Historically, the financial industry has been known for its conservatism and resistance to change. However, in the digital age, it is forced to embark on a journey of innovation and transformation. In this scenario, Open Innovation presents itself as a change of course and an unparalleled opportunity to promote growth and evolution of the sector.

One of the primary goals of open innovation is to bring products, services, or innovations to the market faster and create value for the organization. By leveraging external knowledge, resources, and collaborations, organizations can accelerate their innovation processes and reduce time-to-market.

Innovation and the Financial Industry: A Complex Tandem

Innovation implies a comprehensive review of an organization’s operations, strategies and business models, with the aim of taking advantage of the advantages offered by technology. For the financial industry, this task can be especially complex, given the critical importance of factors such as security, regulatory compliance, and reliability. However, Open Innovation can be the solution to these challenges.

Defining Open Innovation: A Rising Paradigm

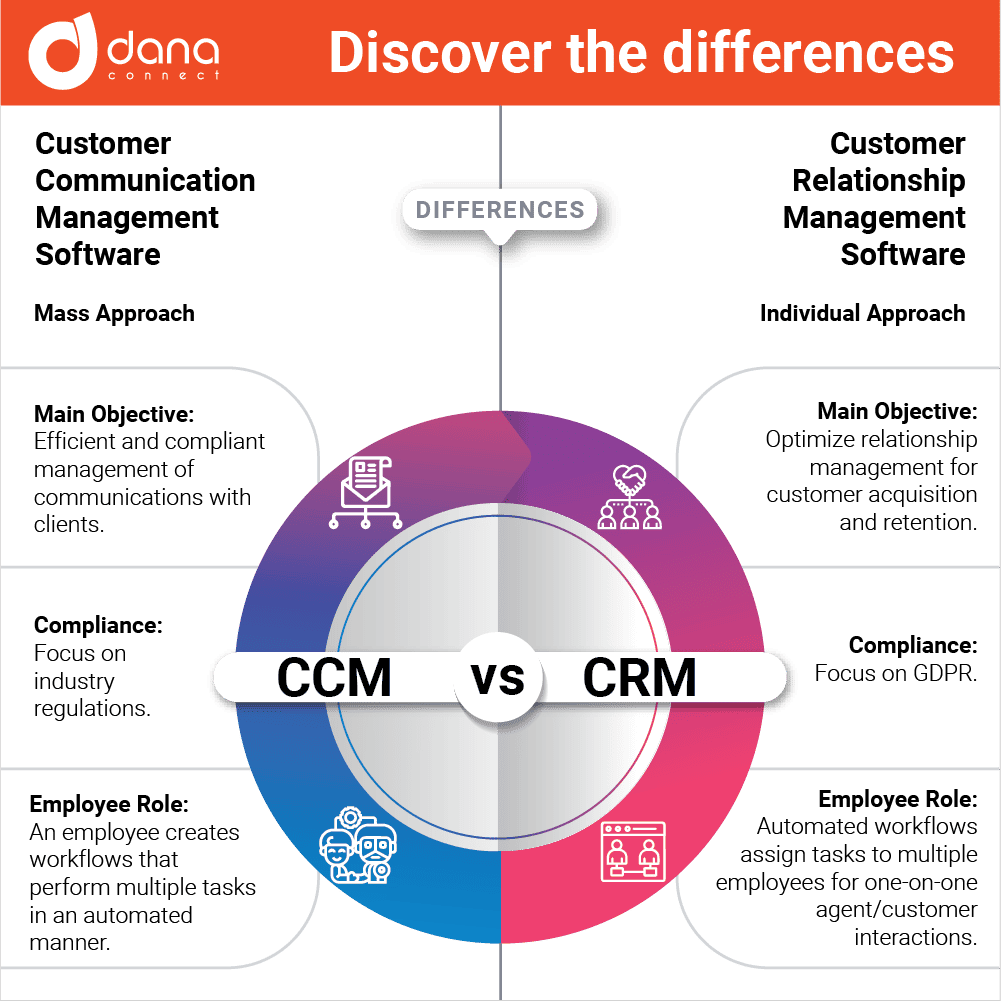

In essence, Open Innovation is an approach that promotes active collaboration with external actors to catalyze innovation and create significant value. It differs from the traditional model of closed innovation, where ideas originate and are maintained within the organization. In a globalized and interconnected world, Open Innovation embraces and celebrates the idea that solutions can and should come from anywhere.

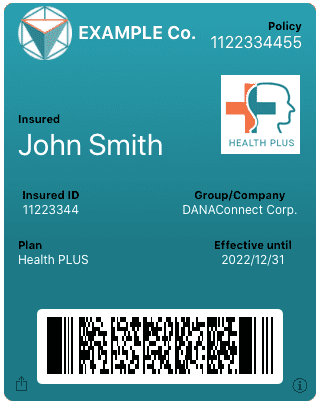

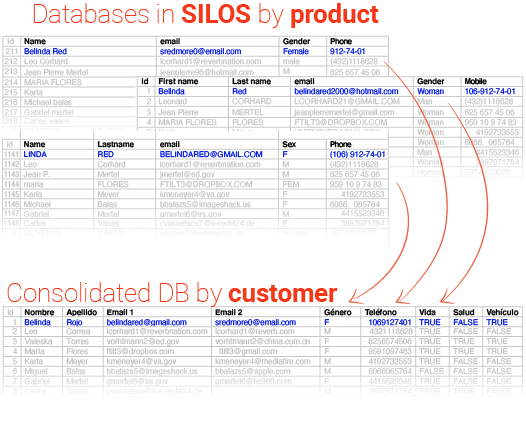

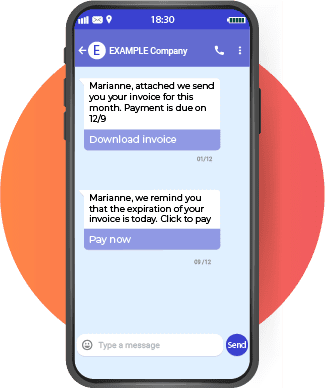

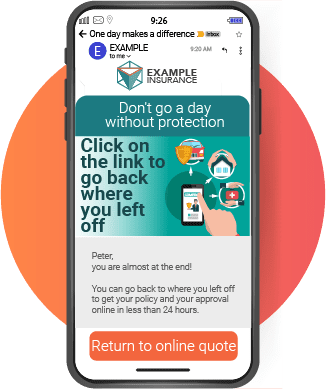

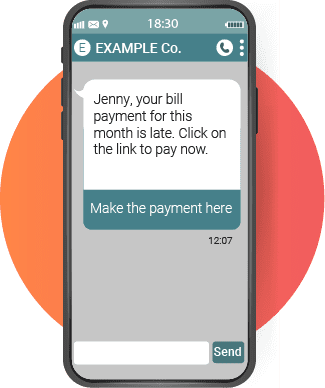

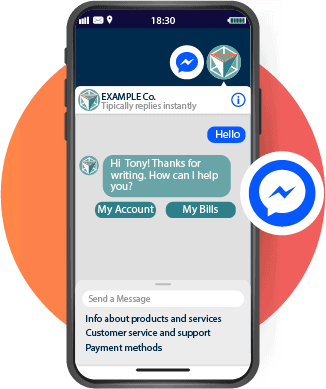

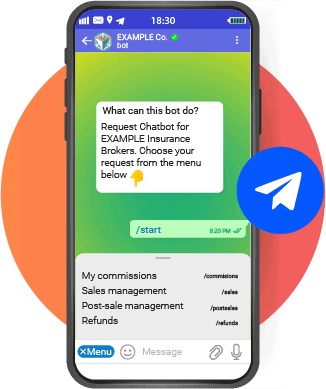

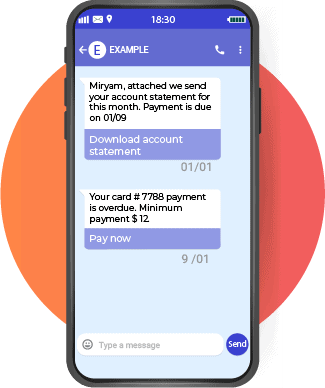

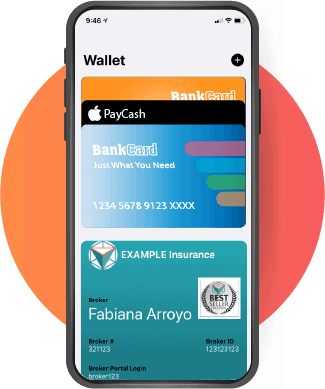

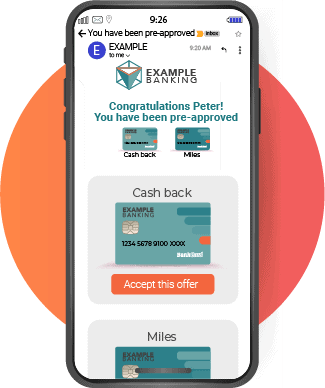

In the financial industry concepts like open banking and open insurances had gained traction as part of the Open Innovation movement. Open banking refers to the practice of sharing financial data and services through secure and standardized application programming interfaces (APIs). It allows third-party developers to build applications and services that utilize banking data, providing customers with enhanced financial experiences and opportunities for innovation.

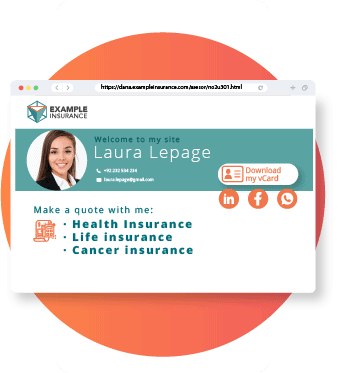

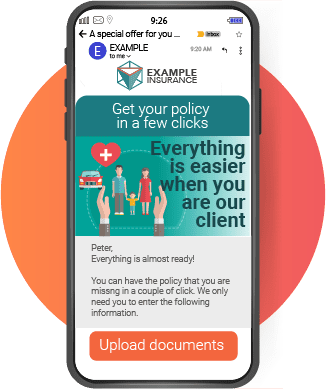

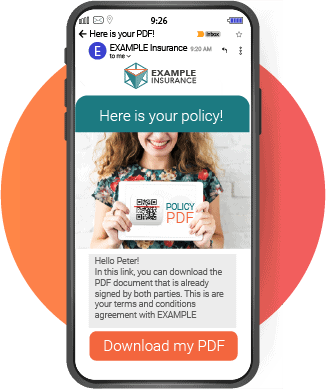

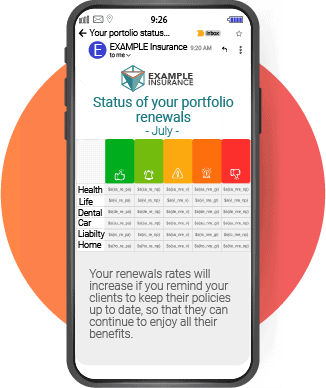

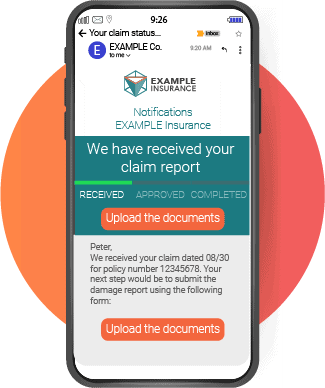

Similarly, open insurance, also related to the term InsurTech, involves the collaboration between traditional insurance companies and technology startups or other external partners. This collaboration aims to leverage technological advancements and data analytics to enhance insurance processes, develop new insurance products, improve risk assessment, and provide personalized customer experiences.

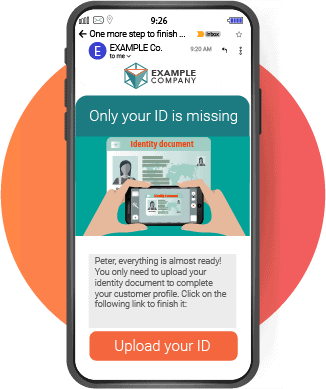

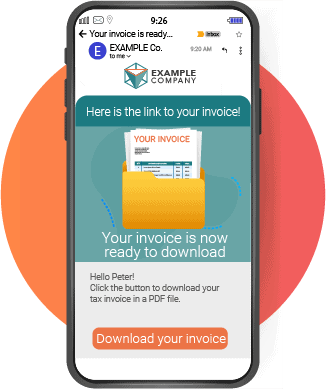

The concepts of open banking and open insurance bring together different stakeholders in the financial industry, including banks, insurers, fintech companies, vendors and customers. By opening up their platforms and data, financial institutions can benefit from external expertise, innovative ideas, and complementary technologies. At the same time, customers can enjoy a broader range of services, increased convenience, and personalized solutions tailored to their specific needs.

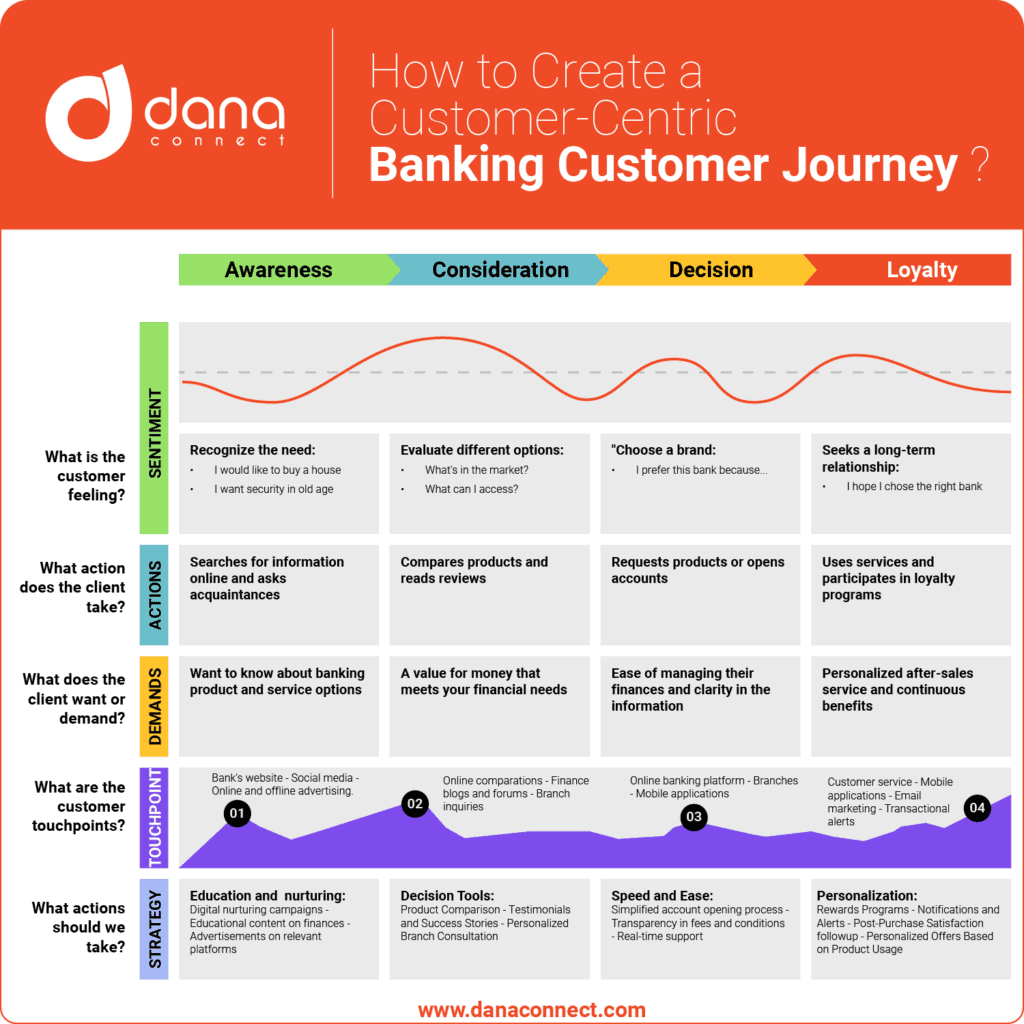

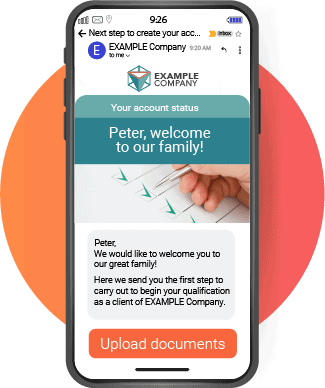

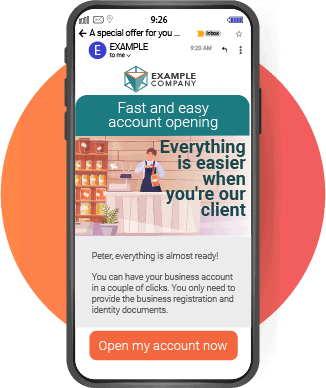

Open Innovation in the financial industry helps drive digital transformation, fosters customer-centricity, and promotes competition and collaboration among industry players. It enables the development of innovative business models, the integration of emerging technologies, and the delivery of more efficient and customer-friendly financial services.

Overall, open banking, open insurance, and other open innovation practices in the financial industry are aimed at creating value for customers, improving industry-wide efficiency, and fostering innovation and collaboration among diverse stakeholders.

Why would your company want to explore Open Innovation?

The purposes of open innovation can vary depending on the specific goals and context of an organization, but here are some common objectives:

- Accessing external knowledge: Open innovation allows organizations to tap into a broader pool of ideas and expertise beyond their internal boundaries. By collaborating with external partners, such as customers, suppliers, universities, startups, and research institutions, organizations can access diverse perspectives, specialized knowledge, and cutting-edge research.

- Accelerating innovation: Open innovation can help expedite the innovation process by enabling organizations to leverage existing solutions, technologies, and intellectual property from external sources. By embracing external inputs, organizations can save time and resources, as they don’t have to reinvent the wheel and can build upon the work of others.

- Enhancing competitiveness: Open innovation can enhance an organization’s competitiveness by enabling access to new markets, technologies, and business models. Collaboration with external partners can lead to the development of new products, services, and processes that address emerging market needs and trends.

- Mitigating risks: Sharing risks and costs is another purpose of open innovation. By engaging in collaborative efforts, organizations can distribute the burden of research and development, experimentation, and market entry. This can reduce individual risks and financial investments while increasing the likelihood of success.

- Fostering creativity and learning: Open innovation fosters a culture of creativity and continuous learning within an organization. Collaborating with external partners exposes employees to new ideas, perspectives, and ways of working, stimulating creativity and inspiring novel approaches to problem-solving.

- Building networks and relationships: Open innovation facilitates the creation of strategic partnerships and networks. These relationships can provide access to new markets, distribution channels, talent, and resources. Building a robust innovation ecosystem can lead to long-term collaborations and mutual benefits.

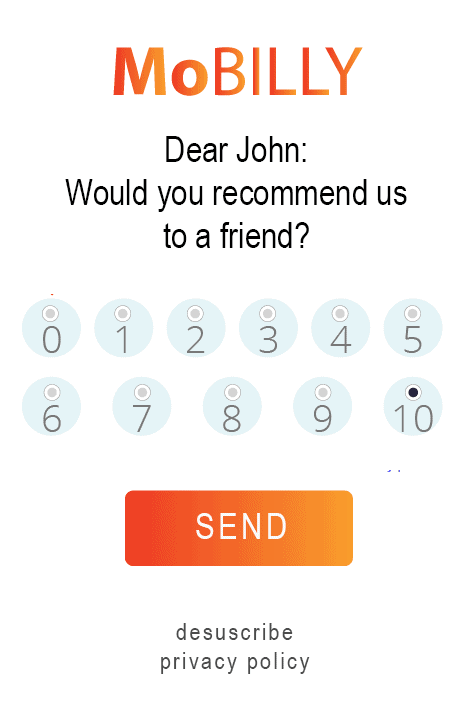

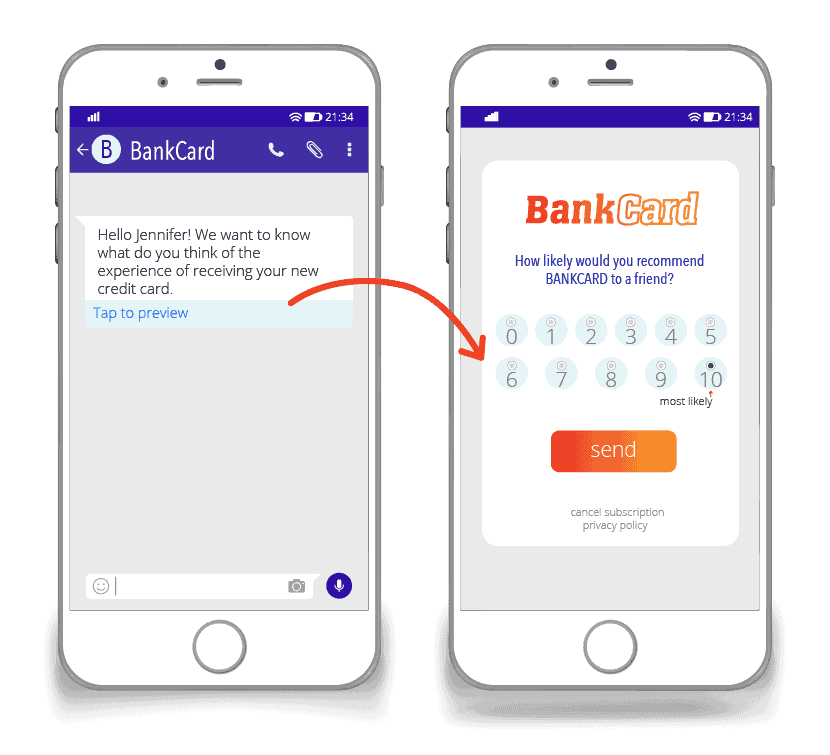

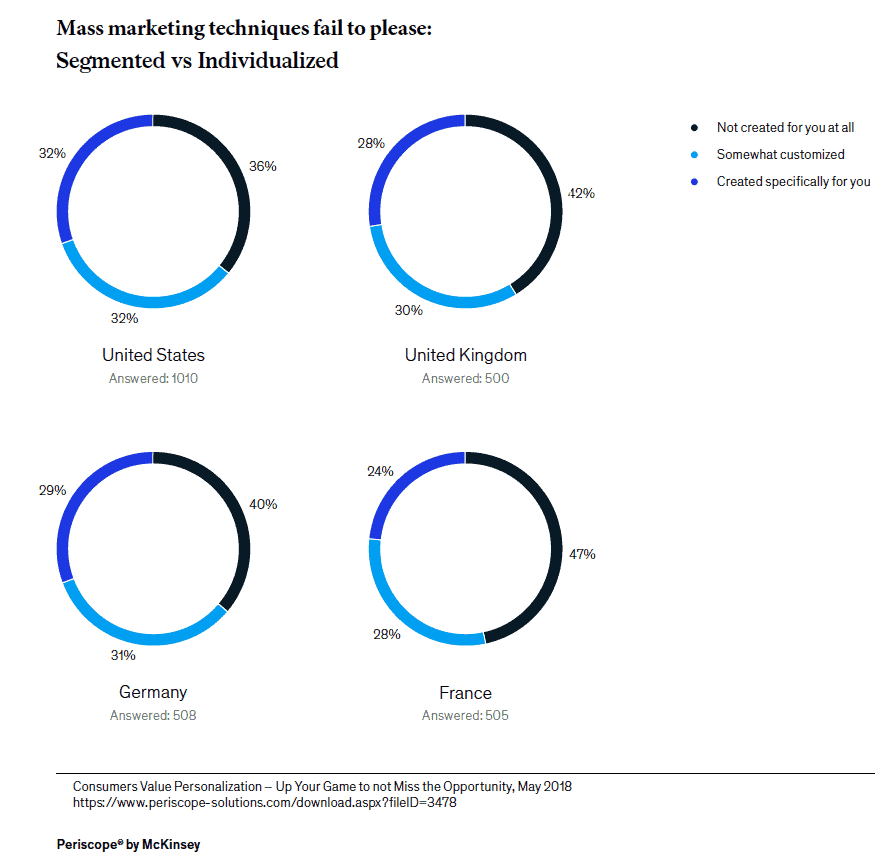

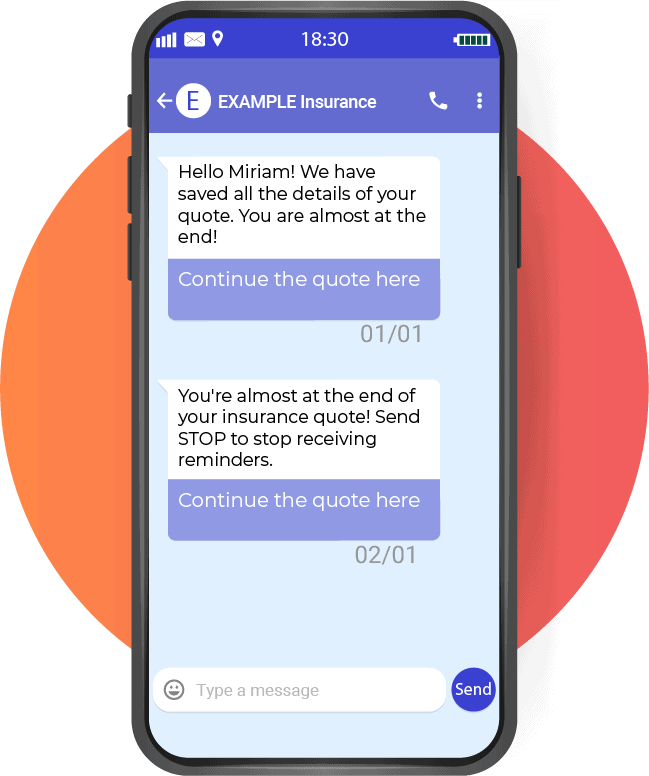

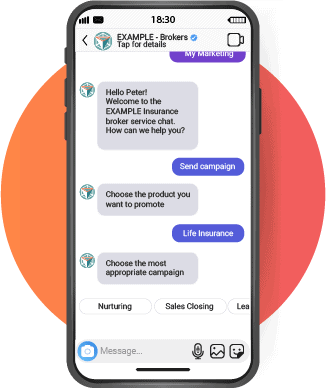

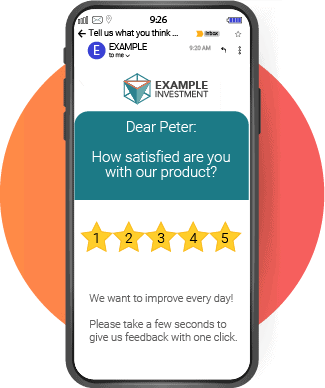

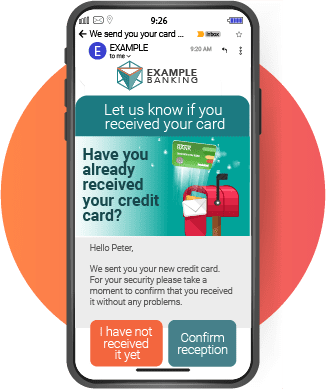

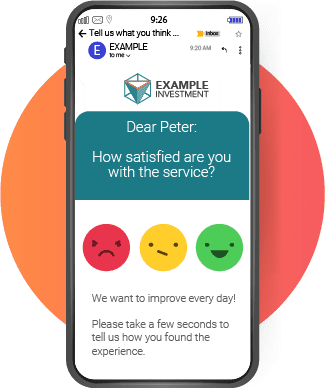

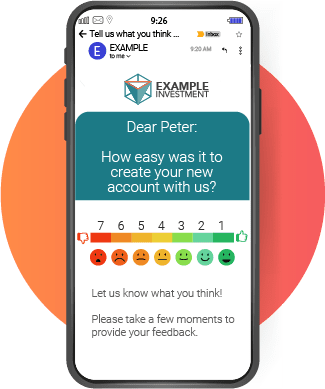

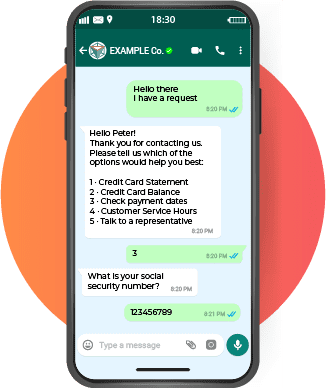

- Co-creating with customers: Open innovation involves engaging customers directly in the innovation process. By soliciting customer feedback, ideas, and preferences, organizations can develop products and services that better align with customer needs and expectations, leading to increased customer satisfaction and loyalty.

Overall, the purposes of open innovation revolve around harnessing external knowledge, accelerating innovation, improving competitiveness, managing risks, fostering creativity, and building collaborative networks. By embracing open innovation practices, organizations can increase their chances of success in today’s dynamic and rapidly evolving business environment.

The main goal of Open Innovation: faster go-to-market and value creation

Through open innovation, organizations can tap into existing solutions, technologies, or expertise developed by others, saving time and effort required to develop everything internally from scratch. This enables them to expedite the development, testing, and commercialization of new products or services.

By accessing a wider range of ideas, perspectives, and market insights, organizations can better understand customer needs and preferences, leading to the creation of products and services that are more likely to resonate with the target market. This customer-centric approach helps organizations create value by delivering solutions that meet market demands more effectively.

Additionally, open innovation allows organizations to collaborate with external partners, such as suppliers, customers, research institutions, or startups. These collaborations can help in sharing costs, risks, and resources, enabling organizations to pursue ambitious projects or explore new market opportunities that may have been otherwise challenging to tackle alone.

Ultimately, the goal of going to market faster and creating value through open innovation is to gain a competitive advantage, increase market share, and generate revenue by delivering innovative solutions that meet customer needs and exceed their expectations.

Open Innovation as a Catalyst for Digital Transformation

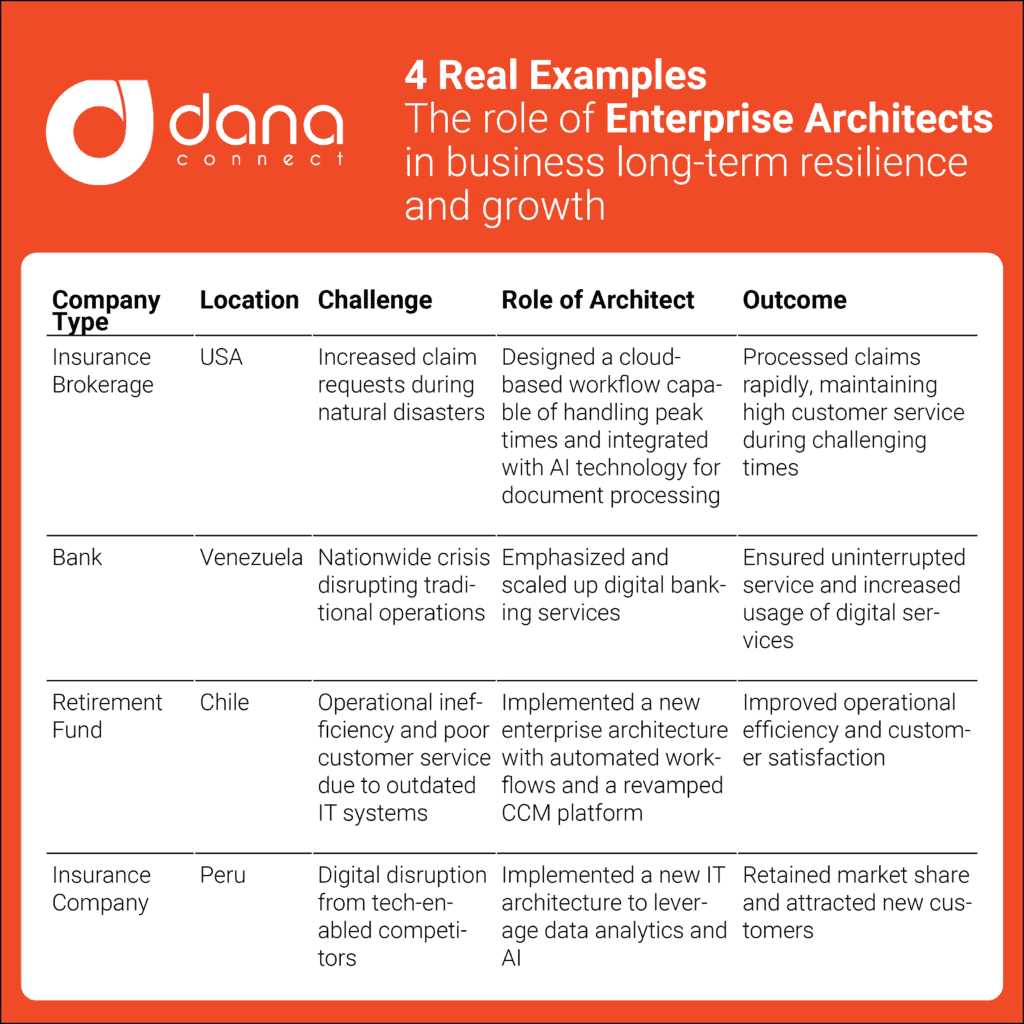

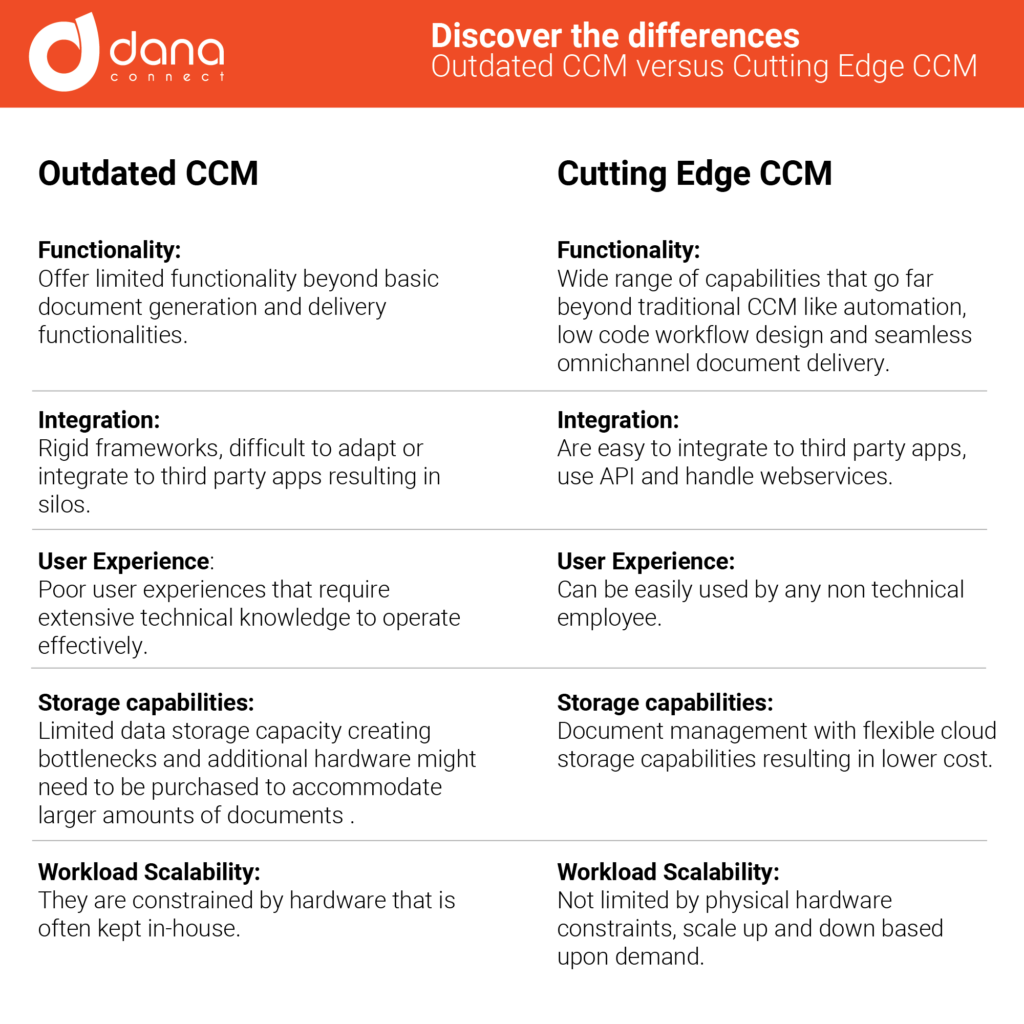

Open Innovation allows financial institutions to access specialized knowledge and advanced technological solutions without having to generate it internally. This facilitates collaboration with fintechs, startups, technology providers, and other innovative agents to develop and adopt solutions that improve operational efficiency and customer experience.

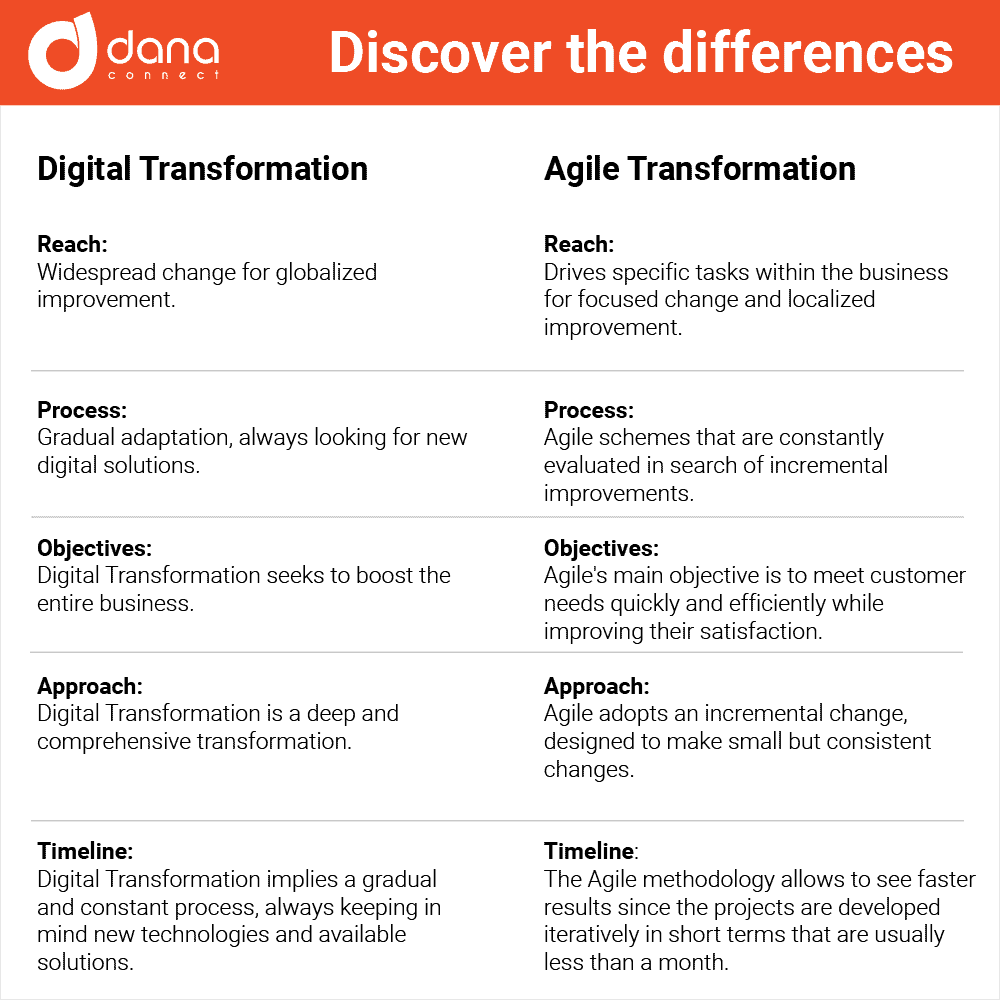

Business Agility through Open Innovation

In an increasingly digital and fast-paced world, being able to quickly adapt to new trends and market demands is essential. This is where Open Innovation shines: it provides a framework for establishing collaborations that accelerate the development and launch of new products and services.

Strategies for the Implementation of Open Innovation in the Financial Industry

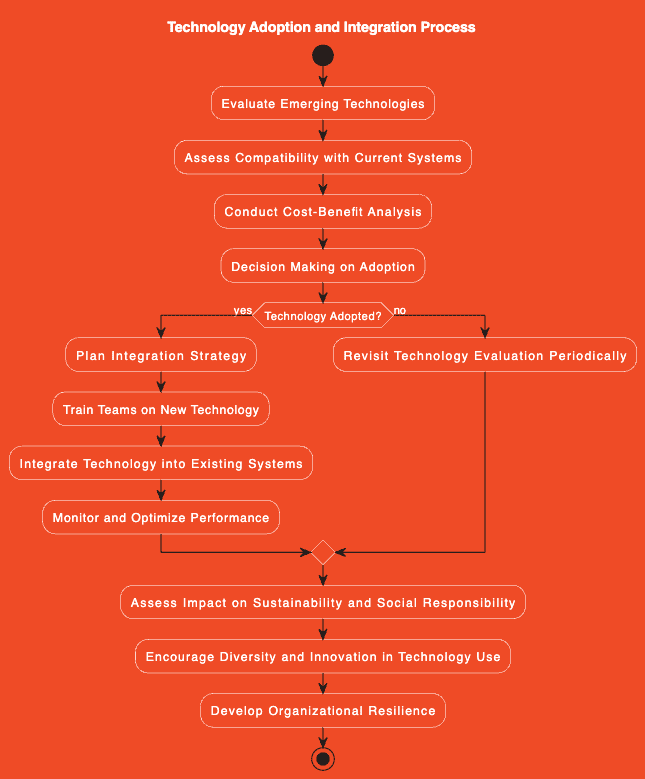

The adoption of Open Innovation in the financial sector requires a mindset shift towards a culture of collaboration, transparency and constant learning. There are several strategies that financial organizations can adopt:

- Acceleration and Incubation Programs: These programs attract startups with innovative ideas, providing them with resources and mentoring to develop their solutions.

- Alliances with Fintechs and Startups: Collaboration with fintechs and startups can be an invaluable source of innovation in the financial industry.

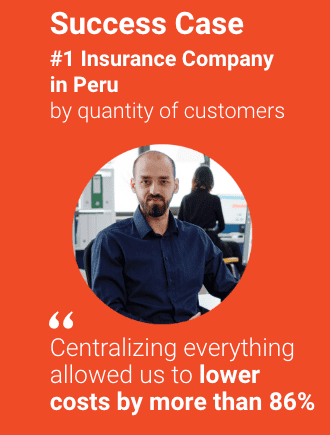

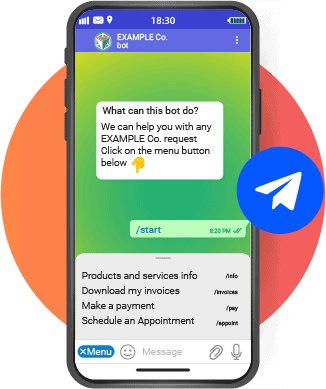

- Strategic Alliances with technology providers: Technology providers or “vendors” are often leaders in innovation within their respective fields. Strategic alliances with these players can provide financial institutions with access to cutting-edge technologies, industry expertise, and resources that might be difficult to acquire internally. This could include emerging technologies such as artificial intelligence, automation, orchestration services, and intelligent flows.

- Participation in Hackathons and Innovation Events: These events encourage collaboration and the exchange of ideas to develop solutions to specific challenges.

- Creation of an Open Innovation Ecosystem: Establishing a collaboration network with various entities, such as universities, research centers and technology companies, can greatly enhance the capacity for innovation.

Technologies Driving Open Innovation

Technology is a key enabler for Open Innovation, enabling collaboration and idea sharing at an unprecedented level. Below are some of the many technologies that are driving Open Innovation. As technology evolves, new trends, tools and platforms are likely to emerge that further facilitate collaboration and co-creation in the field of Open Innovation.

1. Orchestration and integration of Microservices

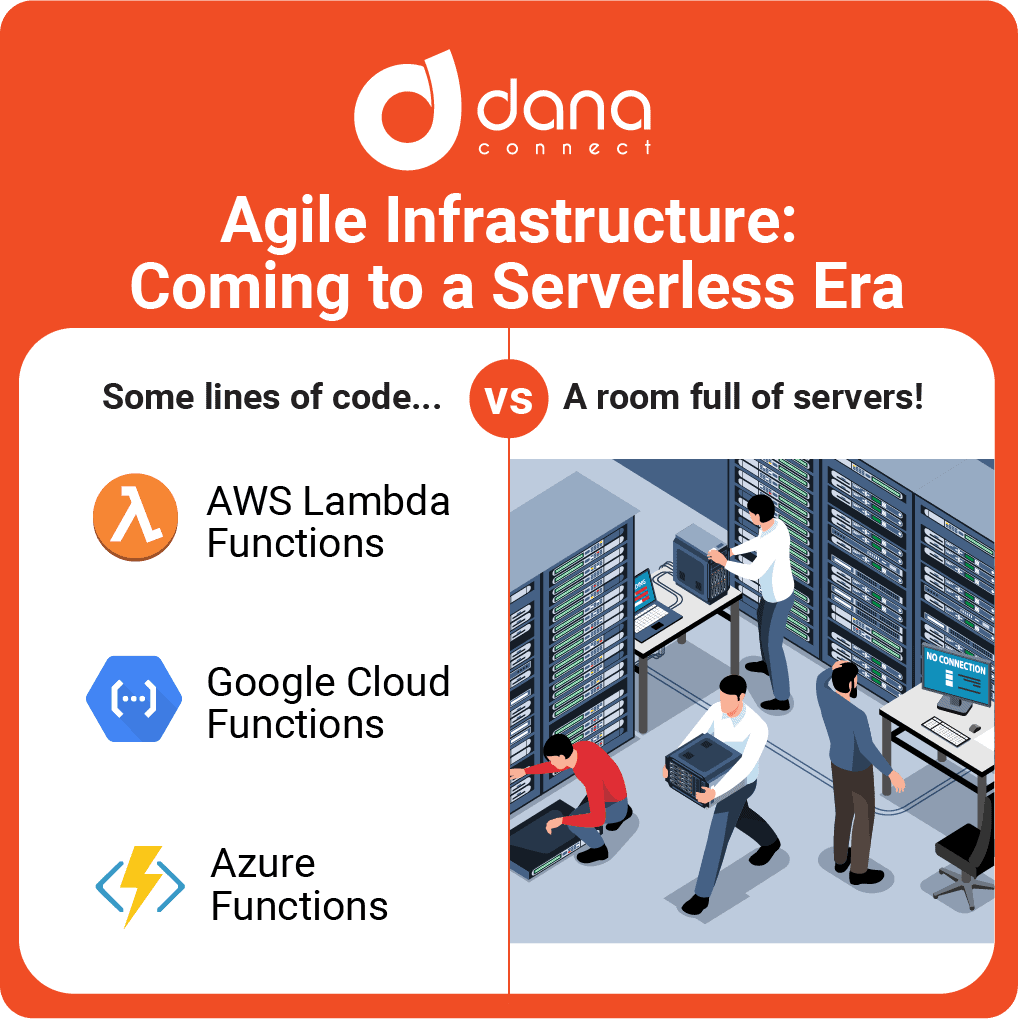

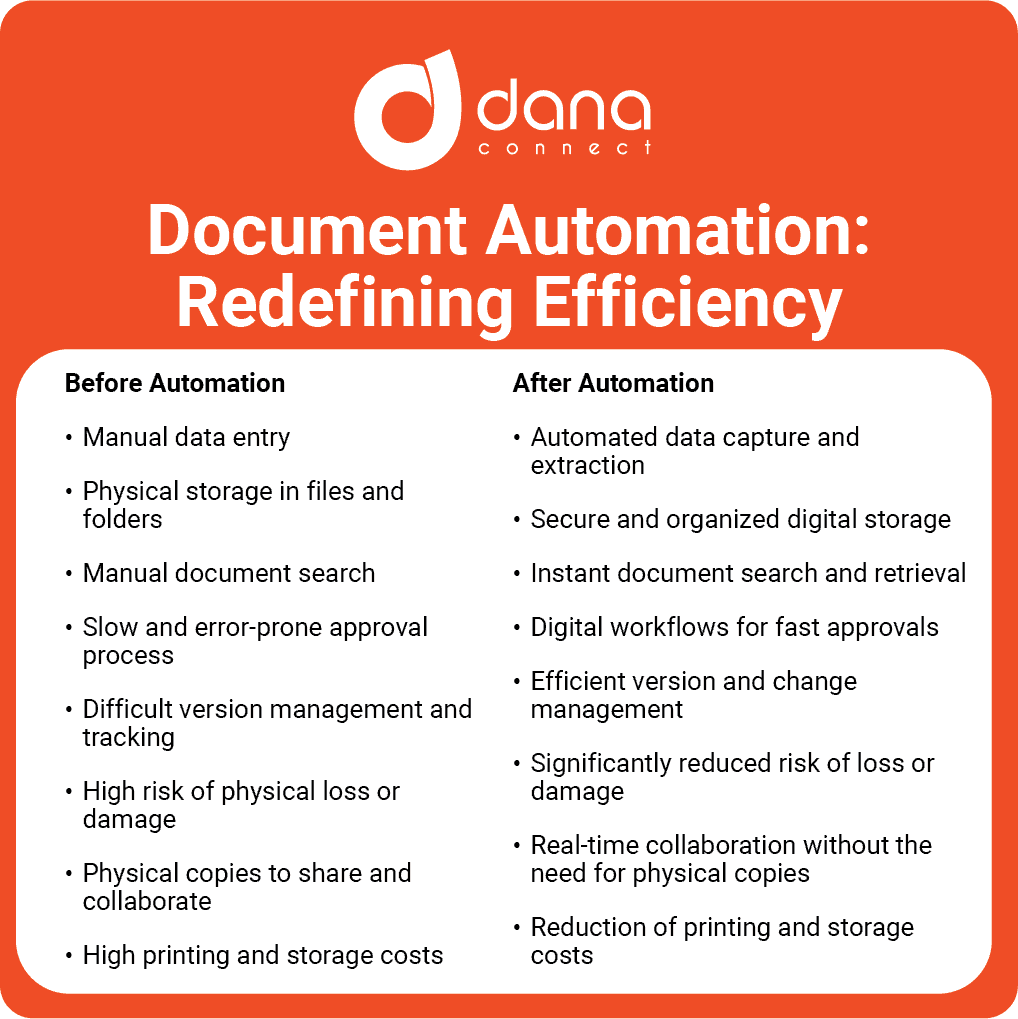

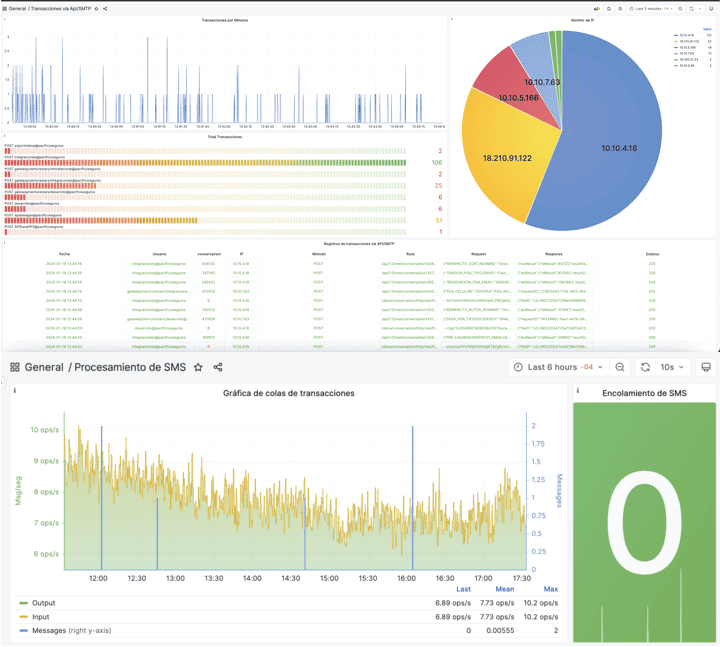

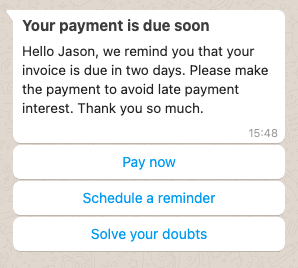

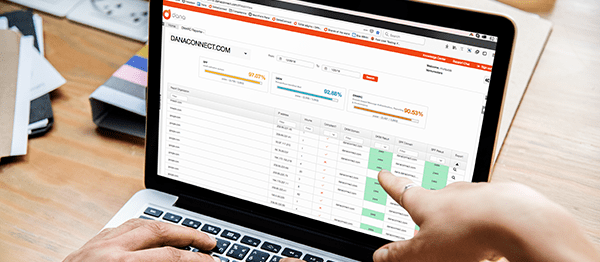

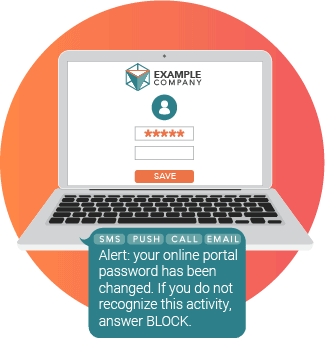

Service orchestration and intelligent workflows are redefining the way organizations collaborate and co-create solutions. Intelligent workflows are automated systems that allow the seamless passage of information and tasks between different applications and services, eliminating the need for manual intervention and reducing the possibility of errors.

Service orchestration, on the other hand, enables the creation of more complex and cohesive systems by assembling several smaller services (often provided by different organizations) into a single workflow. This not only allows for greater flexibility and efficiency, but also facilitates collaboration and co-creation between organizations.

In the context of open innovation, these technologies enable greater collaboration and agility, allowing organizations to respond more quickly to new innovation opportunities. Additionally, by providing a framework that facilitates the integration of various services and applications, service orchestration and intelligent workflows can facilitate the creation of truly innovative and differentiating solutions.

2. APIs y SDKs

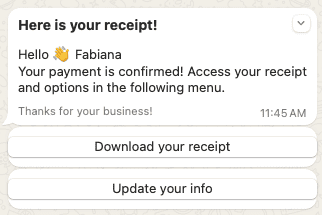

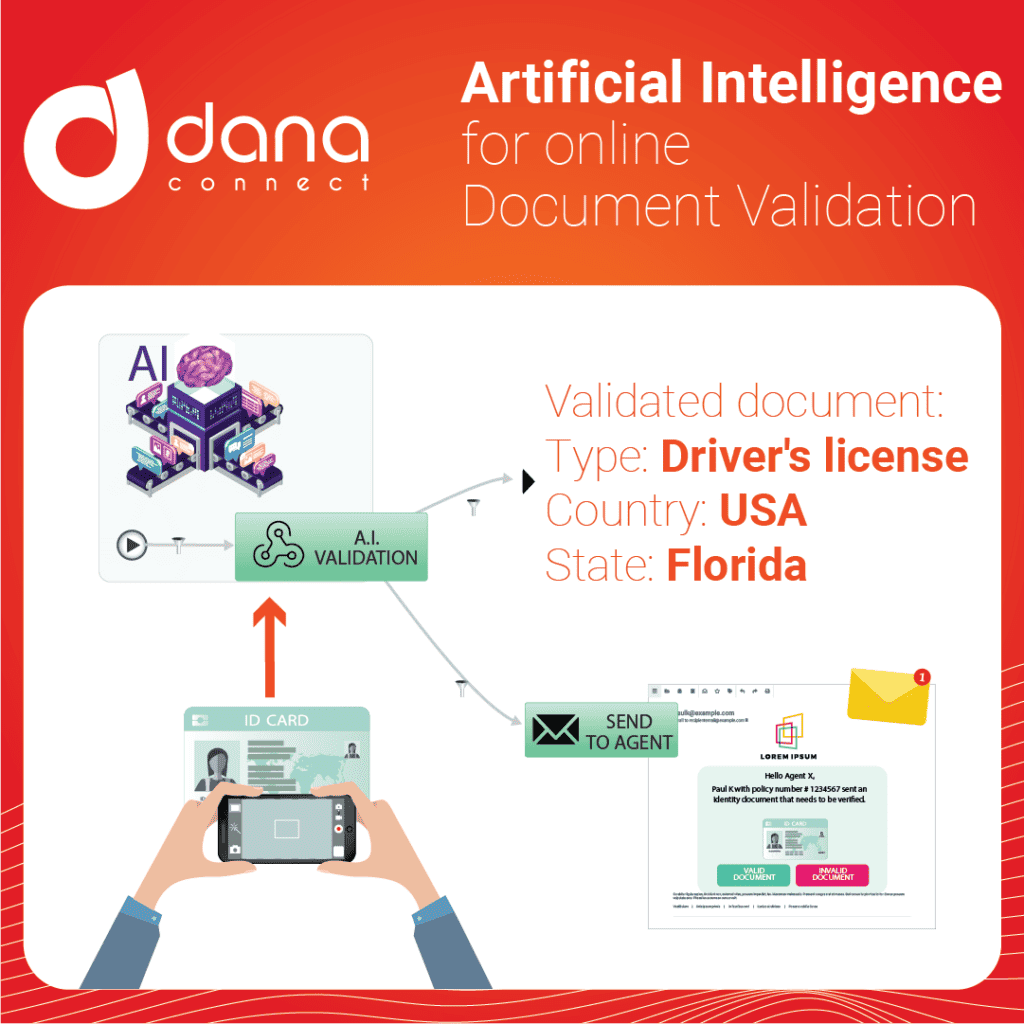

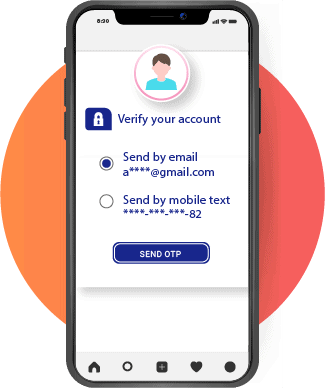

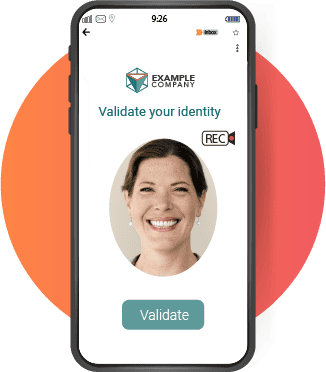

APIs (Application Programming Interfaces) and SDKs (Software Development Kits) allow companies to share their technologies and data with other organizations, facilitating collaboration and co-creation of solutions. In the financial industry, the emergence of open banking APIs is enabling an unprecedented level of cooperation and collaboration between banks and fintechs.

3. Artificial Intelligence and Machine Learning

AI and Machine Learning can accelerate the Open Innovation process by identifying patterns and generating insights from large volumes of data. For example, these technologies can help identify emerging trends, analyze the performance of innovation ideas, and predict the success of Open Innovation projects.

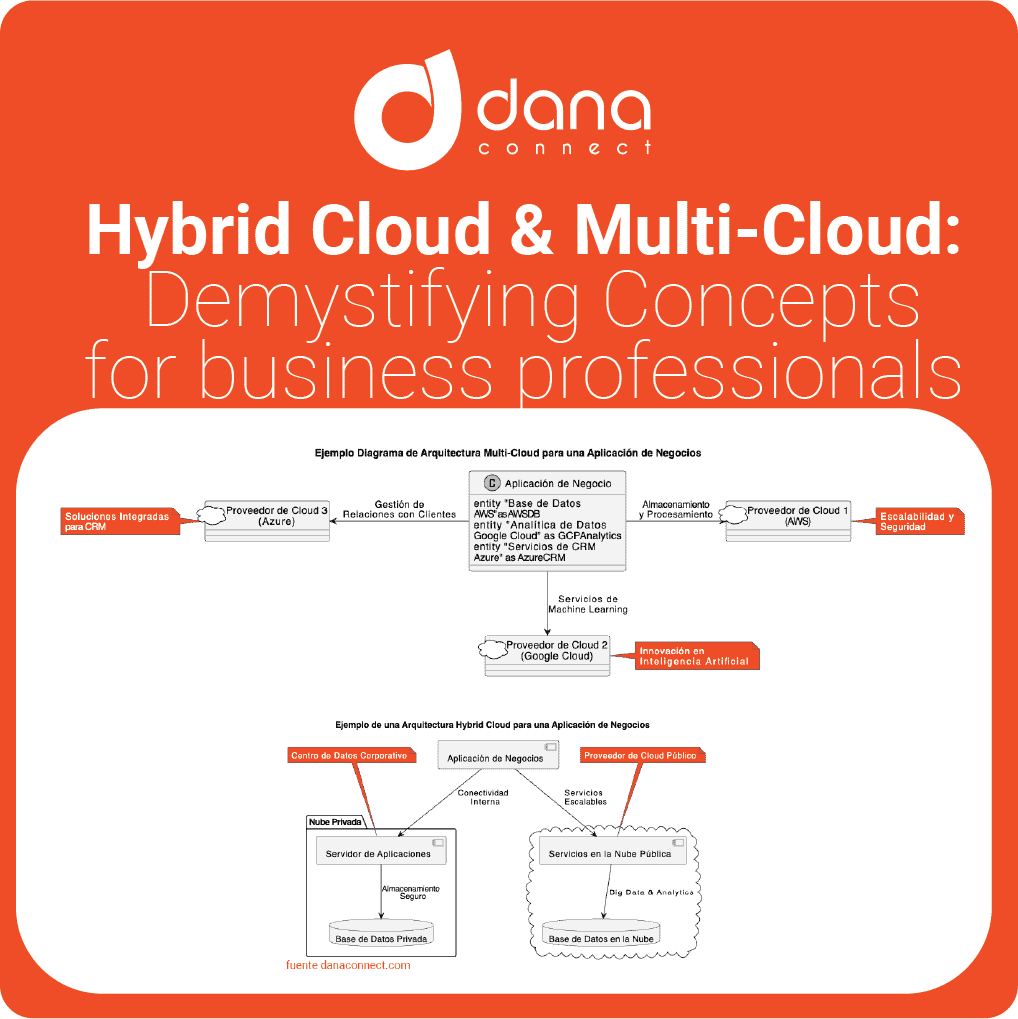

4. Cloud collaboration

Cloud collaboration platforms like Microsoft Teams, Google Workspace, and Slack enable real-time communication and collaboration among geographically dispersed teams. These platforms also provide tools for project management, document sharing, and integration with other productivity applications, facilitating collaboration on Open Innovation projects.

5. Blockchain

Blockchain technology can facilitate Open Innovation by providing a secure and transparent framework for collaboration. In the financial industry, the Blockchain is being used to develop innovative solutions in areas such as payments, remittances, digital identity, and smart contracts.

Open Innovation: The Drive towards a Prosperous Future

Open Innovation represents a great opportunity for financial organizations that seek to accelerate their digital transformation, increase their agility and foster growth. By taking this approach, financial institutions can benefit from the knowledge, creativity and experience of a wide range of stakeholders.

Final Thought: The Value of Open Innovation

The effective use of Open Innovation requires a cultural and strategic change. This transformation must be led from senior management, fostering a culture of collaboration and learning. Although the path to Open Innovation can present challenges, the potential benefits in terms of growth, competitiveness and resilience are enormous. In an ever-evolving world, finance organizations that embrace Open Innovation will be better equipped to successfully navigate the uncertain and exciting future ahead.

You may also be interested: