Security is a crucial issue for financial institutions, banks and insurance. These sectors handle a large amount of sensitive data, so it is expected that they have adequate security measures in place to protect it. One of the most important protocols in online security is the SPF (Sender Policy Framework), and in this article we are going to explain why it is important for financial institutions.

What is the Sender Policy Framework or SPF?

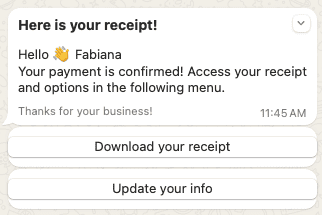

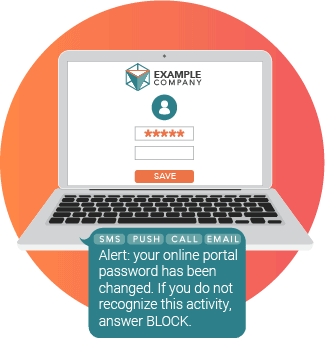

SPF is an email authentication protocol that helps prevent spam and phishing. It works by checking the IP address of the server sending the email to make sure it is authorized to send messages on behalf of the sender’s domain. If the IP address is invalid, the email is considered suspicious and, depending on the settings, it will be marked as spam or blocked completely.

The SPF for financial institutions

Financial institutions, banks and insurance companies handle a large amount of confidential information from their clients, such as credit card numbers, personal and financial information. If a hacker gains access to this information, it can cause serious financial damage to customers and the financial institution itself. Therefore, it is essential that these institutions have adequate security measures in place to protect confidential information and the email channel.

SPF is one of the security measures that can help prevent phishing and spam. Spoofed emails may look genuine, but if they’re not authorized by the sender’s domain, they’ll be blocked by SPF and they won’t even have a chance of reaching the spam folder. This, in addition to protecting customers, also reduces the risk that employees of a financial institution will open malicious emails and compromise the security of sensitive information.

In addition, the SPF also helps protect the reputation of the financial institution. If customers receive fraudulent emails that appear to come from the financial institution, their trust in the institution may suffer. SPF helps prevent this type of situation and ensures that customers only receive genuine emails.

How is SPF implemented?

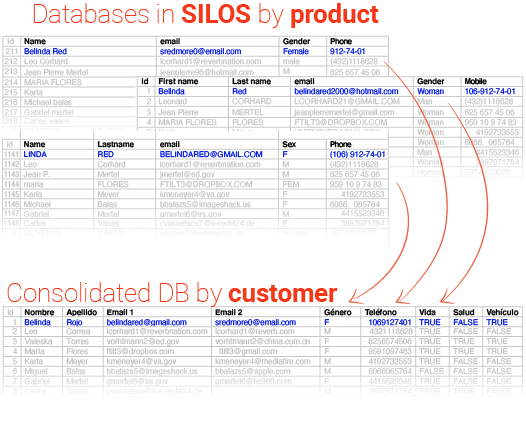

SPF implementation is a relatively simple process. First, the financial institution must decide which IP addresses are authorized to send email on behalf of your domain. Then, an SPF record is created in the domain’s DNS (Domain Name System). This record contains information about the IP addresses authorized to send email on behalf of the domain.

Once the SPF record has been created, the email server must be configured to use it. The email server will verify the IP address of the server sending the email and check if it is authorized to send messages on behalf of the sender’s domain. If the IP address is unauthorized, the email will be marked as spam or blocked.

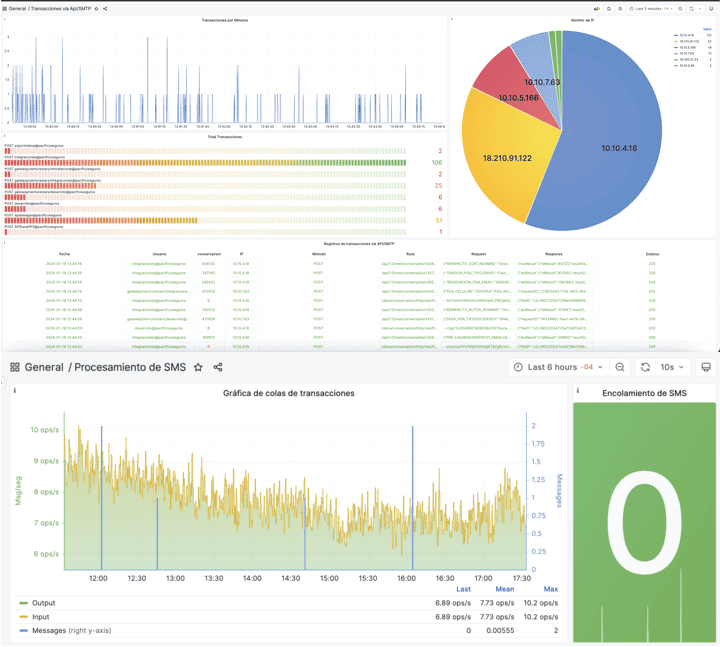

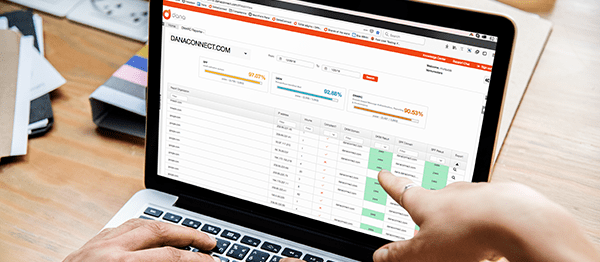

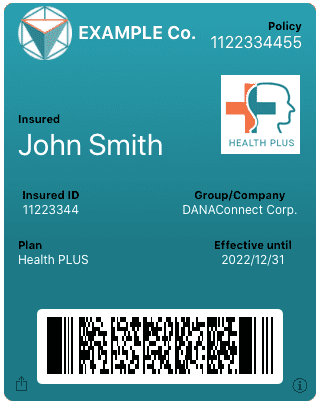

The only way to know which IP addresses are legitimate is by taking an inventory of the organization’s digital assets. For this, there are adequate email security tools to monitor and be able to carry out said survey. Learn about DANAconnect’s email security monitoring tool.

What is SPF in strict mode and what is it for?

Strict mode SPF is a setting that can be applied on the email server to increase the online security of a financial institution. In strict mode, the SPF only accepts email that meets the SPF authentication requirements and rejects any email that does not.

SPF strict mode helps prevent email spoofing, which is a technique used by hackers to send email on behalf of an institution without its consent. By enabling strict mode, email servers will only allow emails that meet SPF authentication rules to be delivered to the recipient’s inbox (and not even the spam box).

It is important to note that strict SPF mode, if not set correctly, can cause some legitimate emails to be marked as spam or blocked, especially when using third-party email services. Therefore, it must be implemented carefully and in conjunction with other online security measures to ensure that legitimate emails are not lost.

How to avoid deliverability problems when implementing SPF in strict mode?

Implementing strict mode SPF can be an effective way to increase a financial institution’s online security, but it can also cause email deliverability issues if not implemented correctly. Here are some best practices to avoid deliverability issues when implementing SPF in strict mode:

- Perform a test in a controlled environment: Before implementing strict mode SPF in the production environment, it is recommended that you test it in a controlled environment to ensure that legitimate emails are not blocked or wrongly marked as spam.

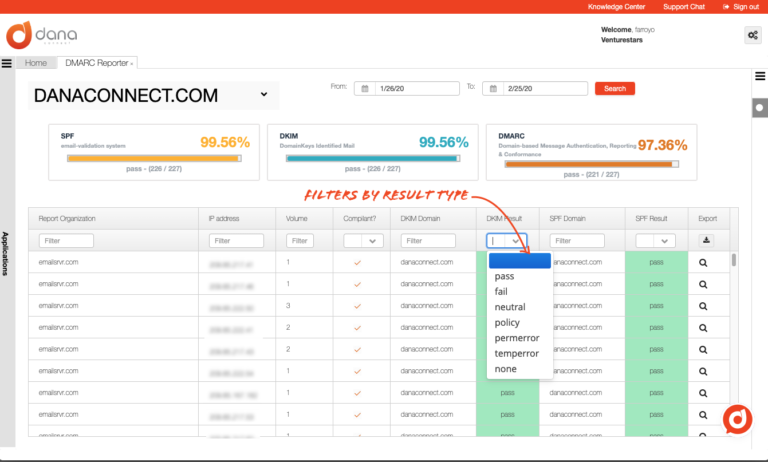

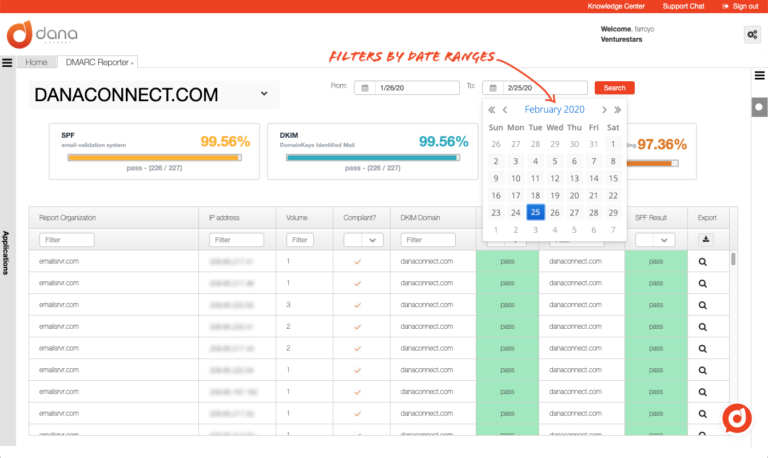

- Use email monitoring tools: Email monitoring tools can help identify deliverability issues and ensure that legitimate emails reach their intended recipients. Learn about DANAconnect’s email security monitoring tool for SPF and DMARC.

- Configure SPF records correctly: It is important to configure SPF records correctly and update them regularly to ensure that all authorized IP addresses are included. Learn about DANAconnect’s free SPF check tool

- Use a reliable bulk email provider: It is recommended to use a reliable email service to ensure that emails are delivered correctly and are not marked as spam. Talk to us to know about the DANAconnect’s SLA that allows the sending of millions of emails per day.

In conclusion, implementing SPF in strict mode can be an effective way to increase the online security of a financial institution, but it can also cause email deliverability issues if not implemented correctly. By following these best practices, you can minimize the risk of deliverability issues and ensure that legitimate emails are delivered correctly.

What other technologies are combined with SPF to ensure email security?

In addition to SPF, there are other methodologies that can be used in combination to further enhance the online security of financial institutions. Some of them are described below:

- DKIM (DomainKeys Identified Mail): DKIM is another email authentication protocol that can be used in conjunction with SPF. It works by adding a digital signature to the email header that verifies the authenticity of the message. DKIM and SPF work together to ensure that email sent from a domain is authentic and has not been tampered with.

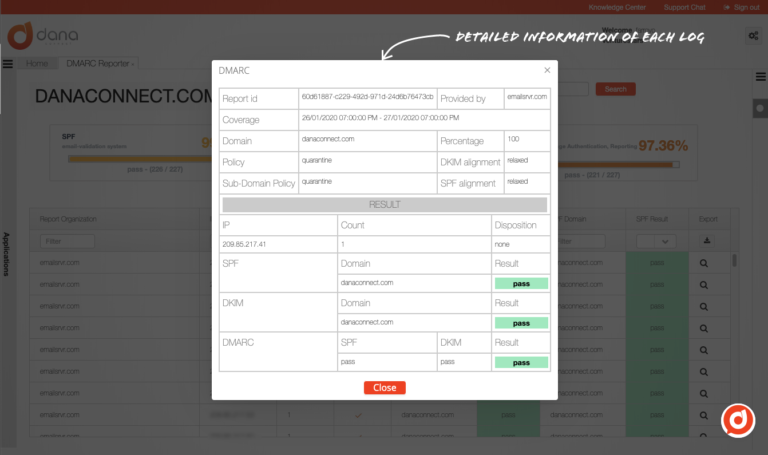

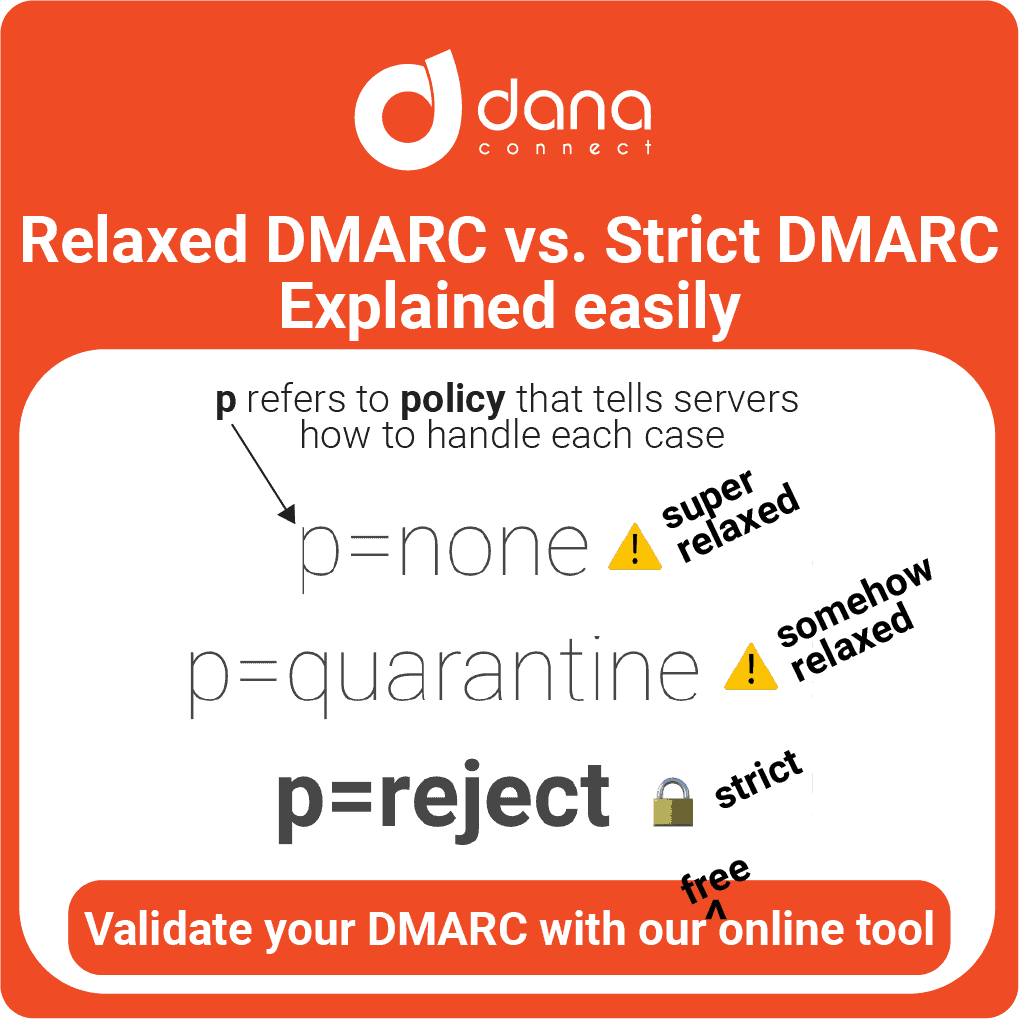

- DMARC (Domain-based Message Authentication, Reporting & Conformance): DMARC is an email policy that uses SPF and DKIM to authenticate emails and set rules for how emails that fail authentication should be handled. DMARC also provides detailed reports on the emails that are sent on behalf of a domain and how they are processed.

- S/MIME (Secure/Multipurpose Internet Mail Extensions): S/MIME is an email encryption technology that protects email content by using an encryption key. S/MIME can be used in conjunction with SPF and DKIM to ensure emails are authentic and encrypted to protect content.

- TLS (Transport Layer Security): TLS is a security protocol used to secure online communications, including email. TLS is used to encrypt the connection between email servers, ensuring that emails cannot be intercepted or read by third parties.

Takeaway conclusion

The SPF is an important security measure for financial institutions, banks and insurance. It helps prevent phishing and spam, reduces the risk of compromising the security of sensitive information, and protects the financial institution’s reputation. SPF implementation is a simple process that can significantly improve a financial institution’s online security.

Strict mode SPF is an additional security setting that can help prevent email spoofing and protect a financial institution’s online reputation. However, it must be implemented carefully and in conjunction with other security measures to ensure proper delivery of legitimate emails.

In short, the combination of multiple methodologies, such as SPF, DKIM, DMARC, S/MIME, and TLS, can provide robust and comprehensive online security for financial institutions, banks, and insurance companies. It is important that these institutions implement all necessary security measures to ensure the protection of their clients’ confidential information and maintain their online reputation.