The insurance and financial industries are undergoing significant transformation, driven by technology, data, and changing customer behavior. Businesses are becoming more like software companies, leveraging technology to offer more personalized and efficient services to customers. This transformation is not just about technology; it is also about changing the organizational culture and mindset. One of the most notable cultural changes occurring in the industry is the adoption of agile transformation methodologies to streamline processes and drive innovation.

Agile transformation is about creating a culture of continuous improvement, collaboration, and customer-centricity. When implemented effectively, Agile helps insurance companies deliver products and services that meet the changing needs of their customers while reducing costs and increasing efficiency.

However, implementing requires ongoing efforts to ensure the cultural change is adopted and sticks across the organization. In this article, we will discuss how implementing Agile transformation not only speeds up the transformation but also ensures the sustainability of such cultural change across an organization in the insurance industry.

Agile Transformation ignites the cultural change needed to succeed

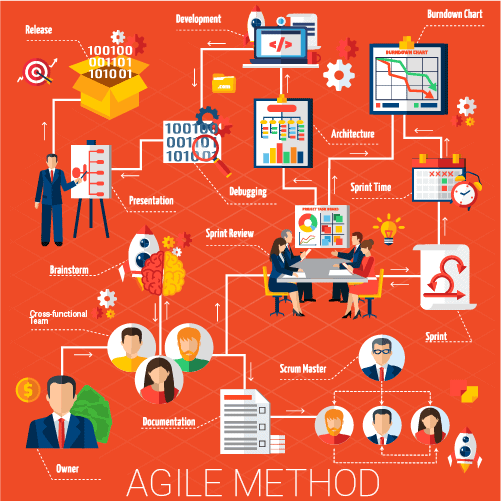

The Agile methodology is based on the principles of transparency, inspection, and adaptation. It emphasizes the importance of working collaboratively, breaking down silos, and delivering value to customers quickly. These principles challenge traditional ways of working in the insurance industry, where processes are often slow, and decision-making is hierarchical.

Implementing Agile transformation requires a fundamental shift in mindset and culture. It encourages employees to take ownership of their work, work in cross-functional teams, and be open to change. This shift in culture is not only necessary for the success of Agile transformation but also for the long-term success of the organization.

Agile transformation provides a framework for change that encourages employees to think outside the box and experiment with new ideas. It creates a culture of innovation, where failure is not seen as a setback but an opportunity to learn and improve.

The evolution of the agile concept and its adoption in Insurance and other industries

The historical antecedent of implementation of agile methodology in the insurance business and other industries can be traced back to the early 2000s. Agile methodology was initially developed for software development and was based on a set of values and principles outlined in the Agile Manifesto, which was published in 2001.

The Agile Manifesto emphasized collaboration, flexibility, and responsiveness to change, which were seen as essential for delivering high-quality software products in a rapidly changing business environment. The key principles of agile methodology included iterative development, continuous feedback, and continuous improvement.

As the software development industry began to embrace agile methodology, other industries started to take notice of its benefits. In particular, the insurance industry, which had traditionally been slow to adopt new technologies and methods, began to explore the use of agile methodology in their business operations.

One of the main drivers for the adoption of agile methodology in the insurance industry was the need to respond more quickly to changing customer needs and market conditions. The traditional approach of developing large, monolithic software systems was no longer effective in a rapidly changing business environment, and agile methodology offered a more flexible and adaptable approach.

Over the years, agile methodology has become more widely adopted in the insurance industry and other industries, including finance, healthcare, and manufacturing. Today, many companies are using agile methodology to improve their business processes, increase efficiency, and deliver better products and services to their customers.

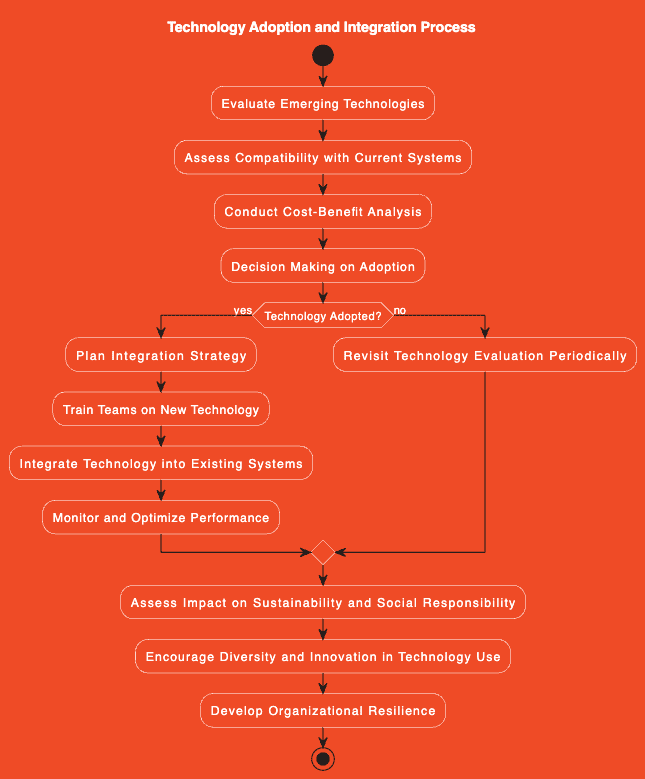

Guaranteeing the resilience of the organization

To ensure the longevity of cultural change, insurance companies need to take ongoing steps to embed the Agile mindset into their organization. One way to achieve this is through regular training and development. Employees need to be trained to work in an Agile environment, and ongoing training and development are necessary to keep Agile skills up to date.

Another way to ensure the permanence of cultural change is through effective communication. Insurance companies should communicate regularly with employees about the benefits of Agile transformation and how it aligns with the organization’s goals.

Finally, insurance companies should encourage and reward Agile behaviors. Recognizing and rewarding employees who embrace the Agile mindset and demonstrate Agile behaviors reinforces the importance of cultural change and encourages others to follow suit.

In today’s rapidly changing industry, it is imperative for insurance companies to adopt Agile transformation to remain competitive. However, it is essential to acknowledge that this is not a one-time event. Insurance companies must continue to implement ongoing measures to ensure cultural change is sustained and an Agile mindset is deeply embedded into their organization. The aim is to create a collaborative environment, centered on customer needs, that promotes continuous improvement. By fostering such a culture, insurance companies can drive innovation and achieve greater success.

The interdependence between digital and agile transformation

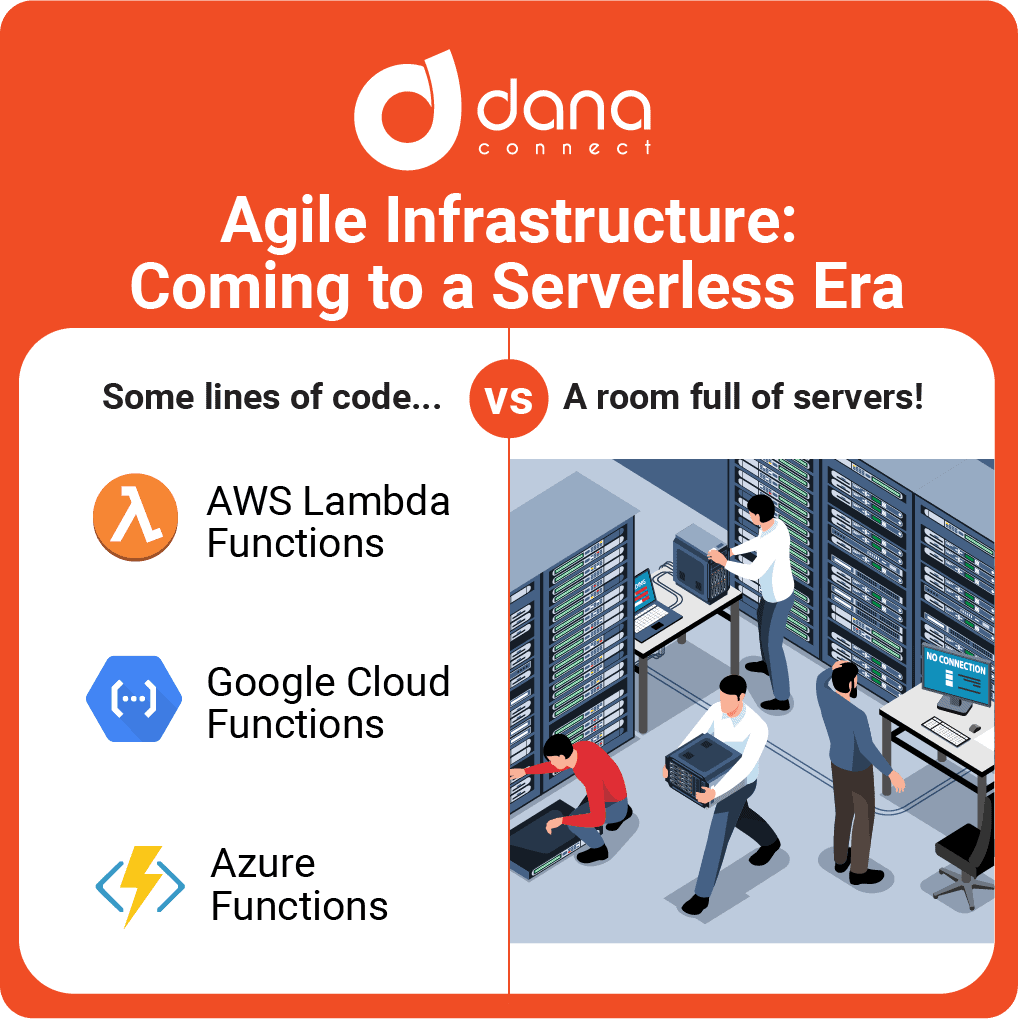

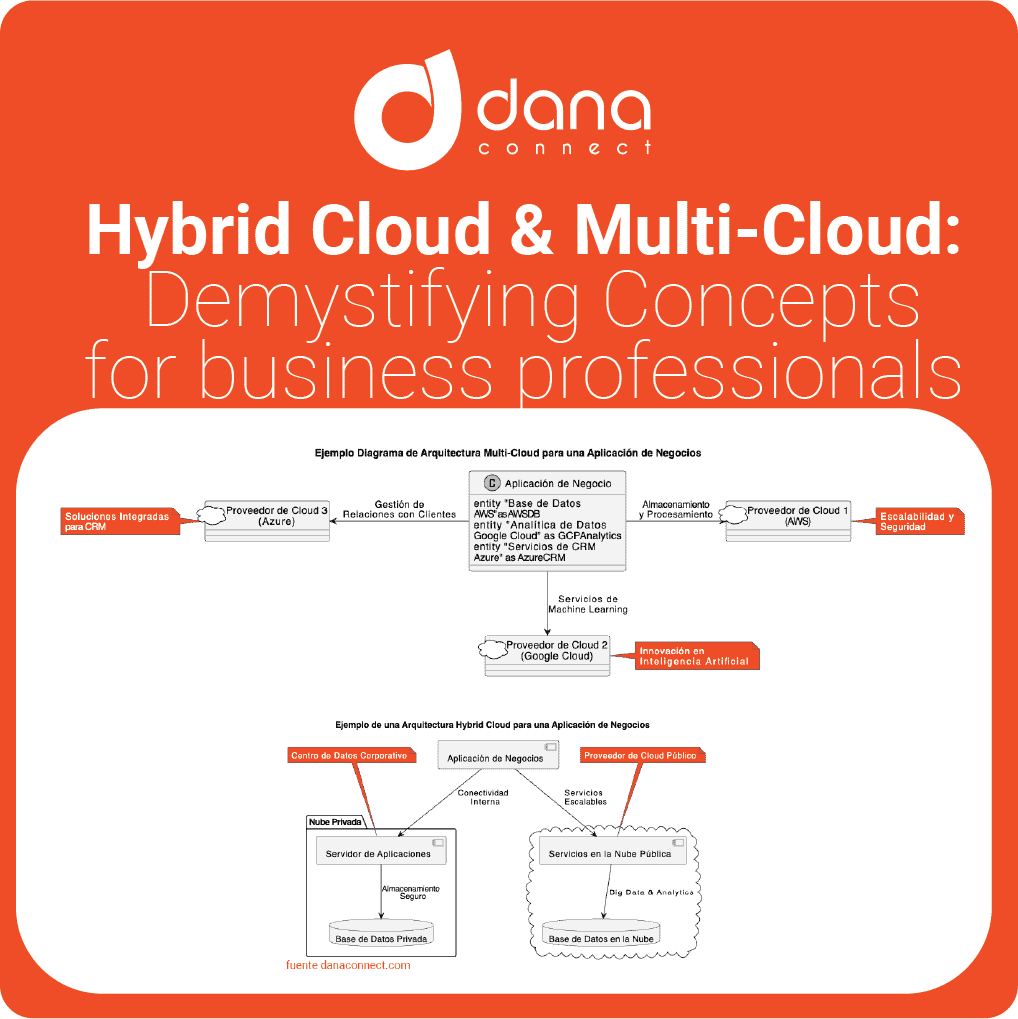

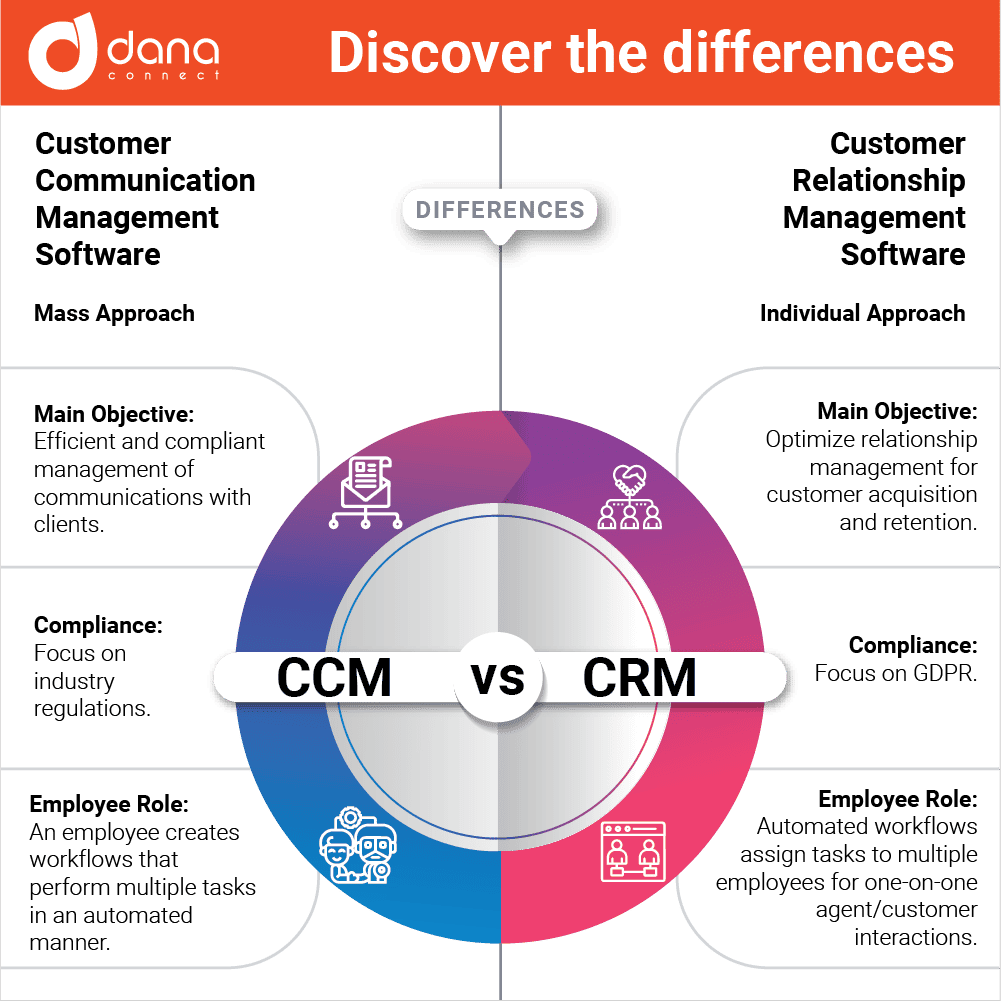

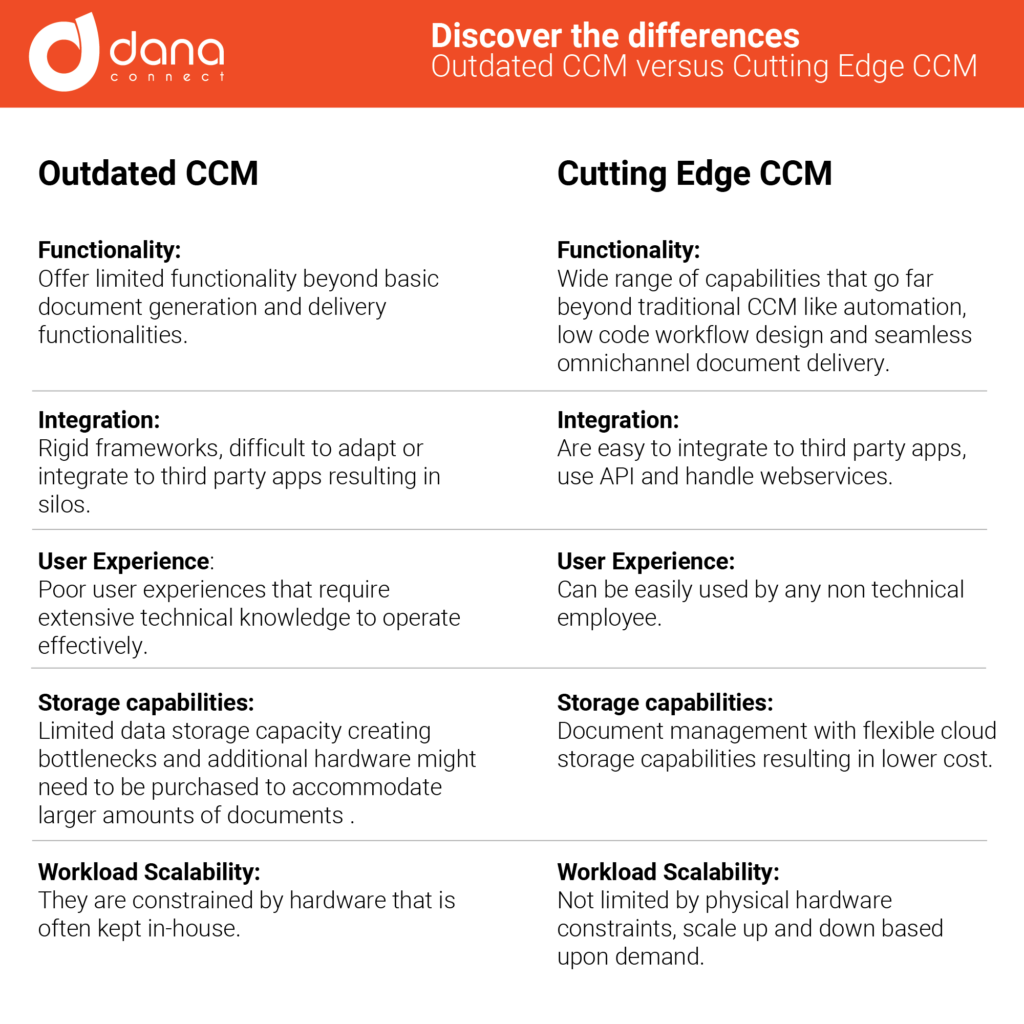

Agile transformation and digital transformation are two distinct but interconnected concepts. While both are essential for organizations to remain competitive in a rapidly changing business environment, they differ in their focus and scope.

Agile transformation is the process of adopting Agile methodologies to streamline processes and drive innovation. Agile methodologies focus on delivering value to customers quickly, breaking down silos, and working collaboratively in cross-functional teams. The goal of Agile transformation is to create a culture of continuous improvement that encourages experimentation, innovation, and customer-centricity.

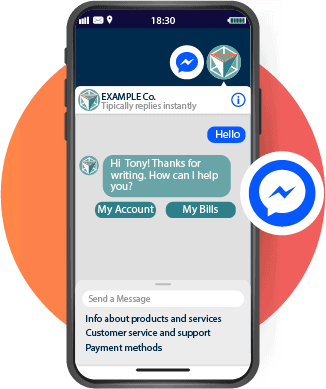

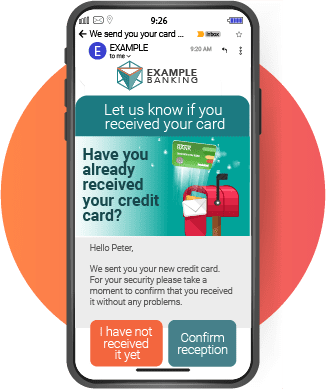

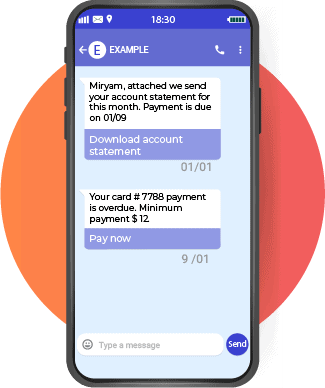

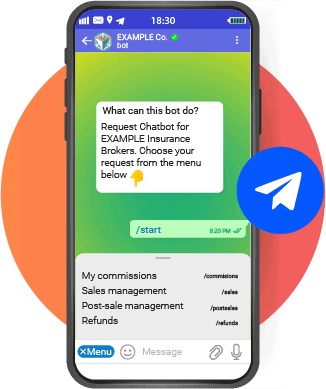

Digital transformation, on the other hand, is the process of using technology to transform an organization’s business model, processes, and customer experience. Digital transformation involves the integration of digital technologies into all areas of the organization, including marketing, sales, customer service, and operations. The goal of digital transformation is to create a more efficient, effective, and customer-centric organization that can compete in a digital-first world.

While Agile transformation and digital transformation are different concepts, they are often intertwined. Agile methodologies are often used in digital transformation initiatives to drive innovation and speed up the delivery of digital products and services. Digital transformation, in turn, provides the technology infrastructure and tools necessary to support Agile transformation initiatives.

Furthermore, Agile transformation and digital transformation are both critical for organizations to remain competitive in a rapidly changing business environment. While they differ in their focus and scope, they are often interconnected, and organizations should consider both when developing their transformation strategies.

Impact on organizational structure and work process flows

Agile transformation can have a significant impact on the organizational structure and work process flows of an insurance company. Here are some examples of how departments, organizational charts, and work process flows may change after implementing Agile transformation:

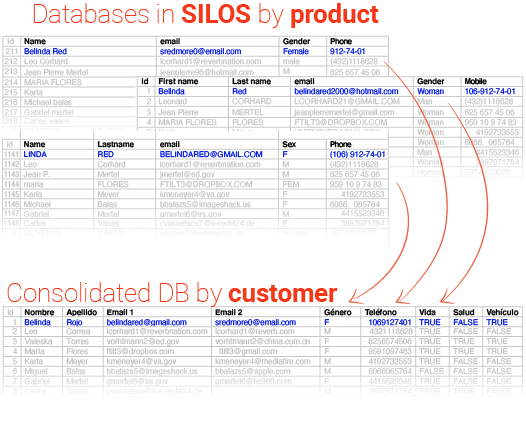

- Departmental restructuring: Agile transformation may require a restructuring of departments to support cross-functional teams. Traditional silos between departments may need to be broken down to create more collaboration and communication between teams.

- Flatter organizational structure: Agile transformation often leads to a flatter organizational structure, with fewer layers of management. This allows for faster decision-making and more flexibility in responding to changing market conditions.

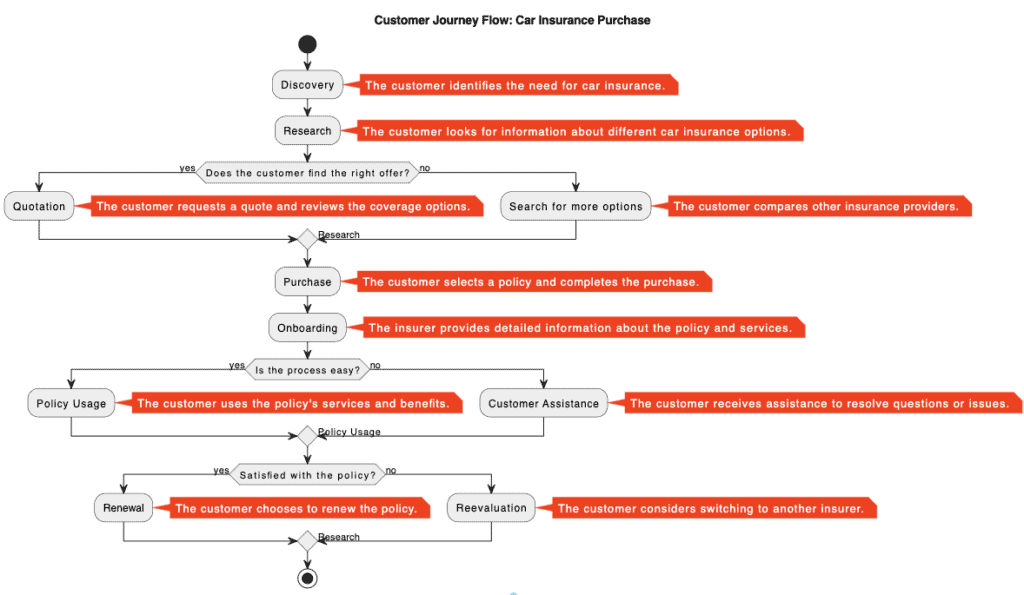

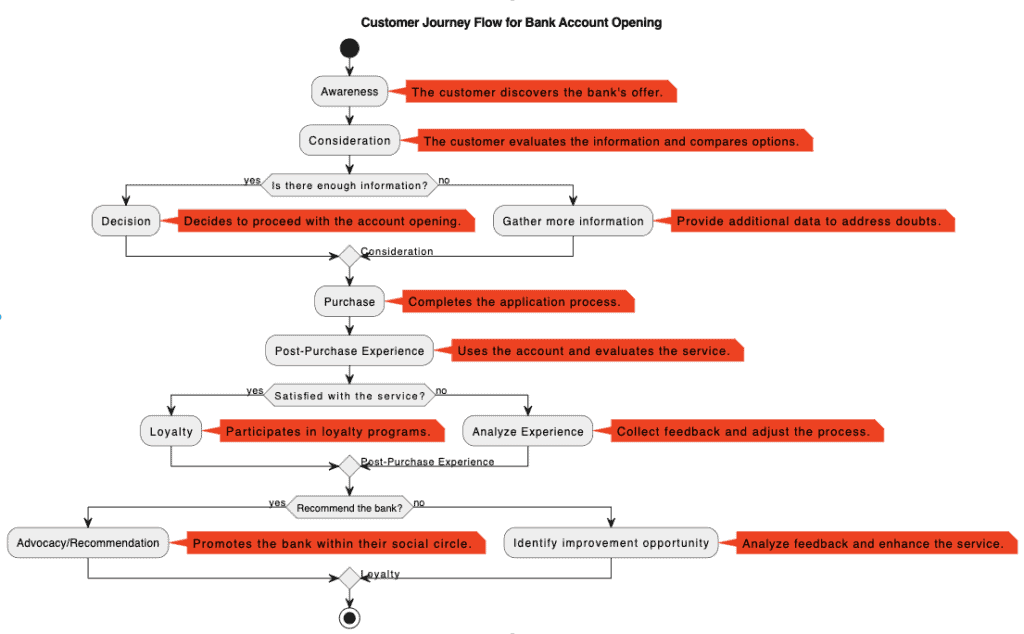

- Focus on customer value: Agile transformation places a strong focus on delivering value to customers quickly. This may require a shift in the way departments are organized, with a greater focus on understanding customer needs and preferences.

- Continuous improvement: Agile transformation encourages a culture of continuous improvement, where departments are constantly looking for ways to improve processes and deliver value to customers. This may require changes to work process flows to enable faster experimentation and iteration.

- Increased collaboration and communication: Agile transformation emphasizes collaboration and communication between teams. This may require changes to work process flows to enable more frequent and effective communication, such as short daily stand-up meetings or regular retrospectives.

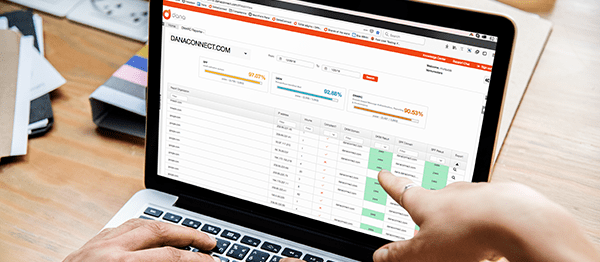

- Emphasis on data-driven decision-making: Agile transformation places a strong emphasis on data-driven decision-making. This may require changes to work process flows to enable more frequent and effective data collection and analysis.

In general, implementing Agile transformation can lead to significant changes in the organizational structure and work process flows of an insurance company. By breaking down silos, focusing on customer value, encouraging continuous improvement, increasing collaboration and communication, and emphasizing data-driven decision-making, insurance companies can become more agile, responsive, and competitive in a rapidly changing industry.

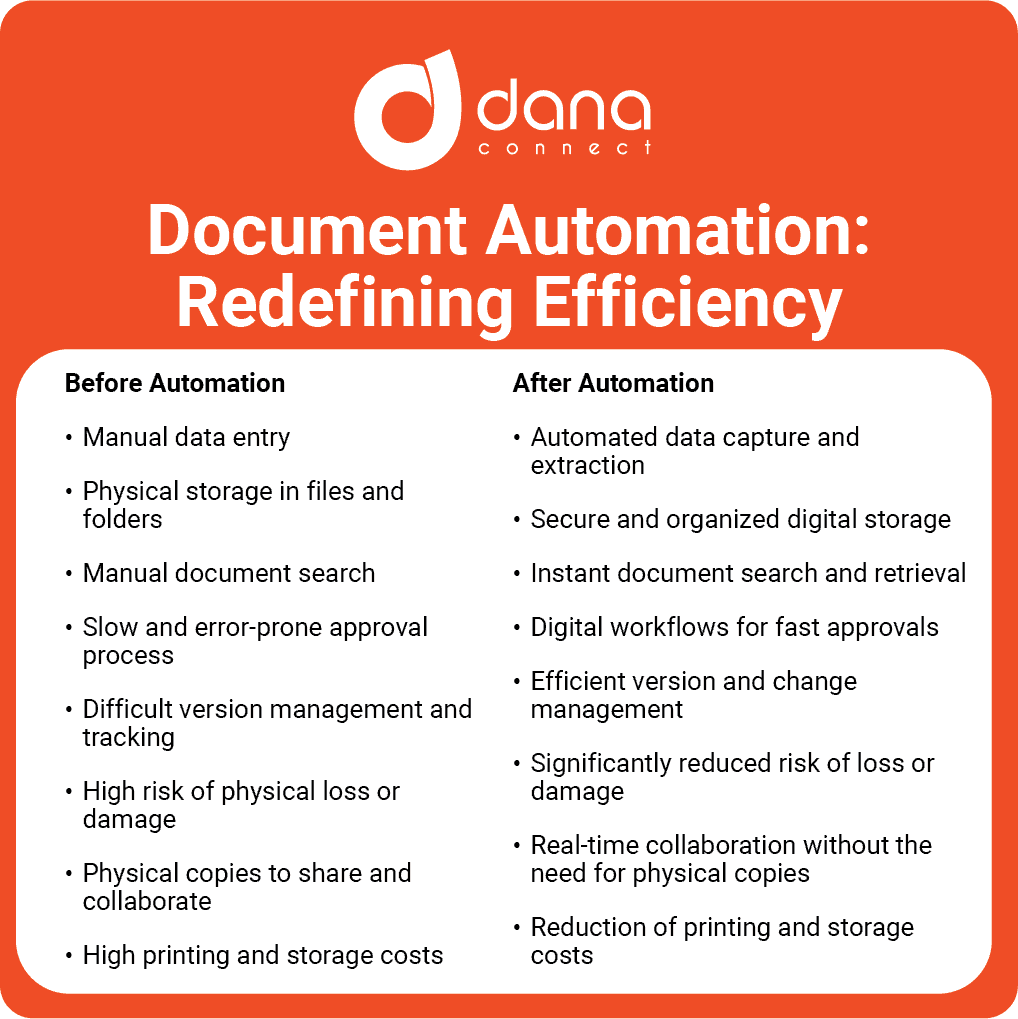

Comparing traditional roles in an insurance company before and after applying Agile transformation.

Agile transformation can have a significant impact on the way employees work together to deliver value to customers.

Implementing Agile transformation requires a shift away from this traditional way of working. Agile methodologies emphasize cross-functional teams, collaboration, and continuous improvement. As a result, the roles and responsibilities of employees may shift to reflect this new way of working. For example, a traditional project manager may become a Scrum Master, responsible for facilitating the Agile process, while a business analyst may work more closely with the development team to define user stories and acceptance criteria. Ultimately, such a shift can lead to an increased speed to market, enhanced levels of employee engagement, and a greater sense of competitiveness in the market.

The following table illustrates some of the ways in which roles may shift to reflect this new way of working:

| Before implementing Agile transformation, the roles in an insurance company may be more siloed and hierarchical. For example: | With Agile, the roles tend to become more fluid and adaptive to the demands of the project. For example: |

| 1. Product development may have been led by a traditional project manager, who was responsible for defining the project plan, assigning tasks, and tracking progress. The development team may have been separate from other departments, such as marketing or customer service. | 1. Product development may be led by a Product Owner, who is responsible for defining the product vision and roadmap, and ensuring that the team is delivering value to customers. The development team may be part of a cross-functional team that includes members from other departments, such as marketing or customer service, bringing a lot of insight from the customer’s POV. |

| 2. Business analysts may have been responsible for gathering requirements from stakeholders and writing long documentation, which would then be handed off to the development team for implementation. | 2. Business analysts may work more closely with the development team to define user stories and acceptance criteria. Rather than writing long documentation, they may work in collaboration with the development team to refine requirements on an ongoing basis. |

| 3. Team members may have been assigned to specific departments and worked independently, with little collaboration or communication between teams. | 3. Team members may be part of cross-functional teams that work collaboratively to deliver value to customers. The team may be self-organizing and responsible for prioritizing tasks and making decisions within the framework of the Agile methodology. |

| 4. The organizational structure may have been hierarchical, with layers of management and a rigid reporting structure. | 4. The organizational structure may be flatter and more flexible, with fewer layers of management and a greater emphasis on collaboration and communication. |

Key benefits of agile transformation

Agile transformation has numerous benefits for insurance companies looking to remain competitive in a rapidly changing industry. Here are some of the key benefits of Agile transformation in the insurance industry:

- Streamlining processes and reducing costs: Agile transformation helps insurance companies streamline their processes, reducing costs and improving efficiency. Agile methodologies focus on eliminating waste and reducing bureaucracy, which can lead to significant cost savings.

- Creating a culture of innovation and customer-centricity: Agile transformation creates a culture of continuous improvement, innovation, and customer-centricity. This culture encourages experimentation, collaboration, and a focus on delivering value to customers quickly.

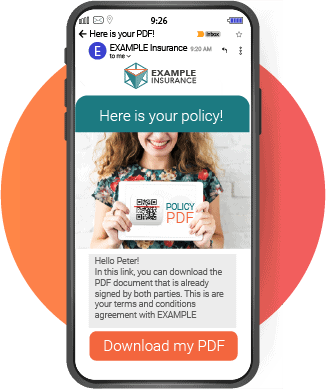

- Improving speed to market and time-to-value: Agile methodologies prioritize delivering products and services quickly, which can significantly improve speed to market and time-to-value. This is particularly important in the insurance industry, where customer needs and preferences are constantly evolving.

- Enhancing employee engagement and ownership: Agile transformation encourages employees to take ownership of their work and be accountable for their results. This sense of ownership can lead to increased engagement, motivation, and job satisfaction.

- Increasing adaptability and flexibility: Agile methodologies are designed to be adaptable and flexible, which is essential in a rapidly changing industry like insurance. Agile transformation enables insurance companies to respond quickly to changing market conditions, customer needs, and emerging technologies.

Key challenges of implementing Agile Transformation in insurance companies

Implementing Agile transformation in the insurance industry can be a complex and challenging process. Here are some of the key challenges that companies may face:

- Resistance to change: Agile transformation requires a significant shift in mindset and culture, which can be difficult for some employees to accept. Resistance to change can come from employees who are comfortable with the status quo or who may be afraid of losing their job or position in the organization.

- Lack of understanding about Agile methodologies: Agile methodologies may be unfamiliar to some employees, particularly those who have been working in the insurance industry for a long time. This can lead to confusion and frustration as employees try to adapt to new ways of working.

- Difficulty in breaking down silos and promoting collaboration: Silos between departments can be a major obstacle to implementing Agile methodologies. Departments may be used to working independently, and may be resistant to working collaboratively with other teams.

- Limited technology infrastructure and tools: Agile methodologies rely heavily on technology tools, such as project management software and collaboration platforms. Companies that lack the necessary infrastructure and tools may struggle to implement Agile methodologies effectively.

- Lack of leadership support: Without strong leadership support, Agile transformation may fail to gain traction within the organization. Leaders must be committed to the process, and willing to invest time and resources to make it successful.

- Difficulty in measuring success: Measuring the success of Agile transformation can be challenging, particularly in the short term. Companies may need to develop new metrics to track progress and demonstrate the value of Agile methodologies.

Implementing Agile transformation in the insurance industry requires a deep commitment to change and a willingness to overcome these challenges. Companies that are able to successfully implement Agile methodologies can gain a competitive edge by delivering value to customers more quickly and efficiently, and by fostering a culture of innovation and continuous improvement.

Best Practices for Successful Agile Transformation in the Insurance Industry

Agile transformation is not easy. It requires a significant amount of planning, communication, and buy-in from stakeholders. By following these best practices, you can ensure a successful Agile transformation and reap the benefits of this powerful methodology.

- Start with a clear vision

The first step in any Agile transformation is to have a clear vision of what you want to achieve. This means defining your goals, identifying the challenges you face, and outlining the benefits of Agile methodology.

The vision should be communicated clearly to all stakeholders, from top-level executives to individual team members. This will help to create a sense of purpose and motivate everyone to work towards a common goal.

- Build a strong team

Agile methodology is all about collaboration and teamwork. To be successful, you need to build a team of people who are committed to the Agile philosophy and have the skills and experience to implement it effectively.

This includes hiring Agile coaches and trainers, as well as creating cross-functional teams that can work together to deliver projects. It’s also important to create a culture of trust and openness, where team members feel comfortable sharing ideas and feedback.

- Adopt an Agile framework

There are several Agile frameworks to choose from, including Scrum, Kanban, and Lean. Each has its own strengths and weaknesses, so it’s important to choose the one that best fits your organization’s needs.

Regardless of the framework you choose, it’s important to stick to Agile principles and practices. This means prioritizing customer value, working in short sprints, and continuously improving through feedback and iteration.

- Provide training and support

Agile transformation requires a significant shift in mindset and behavior. It’s important to provide training and support to help team members understand the principles of Agile and how to apply them in their work.

This includes training on Agile methodologies, as well as tools and technology that support Agile practices. It’s also important to provide ongoing coaching and feedback to help teams improve and stay on track.

- Measure and adapt

Agile methodology is all about continuous improvement. To be successful, you need to measure your progress and adapt your approach as needed.

This means setting clear metrics and KPIs to track your success, as well as regularly reviewing your processes and practices to identify areas for improvement. It’s also important to be flexible and willing to make changes as needed, based on feedback and data.

Many leading insurance companies already have succeed implementing agile transformations

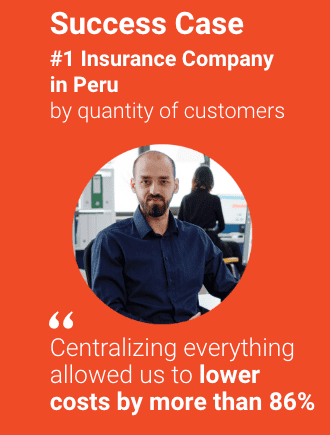

Agile transformation is becoming increasingly popular in the insurance industry, with many companies adopting this approach to improve their processes and stay competitive. Here are some examples of successful Agile transformation in the insurance industry:

- Allianz: Allianz, a leading insurance company, has been implementing Agile transformation for several years. They have created cross-functional teams that work together to deliver customer value quickly. This has allowed them to launch new products and services faster, reduce costs, and improve customer satisfaction.

- AXA: AXA, another leading insurance company, has also adopted Agile transformation. They have created Agile teams that work on specific projects, such as developing new insurance products or improving customer service. This has allowed them to be more flexible and respond quickly to changing customer needs.

- Nationwide: Nationwide, a US-based insurance company, has implemented Agile transformation in their IT department. They have created Agile teams that work on specific projects, such as developing new software or improving the user experience. This has allowed them to reduce costs, improve efficiency, and deliver better solutions to their customers.

- Zurich Insurance: Zurich Insurance, a Swiss-based insurance company, has implemented Agile transformation in their claims department. They have created cross-functional teams that work together to improve the claims process and reduce the time it takes to pay out claims. This has led to higher customer satisfaction and improved efficiency.

- Liberty Mutual: Liberty Mutual, a US-based insurance company, has implemented Agile transformation in their claims department as well. They have created Agile teams that work on specific projects, such as improving the accuracy of claims processing or reducing the time it takes to handle claims. This has led to improved efficiency, faster claim processing times, and higher customer satisfaction.

These case studies demonstrate the benefits of Agile transformation in the insurance industry. By adopting Agile approaches, insurance companies can become more flexible, respond quickly to changing customer needs, improve efficiency, and reduce costs.

A final overview

In conclusion, Agile transformation is becoming increasingly important in the insurance industry as companies look for ways to remain competitive in a rapidly changing landscape. By adopting Agile methodology, insurance companies can streamline their processes, improve collaboration and communication, and deliver better customer experiences.

However, Agile transformation is not without its challenges. It requires a significant shift in mindset and behavior, as well as buy-in from all stakeholders. It’s also important to choose the right Agile framework and provide ongoing training and support to ensure success.

The benefits of Agile transformation are clear. Insurance companies that embrace Agile methodology can respond more quickly to market changes, deliver products and services faster, and improve customer satisfaction. By following best practices and continuously iterating and improving, insurance companies can stay ahead of the curve and remain competitive in the years to come.

In summary, the insurance industry is evolving rapidly, and Agile transformation is one of the key drivers of this change. By embracing Agile methodology and following best practices, insurance companies can navigate these challenges and stay ahead of the competition.