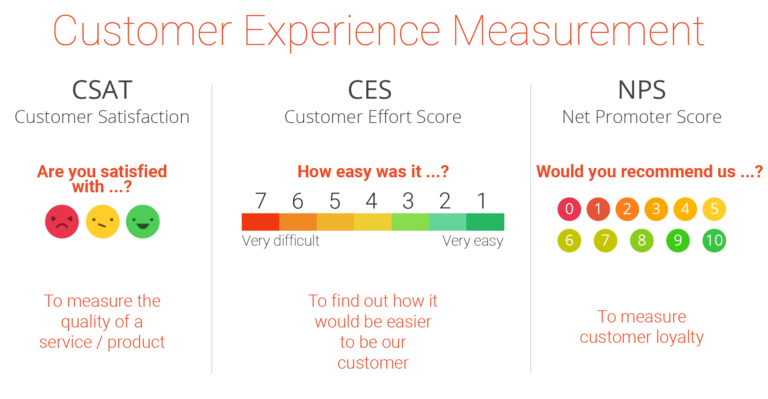

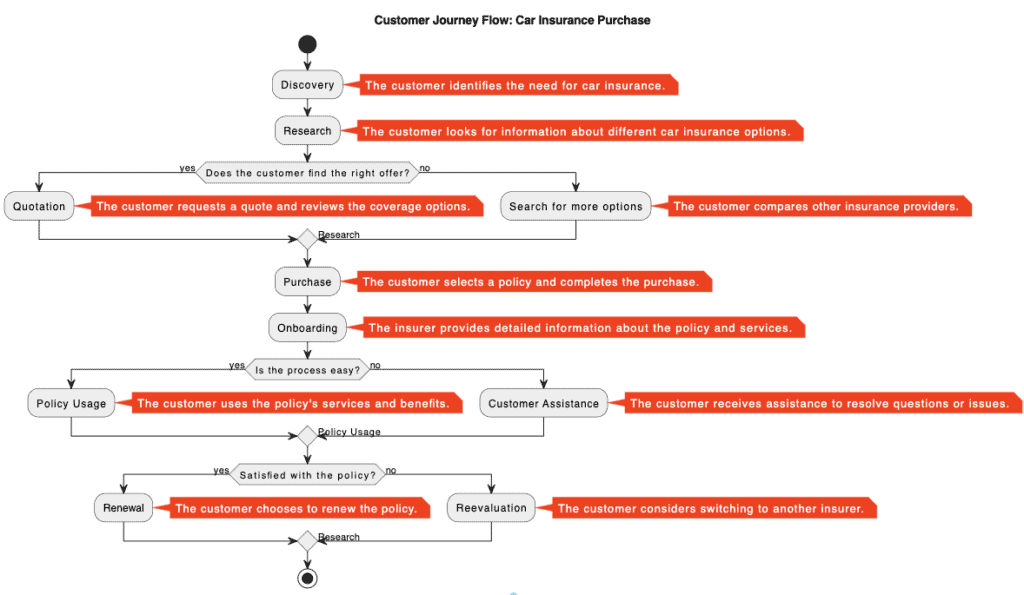

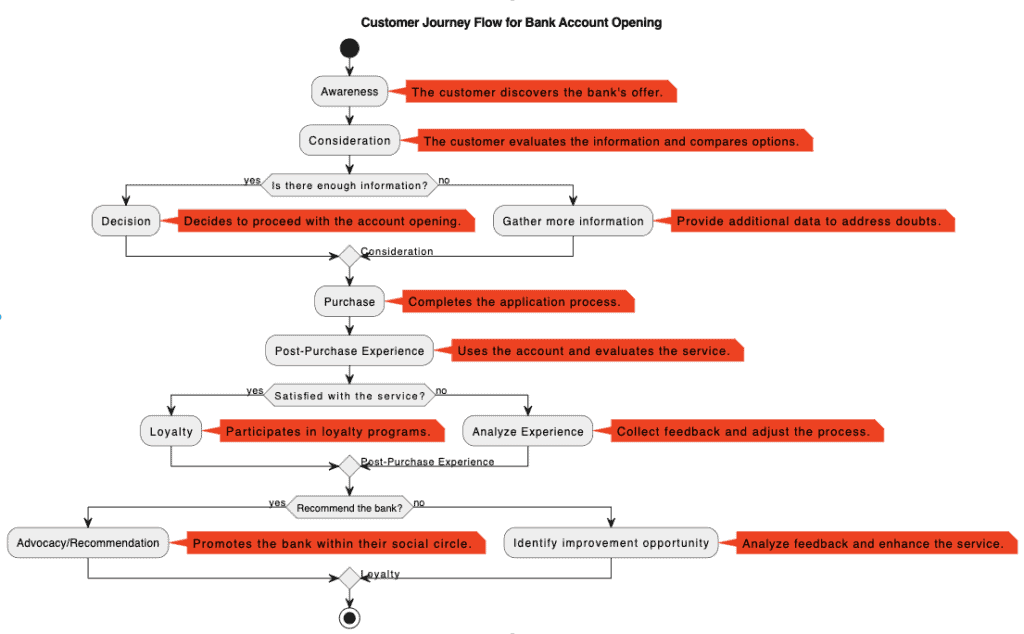

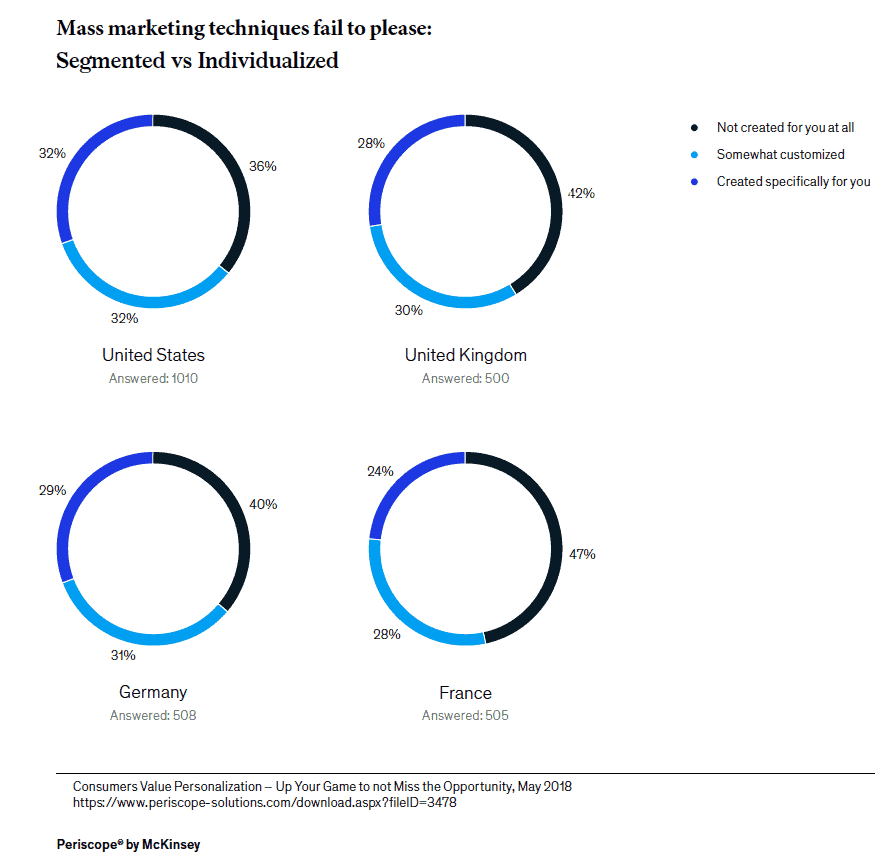

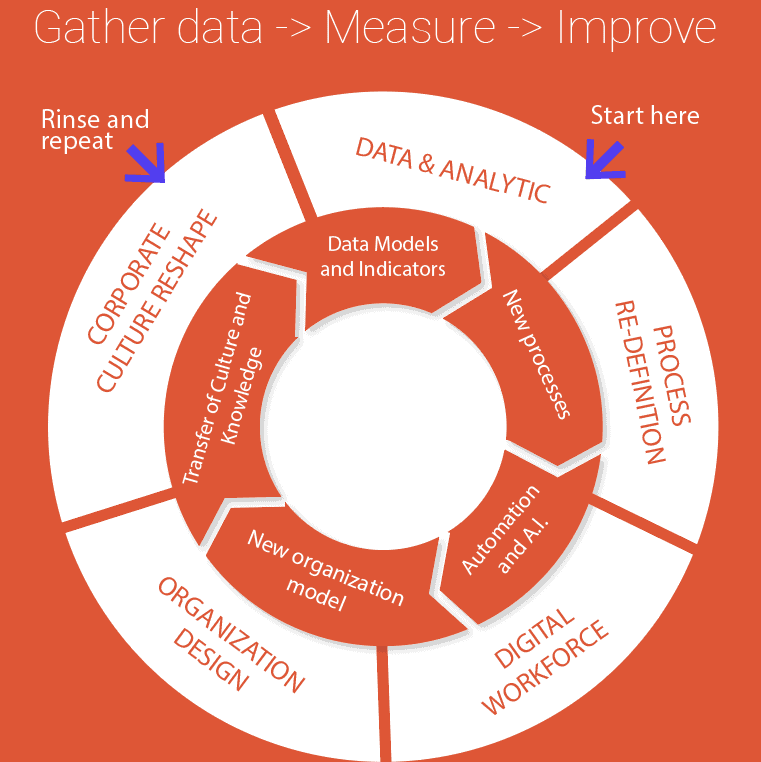

Customer experience measurement is essential for any organization looking to grow and prosper in today’s competitive marketplace. In the financial industry, where the user is increasingly demanding and knowledgeable, having a clear understanding of their needs and expectations becomes imperative. Here we explore the types of surveys that can be used to measure customer experience, the benefits they offer, when to use them, and the typical messages used in each case.

The importance of measuring Customer Experience:

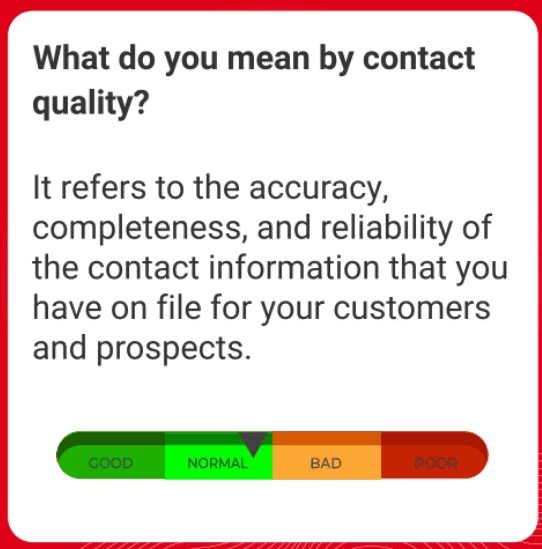

Measuring customer experience is not just a technical task, but an opportunity to empathize, connect, and improve. The choice of the type of survey should be aligned with the specific objectives of your organization and the specific process. The combination of these tools, along with an empathetic understanding of your customers’ needs, can spark a transformation in the way your business connects with and satisfies your audience.

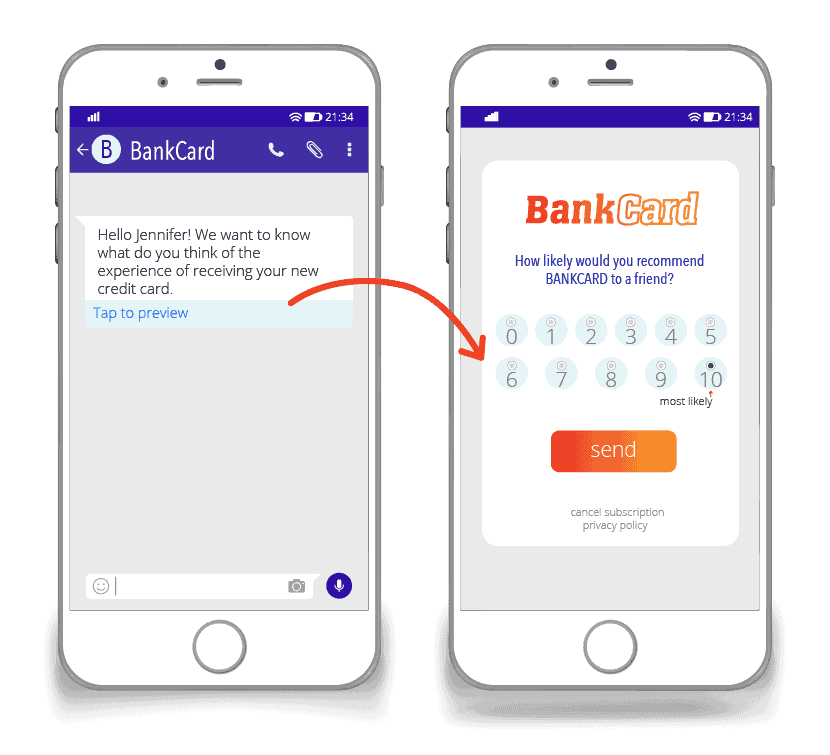

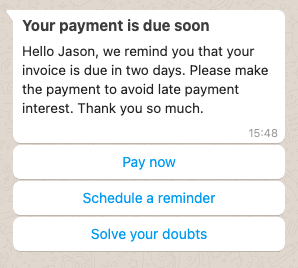

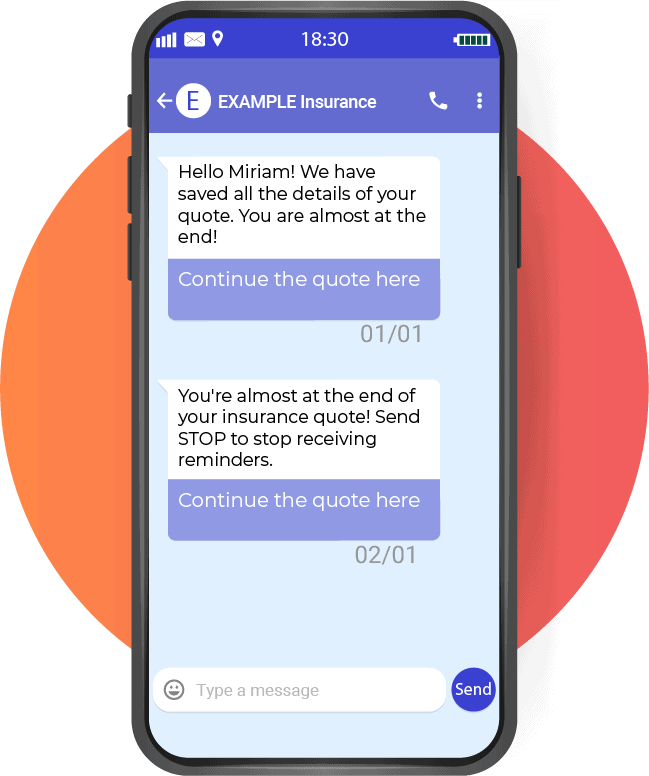

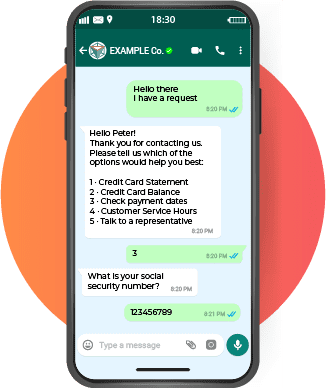

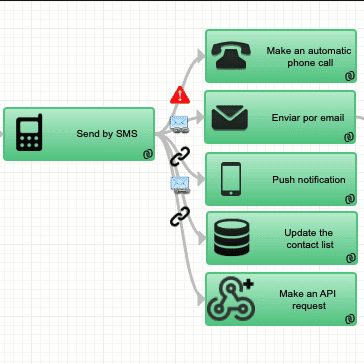

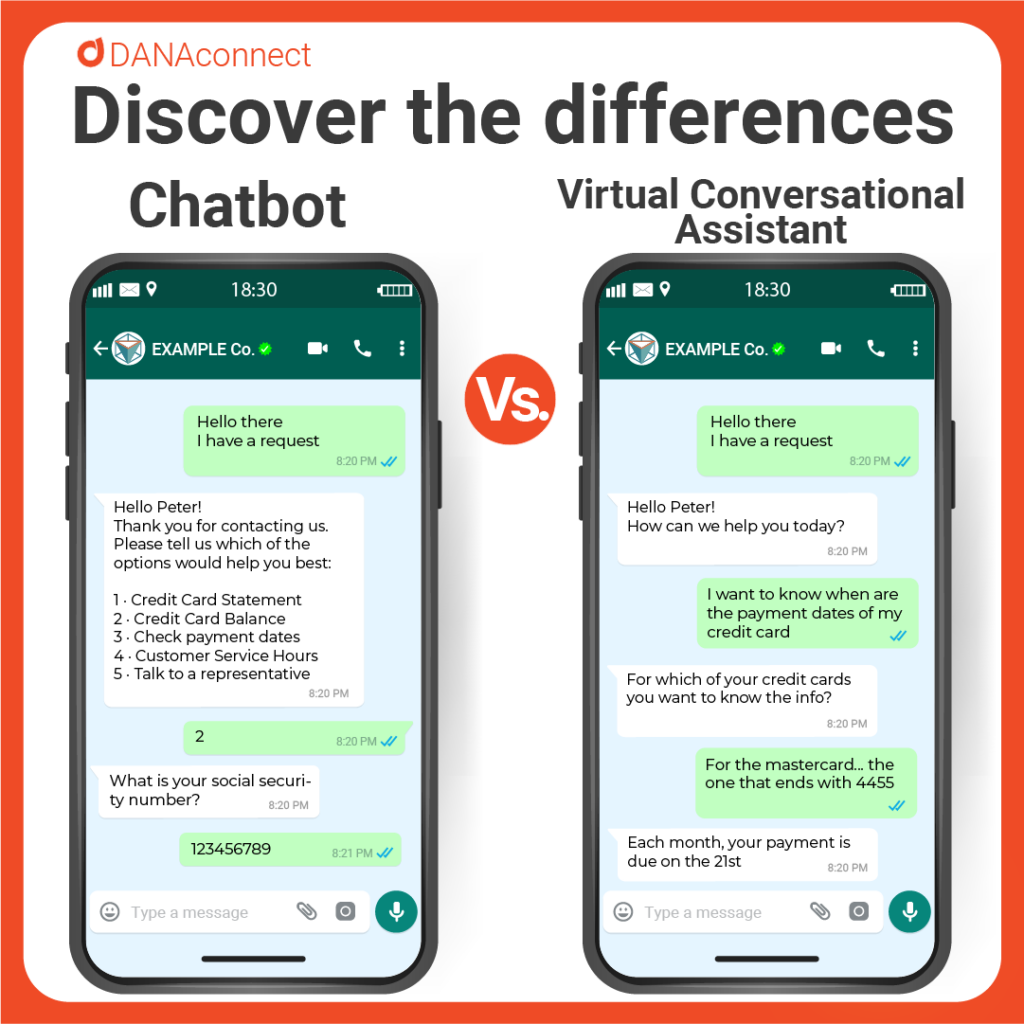

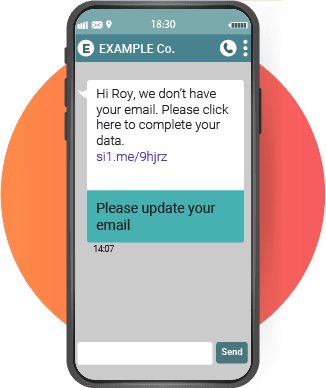

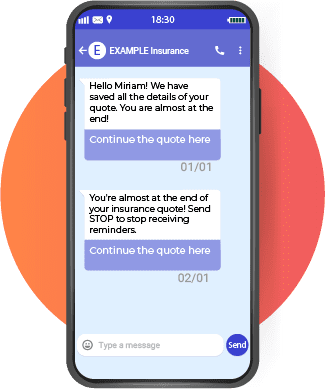

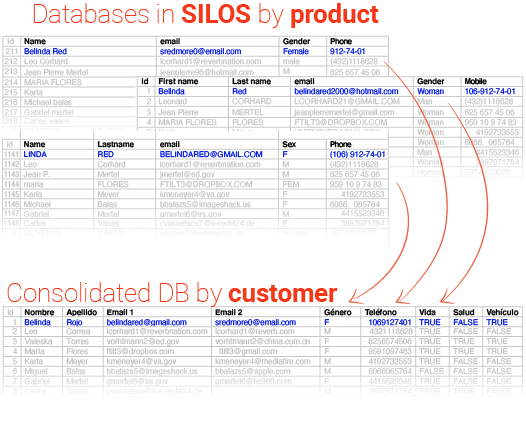

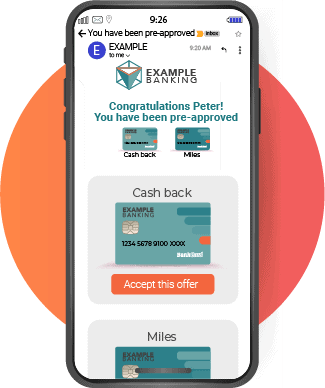

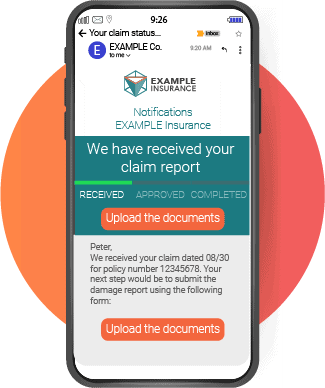

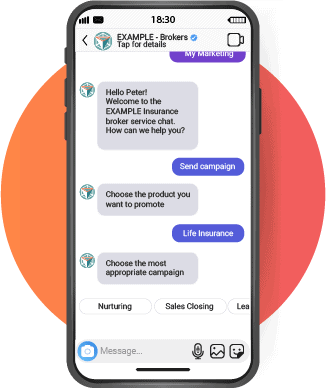

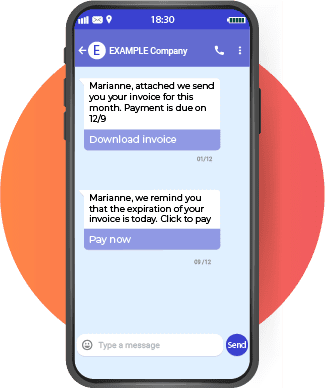

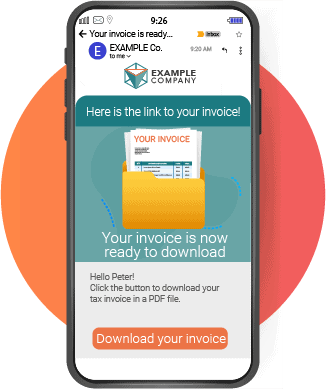

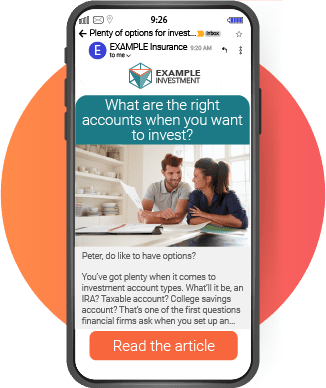

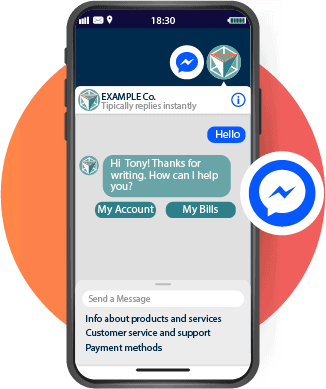

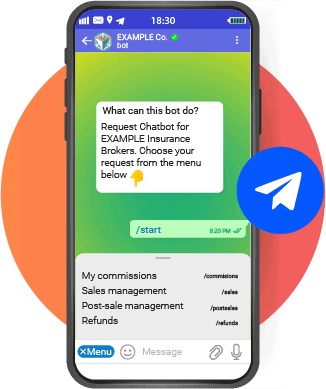

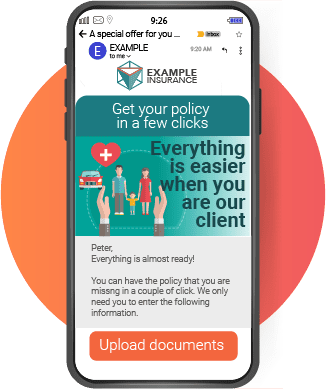

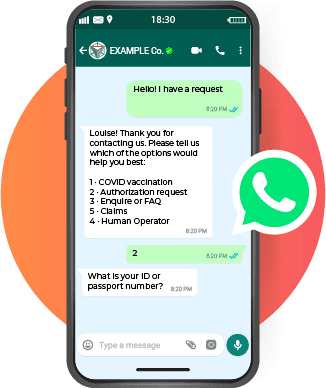

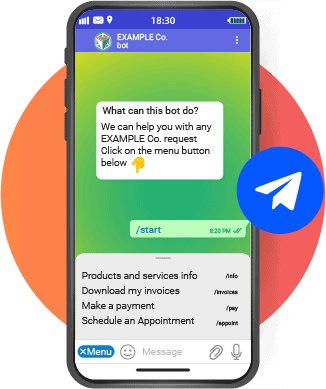

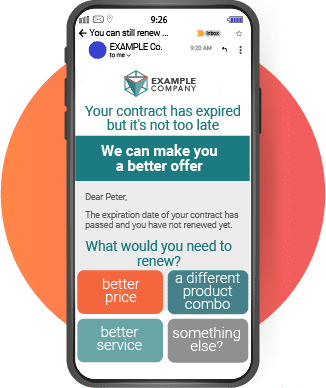

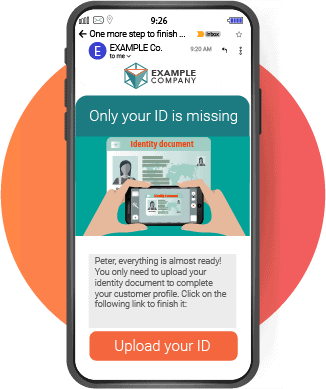

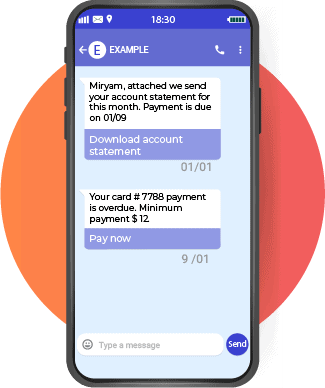

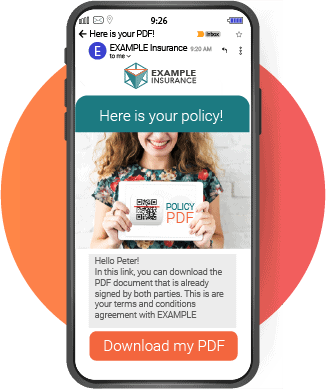

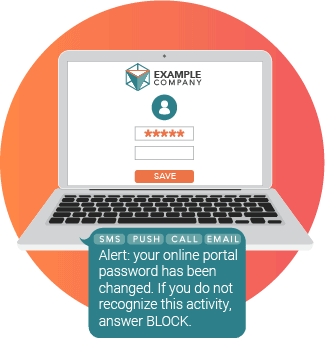

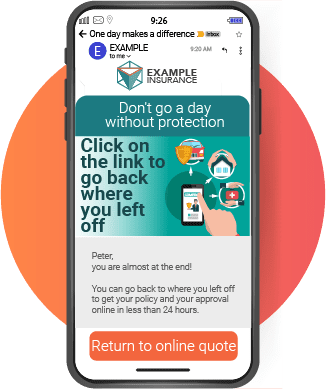

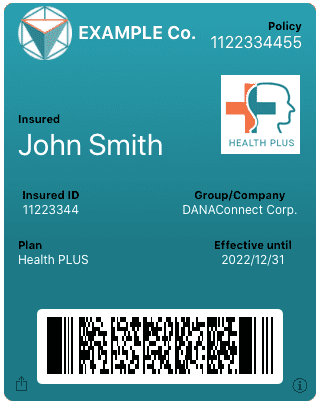

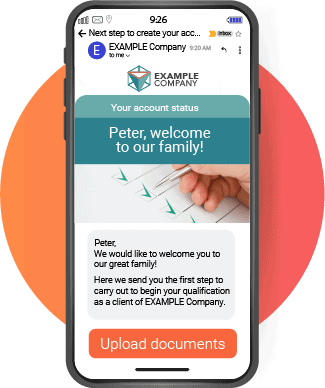

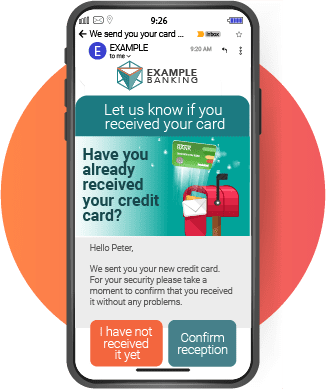

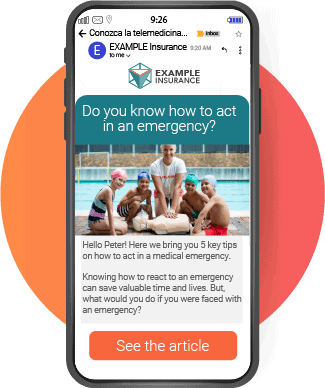

At DANAconnect, we understand that the integration of these surveys through various digital channels such as email, SMS or WhatsApp, can facilitate and speed up this process.

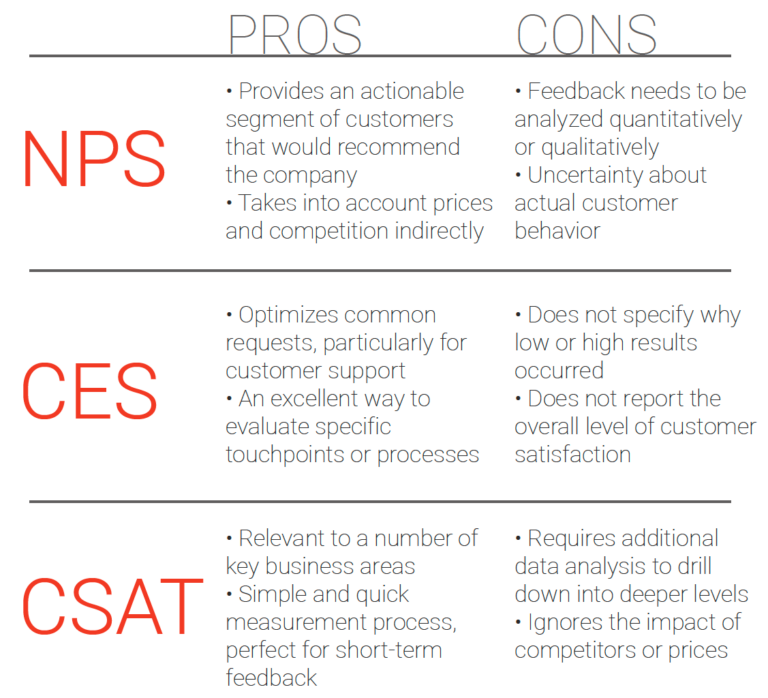

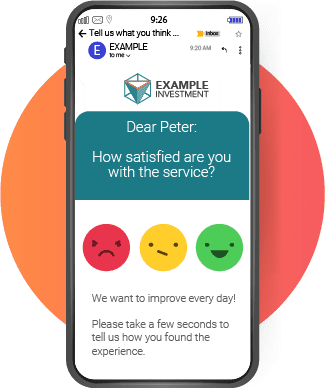

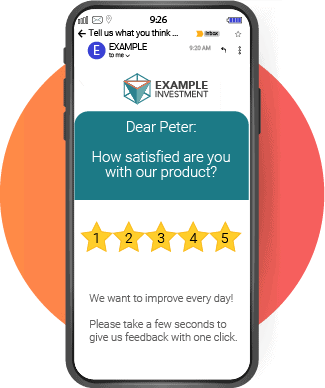

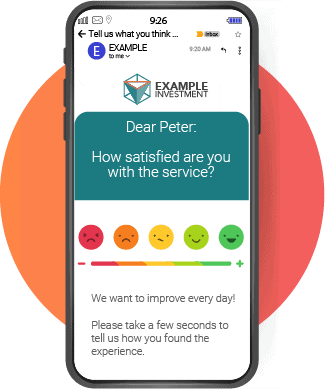

1.Customer Satisfaction Surveys (CSAT)

Differentiating advantages of the CSAT

- Simplicity: They can be brief and to the point, facilitating the participation of the client.

- Immediate Feedback: They help identify specific problems quickly.

- Personalization: They can be easily adapted to different products or services.

When to use CSAT surveys

These surveys are ideal for measuring immediate satisfaction after a specific transaction or interaction.

Messages Type of CSAT surveys

- “How satisfied are you with our service today?”

- “Please rate your experience with our product on a scale of 1-5.”

CSAT Survey Real Use Case

A bank might use CSAT after a customer has used online banking for a major transaction. This would help to understand if the digital experience met the customer’s expectations.

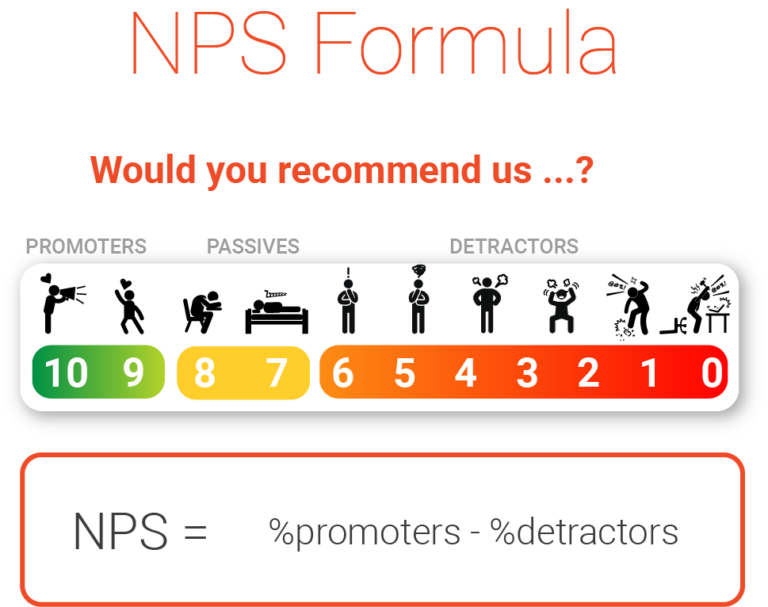

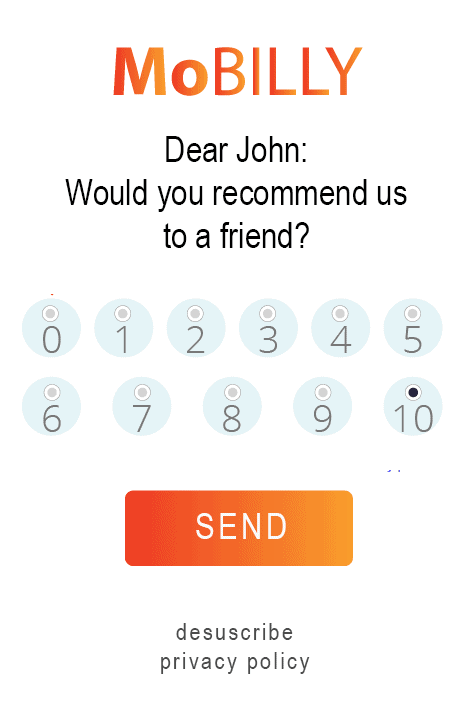

2. Net Promoter Score (NPS)

Differentiating advantages of the NPS

- Global Measure: Captures an overview of customer engagement.

- Benchmark Comparisons: Allows you to compare the results with other companies and industry benchmarks.

- Growth Prediction: It is correlated with loyalty and the probability of recommending the brand.

When to use NPS surveys

The NPS measures the likelihood that a customer will recommend a business to others. It is useful for a long-term assessment of customer loyalty.

Messages Type of NPS surveys

main question “On a scale of 0 to 10, how likely are you to recommend our company to a friend or colleague?”

Follow up question: “What could we do to improve your experience with us?”

NPS Surveys Real Use Case Example

An insurer could use the NPS to measure how customers value their customer support services after a claim. This can reveal deep insights into loyalty and retention.

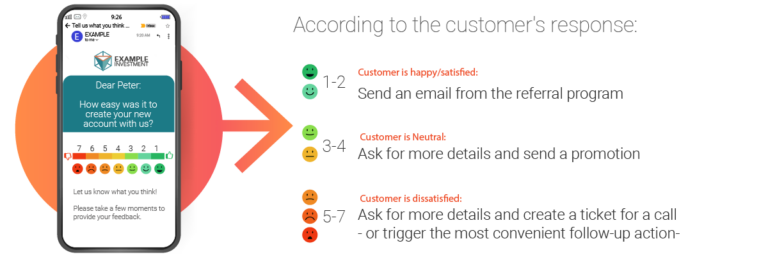

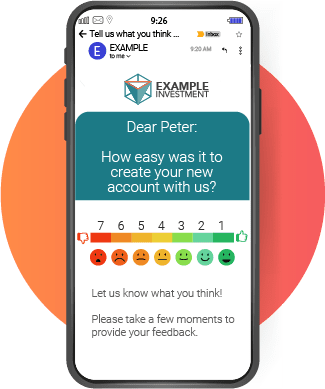

3. Customer Effort Surveys (CES)

Advantages of ESCs

- Ease Focus: Measures how easy it is for customers to interact with the company.

- Churn Prevention: Helps identify and correct problem areas.

- Direct Impact: You can have a direct impact on customer retention and satisfaction.

When to Use Them

These surveys assess how much effort a customer needs to put in to achieve their goal. They are useful for identifying frictions in the process.

Messages Type of Customer Effort surveys

- “How easy was it to solve your problem with us today?”

Example of real use case of Customer Effort surveys

A Retirement Fund company could use CES to assess the ease with which customers can access and understand their financial information through the online platform.

Conclusions: Creating Authentic Connections

The smart application of these tools can take your understanding of customers to a new level. But let’s remember that behind every answer there is a human being with emotions and needs. As we navigate the complex world of finance, empathy and human connection must be the beacons that guide our path.

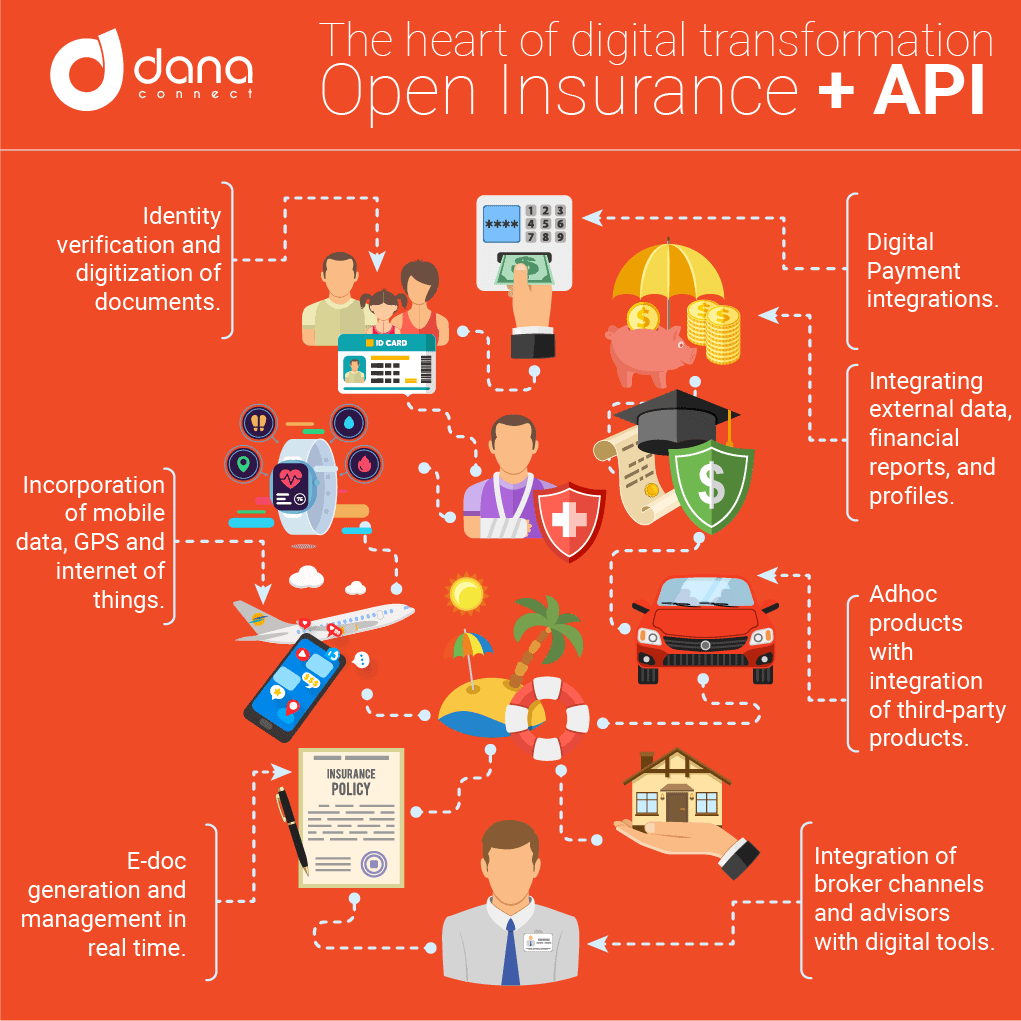

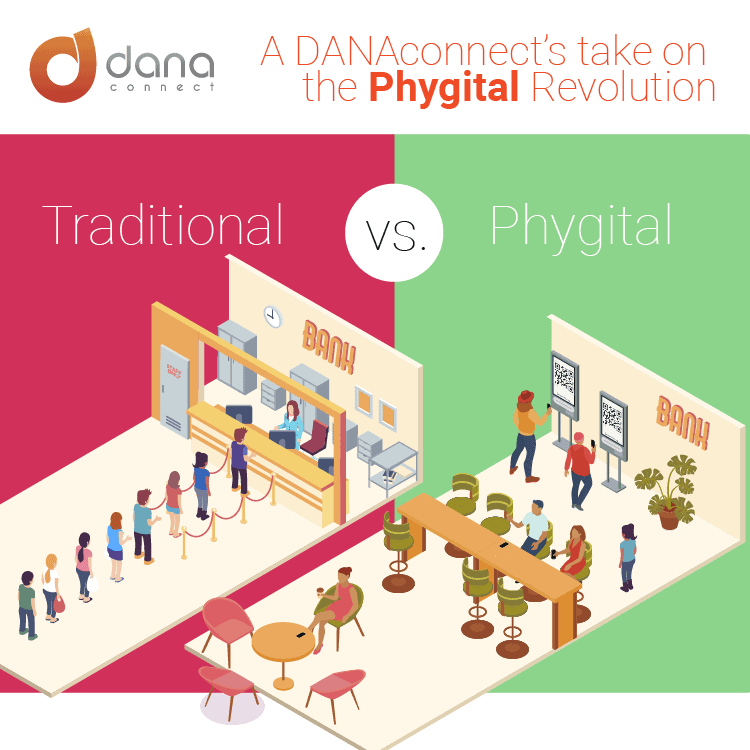

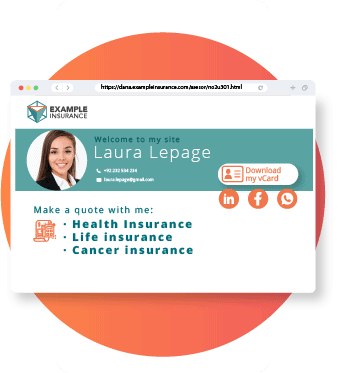

DANAconnect has a unique understanding of the needs of the financial industry. Your comprehensive communication solution goes beyond software and becomes a companion on this demanding journey. At DANAconnect, we recognize the importance of humanizing these surveys and genuinely getting closer to customers. Digital transformation is not just a matter of technology, but a union of technology and humanity to offer an exceptional experience in all channels.