The financial industry has always been a leader in the application of new technologies to drive efficiency and reduce cost. As the industry moves towards becoming more digital and automated, microservices orchestration is playing an increasingly important role. Microservices are a collection of small, modular services which, when orchestrated together, can create more powerful applications. By leveraging microservices orchestration, the financial industry can reap significant benefits, such as increased agility and scalability, as well as enhanced customer experiences. However, there are also challenges which must be addressed, including cost and complexity. In this article, we explore how microservices orchestration is transforming the financial industry, the benefits and challenges it presents, and how financial organizations can best take advantage of this technology.

What are Microservices?

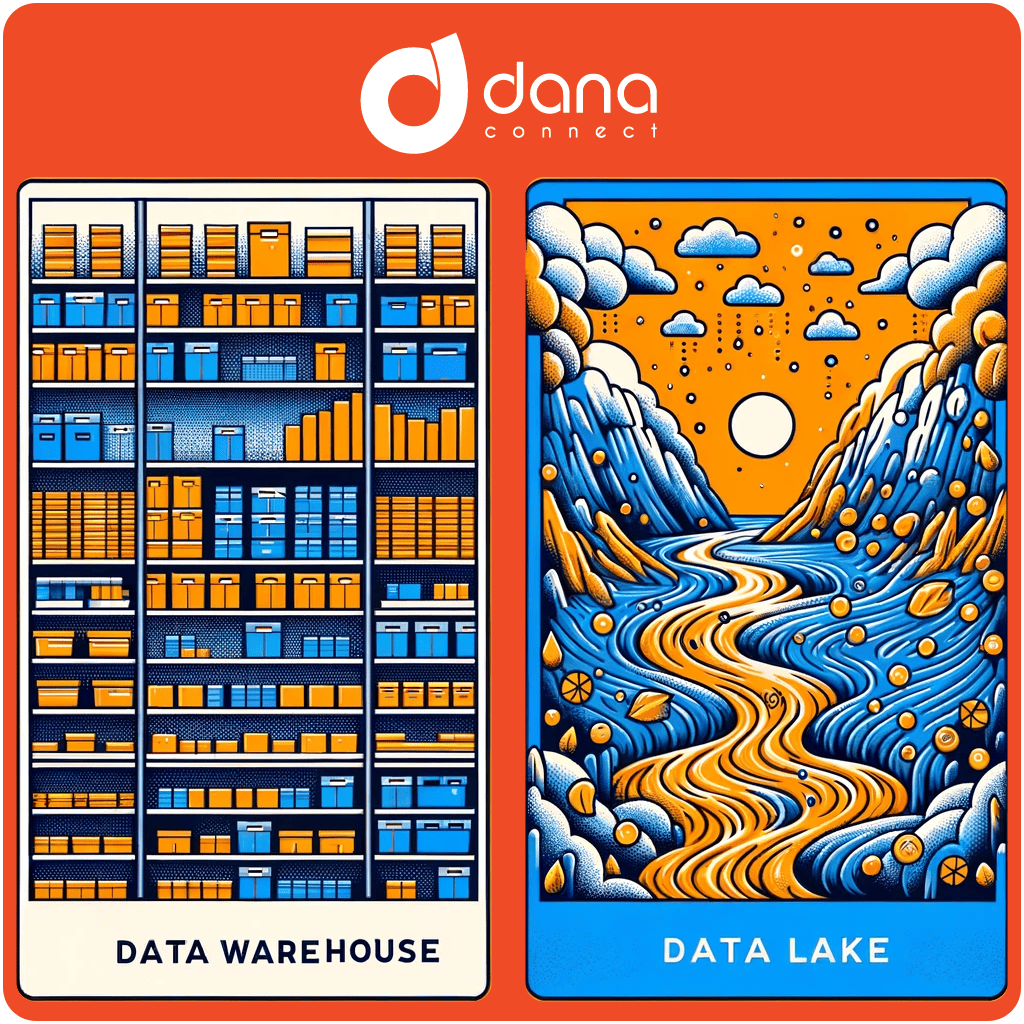

Microservices are a software architecture style that promotes the use of small, independent modules that can be combined to create larger applications. Traditionally, applications have been built as a single, monolithic module that is responsible for managing all aspects of the application, including data storage, customer relationships, etc. The challenge with this approach is that as the application grows its complexity increases, which leads to lower quality, reduced agility, and higher costs. The concept of microservices was developed in the early 2000s by engineers at EBay who were looking for a solution to the challenges of monolithic architectures. Microservices are a way to break down an application into smaller, more manageable pieces, each of which is responsible for a specific function. This means that if one service fails, it shouldn’t have a cascading effect on the rest of the application. Although there isn’t a standard definition of what makes a service “micro,” it is generally accepted that a microservice is small enough to be created, deployed, and tested in one day.

Benefits of Orchestration

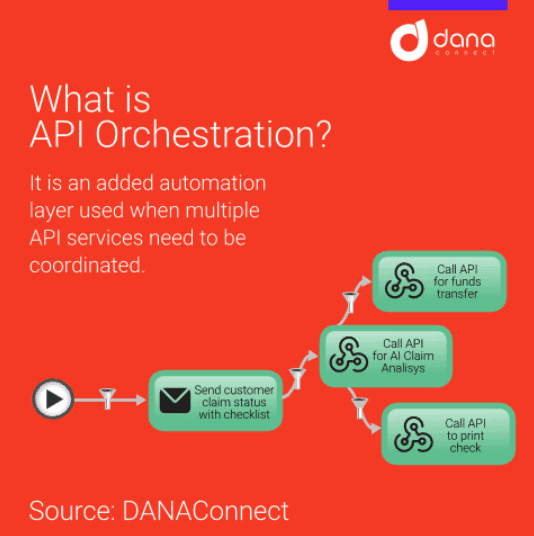

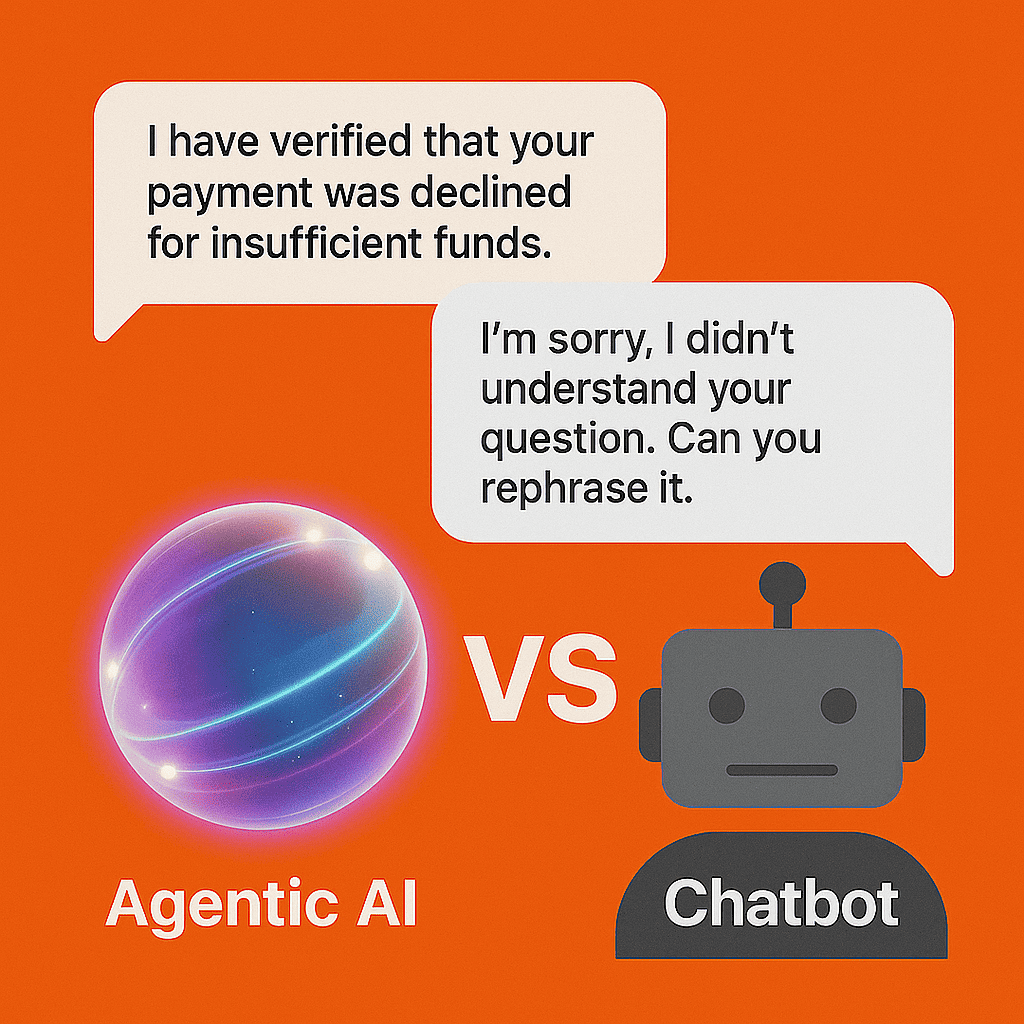

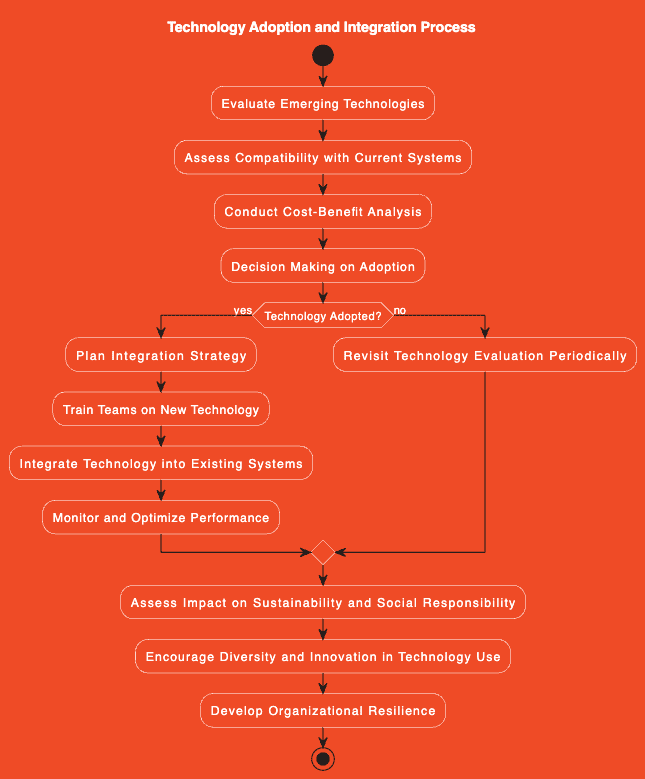

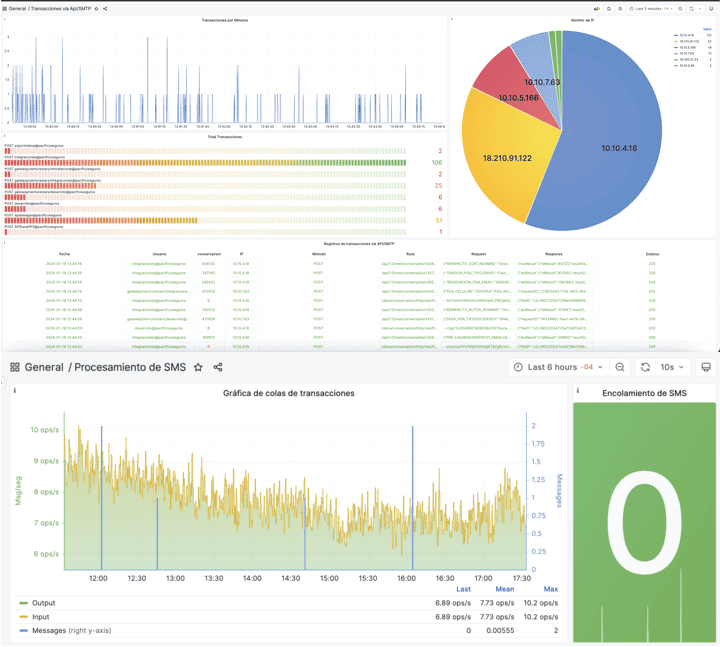

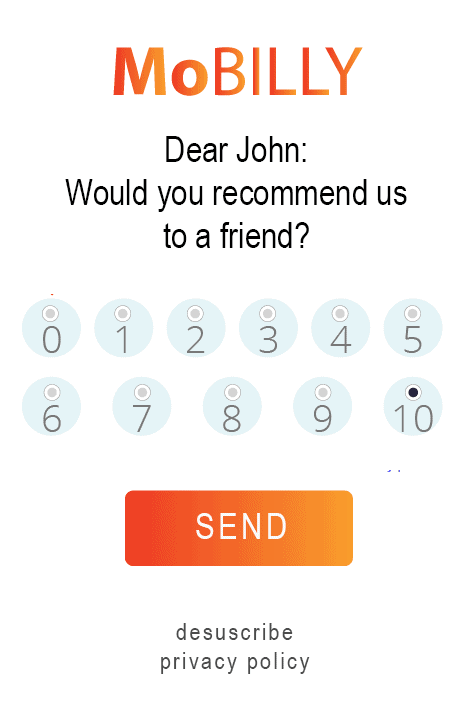

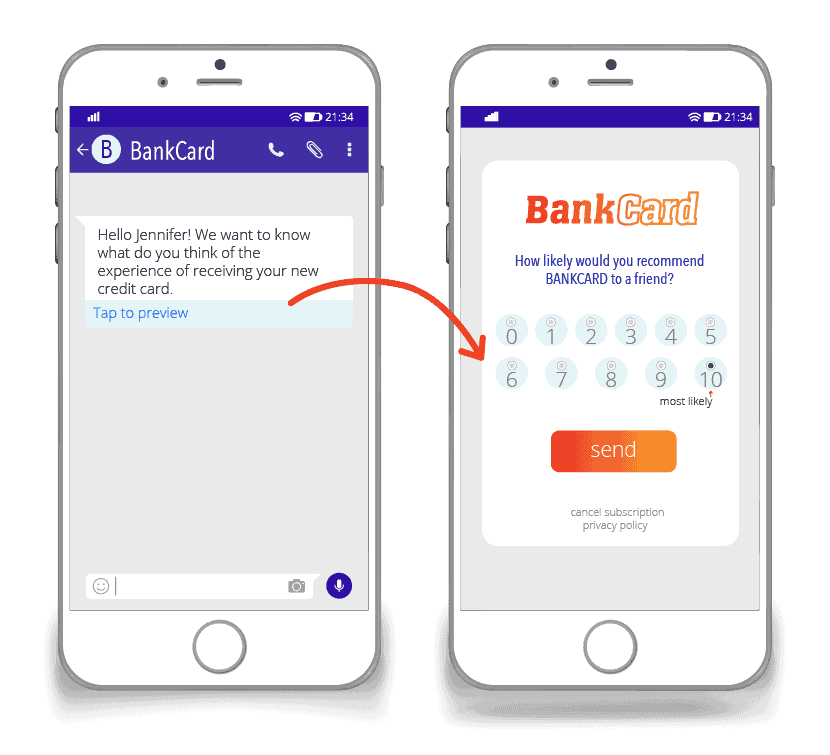

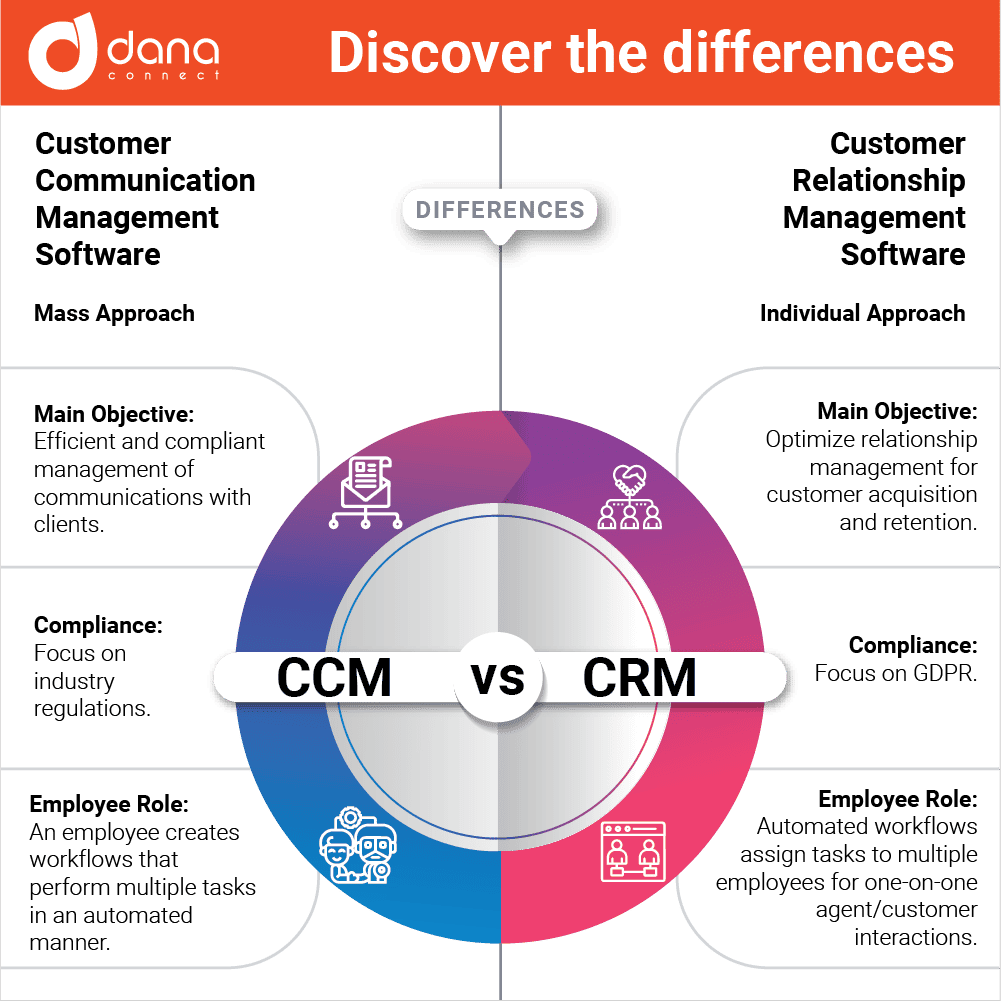

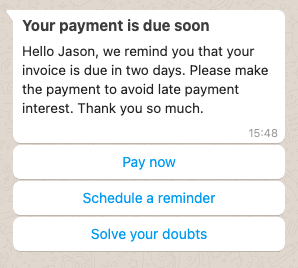

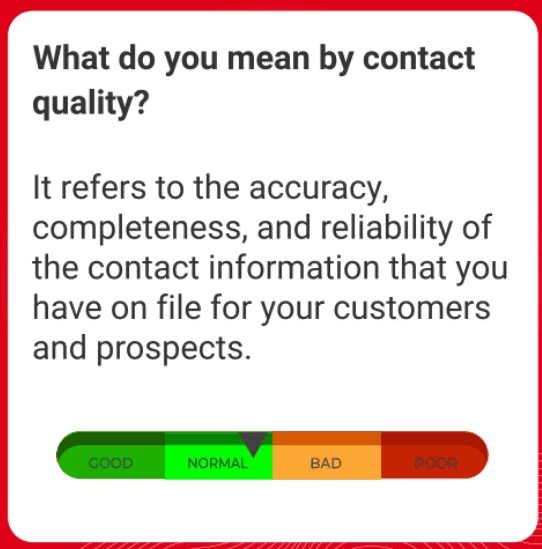

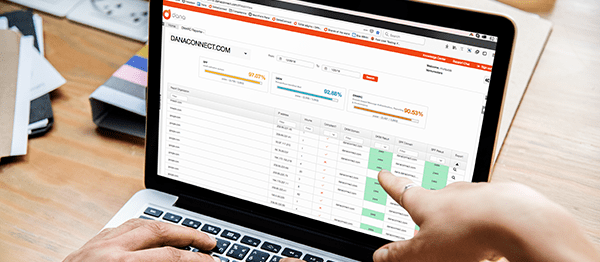

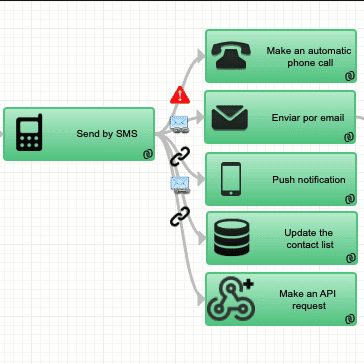

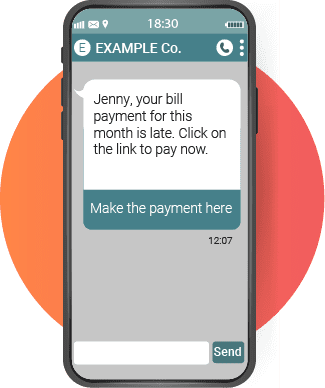

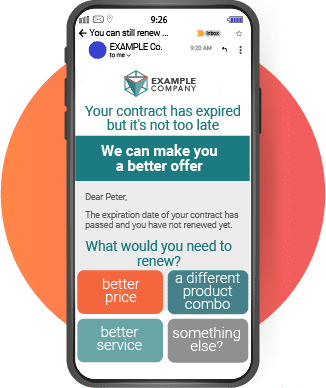

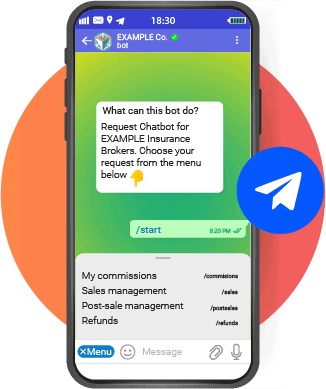

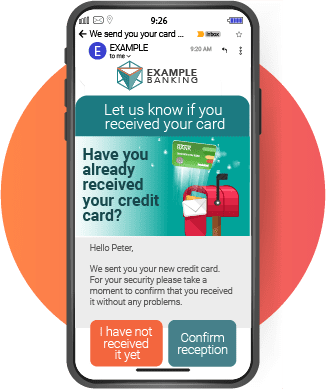

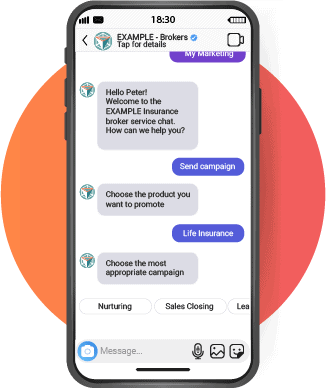

As more organizations adopt microservices and API, they also increasingly rely on orchestration to manage interactions between these microservices. Orchestration is an automation framework that manages the interactions between microservices and omnichannel two-way customer communications in order to create a more powerful application.

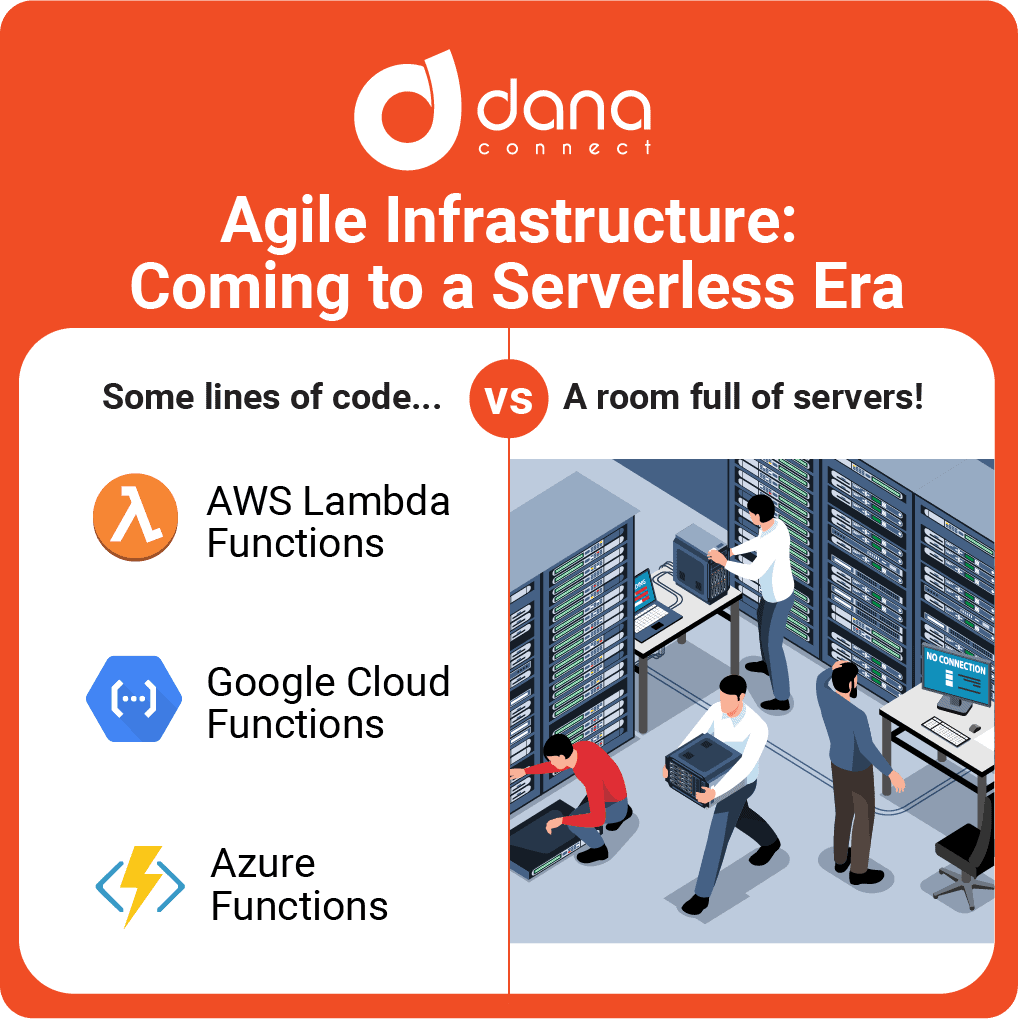

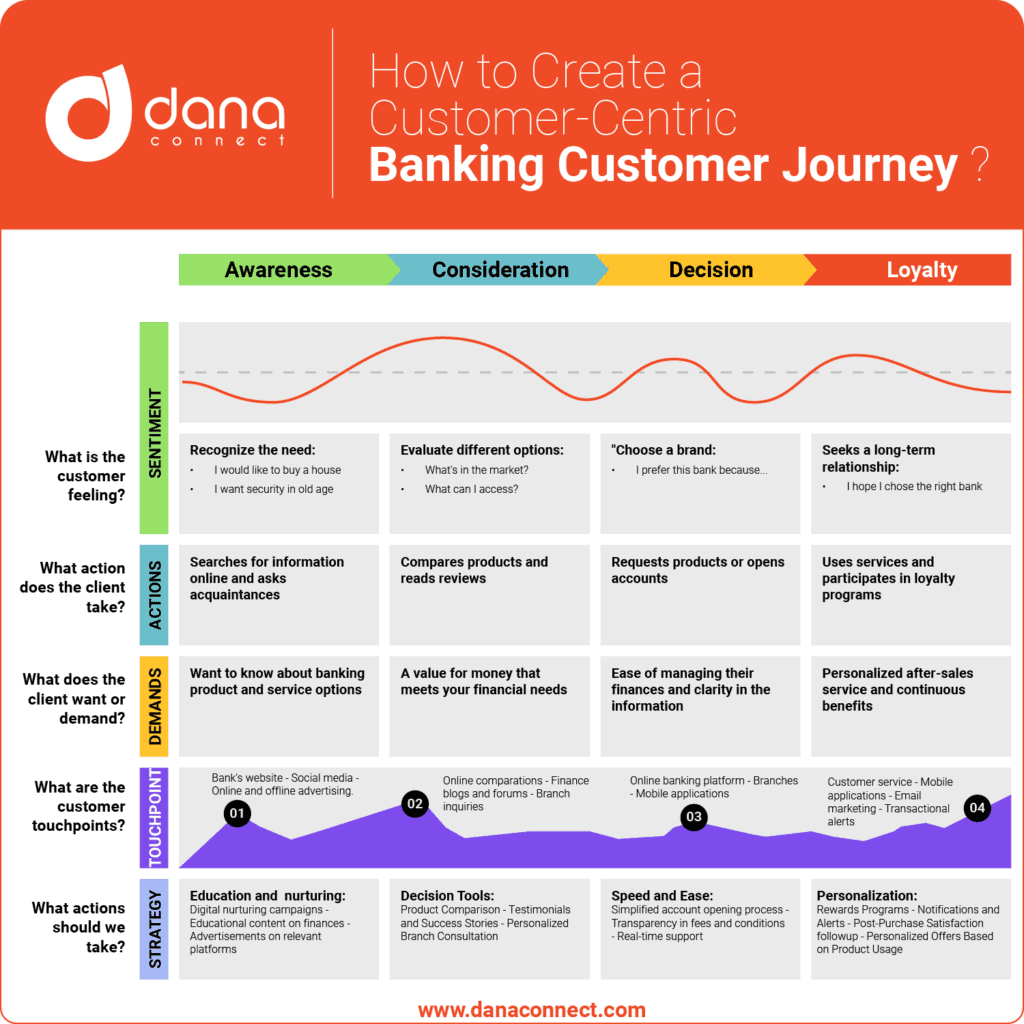

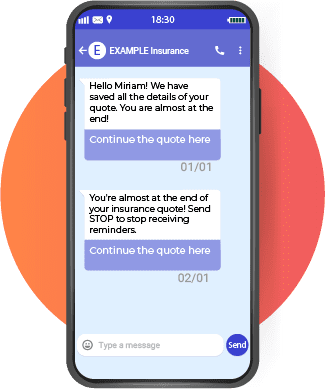

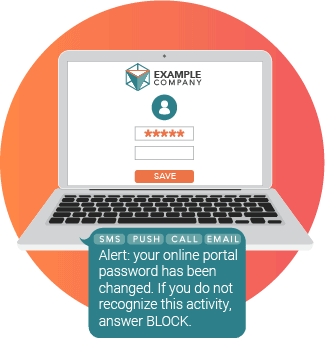

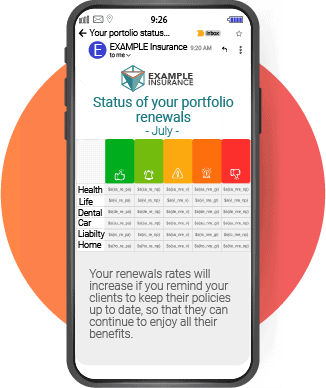

Orchestration can streamline operations and increase efficiency. In a nutshell, orchestration is a technology that allows for the automation and coordination of multiple systems and processes to simplify complex tasks. Automated orchestration can allow businesses to take advantage of existing IT infrastructure investments while also deploying new technologies quickly and efficiently. It can be used to create an increasingly customer-centric experience by combining multiple microservices with the goal of providing a seamless experience for users.

Improved agility and scalability: By leveraging orchestration, organizations can respond more quickly to changes in the market, customer requirements, and industry trends. It is also easier to scale applications when you are leveraging microservices rather than monolithic applications, since you can scale an individual microservice rather than the entire application.

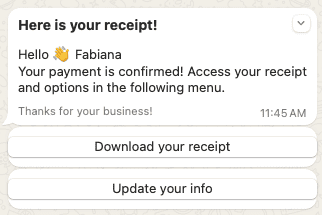

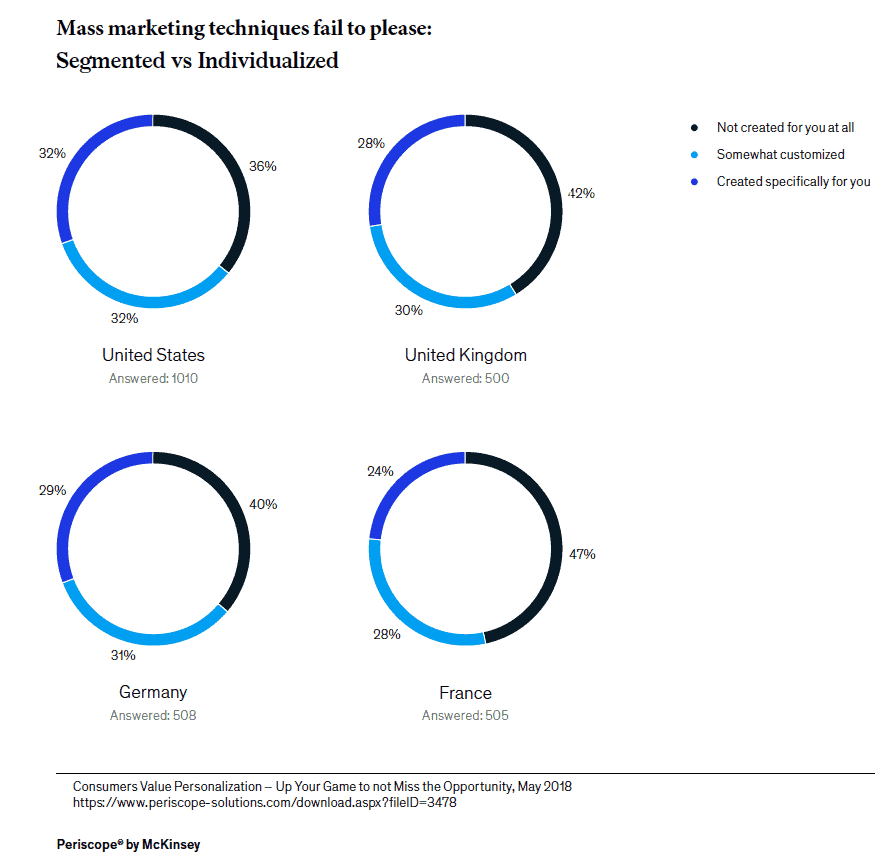

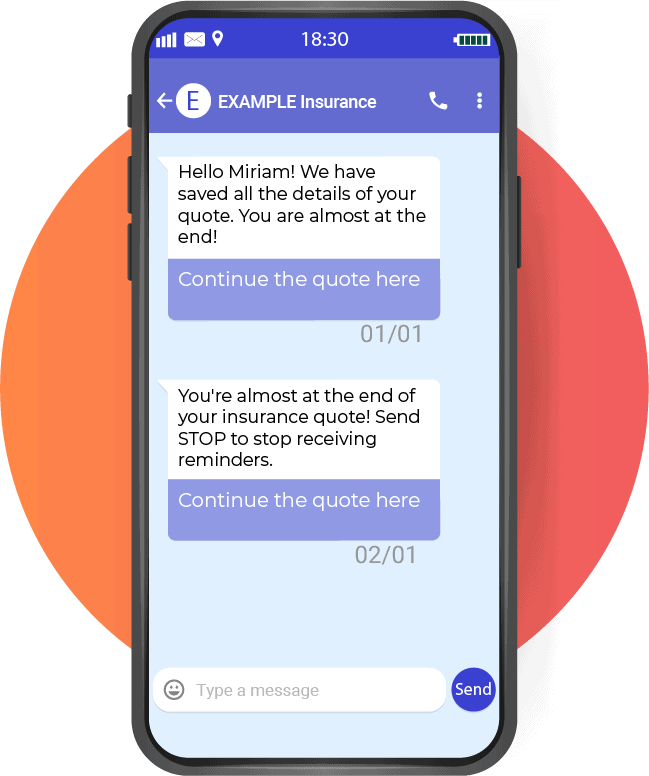

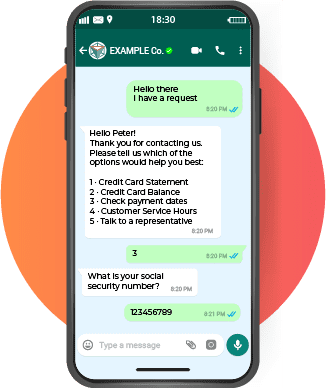

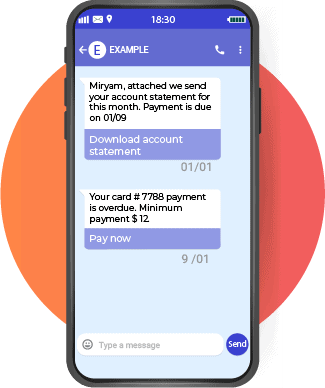

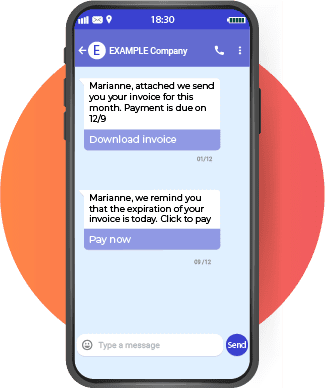

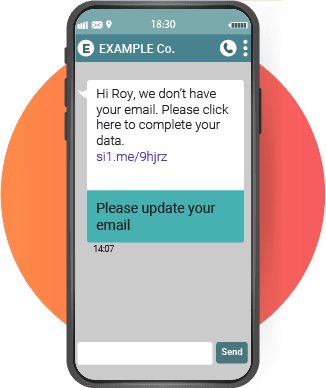

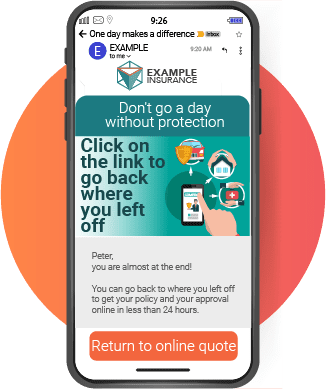

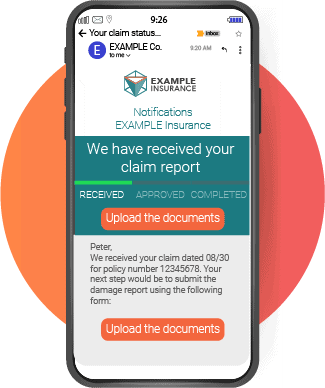

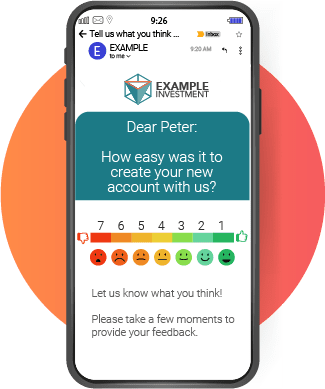

Streamlined customer experience and increased customer loyalty: By combining multiple microservices that are responsible for different functions, organizations can create a more customer-centric experience, such as combining a microservice that manages customer data with one that is responsible for providing customer analytics. This can help organizations better understand and serve their customers, while also creating a more seamless experience.

Challenges of Microservices Orchestration

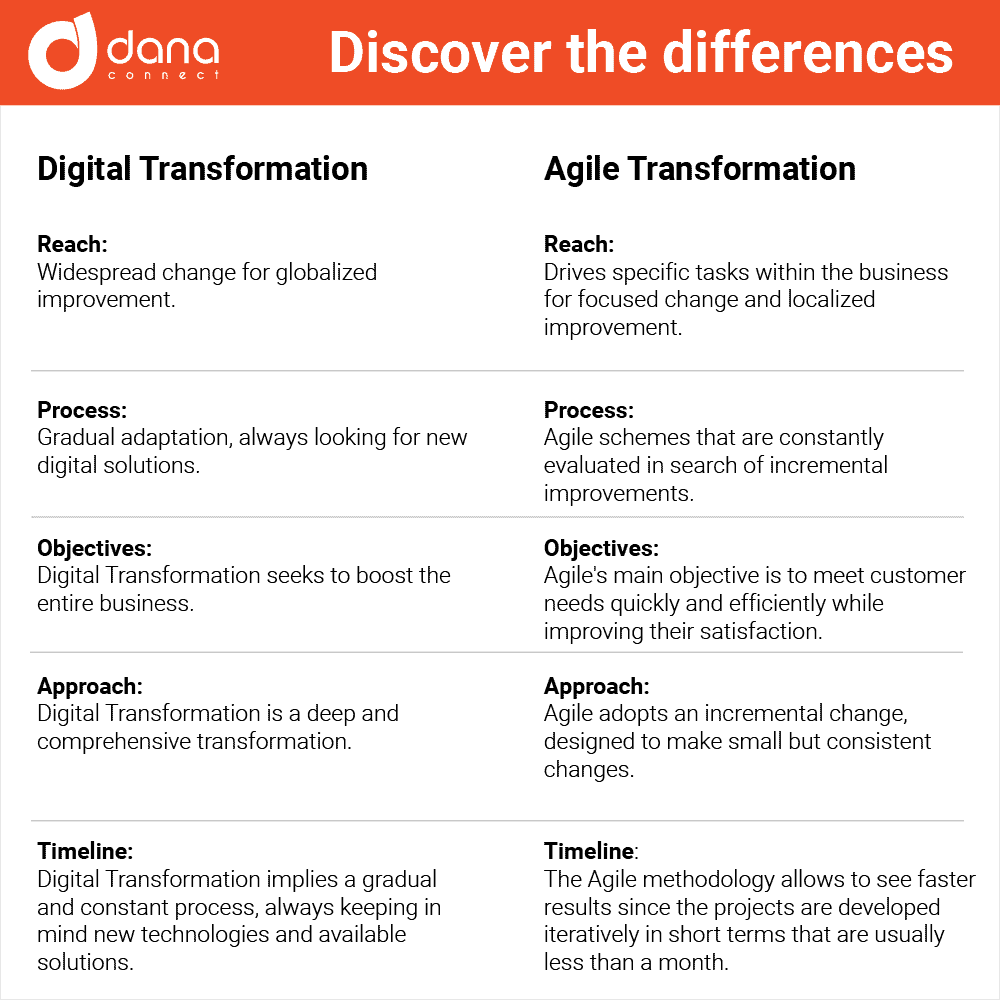

Although microservices orchestration are powerful digital transformation tools, they also present a number of challenges.

Traditionally, applications have been built as a single, monolithic module that is responsible for managing all aspects of the application, including data storage, customer relationships, etc. Just as monolithic applications can be challenging to manage and scale, so too can microservices. As more microservices are added to an application, the complexity of the system increases, making it more difficult to troubleshoot and repair.

Without the right orchestration solution in place, the costs associated with developing for managing and microservices can quickly become unmanageable.

How the Financial Industry is Leveraging Microservices Orchestration

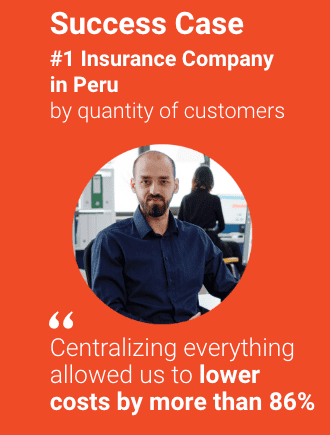

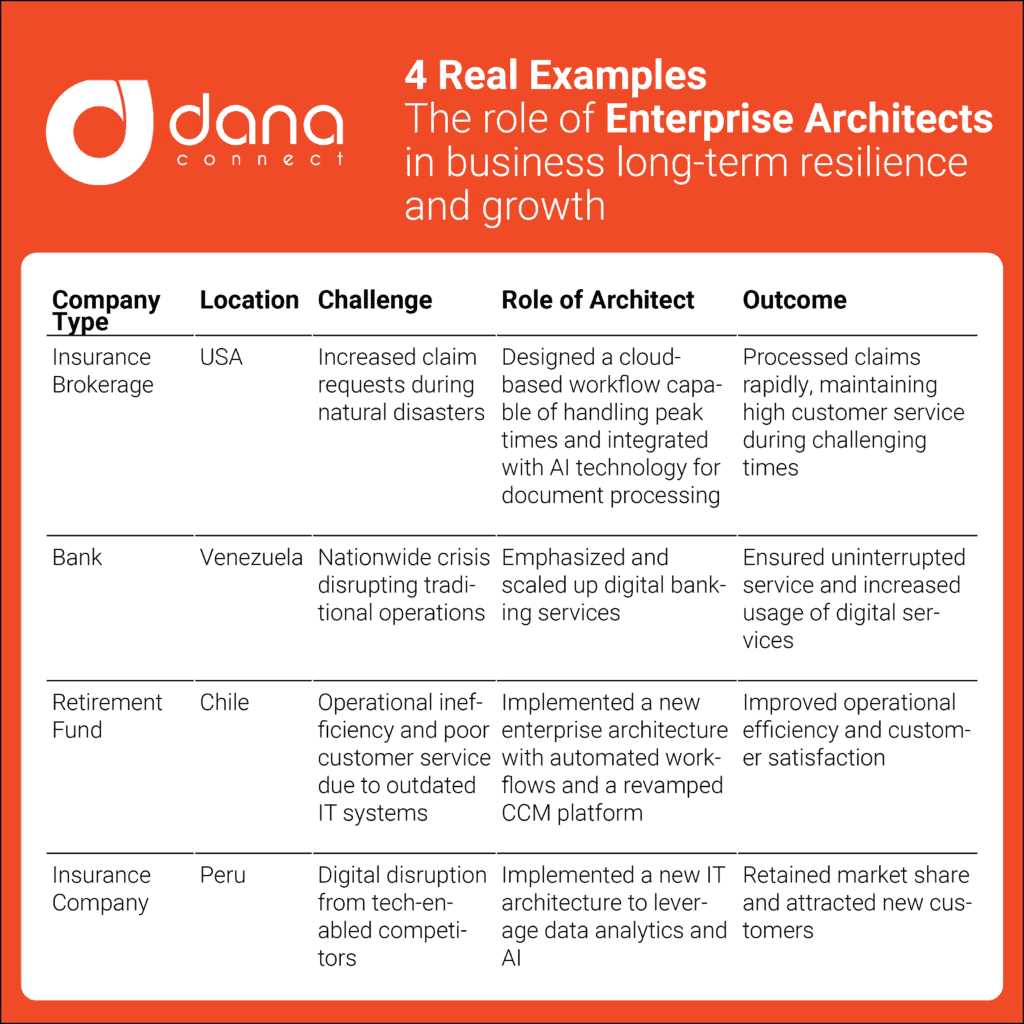

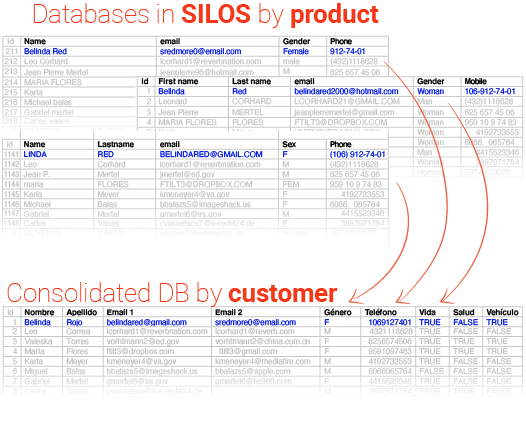

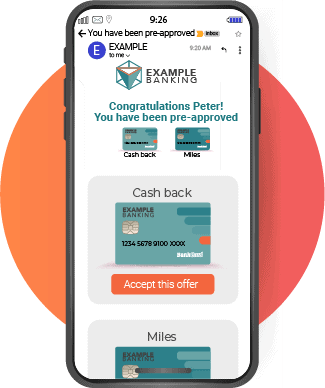

The financial industry is one of the first sectors to adopt technology and digitization to improve every aspect of its business. As a result, it has been a leader in the adoption of microservices and their orchestration. Indeed, many of the world’s largest financial institutions are leveraging microservices and orchestration to meet the needs of their customers in new ways. This includes everything from improving the experience of existing customers to meeting the needs of new digital customers. From a business perspective, the financial industry is leveraging microservices orchestration to respond more quickly to changes in the market, gain a better understanding of customers, and increase efficiency and profitability. This includes automating manual activities, such as data collection and auditing, through the use of microservices. It is also leveraging microservices to create new products and services that meet the needs of both traditional and digital customers and go faster to market.

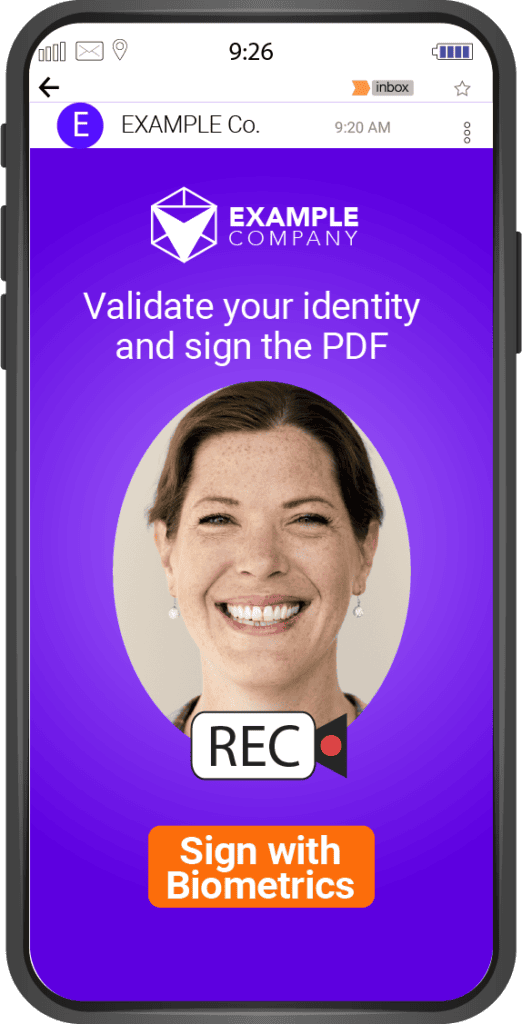

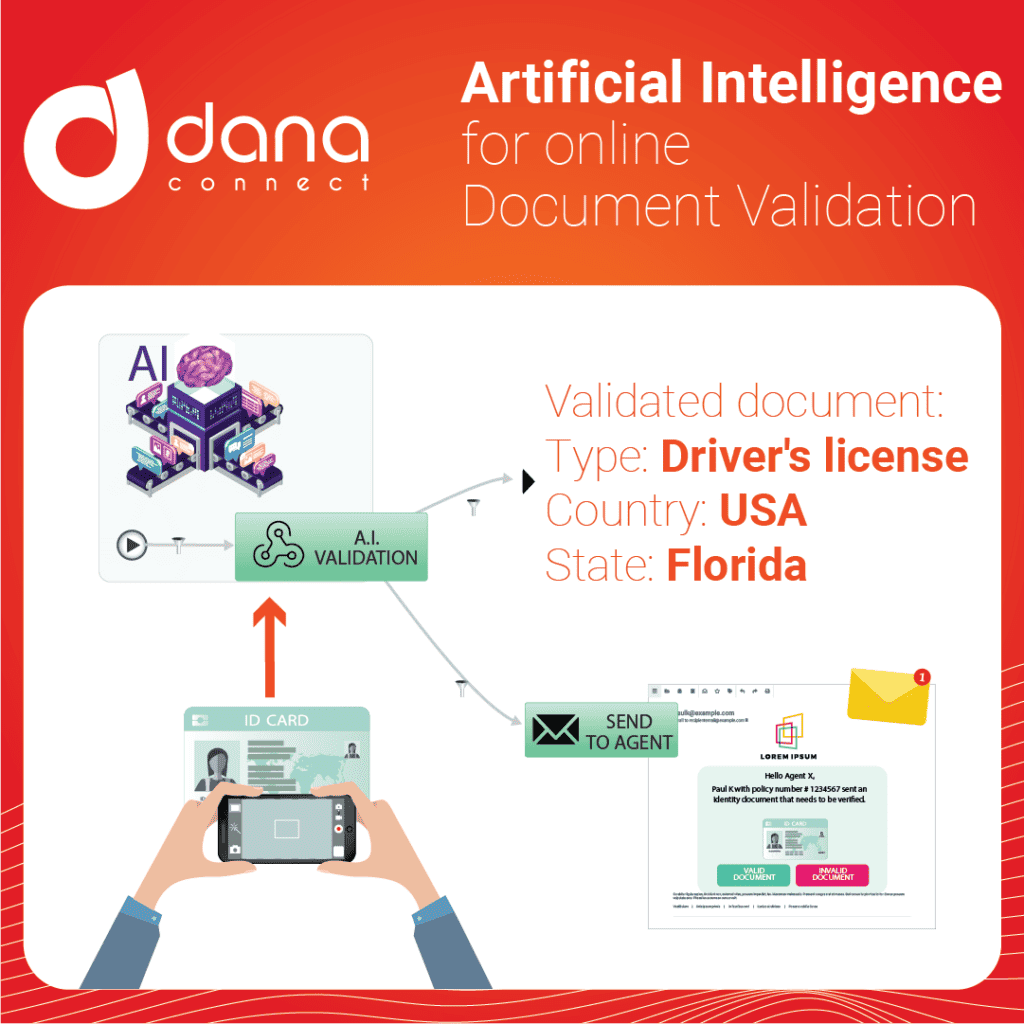

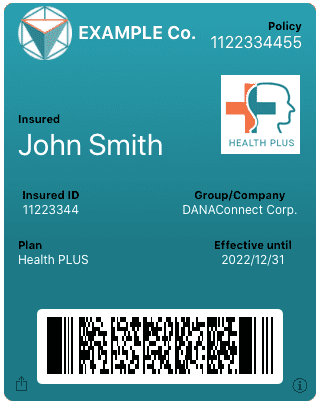

Financial institutions are using microservices to enhance the digital customer experience through the use of new product offerings and enhanced experiences. New products include sophisticated wealth management tools and investment advice, as well as new digital offerings for the unbanked, such as digital cash and credit. These include new offerings, such as increasing the use of robo-advisory tools, providing digital documents on demand across all channels, faster document validation with A.I. among many others.

Successful Microservices Orchestration

Given the complexities and challenges of orchestrating microservices, it is essential that financial organizations take a strategic approach to implementing this technology. They should start by mapping out their entire application to identify the modules that could be broken down into microservices, taking into account both technical and functional considerations. They should then select and implement an orchestration solution that can provide the capabilities required to manage the interactions between microservices. Once in place, organizations should continue to monitor and evaluate the solution, including assessing the need for new functionality and scalability.