At present, the use of QR codes has become more and more popular in various industries. Consumers can scan a code with their mobile phones to quickly access additional information or services. However, this ease has also increased the risk of fraud known as QRshing.

QRshing is a technique used by criminals to trick the user into scanning malicious code instead of legitimate one. The ultimate goal is to steal valuable personal or financial information.

As companies look for innovative ways to connect with their customers through emerging technologies like QR codes, they must understand how to prevent and properly respond to potential security threats associated with them.

In this article, we explore different strategies that help both businesses and end users protect themselves against potentially devastating fraud associated with these popular digital systems.

What exactly is QRshing?

What exactly is QRshing?

The term “QR” stands for Quick Response. As their name indicates, they are easy and fast to use either from mobile devices or other electronic means available today.

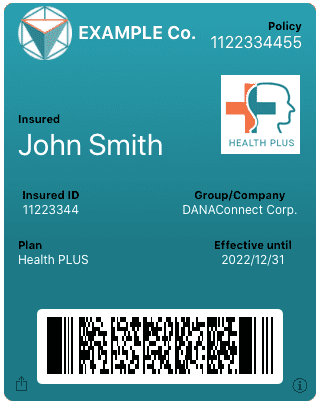

The basic idea behind the system might seem simple: anyone can create one simply by printing a two-dimensional encoded text generated by specialized software capable of including specific images and iconography as well as displaying short URL web addresses to sites external to the original content; the latter is very useful especially when you want to share details about products/services offered by companies from various sectors.

Unfortunately, criminals have also found this technology very useful for tricking unsuspecting users. QRs can be used in phishing or malware and become a major online security threat. Fraud is known as “QRshing” when a malicious QR code is designed to look like the original but redirects traffic to fake websites looking to steal valuable financial or personal information.

How does QRshing work?

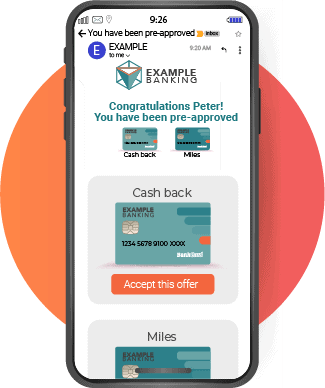

Attackers take advantage of people’s trust in secure code created by well-known legitimate brands; that is, they create similar codes that are visually the same as those issued by reputable companies.

The user scans this code thinking that it takes him to the correct site (for example: www.unbanco.com), however, he will end up being directed to a fake site created specifically to capture his information and use it later.

These scams are especially dangerous because they do not require a lot of work or technical skill on the attacker’s side, as anyone can easily create these types of scams using simple tools freely available even from the Play Store.

What risks does this imply for both companies and end users?

For business organizations:

– Direct economic loss.

– Potential reputational damage due to improper use of your digital systems.

– Regulatory violations if it turns out to be necessary to notify publicly about any breach.

For consumers/end users:

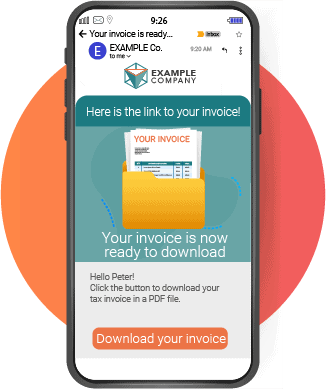

– Financial theft/bank fraud related to bank accounts/balances.

– Theft of personal data, including personal and financial information such as full names, physical addresses and emails.

– Damage to the reputation of the end user in the event that their name is used to commit other online fraud.

How can companies protect themselves against QRshing?

Here are the top 5 tips on how to protect your business and customers from QRshing:

1. Use unique URLs and domain names:

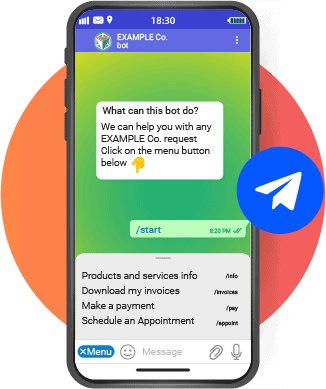

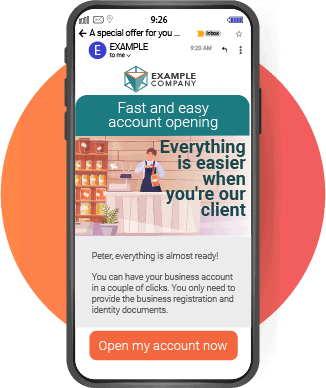

Financial institutions must use unique URLs and domain names that are unique to their business. This can help customers identify legitimate QR codes and avoid scams. Financial institutions can also use website security certificates to ensure that their website is secure and that customers access the official website.

2. Educate customers on the importance of verifying the URL:

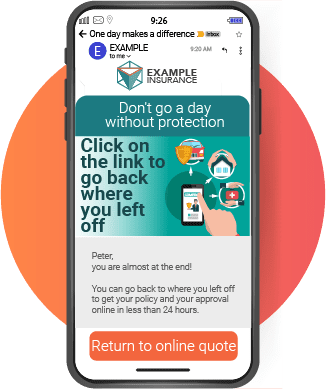

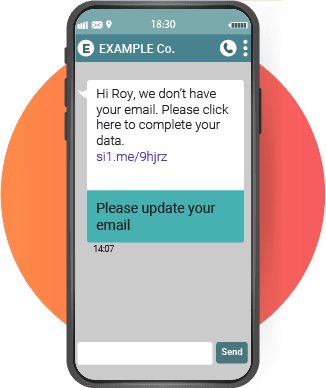

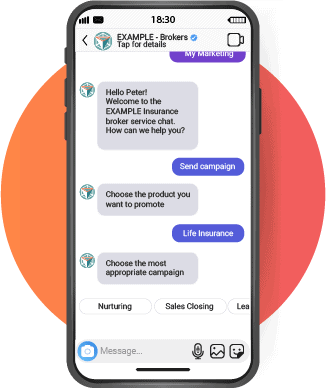

Financial institutions should educate their customers on the importance of verifying the QR code URL before clicking on it. Run campaigns about the correct use of your QR codes.

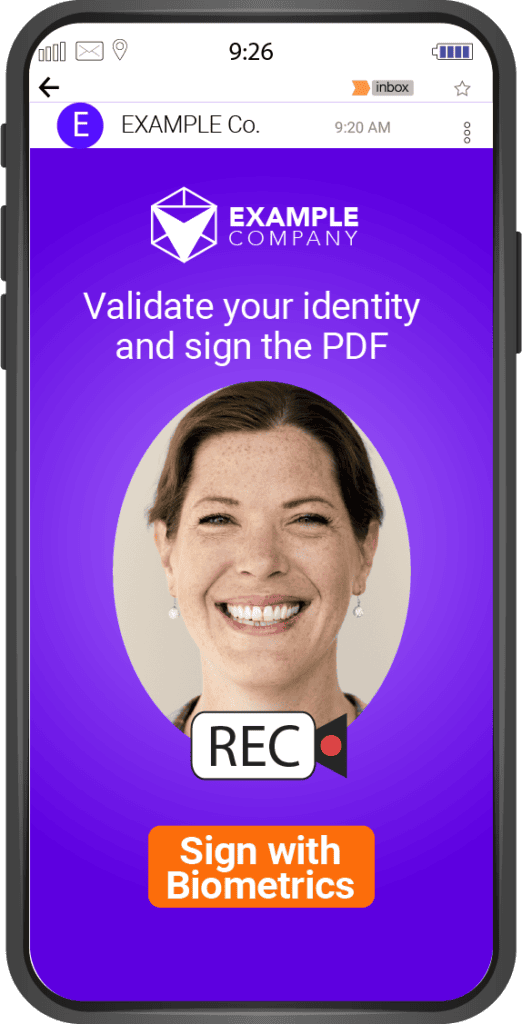

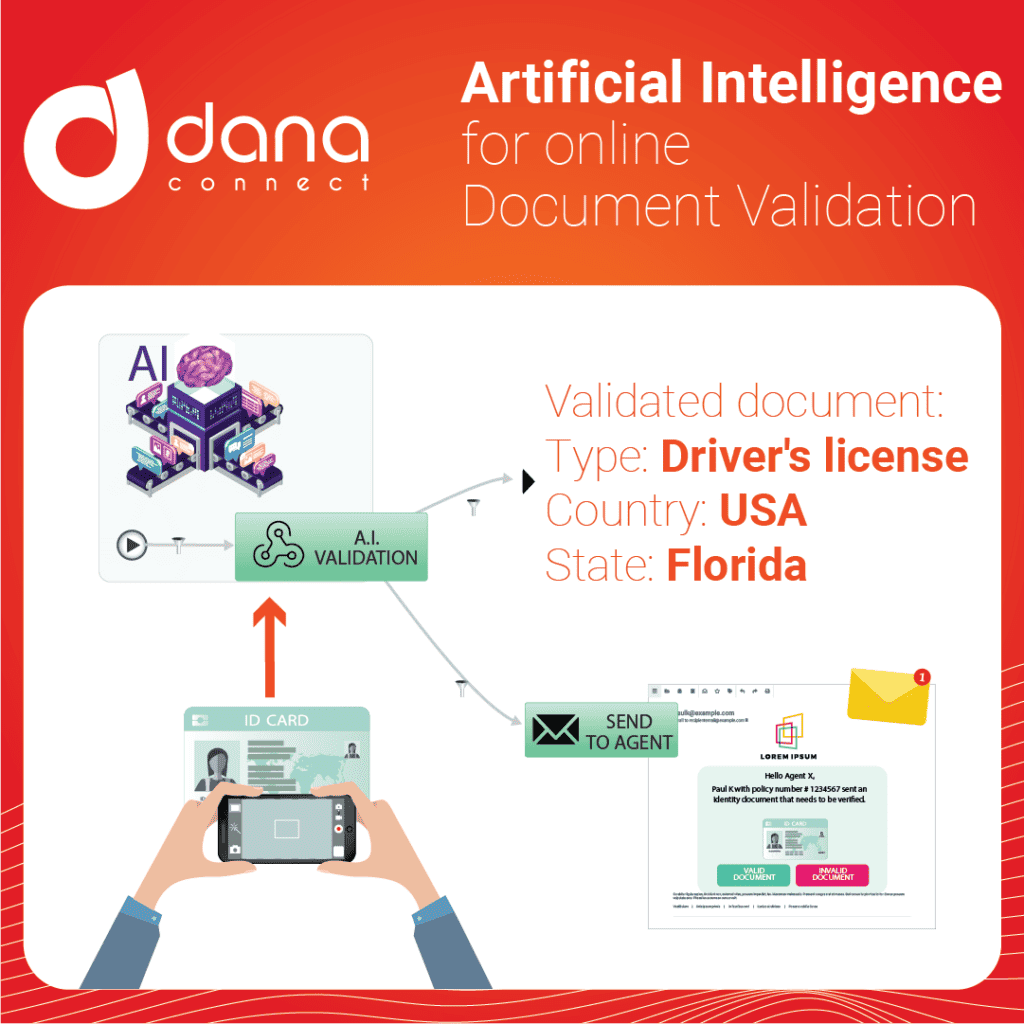

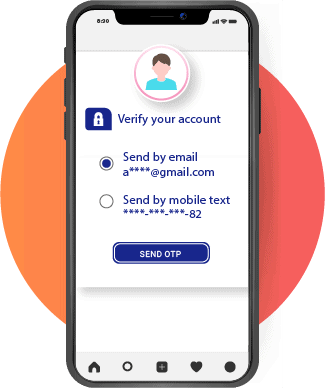

3. Implement multi-factor authentication:

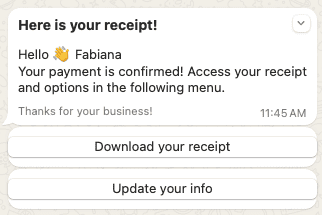

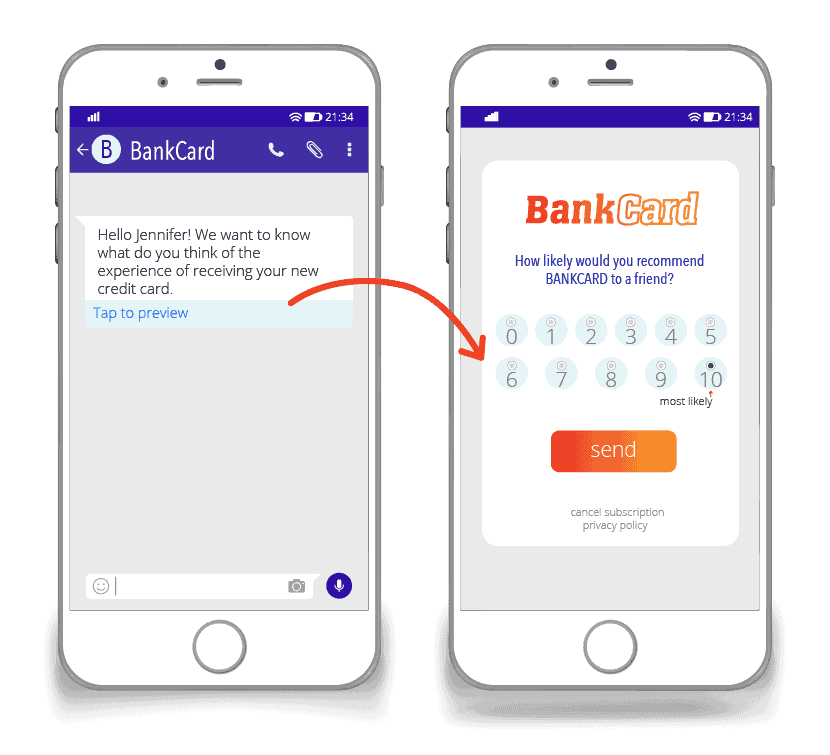

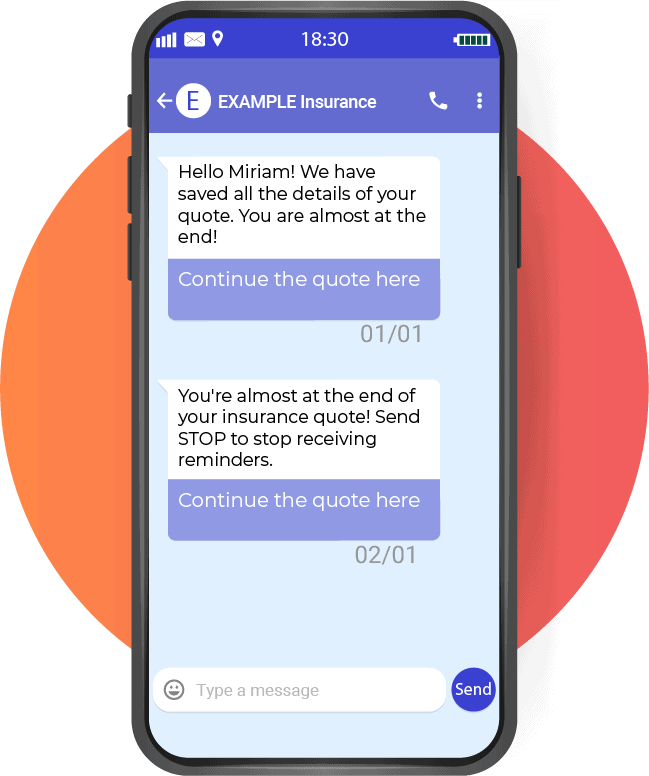

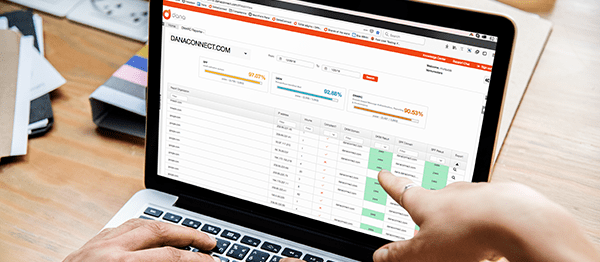

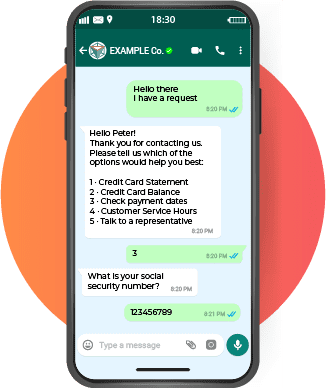

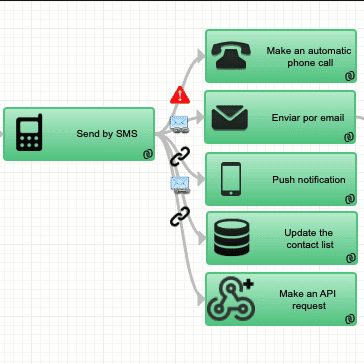

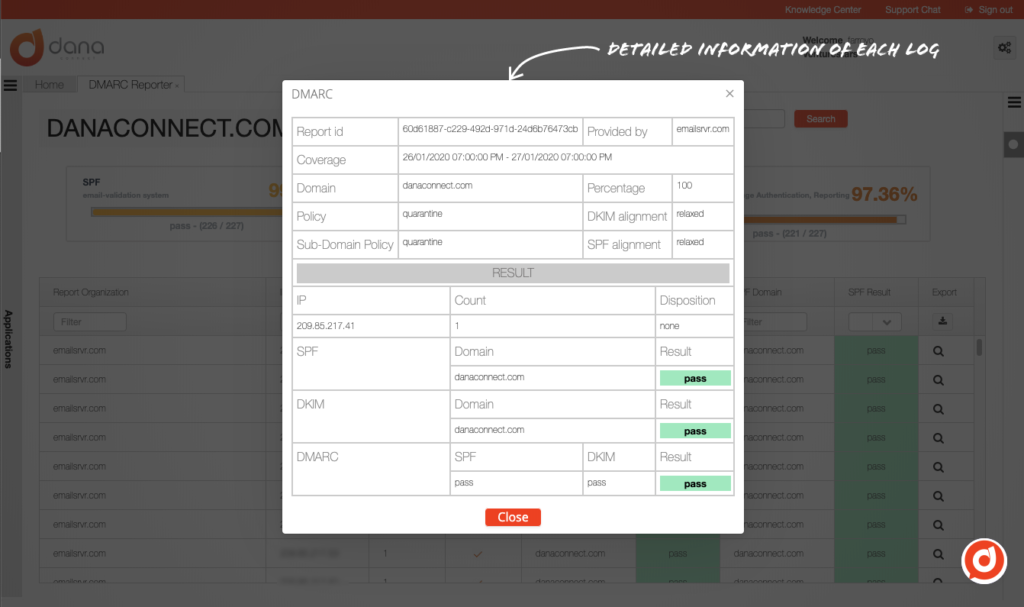

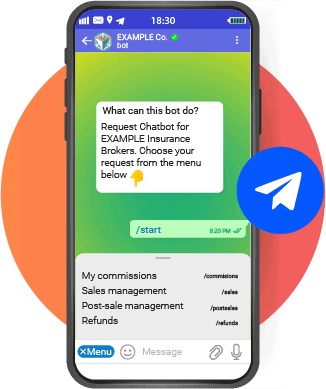

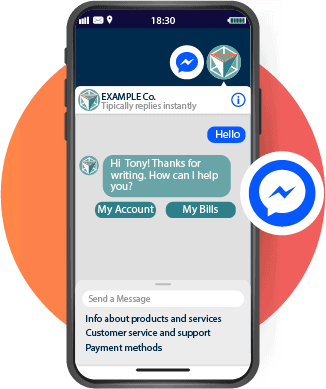

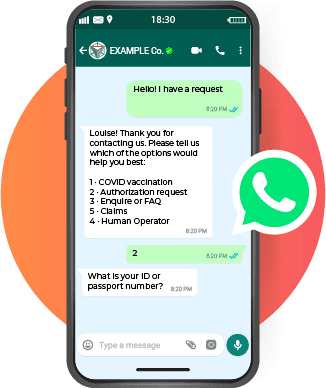

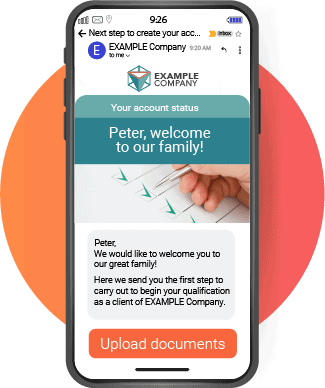

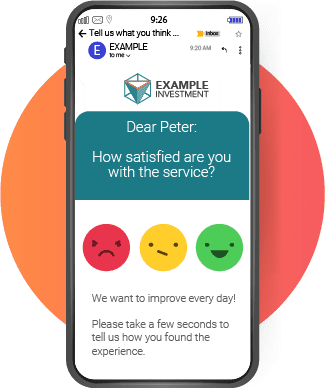

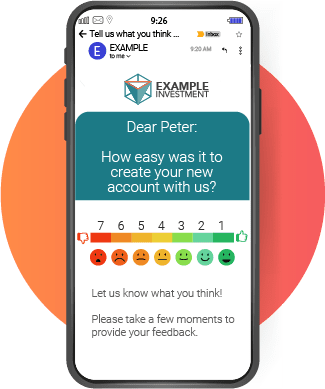

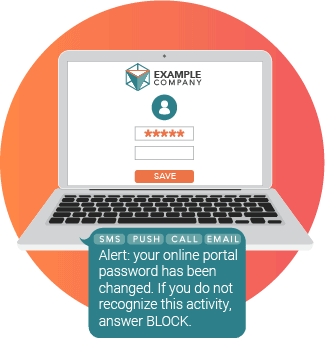

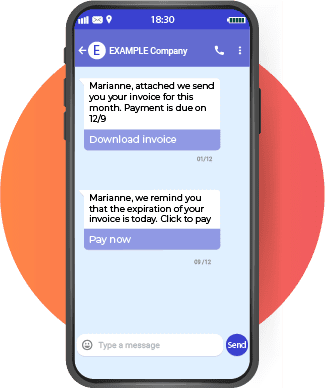

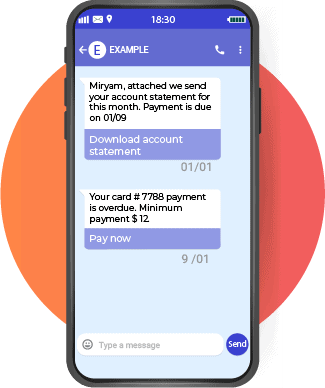

Financial institutions must implement multi-factor authentication measures, such as sending one-time passwords to the registered phone or email to verify the identity of customers and prevent unauthorized access to their accounts. See the DANAconnect OTP solution.

4. Use secure QR codes:

Financial institutions must use secure QR codes that cannot be easily copied or modified. This may include the use of unique QR codes for each customer, adding a token, and authentication measures.

5. Monitor suspicious activity:

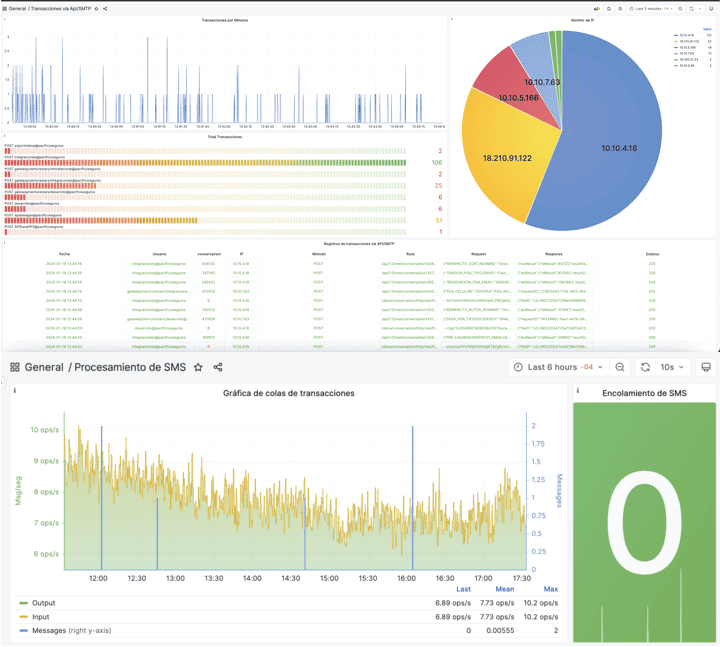

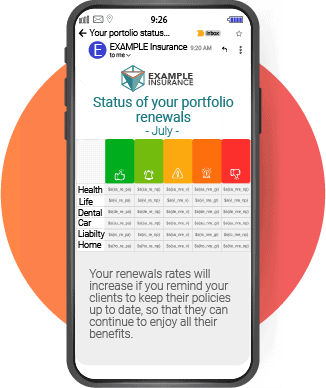

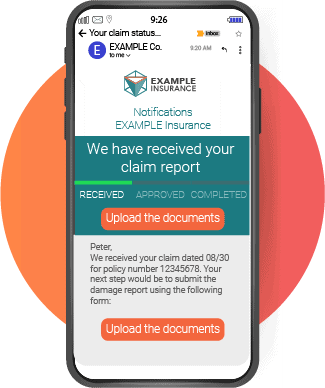

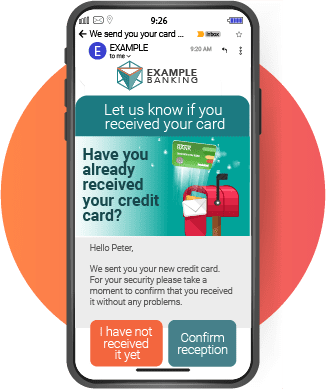

Financial institutions must monitor suspicious activity, such as multiple attempts to scan a QR and alert the customer by SMS or email.

How can end users protect themselves against QRshing?

The following tips offer some effective strategies:

1. Always check before scanning

First of all, we must verify if the sources and URLs are reliable (for example, official websites use the brand’s web address) either through the mobile browser or other specialized apps specially designed for these purposes.

2. Do not share personal data without a clear need

There is no reason why we should share sensitive personal information such as bank numbers or physical addresses if we are not sure about its legitimate origin.

In case we have doubts regarding the correct origin, it is best to avoid it until we have clear certainties about said request/order.

3. Use updated antivirus software

Any mobile device requires having a good anti-malware program installed both on cell phones as well as laptops, tablets, etc., capable of detecting suspicious patterns and even alerting us to possible threats related to phishing/malware associated with malicious coding via QR code.

4.Use VPN apps when browsing online

Internet access via VPN (Virtual Private Network) networks has become increasingly popular due to its ability to protect our identity online and ensure the privacy of our data.

It is recommended to use reliable VPN applications especially when we browse websites that contain delicate or sensitive information such as banks, online purchases, etc.

5. Regularly update your mobile devices

Regular updates of both the operating system and the installed apps are essential since they not only improve performance but also include security patches necessary to update your digital systems; this reduces potential risks related to fraudulent QR codes.

Summary

The widespread use of emerging digital technologies has significant challenges and implications associated with computer security, including threats related to malicious QR code, also called “QRshing”.

To prevent incidents, it is essential to have specialized anti-fraud solutions capable of detecting suspicious patterns and likewise constant education on good practices in digital matters, both end-user companies are key to significantly reducing any unnecessary exposure to possible compromised situations.