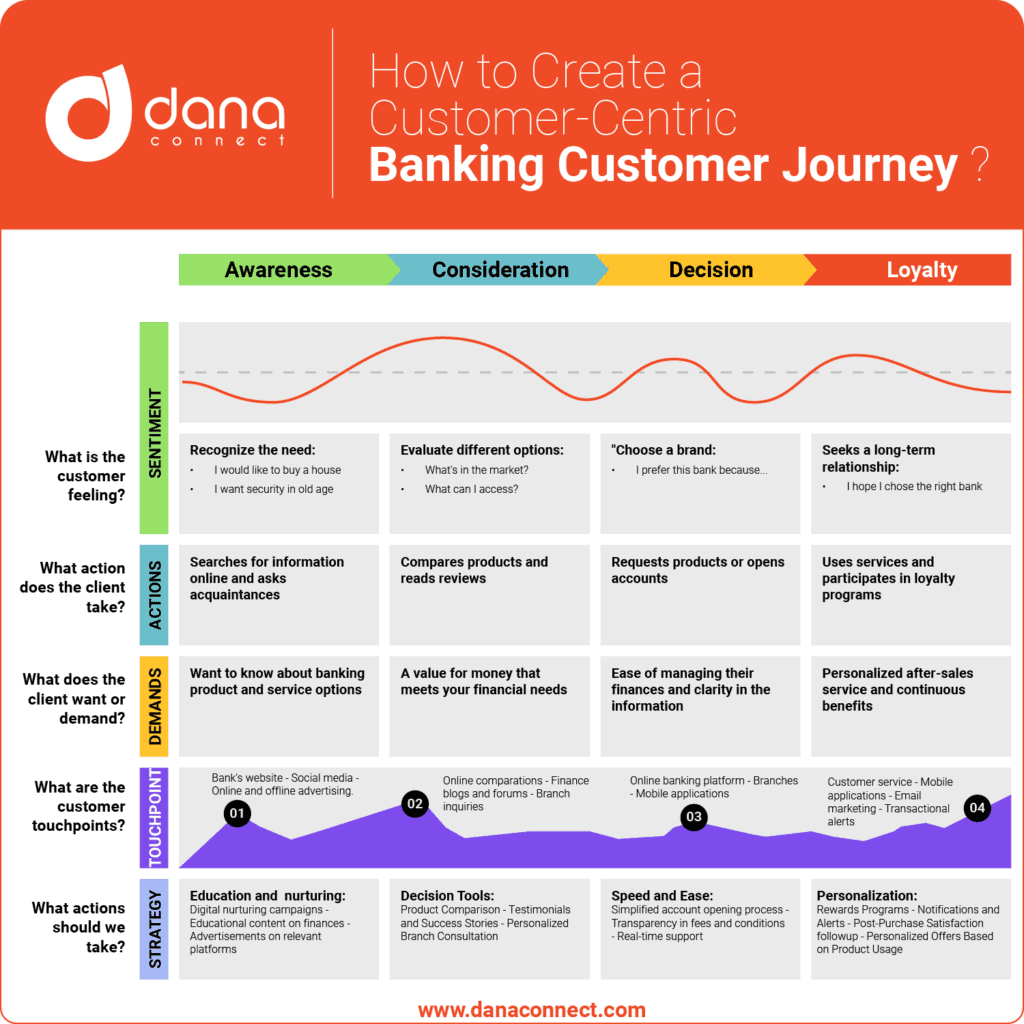

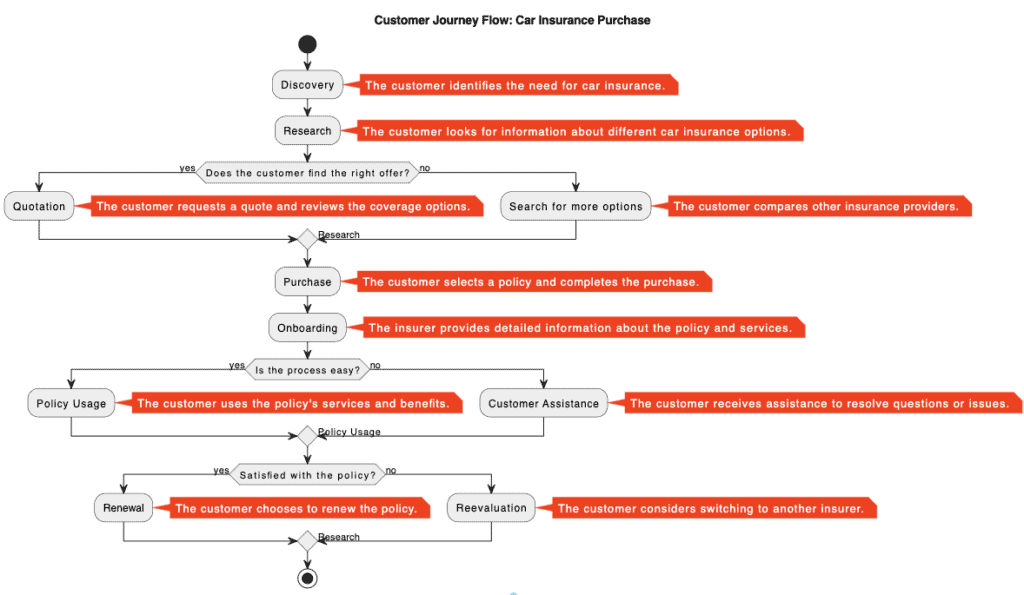

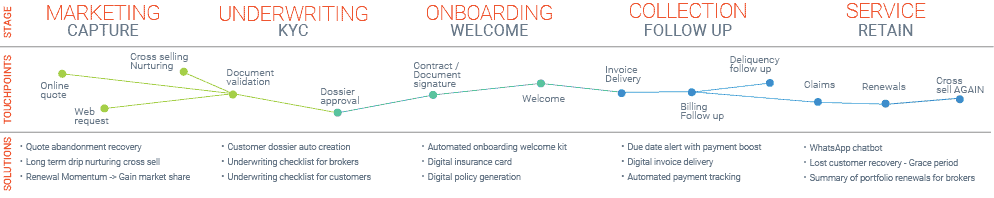

– This article explains how the processes of the customer journey in the insurance industry can be mapped to small automated solutions to create a more fluid and better customer experience –

Currently, it is more important to prioritize the needs of the client than the benefits of the insurance product itself, as was done in the past. The new battlefront is a new and improved customer experience, combining interactions across a variety of channels and the flexibility to respond to a more demanding customer.

On the other hand, customers are currently more and more willing to accept products offered in non-traditional channels, which are gaining more and more market. Insurance companies must act now to defend their market share and take advantage of their current competitive advantage to strengthen their growth.

InsureTechnize your company one process at a time

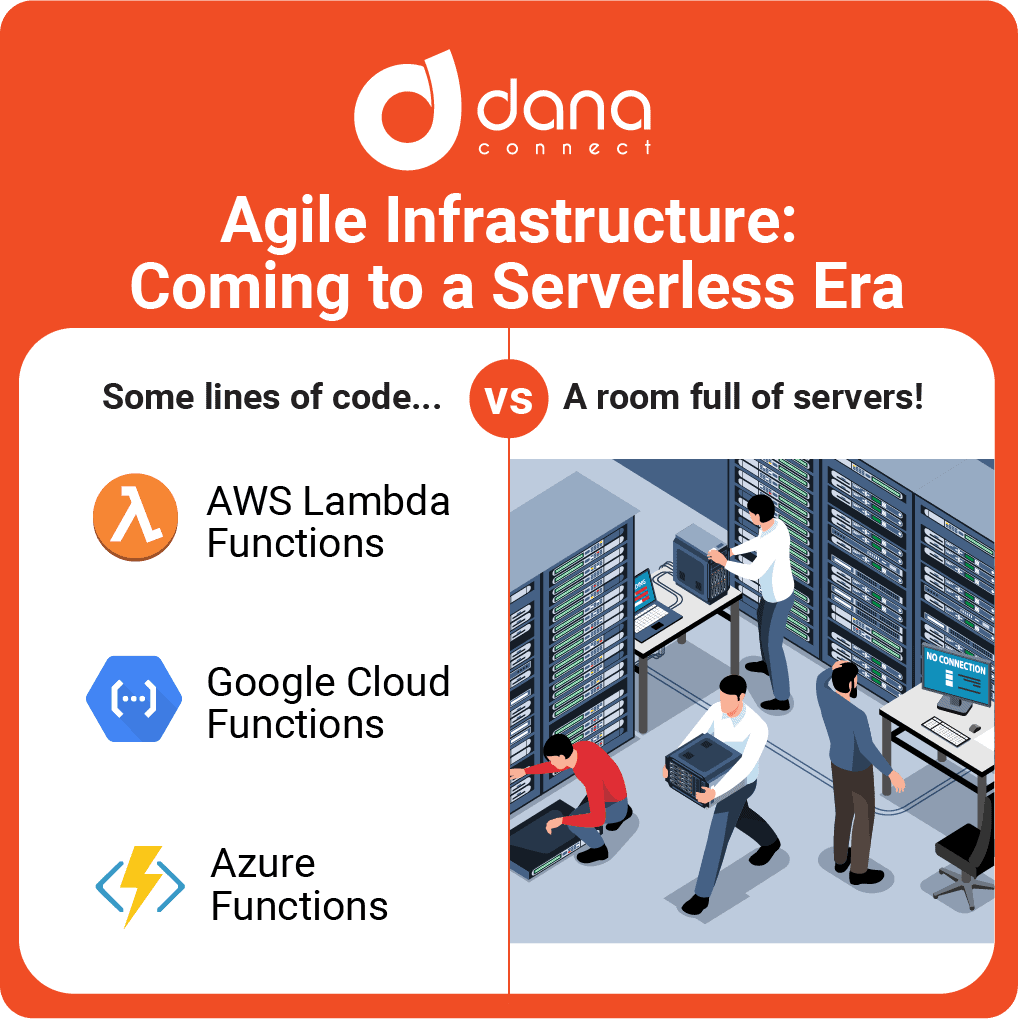

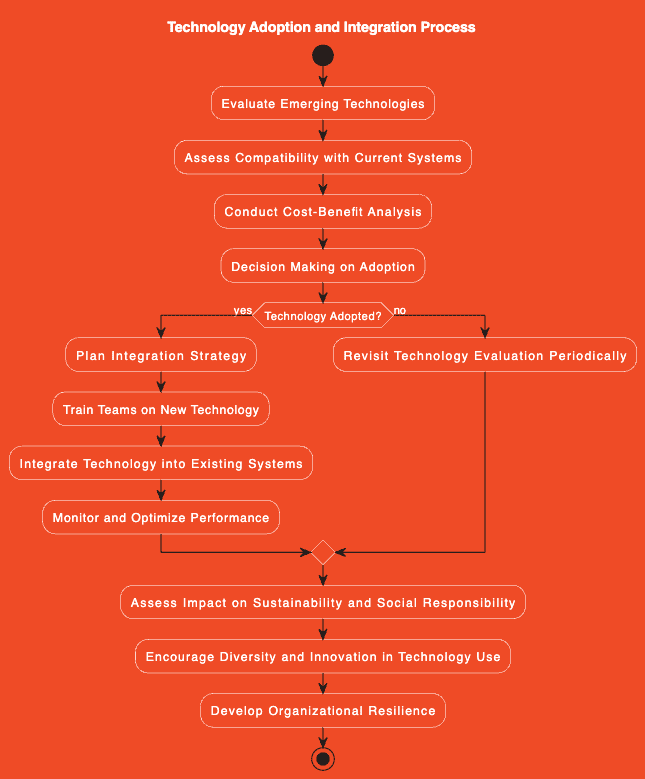

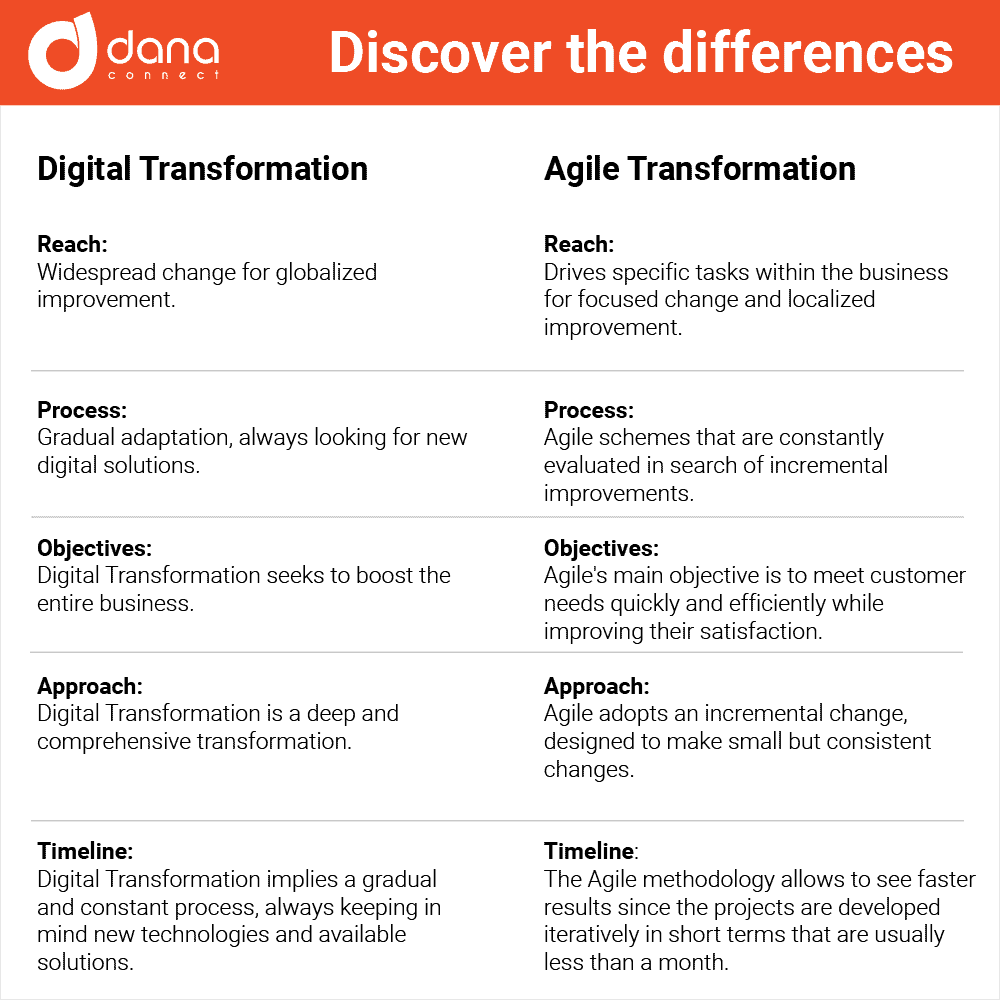

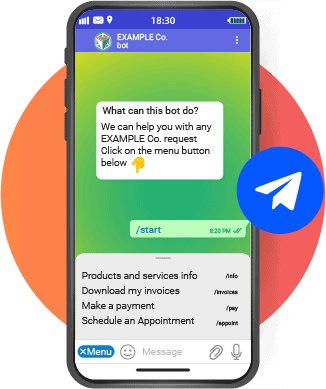

Digital transformation may seem like a daunting task. As opposed to tackling a big-scale transformation project across the company, it would be better to decompose your business into processes that can be automated. There is a possibility to map all the processes of the customer journey to agile, small solutions to create a more fluid and better customer experience in insurance.

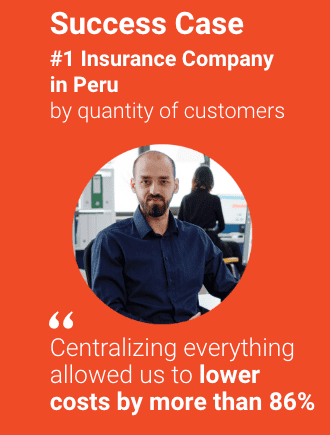

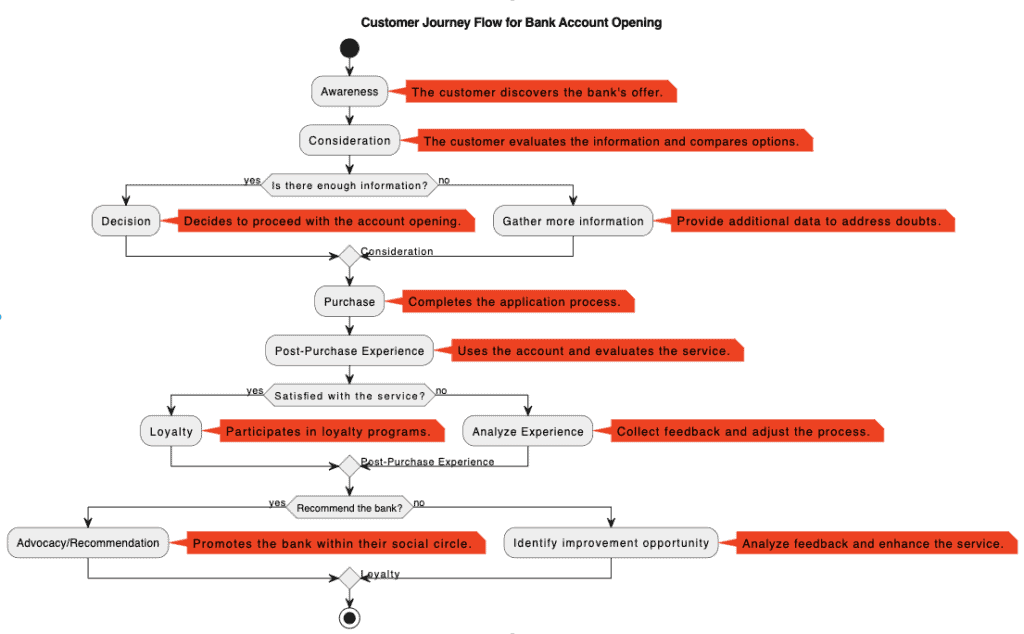

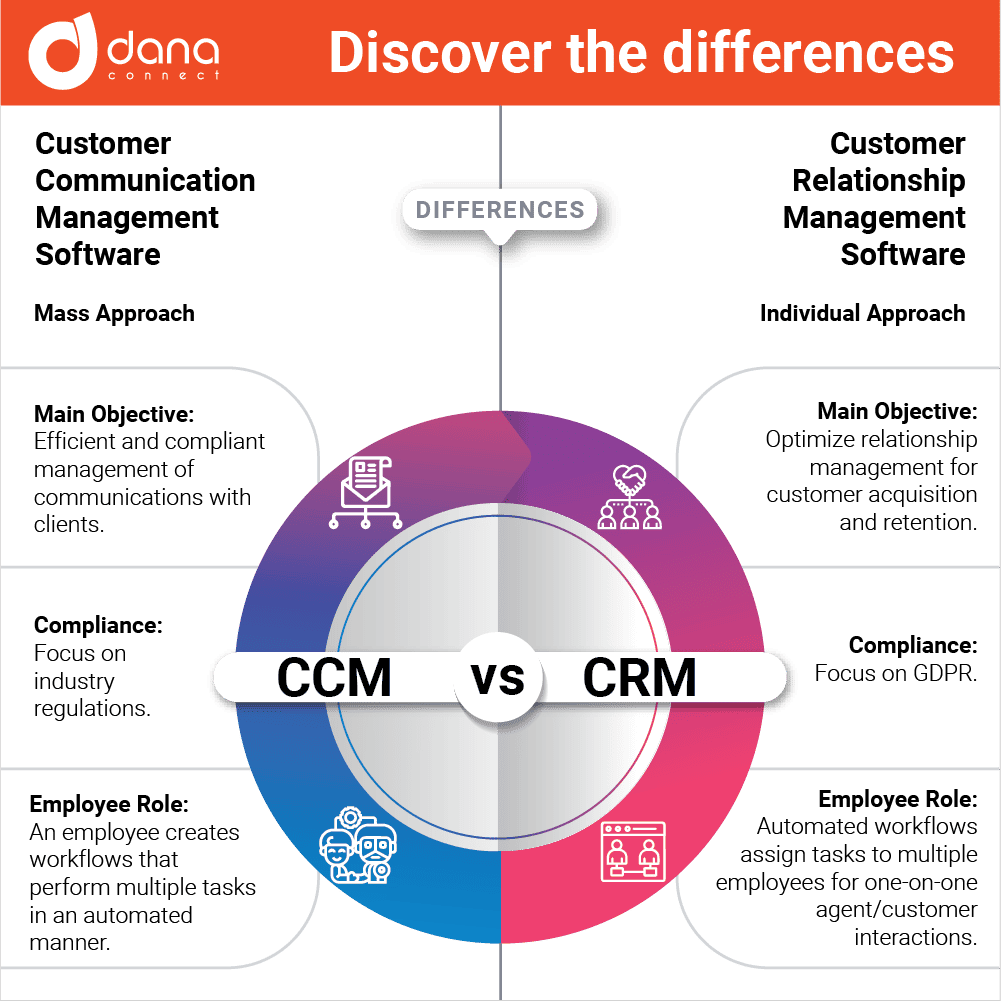

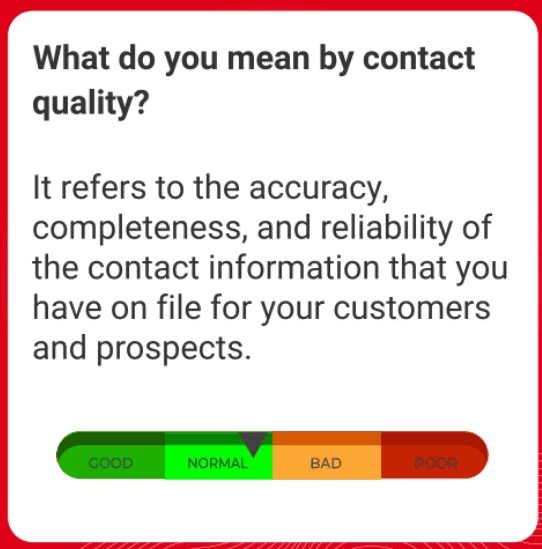

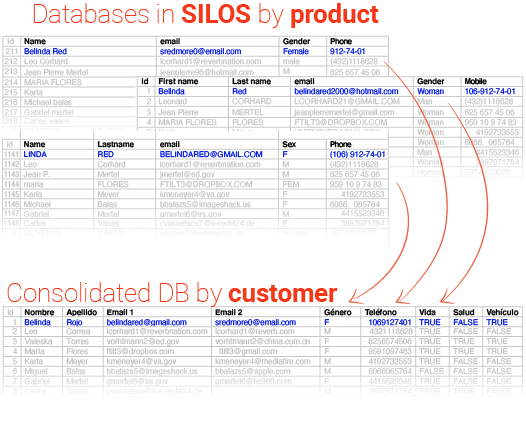

Digital transformation in insurance crosses all departments and requires a single and unified type of platform.

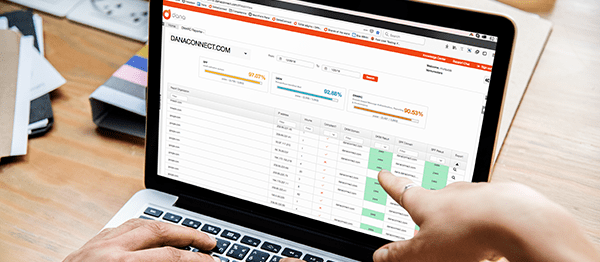

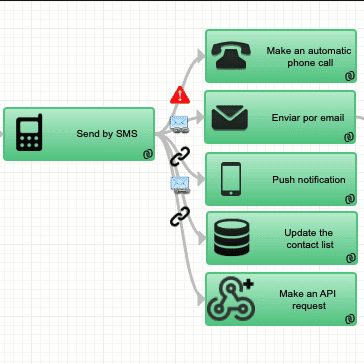

The ability to map processes between all sectors and departments of the company is achieved by using a centralized platform that manages customer data and governs all communications in a unified way. The long-term customer journey involves all departments connected directly to customers before, during, and after the sale. A platform that puts contact data, files, and documents in one place, facilitates easy access for everyone in the company.

This approach towards the automation of processes allows to increase the capacity of response and guarantees the speed and effectiveness of attention at all touchpoints. By having the customer data centralized in a single platform, it is possible to make a process flow that begins with marketing prospecting, goes through underwriting, due diligence, account creation, onboarding, and then diversifies across the entire organization.

How can you automate the customer experience in insurance?

- Creation of personal dossiers

- Learn about customer dossier creation

- Due diligence and KYC

- Welcoming and onboarding

- Generating and sending documents with digital signature

- Generation, sending and validation of One-Time Passwords (OTP)

- Collections and Account Statements

- Customer experience measurement

- Claims Processing

- Renewal and Retention

- Cross selling and prospecting of current customers

Get to know the catalogue for mapping solutions to process

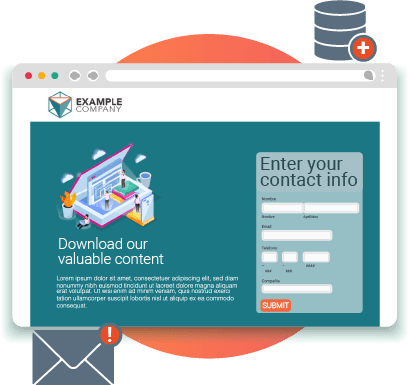

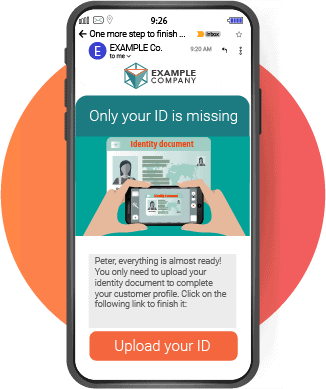

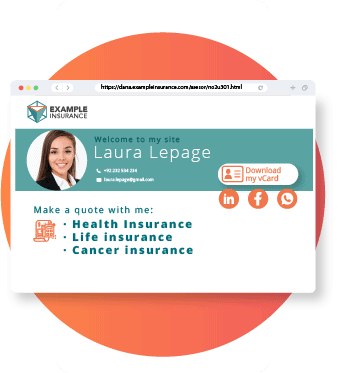

Creation of personal dossiers

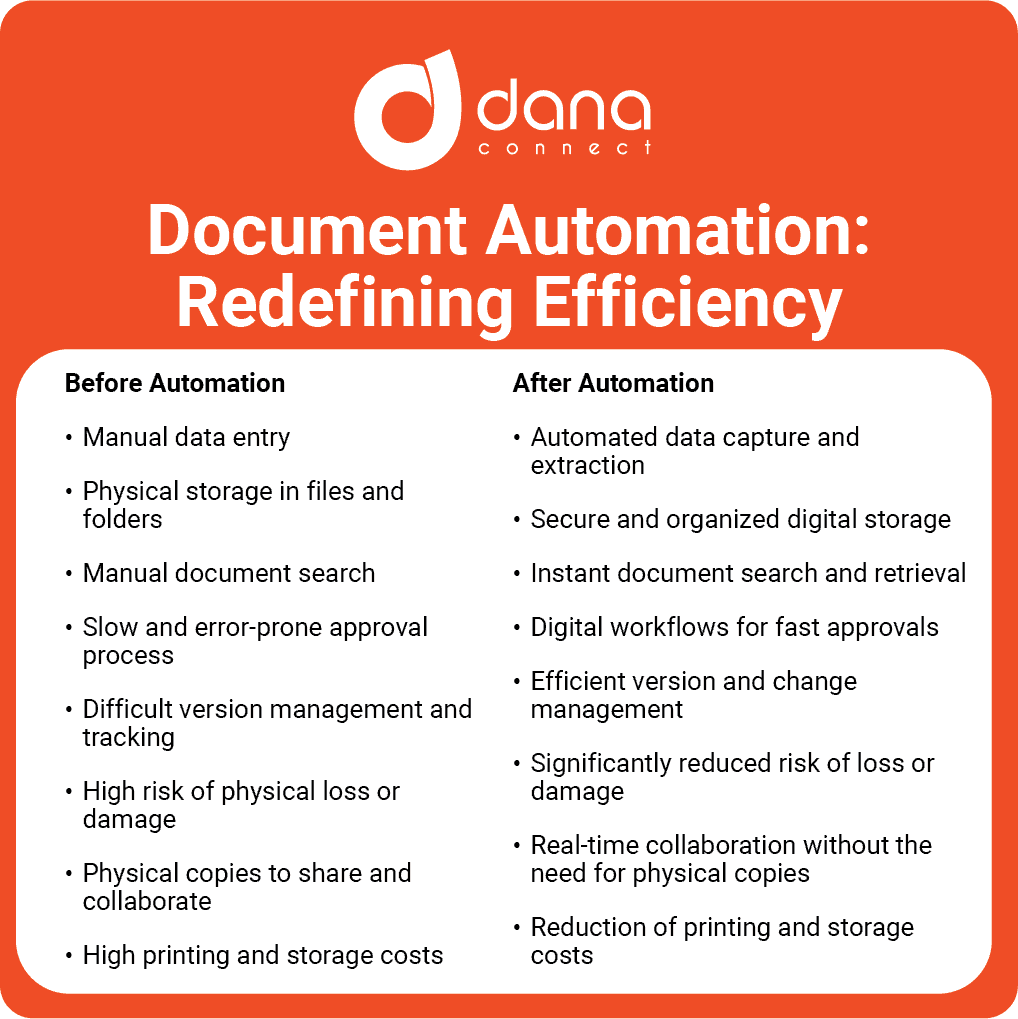

You can automate the process of sending all the necessary tools to your customers so that they can set up their own accounts and send the required documents. Through the use of web forms, it is possible to upload information and personal documents, with the option of registering an electronic signature. In addition to being indexed to the client’s central dossier, the documents are also added to a unified repository and if necessary, they are sent to the customer support agents via email or a helpdesk ticket.

Learn about customer dossier creation

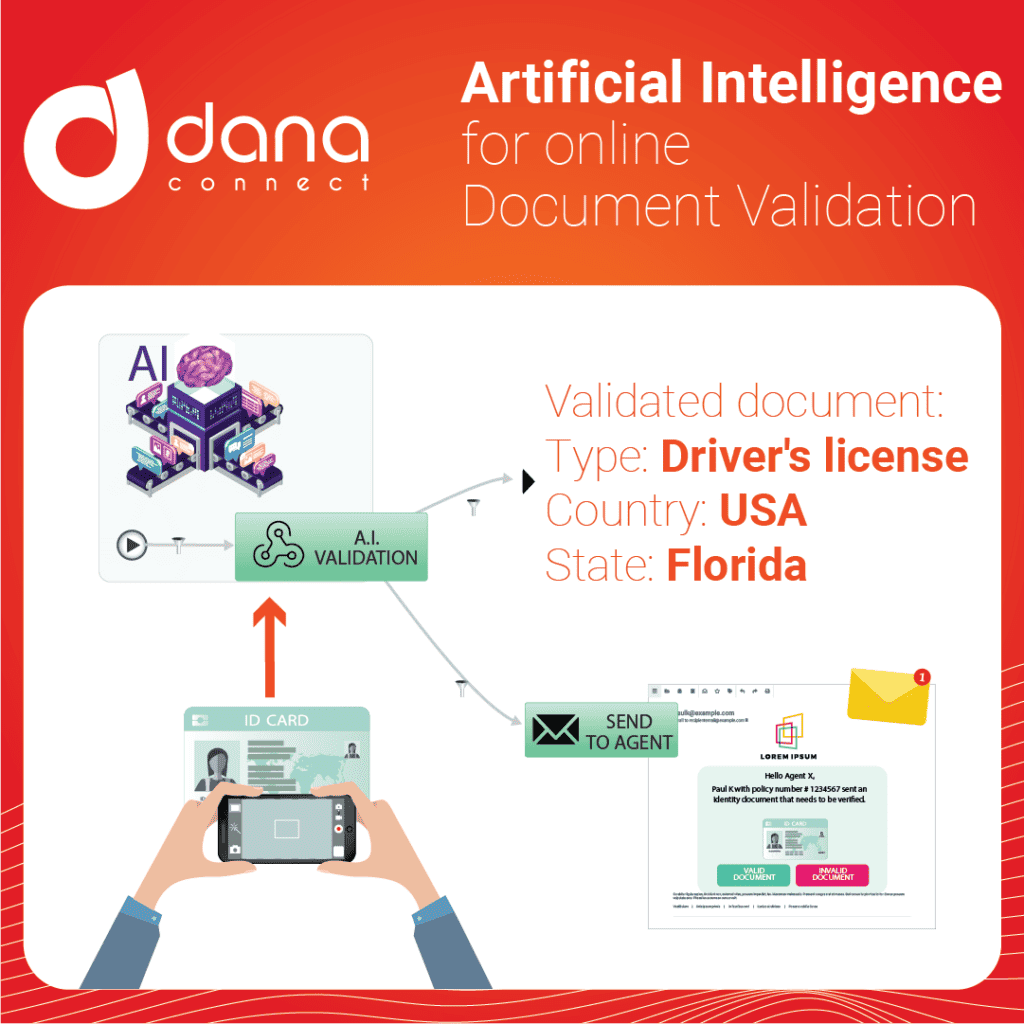

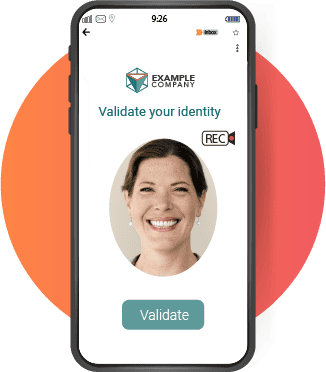

Due diligence and KYC

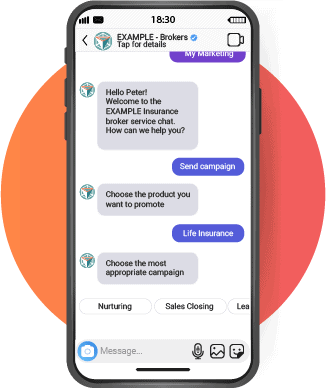

The underwriting agents can be included in the flow so that they can receive and validate the documents of the prospect’s personal dossier. All the customer information would already be in the system, so the agent can simply approve after verification. Once the documents are verified by the agent and he/she clicks on “approve” , the status of the policy is immediately changed and the automation continues with onboarding and welcome messages.

Get to know our Self-managed Customer Dossier Automation

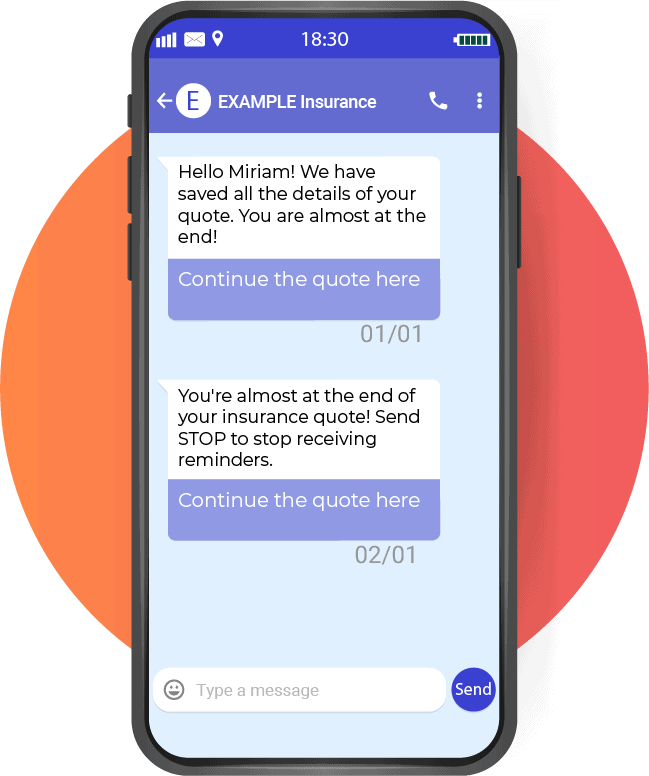

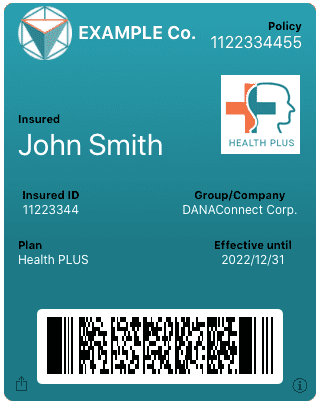

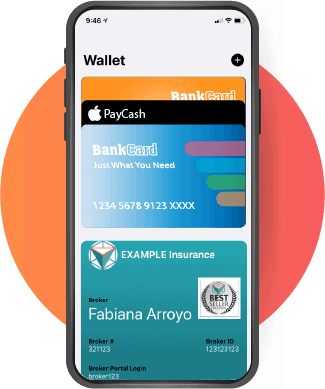

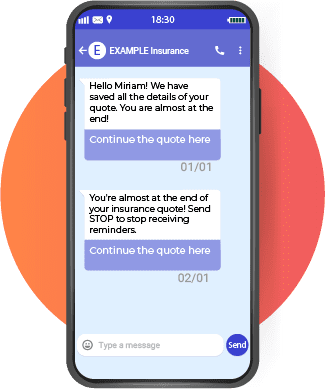

Welcoming and onboarding

This is an excellent opportunity to demonstrate how easy it will be to do business with your company. At this point, automation allows you to send all the information that a customer needs after purchasing a product or service. The newcomers should have all the information they need to lower call center demand volumes and avoid bad experiences. This phase involves sending customers a welcome kit that contains documents, information, and links to support, as well as any other information they need to know about your product. During the process, the automation also checks periodically if the client has downloaded and enabled mobile applications, portals, or any critical information. In addition, a digital insurance card could be included as part of this starter kit.

View our catalogue of automated onboarding solutions

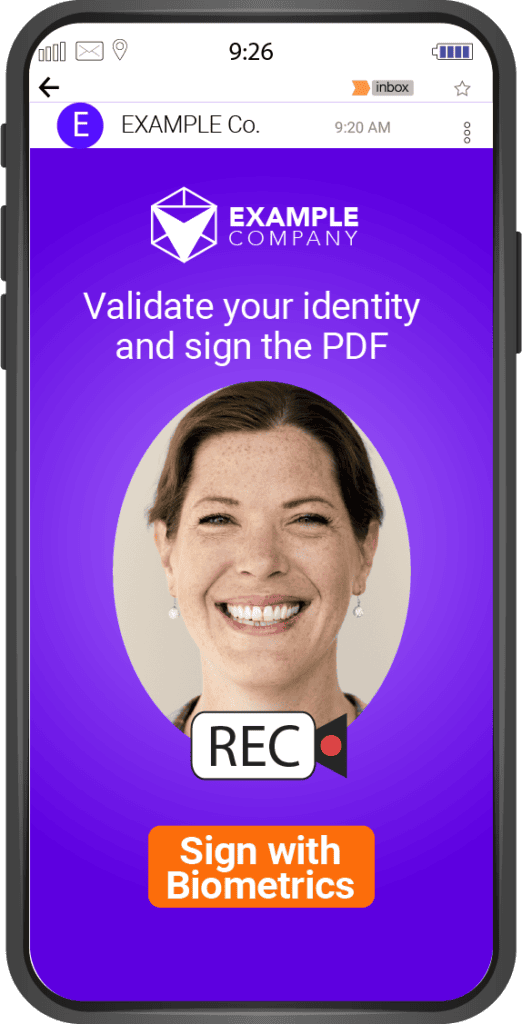

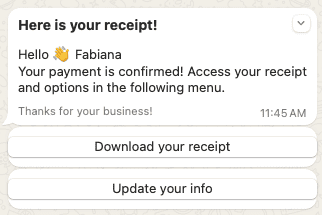

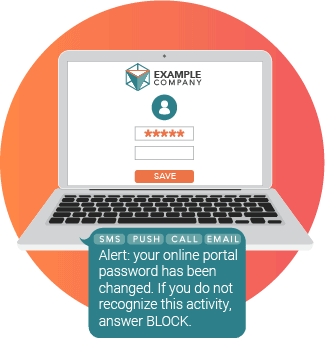

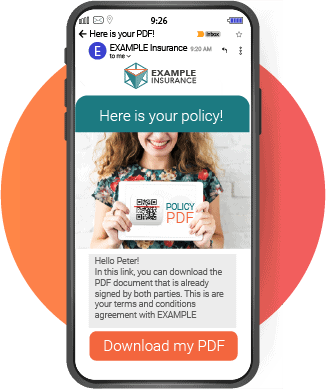

Sending documents with digital signature

The service contract, or any document template, can be signed with your company’s digital signature. As a final step in the legal process, the client may sign electronically. Then a PDF is generated and sent via email, ticket or API to all parties involved, including brokers.

View our solutions for generating digitally signed documents

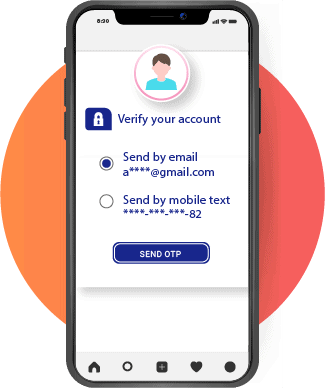

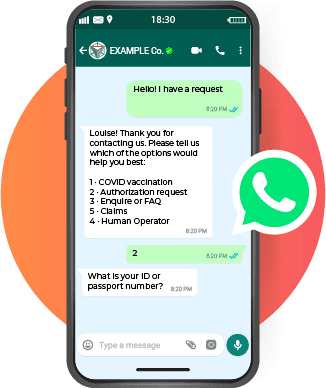

Generation, sending and validation of One-Time Passwords (OTP)

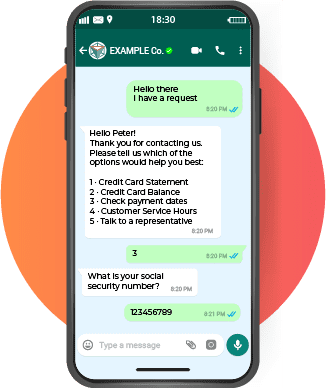

An API that can generate, send, and validate One-Time Passwords must be available for the platform to be able to access the information and validate sessions. It is a good combination of features in a centralized system to have APIs that enable specifying the OTP format and choosing the best channel for each client or case.

Get to know the OTP generation, delivery and validation solution

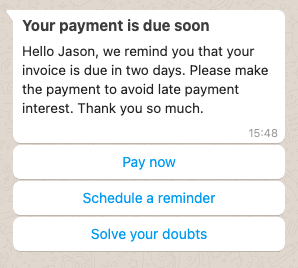

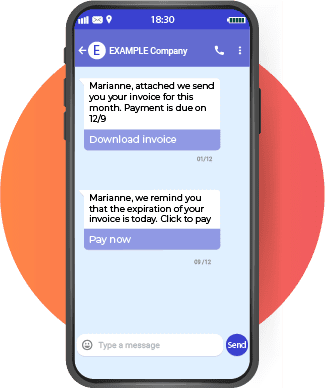

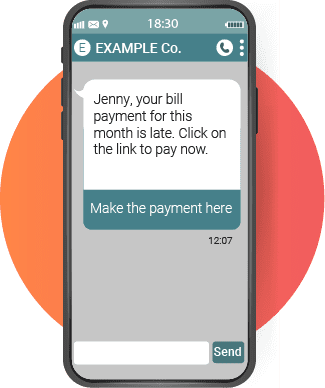

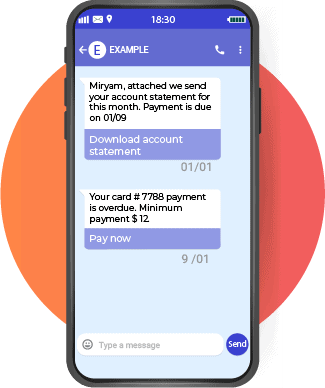

Collections and Account Statements

By using multiple communication channels simultaneously, it is possible to automate the delivery of account statements, monitor payments, and promote scheduled debits in order to increase efficiency, reduce costs, and increase collection rates by up to 16 percent.

View our Automated Collections and Account Statements Solutions

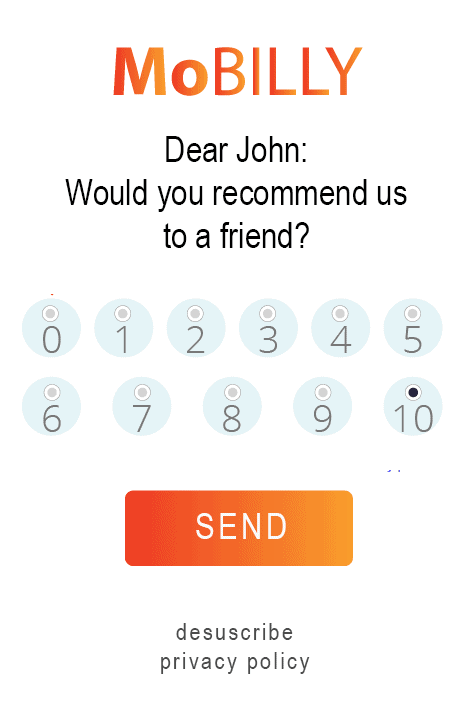

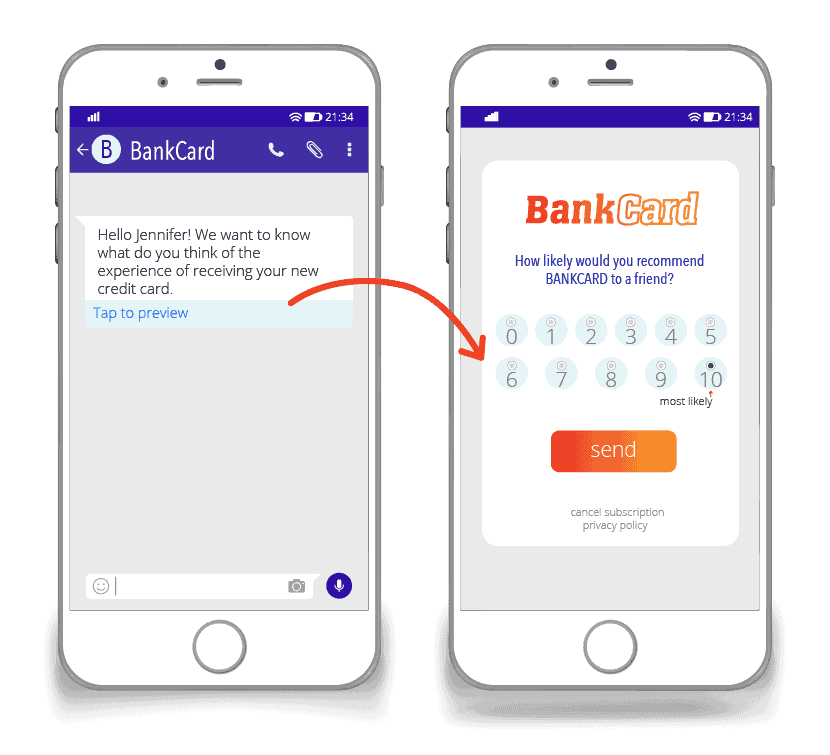

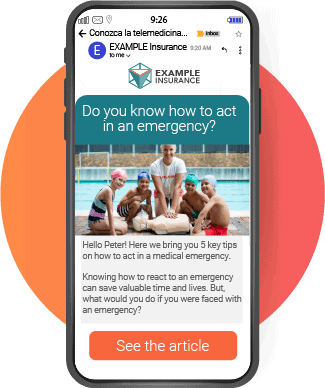

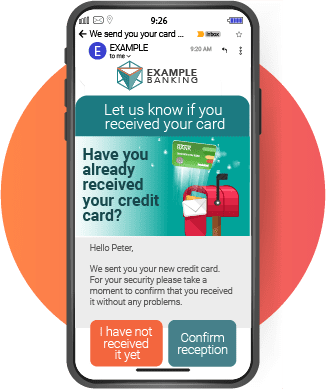

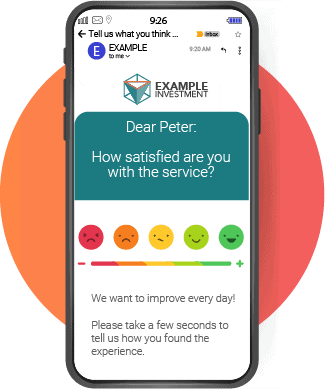

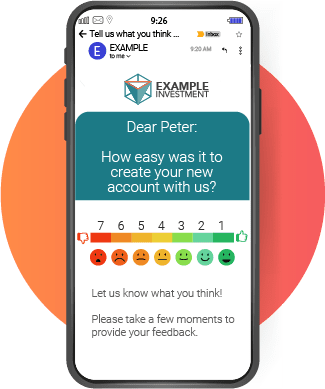

Customer experience measurement

A great way to achieve effective survey results is sending emails or text messages to customers, so that they can easily respond with only one click. According to the link that the client chooses, a future action can be automatically programmed a few days later, which has some relation to the client’s response. You will boost and cultivate the relationship by following up and demonstrating your commitment to finding solutions to the customer’s concerns.

View our Customer experience measurement Solutions

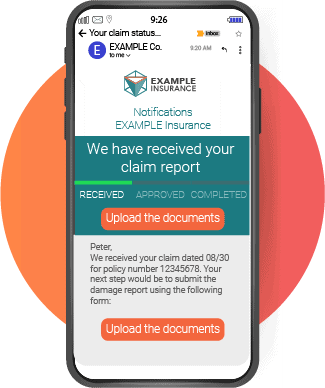

Claims Processing

Automation can streamline claims processes by receiving and routing requests in a standardized manner. Furthermore, claims status updates are sent automatically via text message, automated voice call, or e-mail, meaning fewer calls to customer service.

View our Customer Service Solutions for Insurance

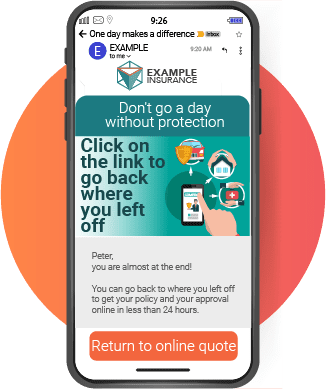

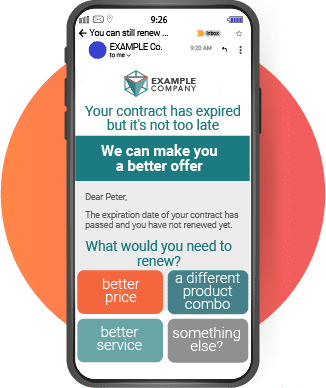

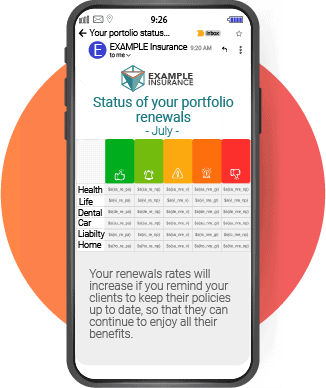

Renewal and Retention

It is perfectly possible to automate the renewal reminder process and enable a new phase of the customer lifecycle. The best arrangement would be to incorporate Net Promoter Score type satisfaction measurement, which would be automatic and scheduled before an upcoming renewal, allowing us to be able to address and possibly modify the client’s behavior to our advantage.

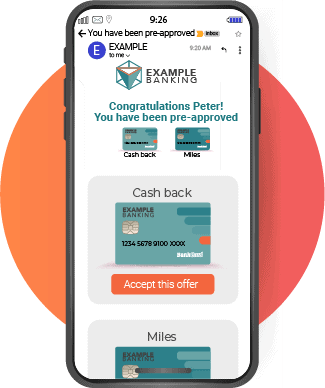

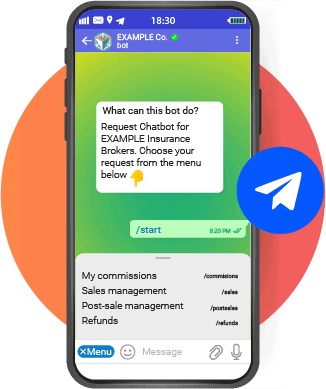

Cross selling and prospecting of current customers

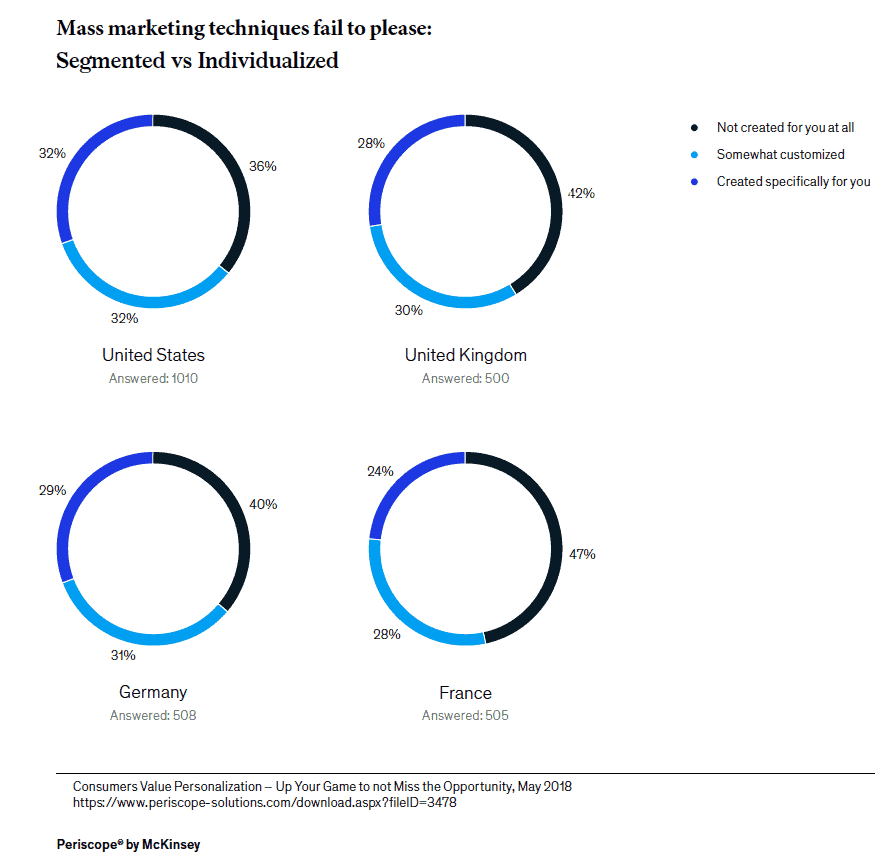

Using automation allows you to target segments that are not necessarily attractive to marketing and sales departments, but can actually be very profitable when implemented on a large scale, or at low cost, on a mass automation scale.

Get to know our Marketing Automation for Insurance Solutions

Automation offers the opportunity to increase the overall value of the customer journey of insurance companies: from reducing operating costs, to improving customer satisfaction and retention, to optimizing processes.