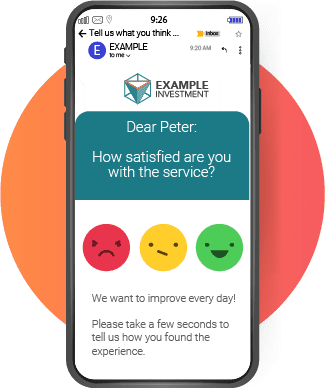

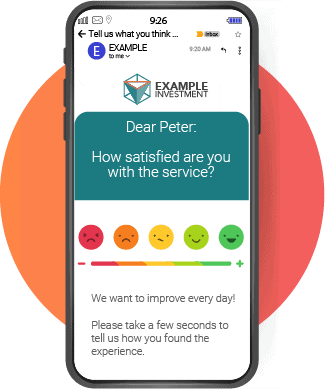

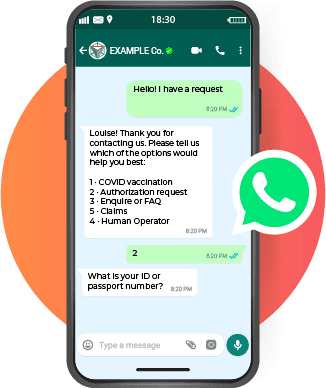

- Omnichannel Document Delivery and Billing: Unified communication channels (Email, SMS, chatbot) for efficient and compliant document and invoice delivery.

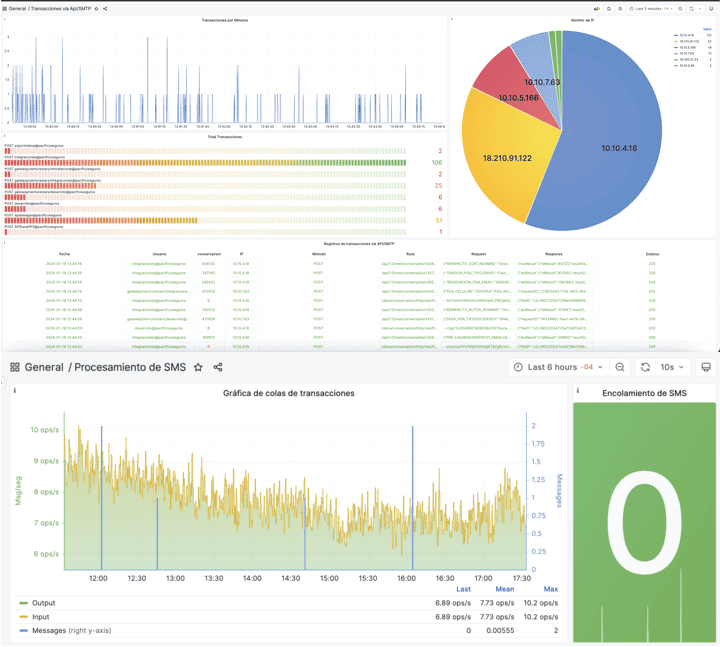

Additionally, DANAconnect’s platform provided a specialized SMS and Email Message Audit Module for the financial industry, enabling comprehensive review and auditing of all communications.

Digital Document Management Implementation:

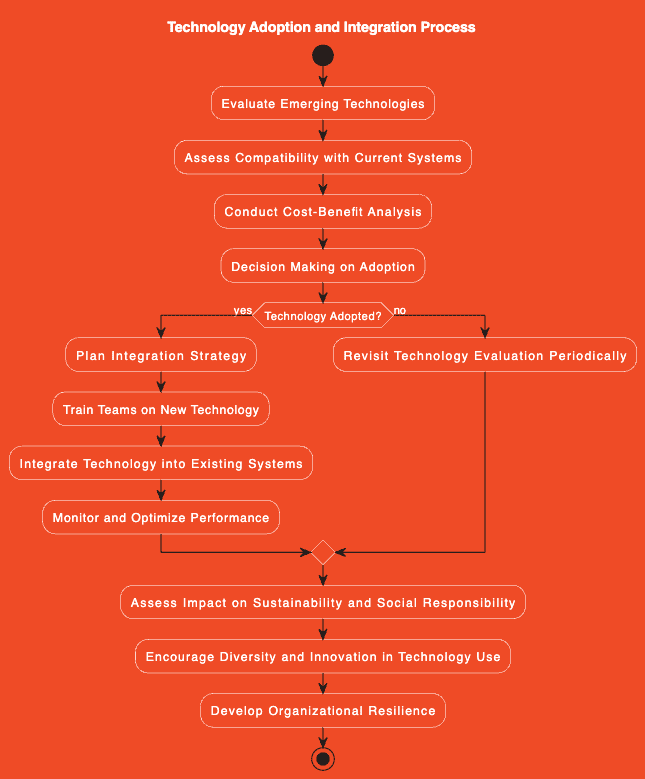

The implementation of the DANAconnect Digital Document Management solution at the insurer was a meticulous and collaborative process aimed at addressing the company’s operational and document management challenges. Here are the highlights of this phase:

- Preliminary Analysis:

-

-

- Started with a detailed analysis of the insurer’s existing requirements and challenges. DANAconnect experts worked closely with the company’s technical and operational teams to thoroughly understand their needs and expectations.

-

- Solution Design:

-

-

- Based on the analysis, a customized solution was designed, including enterprise document management, email and SMS archiving, digital document signing, and omnichannel communication. The design focused on simplifying the existing technological architecture and promoting efficient centralization.

-

- Services Provided by DANAconnect:

-

-

- DANAconnect provided specialized services, including platform configuration, migration of existing documents, integration with the insurer’s existing systems, and customization of features to meet the company’s specific demands.

-

- Training and Support:

-

-

- Training sessions were conducted to ensure the insurer’s teams were well-versed in using the platform. Additionally, DANAconnect offered continuous technical support to ensure a smooth transition and resolve any challenges that arose during and after implementation.

-

- Integration and Unification:

-

-

- Together with the insurer’s migration project team, multiple systems and processes were unified under the DANAconnect platform. The integration was meticulously planned and executed to avoid operational disruptions and ensure a smooth transition.

-

- Testing and Adjustments:

-

-

- Extensive testing was conducted to ensure the platform met the defined objectives. Necessary adjustments were made based on feedback and test results to ensure the final solution was robust and reliable.

-

- Launch and Monitoring:

-

- Once validated, the solution was officially launched. DANAconnect and the insurer’s teams closely monitored the platform’s operability and performance, making fine adjustments as needed to optimize performance and efficiency.

Results and Benefits in Digital Document Management:

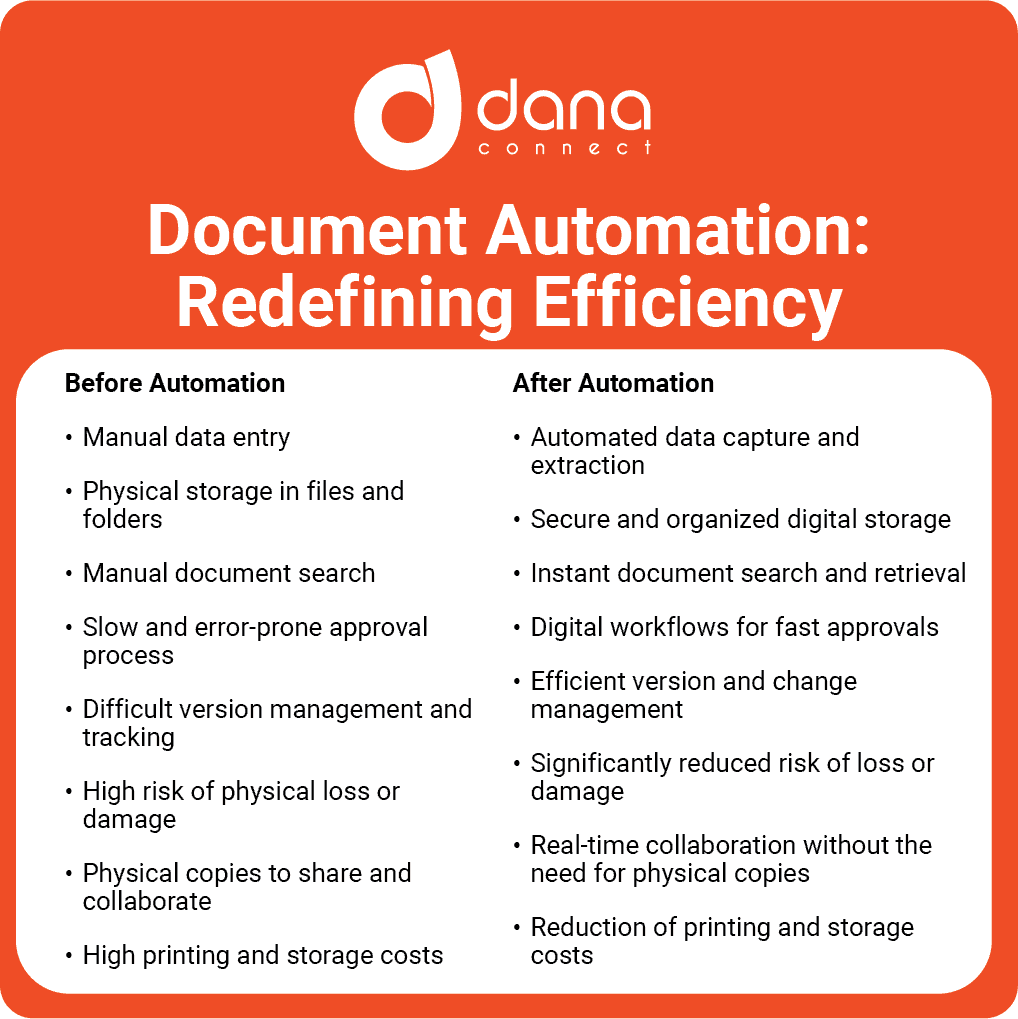

Centralizing document management and client communication in DANAconnect resulted in significant cost reductions. Additionally, the company was able to capitalize on volume discounts for email and SMS document deliveries, and save on integration costs between systems.

- Drastic Cost Reduction in Digital Document Management:

-

-

- Centralizing document management and communications resulted in substantial operational cost reductions. Annual costs decreased from US$ 260K to US$ 36K, equivalent to an 86% reduction. This financial saving is a considerable competitive advantage, freeing up resources that can be reassigned to other strategic initiatives.

-

- Operational Efficiency in Digital Document Management:

-

-

- Simplifying the technological architecture by unifying various functionalities in DANAconnect eliminated redundancies and improved operational efficiency. Billing, subscriptions, and the legal department, among others, experienced smoother workflows and accelerated processes.

-

- Volume Discounts in Digital Document Management:

-

-

- By consolidating all email and SMS document deliveries from a single platform, the insurer was able to capitalize on volume discounts, further contributing to cost reductions.</li >

-

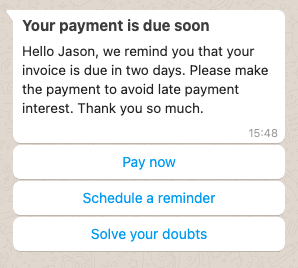

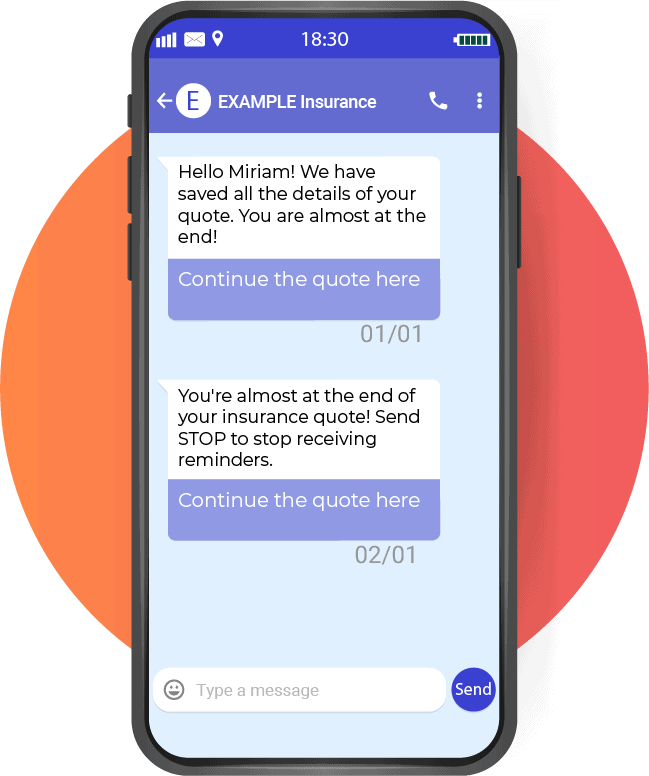

- Improvement in Omnichannel Communication:

-

-

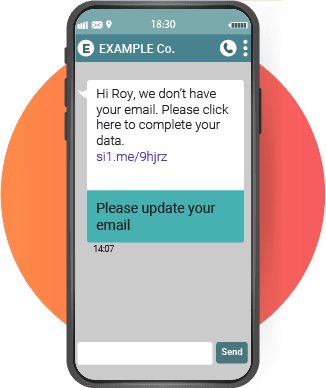

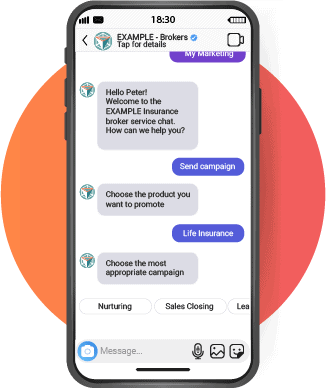

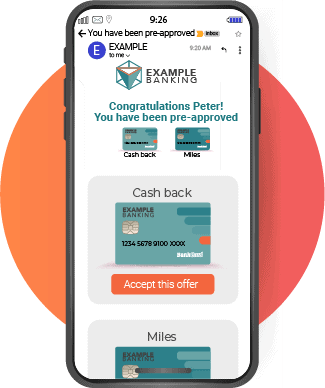

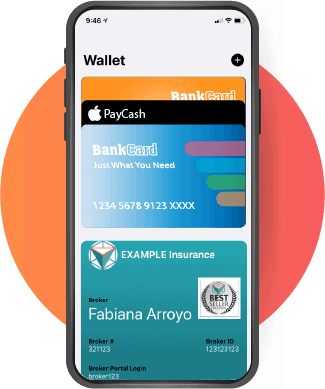

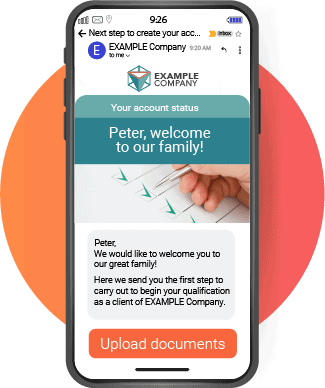

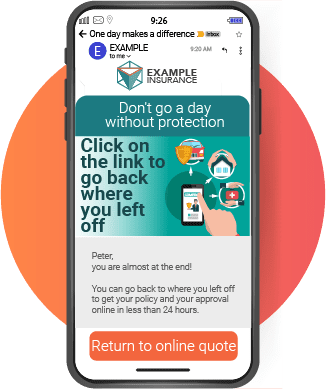

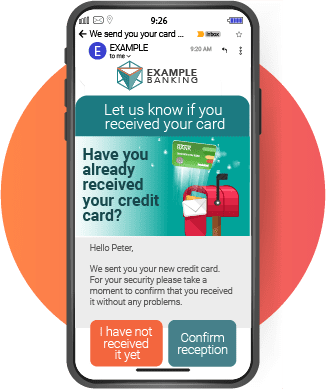

- Unifying communication channels (Email, SMS, chatbot) improved the delivery of documents and invoices, providing a consistent and satisfying user experience. Clients can now receive important information and documents via their preferred channel, quickly and securely.

-

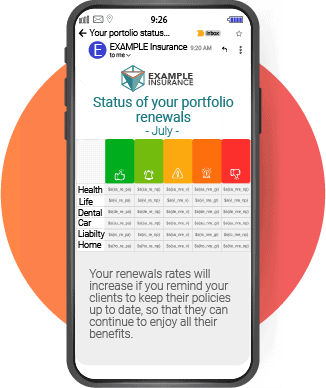

- Effective Compliance, Audit, and e-discovery:

-

-

- With the audit and archiving tools provided by DANAconnect, the insurer can now ensure regulatory compliance and conduct communication audits efficiently, reducing associated risks and strengthening stakeholder confidence.

-

- Adoption of Digital Signature and Dynamic Document Generation:

-

- The introduction of digital document signing facilitated faster and more secure document authentication and approval, improving the management of contracts and other legal documents.

Lessons Learned:

During the implementation and adaptation process to the new unified platform provided by DANAconnect, significant learning was generated among the insurer’s different departments. Departments such as Billing, Subscriptions, and Legal began to discover the value of having a common repository for document management.

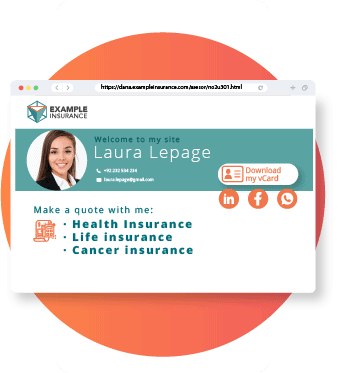

- Centralized Document Access: Departments found immense value in having centralized access to documents, allowing quick and easy reference to crucial information in real-time. This centralized access also facilitated the on-demand use of documents for different communication channels such as chatbots and the web portal, enabling faster and more efficient responses to client queries.

- Improved Workflows: With the possibility of accessing a common repository, departments were able to integrate relevant documents into subscription and onboarding workflows more efficiently. This not only streamlined internal processes but also improved the customer experience when interacting with the insurer.

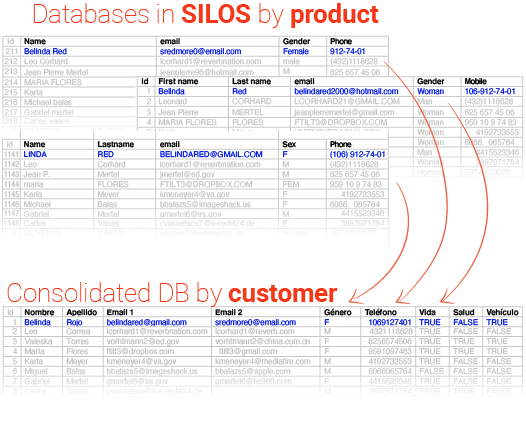

- Interdepartmental Collaboration: The implementation of a unified platform fostered greater collaboration among departments. Sharing a common repository eliminated information silos, enabling smoother communication and effective collaboration in document management and related processes.

- Innovation Adoption: This case also highlights how adopting an innovative technological solution can trigger a positive transformation in how different departments operate and collaborate. The experience with DANAconnect showed the insurer the potential of digitization to improve operational efficiency and customer satisfaction.

Next Steps:

The experience with DANAconnect has demonstrated the value of an integrated platform that not only reduces costs but also strengthens regulatory compliance and operational efficiency.

The insurance company aims to continue exploring and expanding the capabilities of the DANAconnect platform to further optimize its operational processes and improve customer experience. New ways of integrating the platform into other areas of the company are also being considered to continue benefiting from the centralization and automation of document management and communications.