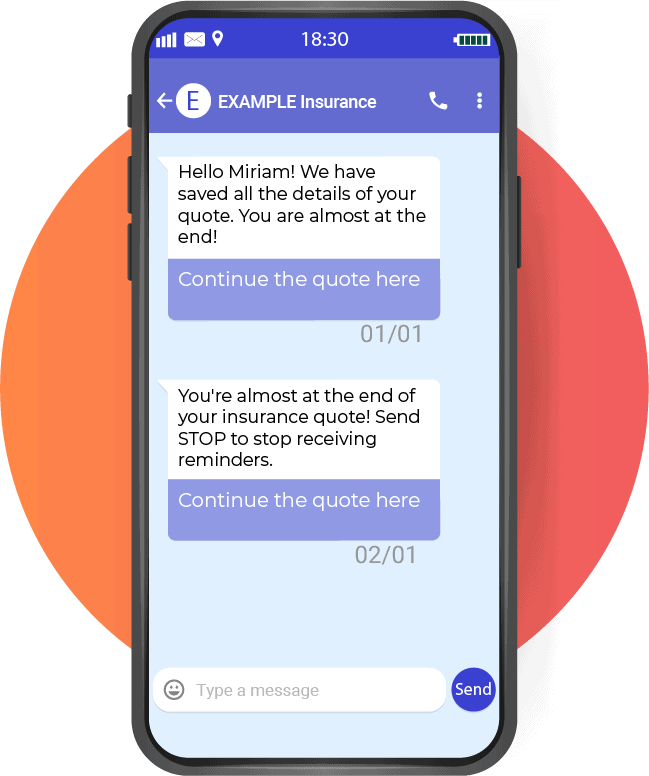

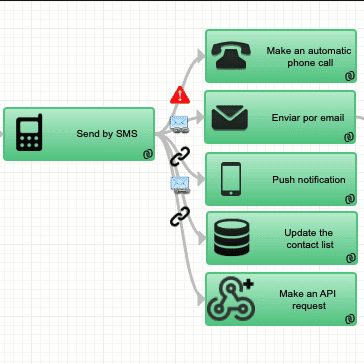

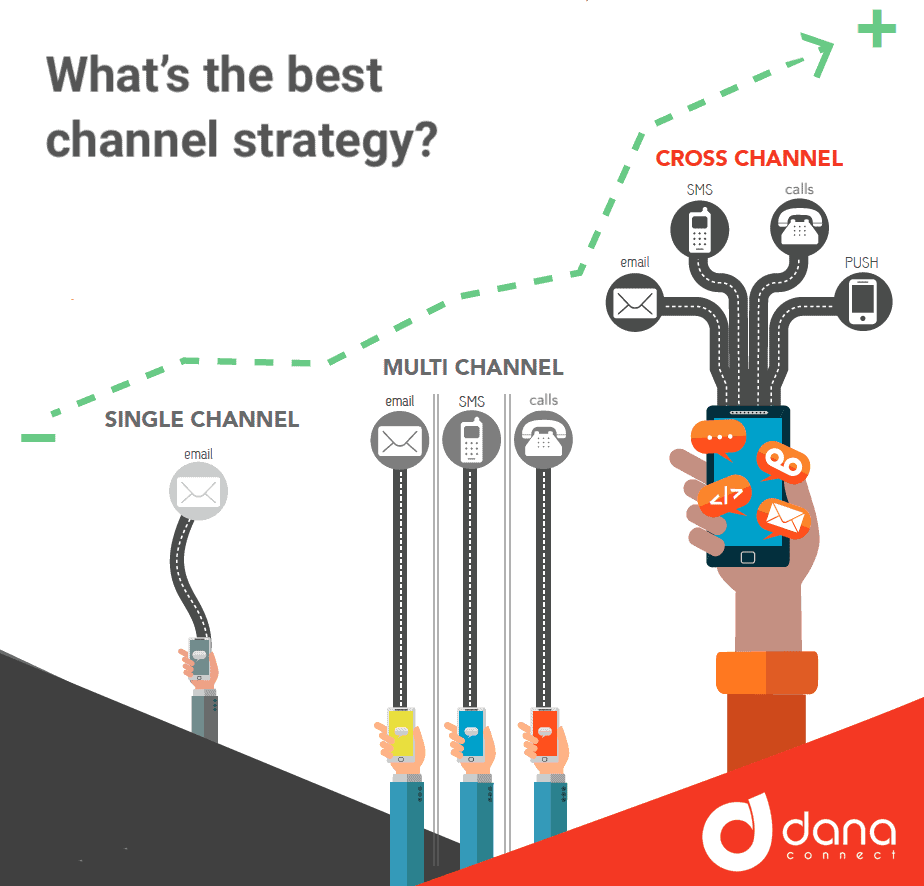

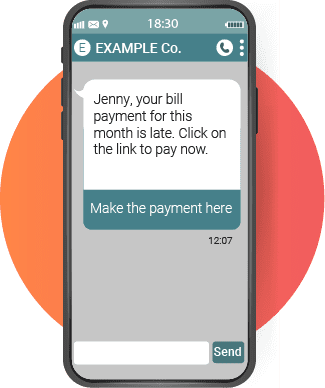

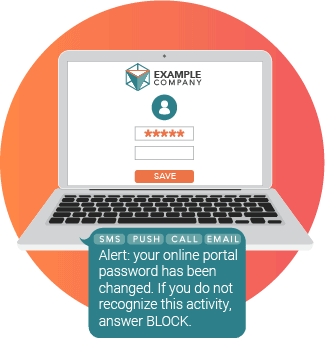

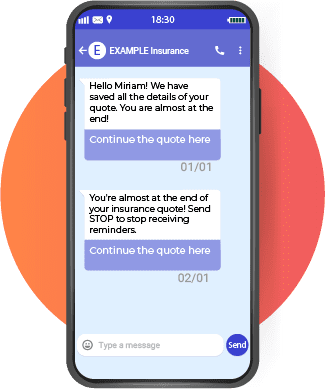

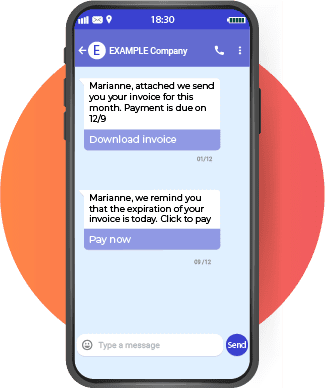

If you want to get paid on time, you need to act before the payment due date. Timing of reminders is therefore crucial. Likewise, the channel through which it is sent is critical since the sooner the message reaches the recipient, the better. Having an alternative delivery method is very important if the primary channel fails.

Sending invoices and statements by email is the most common and recommended method today. However, in this article we also recommend that you use SMS communication automation as an alternative channel for reminders and the initial invoice.

6 Example templates for a collection strategy using text messages

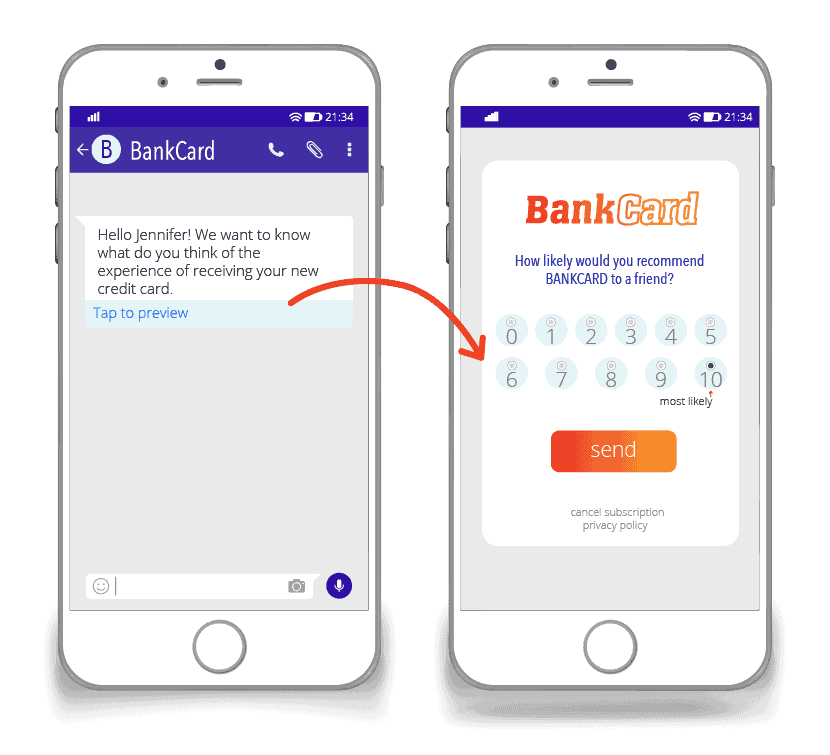

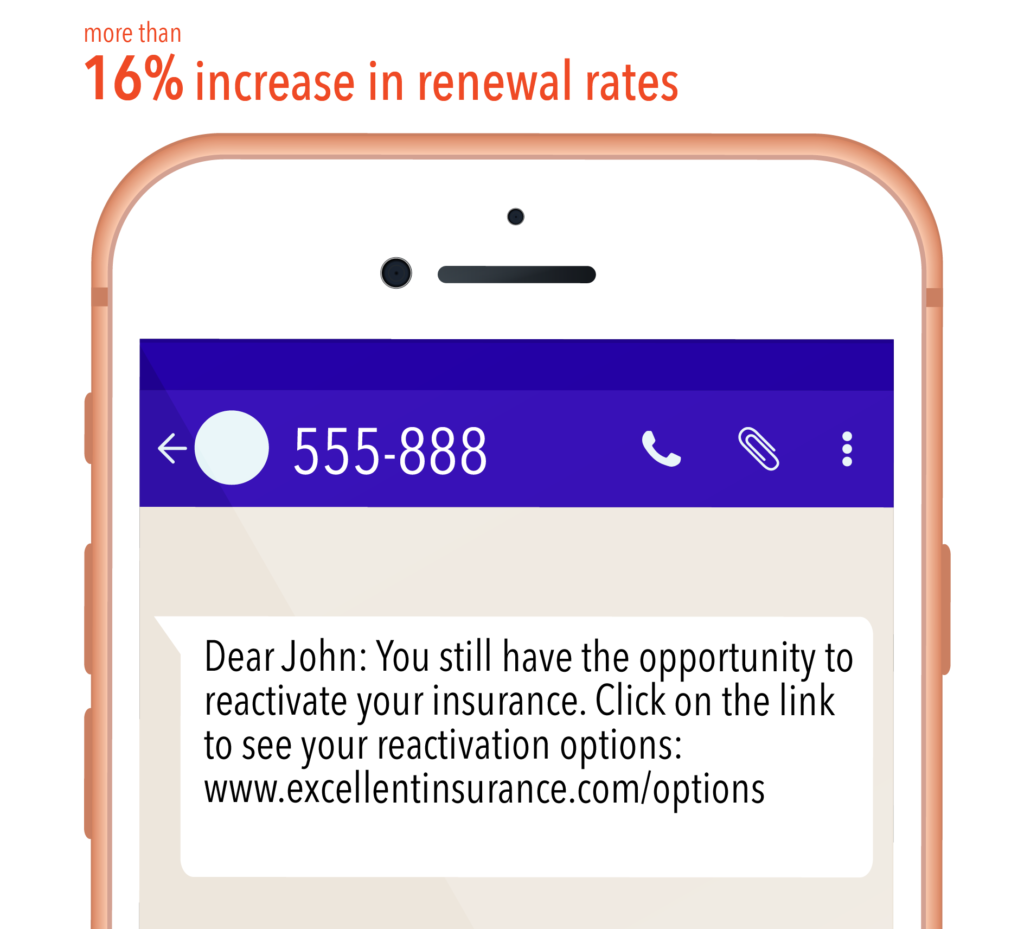

In late collections, SMS is an important cost-saving measure compared to calls. Furthermore, more than 80% of people refuse to answer calls from strangers, and 82% of customers don’t check their emails daily. On the other hand, the average person checks their cell phone more than 50 times a day and carries it 90% of the time.

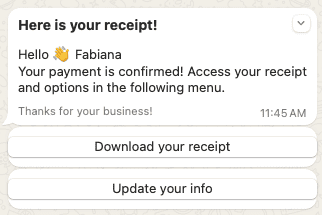

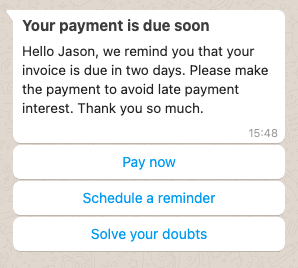

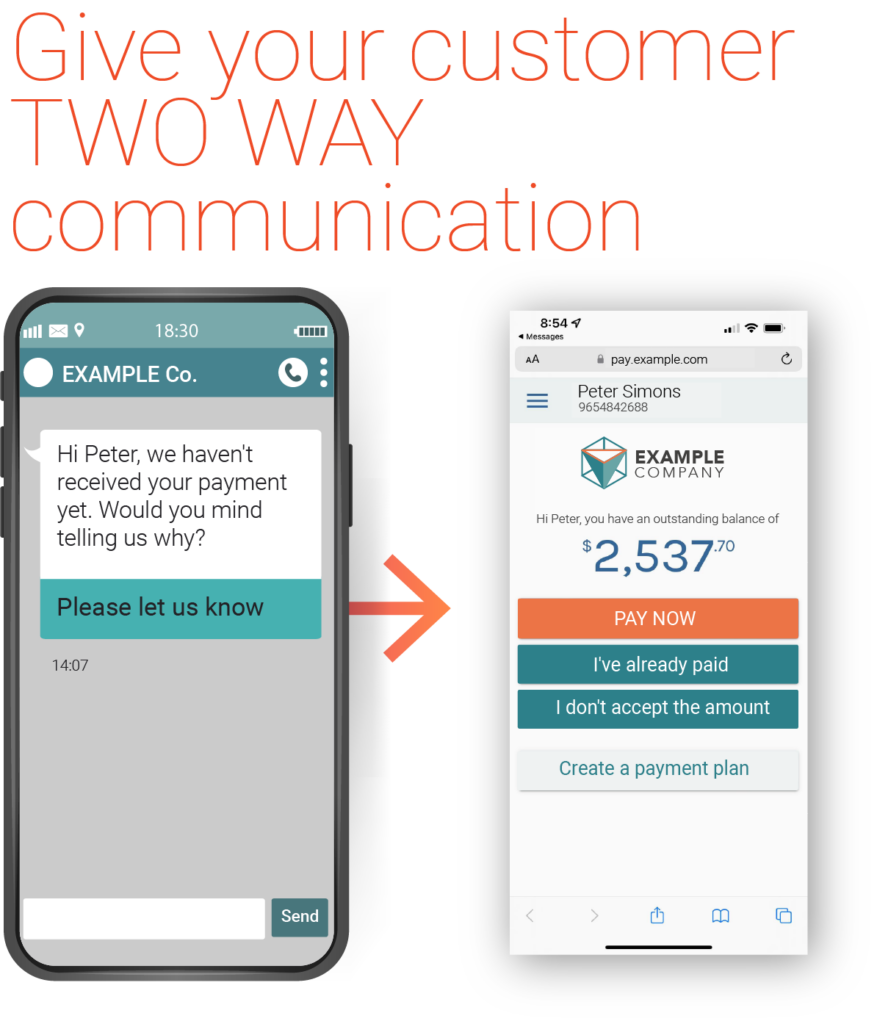

A kindly SMS payment reminder that is both firm and kind is the most effective way to get your debt and compensation back on track. Especially if they are accompanied by links that enable bidirectional communication.

These six text message payment reminder templates are a helpful way to start understanding this simple and effective collections strategy, as well as methods to enable customer responses and feedback:

1.Send a reminder one week before the payment due date

Text Message Template:

Hi Mary, this is a reminder that your $X debt payment is due next week. Click for payment methods.

Why this SMS payment reminder works:

This reminder is short, friendly, and informative. Your customer can easily open, read, and decide without spending too much time away from their duties. Without being pushy or bossy, it informs customers of the payment and the payment options gently and helpfully.

Solutions we recommend:

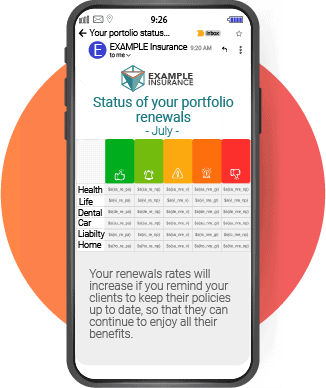

For Account Statements and Collections:

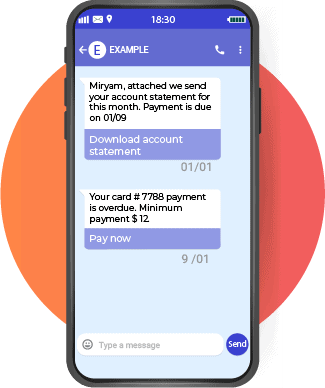

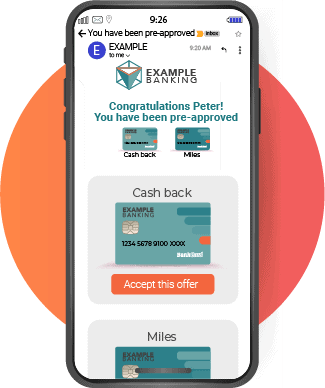

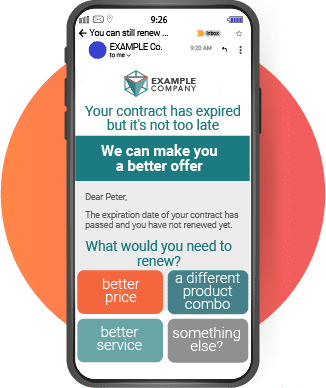

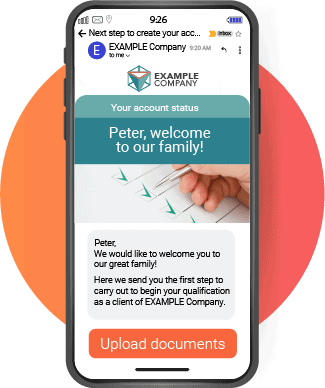

Credit Card Account Statement with Collections Follow up

For Invoicing and Collections:

Electronic Invoice with Automated Collections Follow up

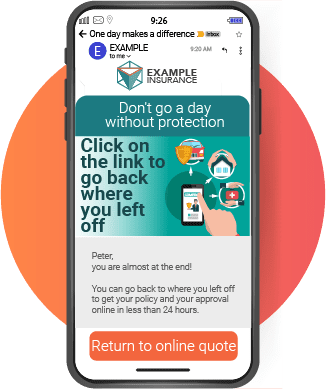

2. On the due date, a second payment reminder

Text message template:

Hi Mary, this is a reminder that your $X debt payment is due today. Click here to pay now.

Why this payment reminder works:

With this payment reminder, you’re sending your first payment call-to-action. This is the most crucial payment reminder you could send, as it often defines the relationship with your client in the future. So write the reminder in a friendly and direct way, including a direct link to pay. In this way, your customers are more likely to finish the payment immediately.

3. Third payment reminder, one week after the due date

Text message template:

Mary, according to our records, you are one week late in paying your debt of $X. Click here to pay now.

Why this payment reminder works:

Since your payment is officially overdue, it can sharpen your tone. Include details about the payment, such as the invoice number, the corresponding service, and the amount. As always, continue to remind the customer when the due date was and how far behind they are. Don’t stop being kind, as you still don’t know what the customers are experiencing. Maybe everything went wrong, but the customer already paid.

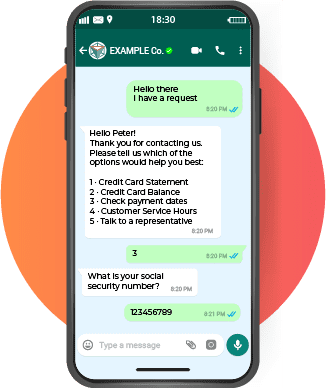

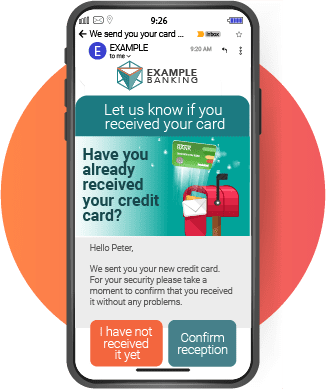

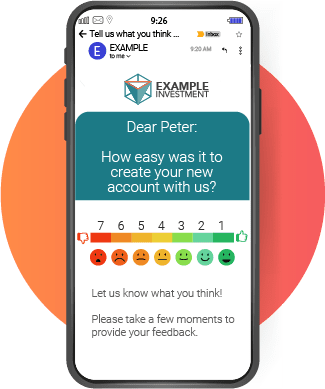

4. Two weeks after the due date: Payment reminder with feedback options

Text message template:

Mary, this is another reminder that your payment is two weeks behind. We want to help. Click here if you have had trouble paying or have already paid.

Why this payment reminder works:

As you’ve probably noticed, the tone becomes more direct. By now, you should be requesting payment accurately and clearly. Keep the message short and ask the customer to confirm their reasons for not paying. These reasons may include: I have not received the invoice, I have already made the payment, and I do not agree with the amount.

5. Four Weeks After Due Date: Fifth Payment Reminder

Text Message Template:

Mary, this is a reminder that your $X debt payment is one month late. Please provide a reason for non-payment by clicking here to avoid further complications.

Why this payment reminder works:

Now, a whole month late and without a response or reason for the late payment, you can take a more aggressive approach to receiving your payment. However, continue to be helpful in solving the problem.

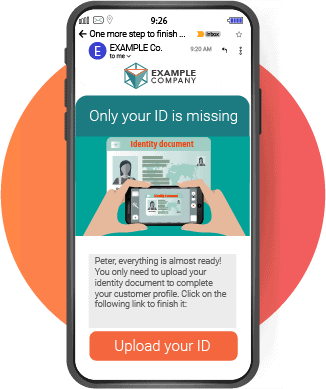

6. Five Weeks After Due Date: Sixth and Final Payment Plan Reminder

Text Message Template:

Mary, this is your final notice that your $X debt payment is 35 days past due. Do you need a payment plan?

Why this payment reminder works:

After 35 days without a response or reason for the late payment, you can start offering payment options that match the customer’s actual ability to pay. This allows the client to organize their finances with a self-service option to agree on new payment terms and the possibility of choosing different alternatives, calendars, and means of payment. At this level of late collections, offering a payment plan guarantees a sure increase in your debt recovery rates.