The insurance sector, traditionally characterized by its conservative approach and entrenched business models, is now at the heart of a digital revolution. This metamorphosis is largely due to the rise of insurtechs, emerging companies that combine technological innovation with insurance solutions, redefining the rules of the game. In this article, we explore the best examples of Insurance Innovation.

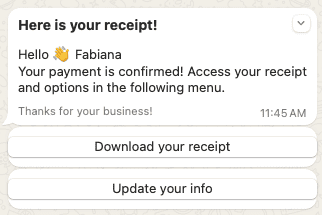

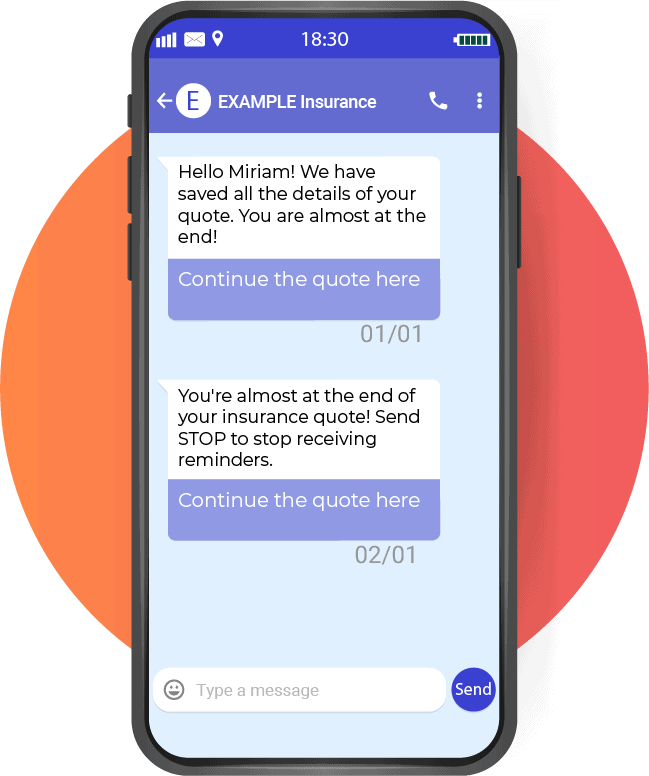

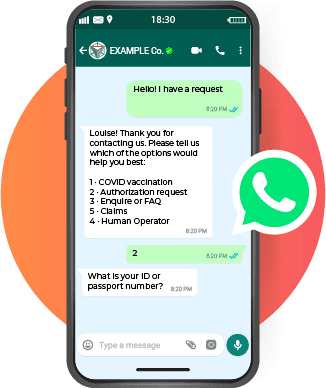

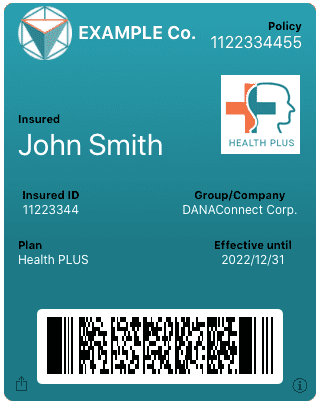

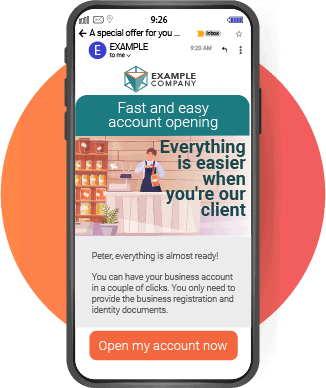

These insurtechs, driven by technological advancements and a deep understanding of consumers’ digital needs, have begun to offer simpler, smaller, highly personalized and more accessible insurance products. These products not only address the specific needs of users but also democratize access to insurance, allowing for greater financial inclusion.

The best examples of Innovation in Insurance Products

Microinsurance for Online Purchases

One of the most relevant examples in the current context is the development of microinsurance for online purchases. These products offer coverage for specific transactions carried out on e-commerce platforms, protecting the consumer against possible fraud, damage during shipping or even dissatisfaction with the product. For example, an insurtech could offer microinsurance that is activated when making an online purchase, providing additional guarantee and peace of mind for the consumer.

On-Demand Insurance for Electronic Devices

Another interesting innovation is on-demand insurance for electronic devices. These locks allow users to activate or deactivate coverage based on actual use of the device. For example, a user could activate insurance for their laptop or smartphone during a trip and deactivate it when they do not need it, optimizing cost and coverage according to their needs.

Behavior-Based Auto Insurance

Behavioral-based vehicle insurance uses telematics and vehicle data to adjust premiums based on the insured’s driving behavior. Those drivers who demonstrate safe driving habits can benefit from lower premiums, thus encouraging responsible driving. This type of insurance is particularly attractive for young drivers or those who use their vehicle sporadically.

Personalized Health Insurance

In the field of health, we are seeing the emergence of personalized insurance that adjusts to the needs and lifestyle of the individual. For example, health insurance that offers lower premiums for people who maintain a healthy lifestyle, based on data on physical activity and eating habits.

Cancellation Insurance for Events and Travel

With the uncertainty surrounding travel and events in the current context, cancellation insurance has emerged that offers refunds for cancellations related to unforeseen circumstances such as illness or travel restrictions. These insurances provide an additional layer of security and flexibility for consumers when planning trips or events.

Customized Pet Insurance

One of the most exciting and rapidly growing areas of the insurance market is pet insurance. As pets increasingly become valued members of the family, the need arises for insurance products that specifically address their needs. Insurtechs are leading the way, offering pet insurance that is as varied and personalized as that available for humans.

Also of interest: Top 4 Innovations in Cyber Risk Insurance

Change in Consumer Behavior: Expectations and Preferences

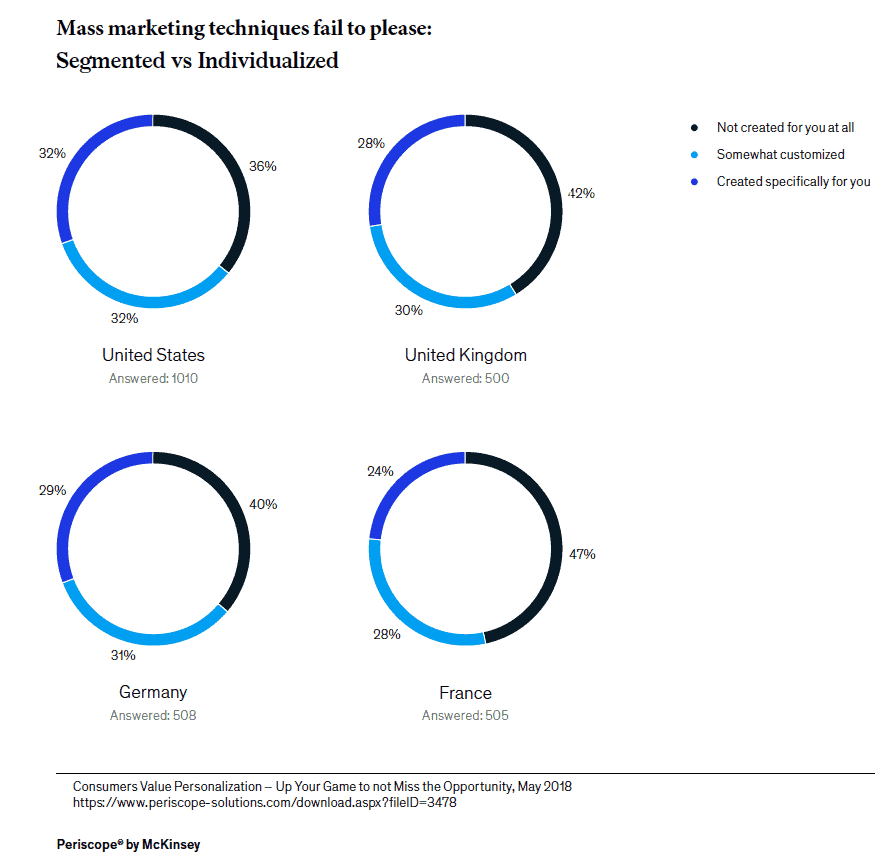

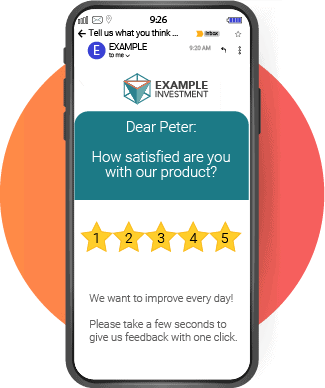

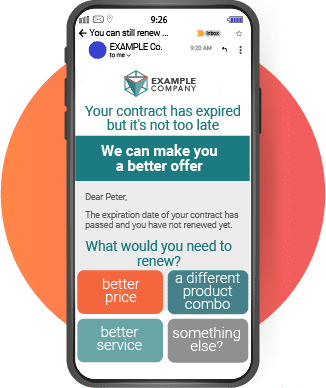

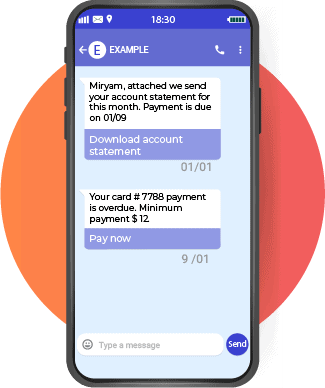

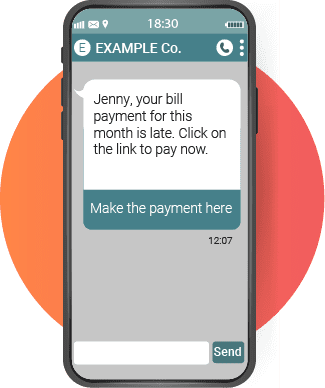

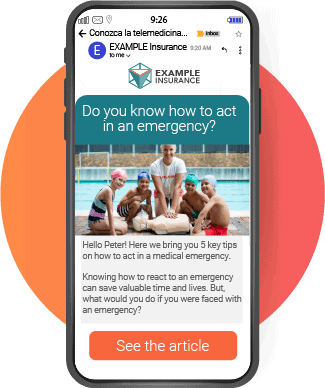

The popularity of these innovative products is a clear indication of a change in consumer behavior and expectations. Today’s customers are looking for solutions that are not only affordable and accessible but also customized to their needs and lifestyles. The era of “one size fits all” insurance products is giving way to a demand for more flexible and tailored solutions.

This change also reflects greater financial awareness and education among consumers. With easier access to information through digital channels, customers are better informed and more empowered to make decisions that best fit their needs and budgets.

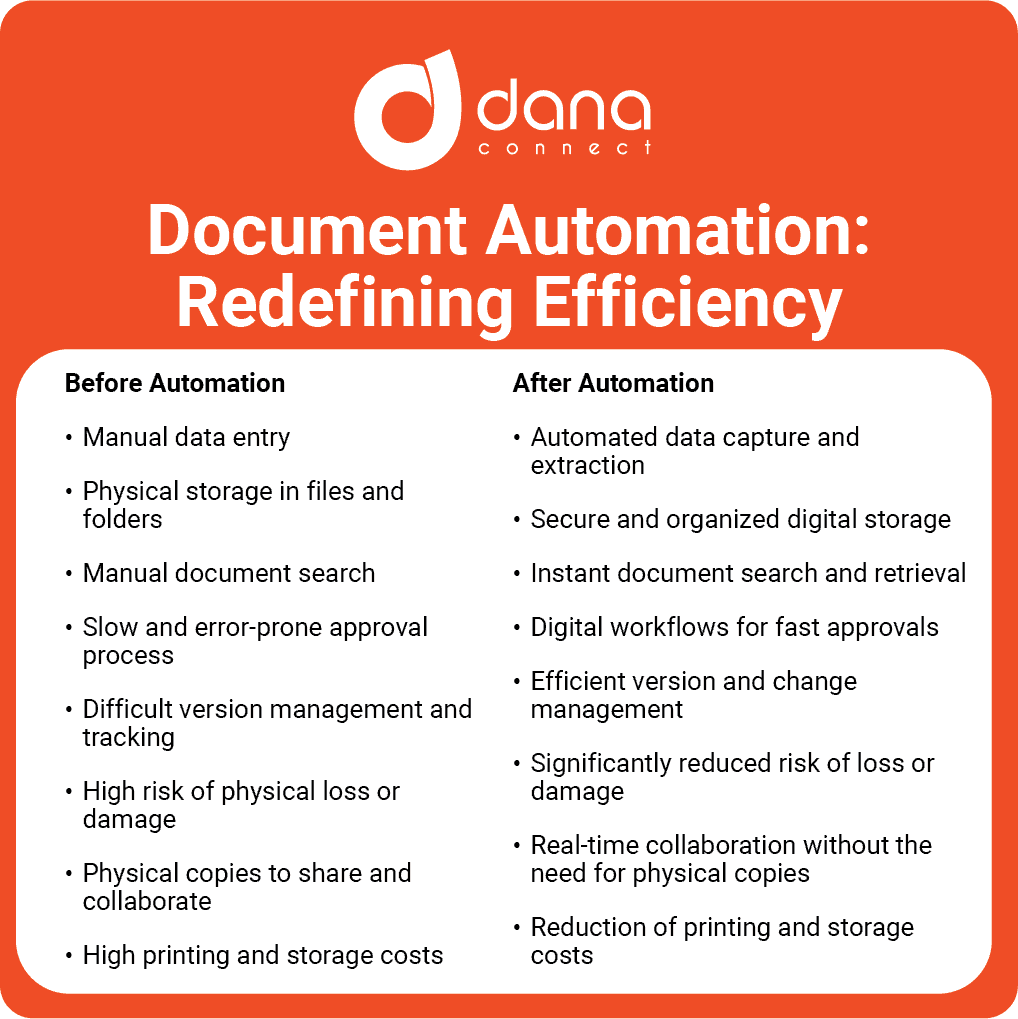

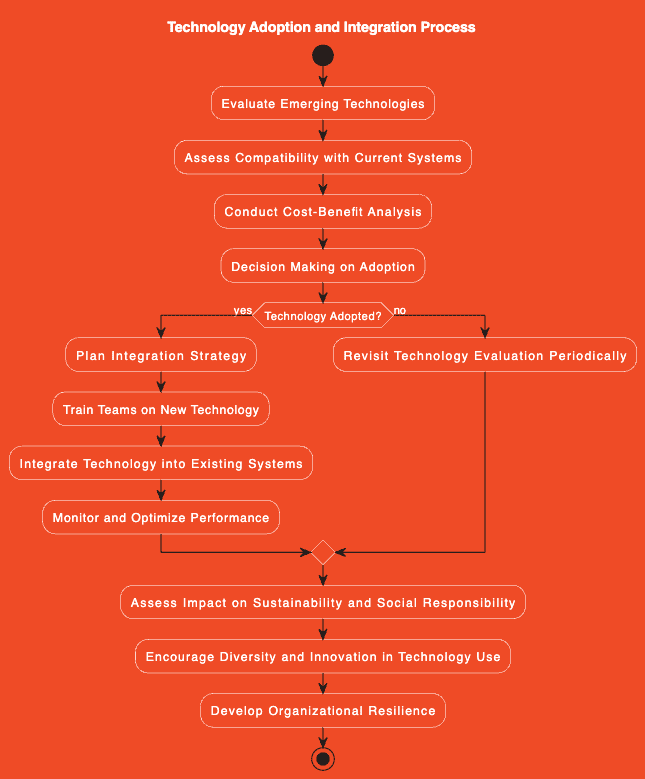

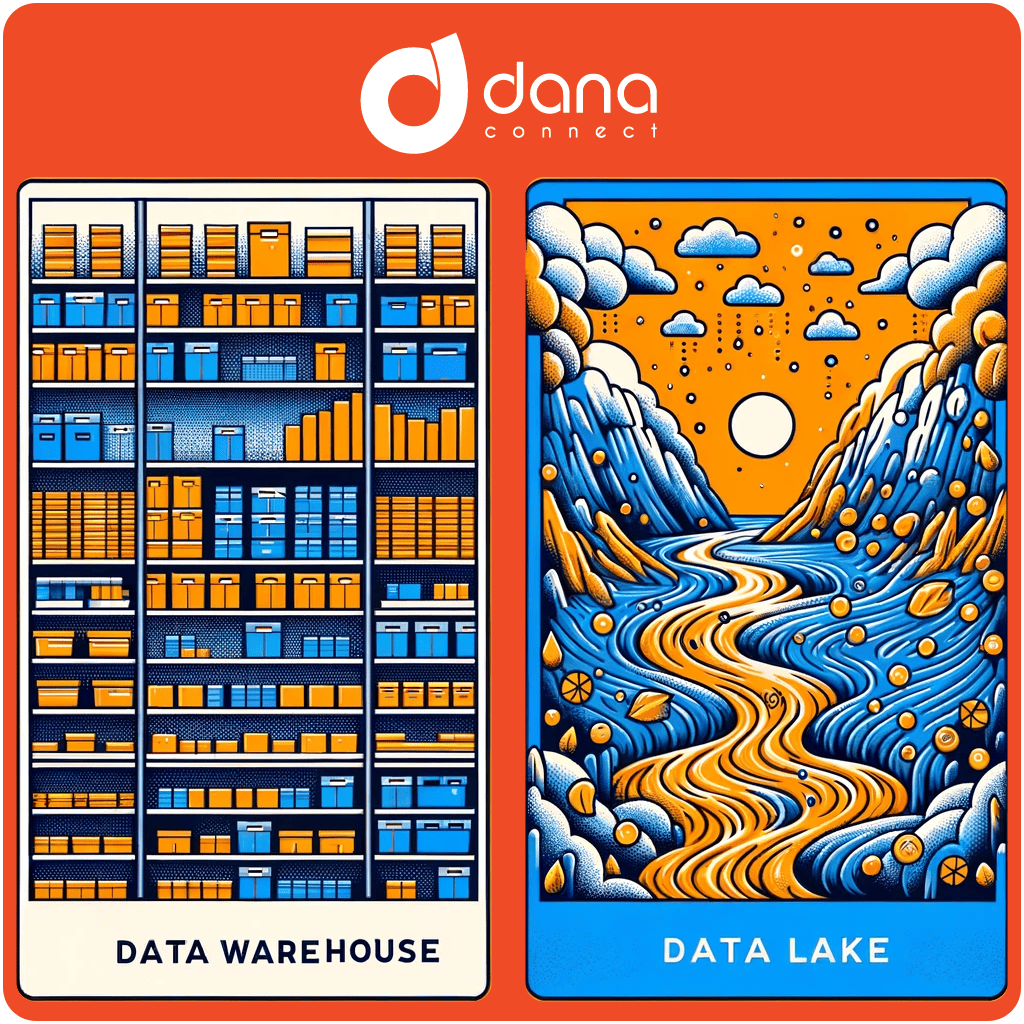

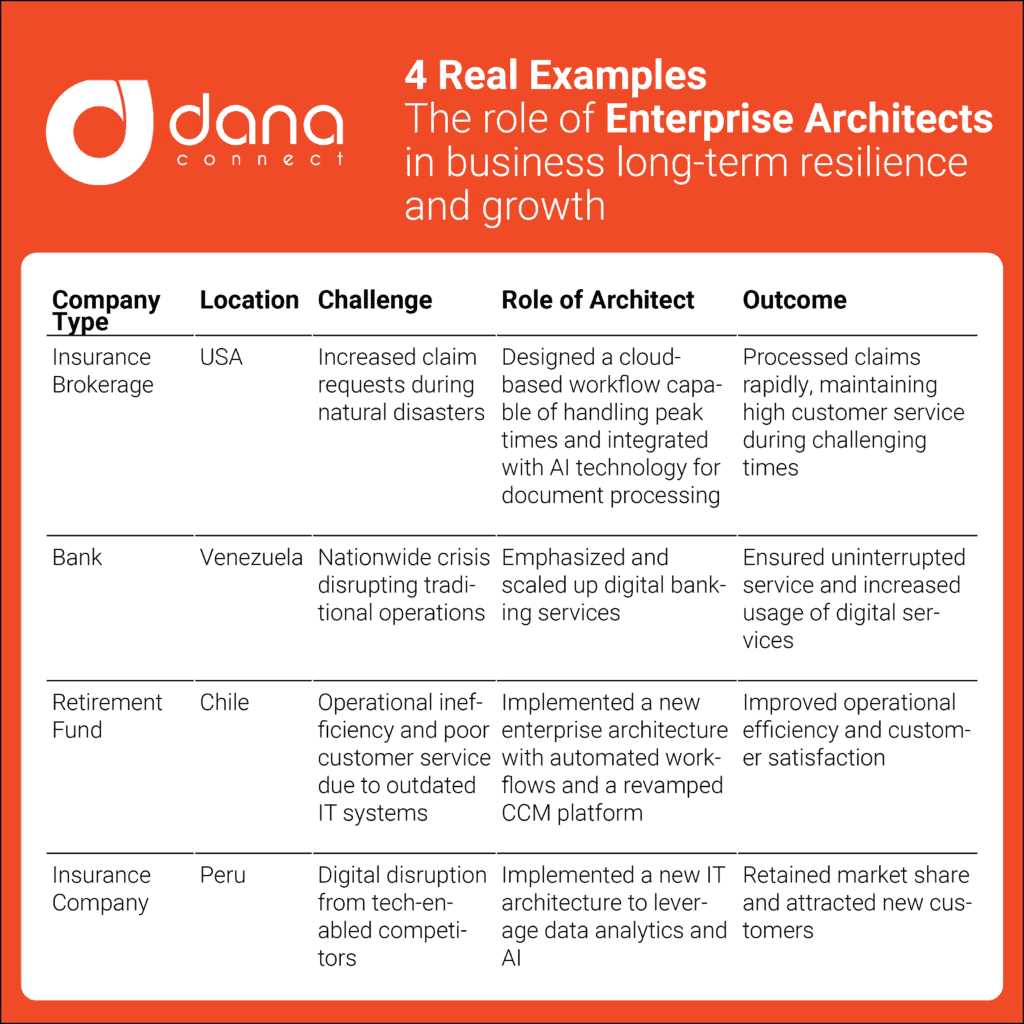

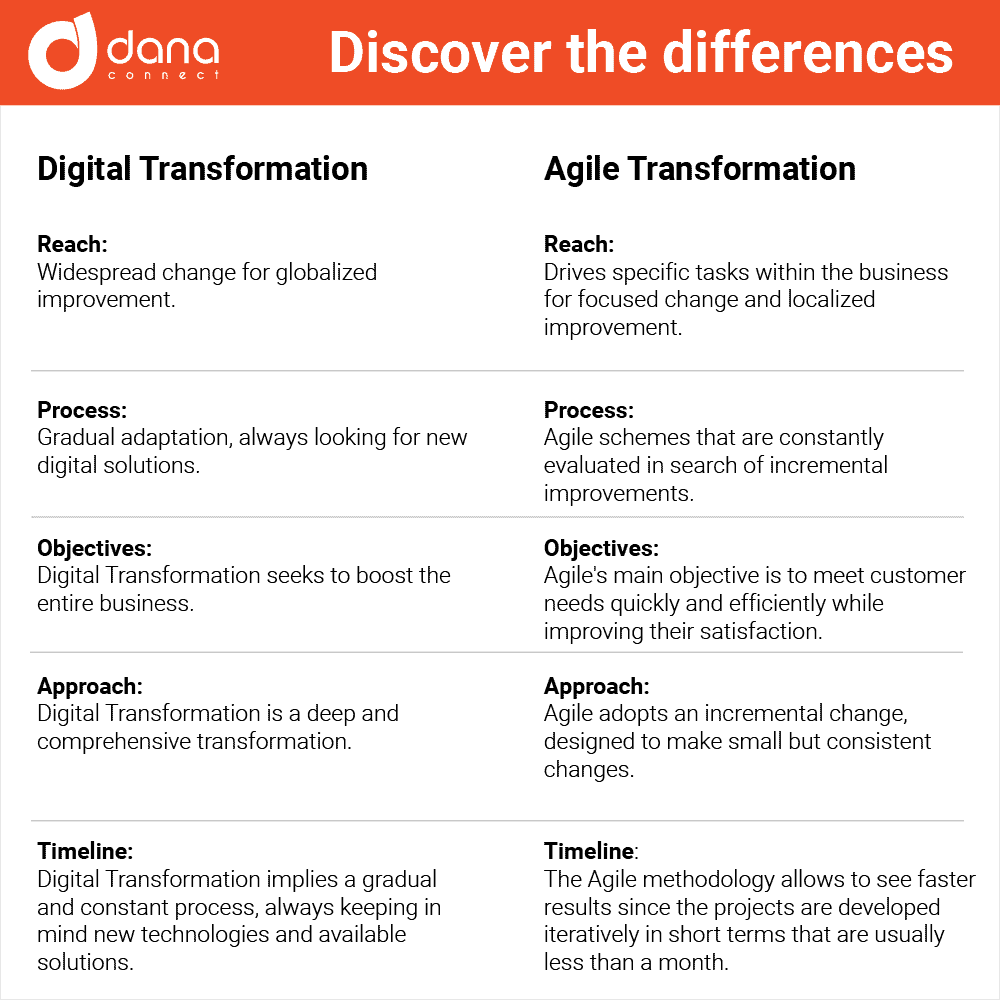

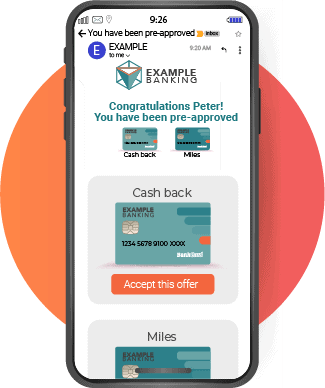

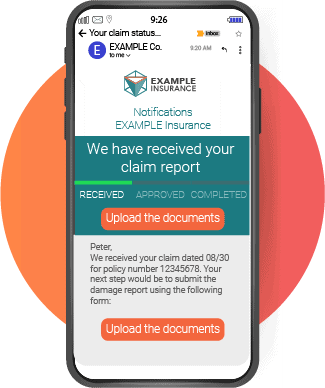

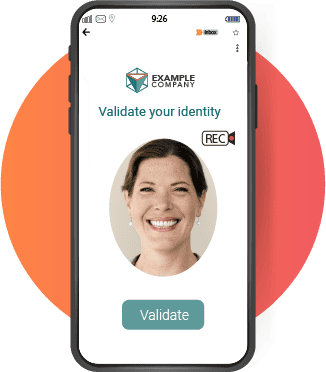

Technology as an Enabler: The Role of Digital Transformation

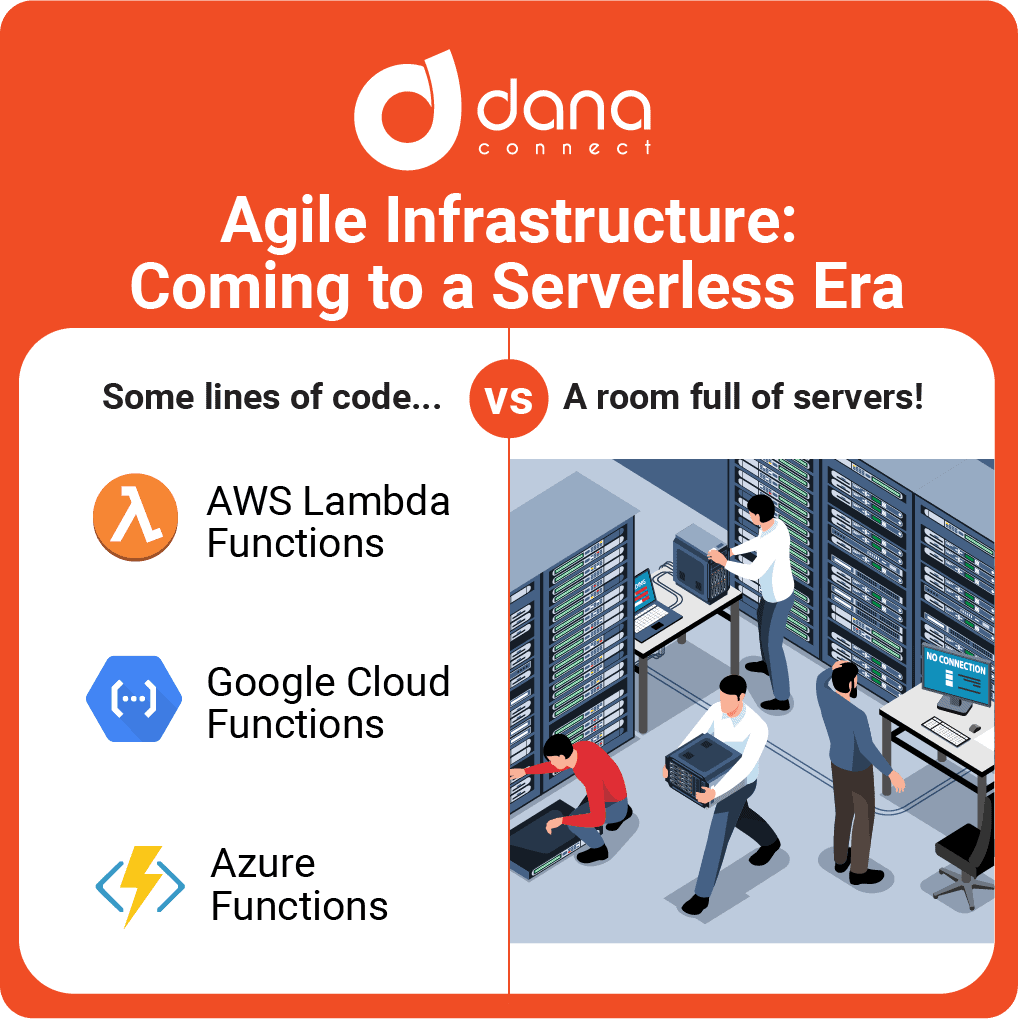

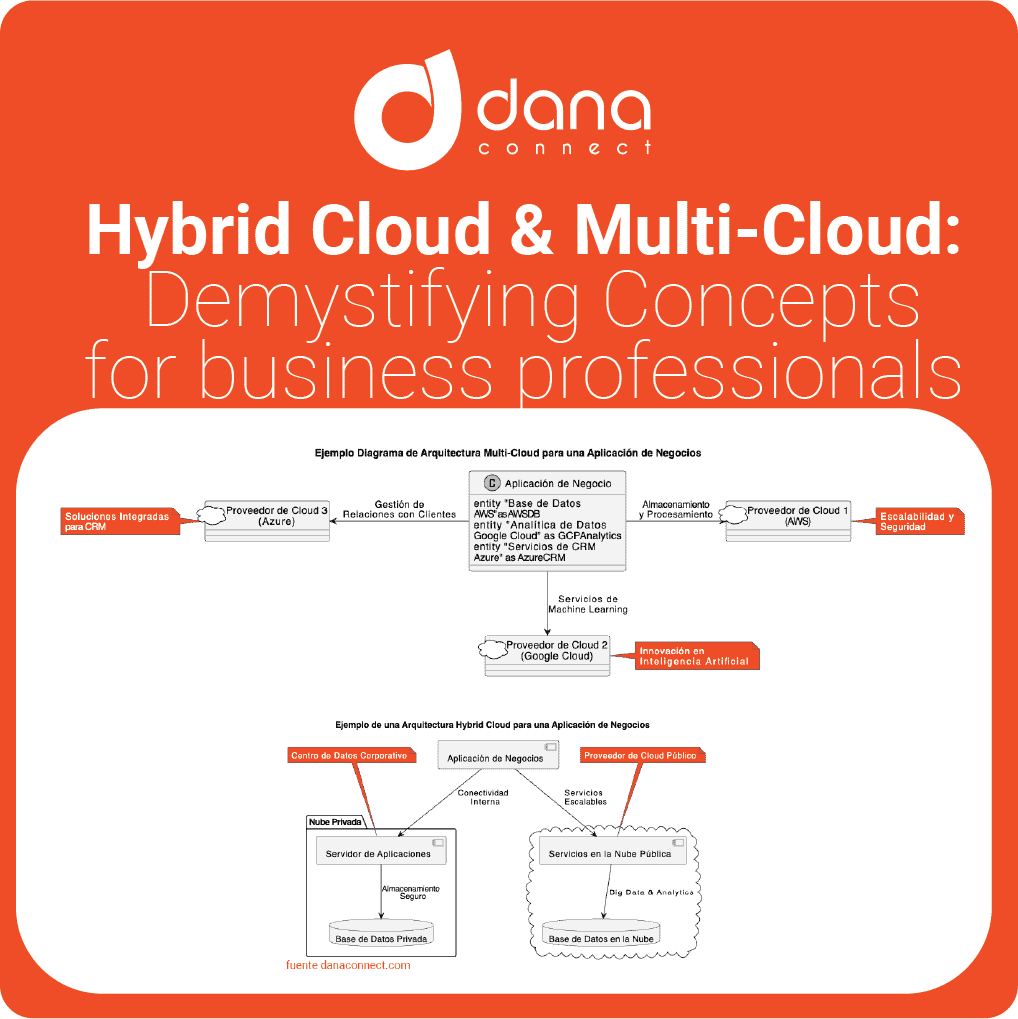

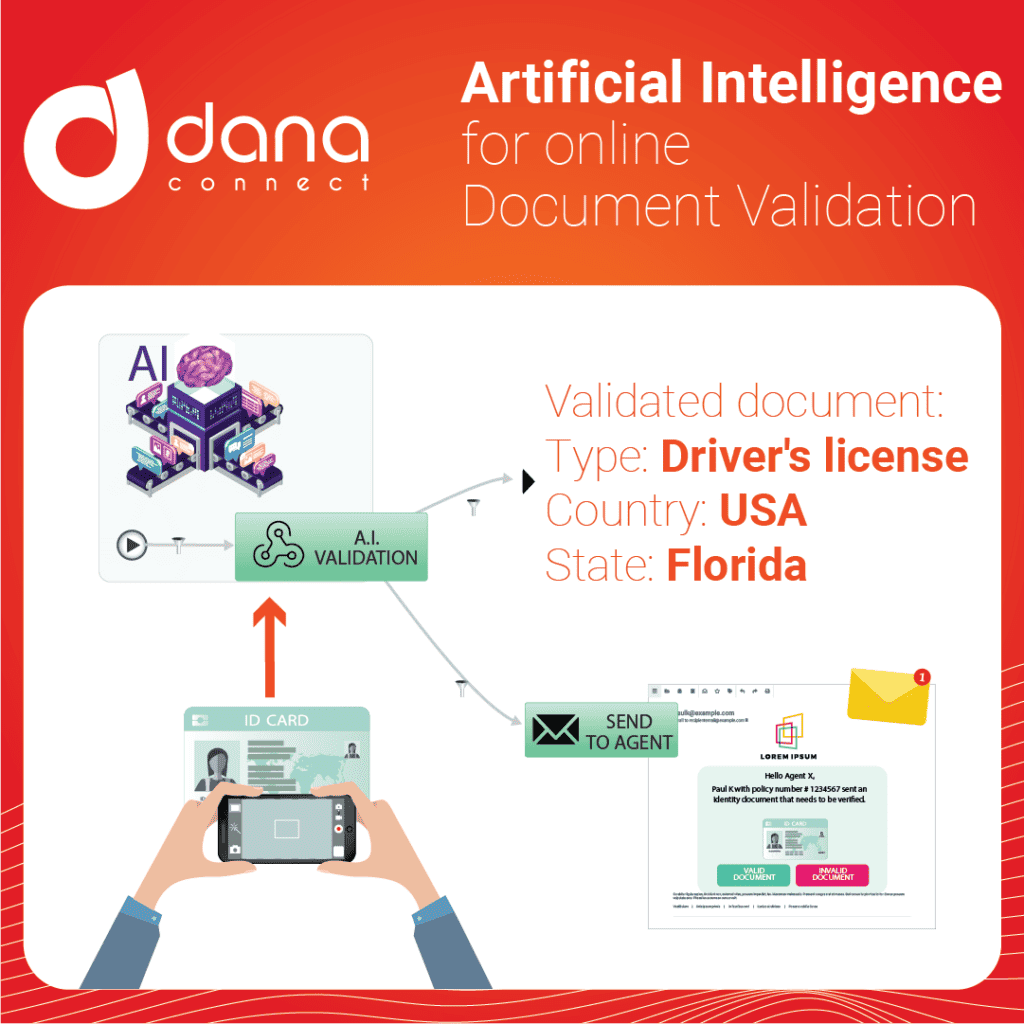

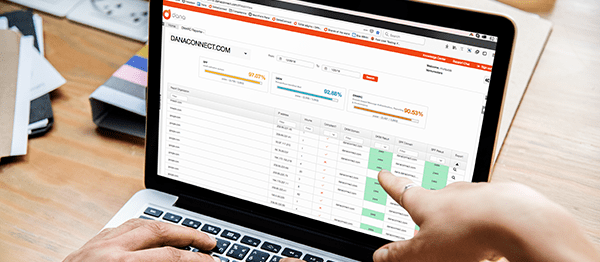

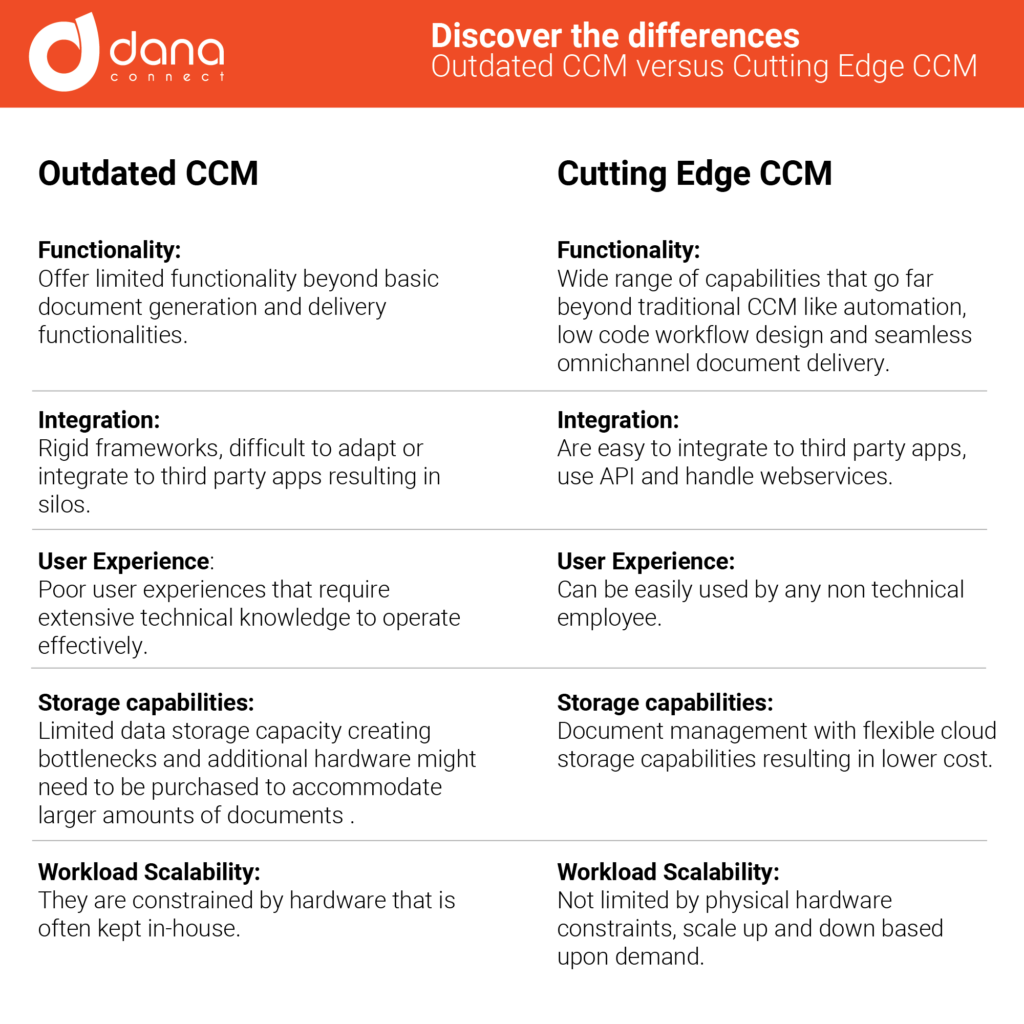

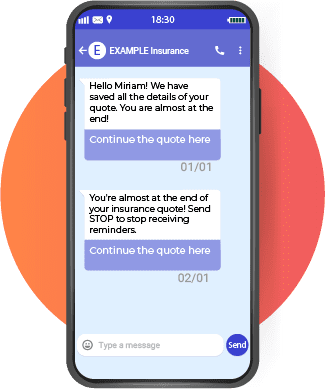

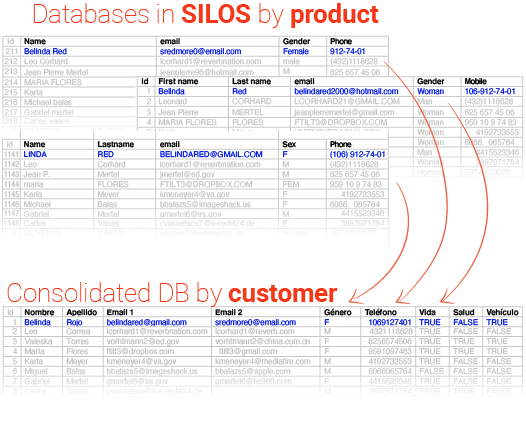

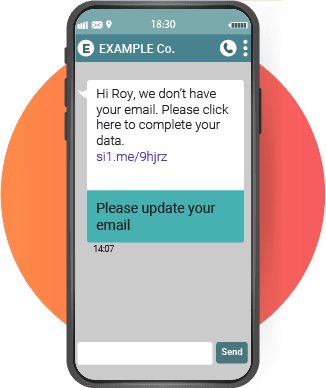

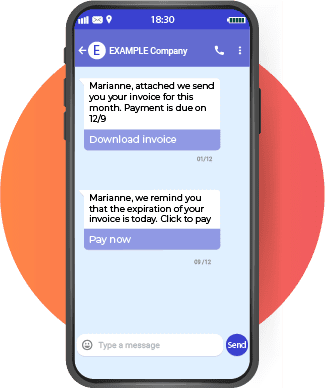

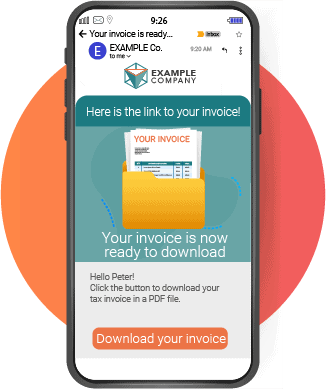

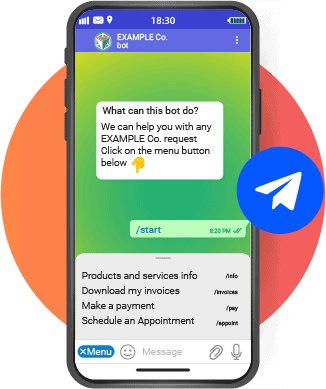

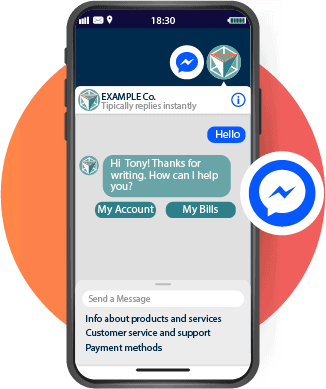

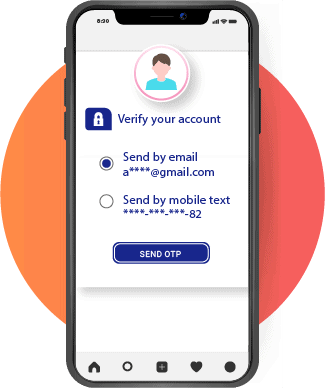

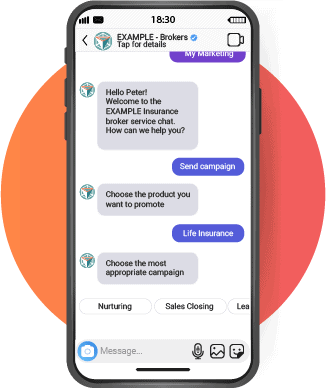

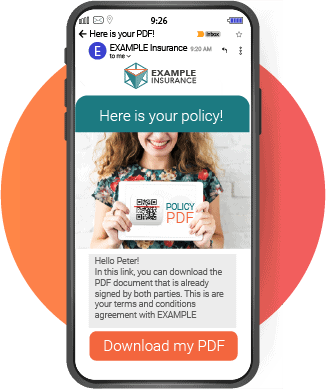

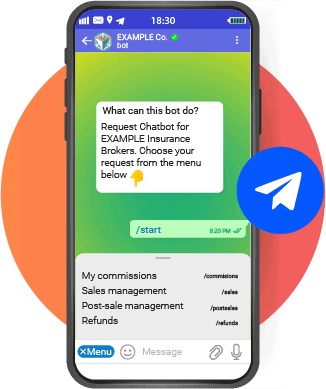

Digital Transformation is not only an enabler of these innovative insurance products; It is the core of your existence. Insurtechs are leveraging advanced technologies such as artificial intelligence, big data analytics and cloud computing to develop products that are both intuitive and efficient. These technologies enable better market segmentation, deeper product customization, and most importantly, greater operational efficiency.

For example, artificial intelligence and machine learning are allowing insurers to analyze large data sets to identify patterns and predict risks more accurately. This not only improves risk assessment but also allows for more accurate and fair pricing. Cloud computing, on the other hand, provides the scalability and flexibility necessary to handle large volumes of transactions and data, essential in a market that demands agility and adaptability.

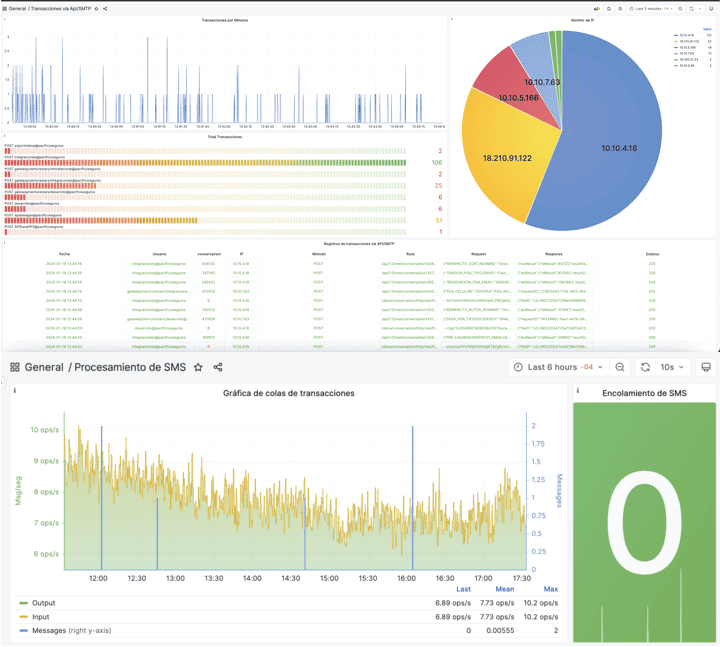

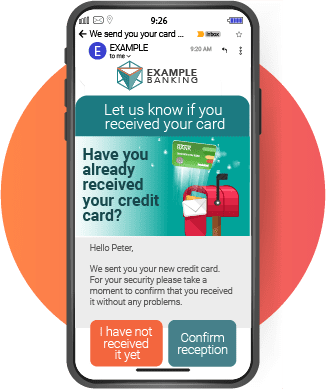

Boosting Innovation: Collaboration with Open Insurance

In the context of growing innovation in the insurance sector, one concept that is gaining traction is Open Insurance. Similar to the Open Banking movement in the financial sector, Open Insurance refers to the practice of sharing insurance data and services through application programming interfaces (APIs) in a secure and controlled manner. This practice not only promotes transparency and collaboration but also encourages innovation and customization of insurance products.

Adapting to the New Wave: Strategies for Financial Institutions

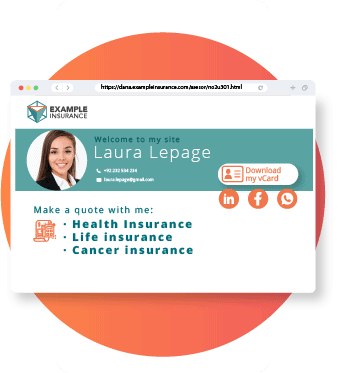

For traditional financial institutions, adapting to this new wave of innovation involves not only adopting new technologies but also reconsidering their product strategies and customer approach. Collaborating with insurtechs can be a key strategy, allowing traditional institutions to benefit from the agility and innovation of these startups while maintaining their expertise and customer base.

Additionally, financial institutions must invest in the digital transformation of their own operations. This includes the digitalization of processes, the implementation of data analysis solutions and the adoption of technological platforms that allow greater customization and flexibility in their insurance offerings.

In summary, the key to success in the future of the insurance market lies in the ability to combine technological innovation with a deep understanding of customer needs, ensuring that the solutions offered are not only technologically advanced, but also relevant and accessible to today’s consumers.